The TCS earnings call gave investors an unusual treat of two CEOs on one call – the outgoing CEO Rajesh Gopinathan, and incoming CEO-designate K Krithivasan. But they came bearing somewhat disappointing earnings results.

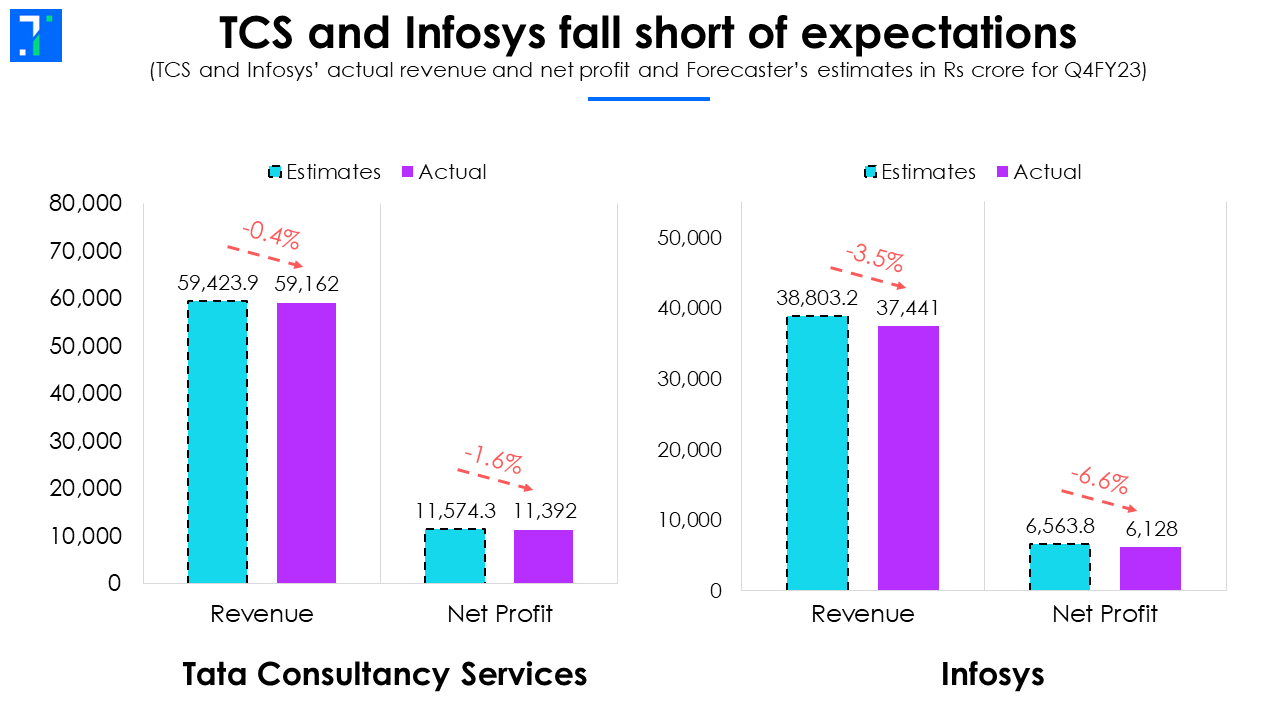

Q4FY23 in fact, turned out to be a difficult quarter for both of India's two largest IT companies, Tata Consultancy Services (TCS) and Infosys, with missed street expectations and muted growth. According to Trendlyne’s Forecaster, both TCS and Infosys missed their revenue and net profit estimates, which resulted in a decline in Nifty IT, and Infosys crashing 15% in intraday trade to touch its 52-week low of Rs 1,185.3 on Monday.

N G Subramaniam, COO of TCS, said, “We saw clients deferring newer initiatives which were not critical and, in some cases, completely halting discretionary projects. Anxiety around the stability of the banking sector in March added to the uncertainty. Consequently, growth decelerated across all verticals.”

The impact of the US banking crisis hit home much sooner than expected. Lower technology spending and delays in decision-making in the Banking, Financial Services and Insurance (BFSI) segment across the North American and European markets hit revenue growth. This was further compounded by macroeconomic uncertainty and high-interest rates, leading to reduced spending across other business verticals as well.

Despite these challenges, both companies saw robust deal wins and a decrease in their attrition levels. However, the IT giants are conservative about their growth prospects in the coming quarters, with the US market being a key area of concern.

Overall, both companies have an uncertain outlook for FY24. Infosys’ constant currency growth guidance for FY24 is 4-7%, a significant decline from its guidance of 13-15% for FY23. However, both companies are more optimistic about their medium-to-long-term prospects on the back of robust order book pipelines.

Cut in discretionary spending impacts revenue growth

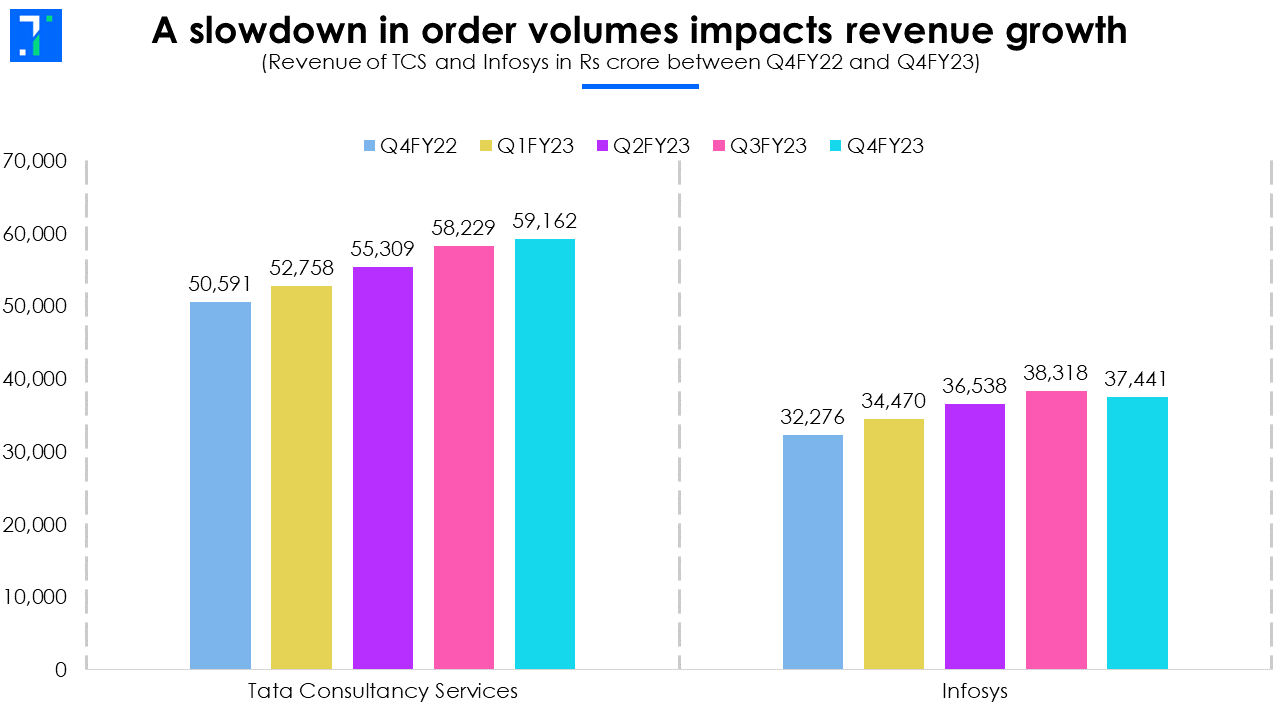

Although both companies’ revenue growth was below expectations, they went in different directions. TCS’ revenue grew slightly, while Infosys’ fell. TCS’ revenue grew 1.6% QoQ to Rs 59,162 crore amid a slowdown in discretionary tech spending across key markets of North America and Europe. However, the slowdown was offset by rising demand for cost optimization and strategically important projects.

Key verticals drive revenue growth for TCS, while Infosys struggles

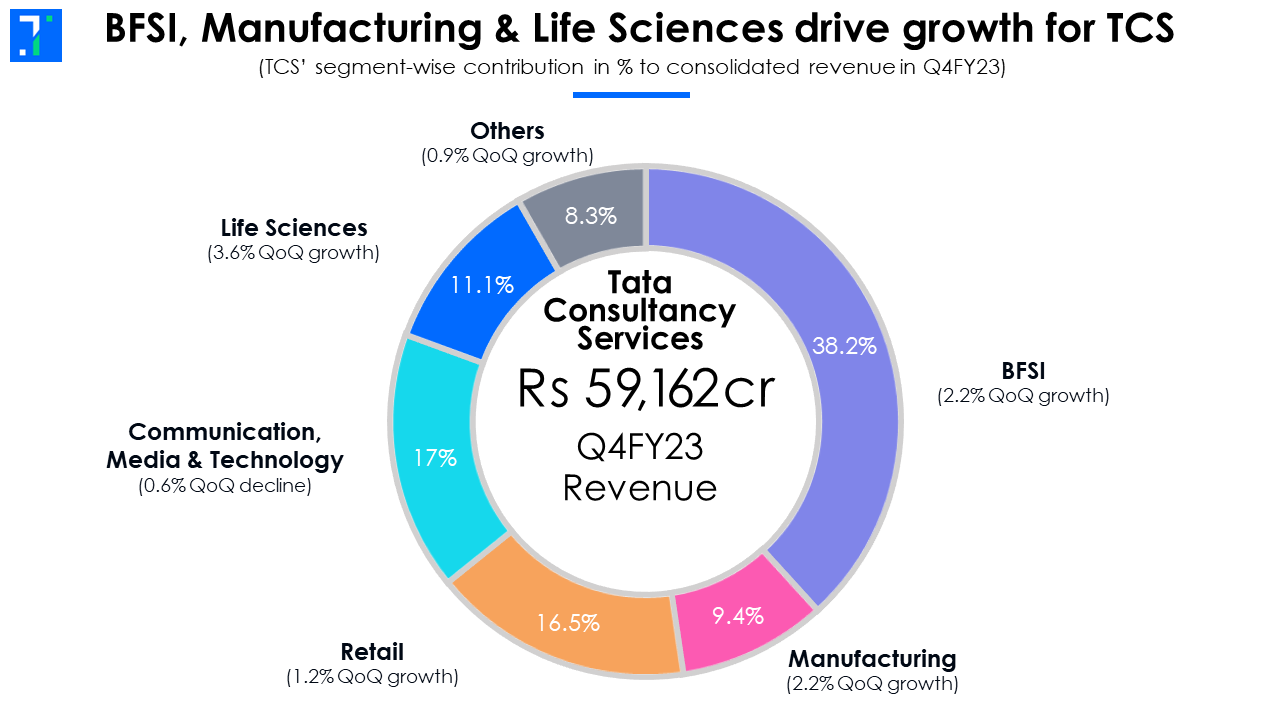

Despite macroeconomic headwinds impacting decision-making across business verticals, TCS managed to achieve revenue growth in most of its segments, except the communication, media & technology vertical. Growth was driven by life sciences, BFSI and manufacturing.

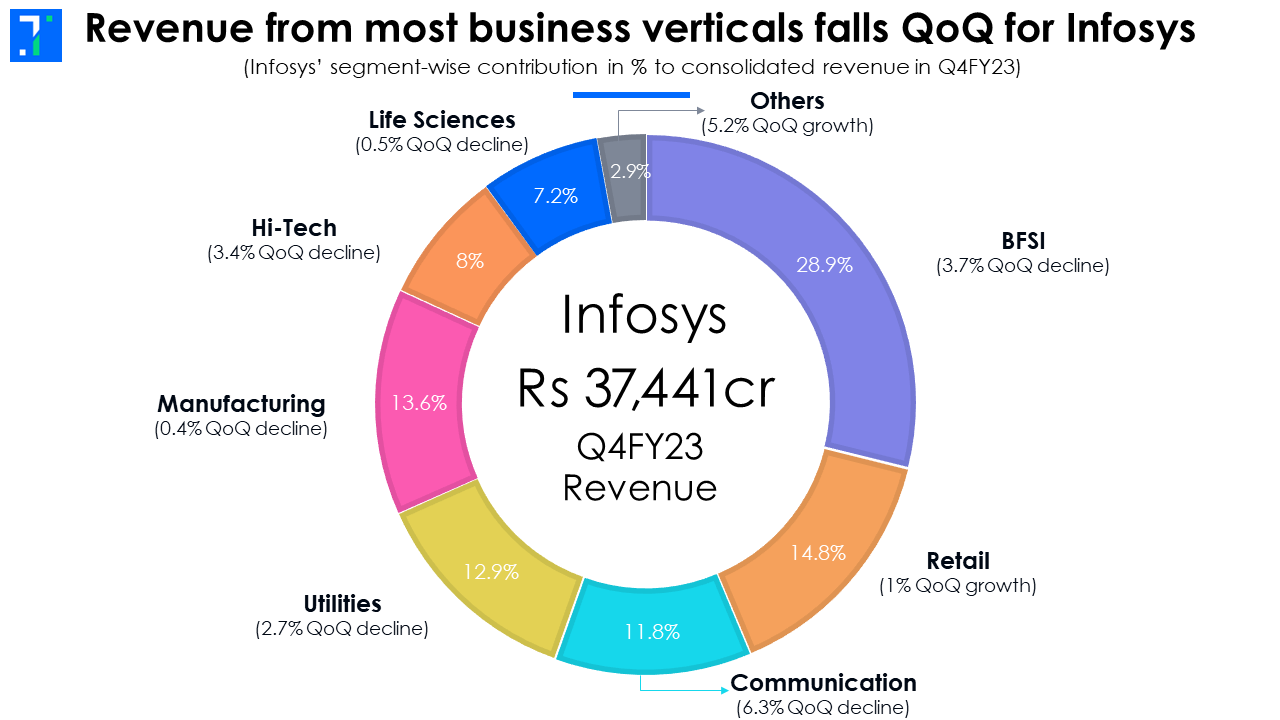

Infosys, on the other hand, witnessed a revenue decline of 2.3% QoQ to Rs 37,441 crore. The management attributed it to unplanned project ramp-downs, delays in decision making and one-time revenue impact. Salil Parekh, CEO & Managing Director of Infosys, added, “While we saw some signs of stabilisation in March, the environment remains uncertain.” The company fell short of meeting its revenue growth guidance of 16-16.5% for FY23, as it posted a growth of 15.4% YoY.

Most of the company’s business verticals saw revenue fall on a QoQ basis in Q4, with only the retail business and other business segments posting growth of 1% QoQ and 5.2% QoQ respectively. The relatively better performance here was not enough to offset the decline elsewhere as these segments contributed less than 18% to the company’s revenue.

TCS sees fewer mega deals, Infosys battles slow deal conversion

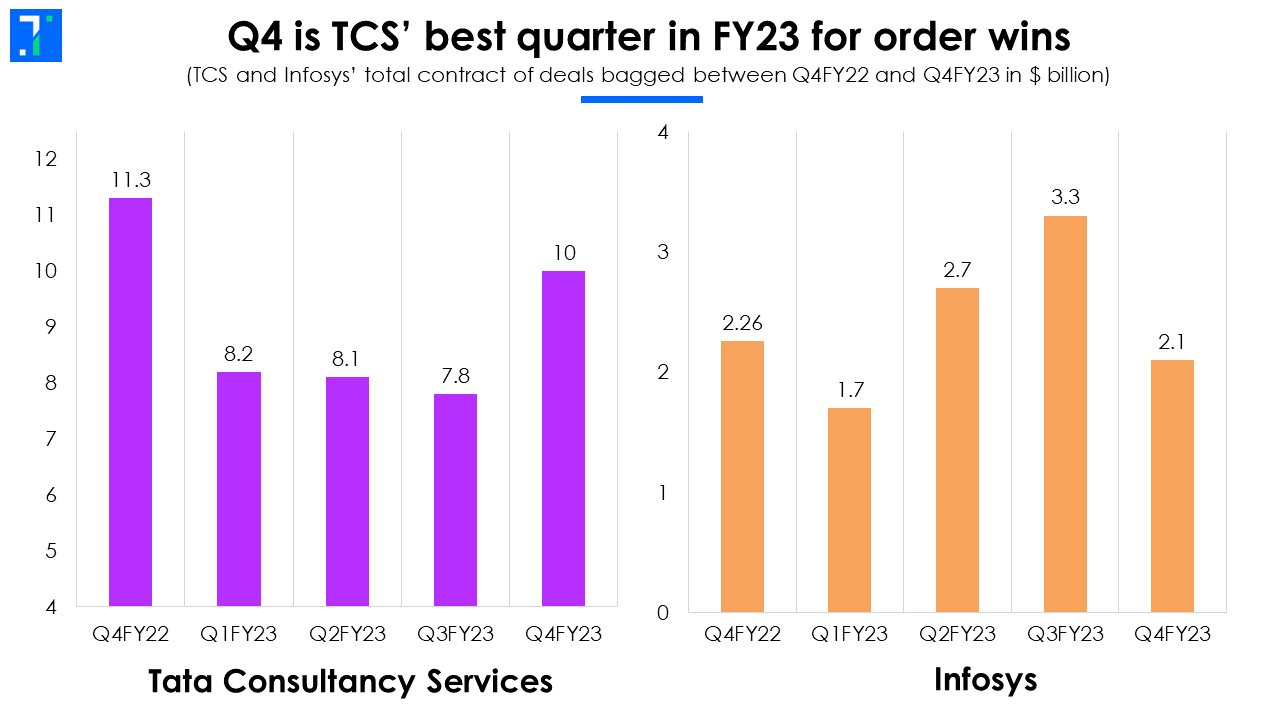

Looking at deal wins, TCS reported a robust order book in Q4 with a total contract value of $10 billion, compared to $7.8 billion in Q3FY23. The order book for Q4 also contains an all-time high number of deals worth over $50 million and one mega deal worth around $750 million. For FY23, the company bagged orders with a TCV of $34.1 billion, similar to the order book in FY22.

However, the management points out that the order book in FY23 is not as lumpy.There are fewer mega deals and more medium & small-sized deals. K. Krithivasan, TCS CEO designate, said, “This implies faster revenue conversion compared to last year's order book and gives us better visibility into growth next year.”

On the other hand, Infosys’ performance on deal wins was not as impressive. Its TCV of large deals in Q4 stood at $2.1 billion, down 37% QoQ and 7% YoY. The company bagged 17 large deals, with 10 in North America and 7 in Europe. The order book consists of 21% net new deals, lower compared to Q3. This brings the company’s FY23 deal wins TCV to $9.8 billion. Although Infosys’ large deal pipeline remains healthy with higher vendor consolidation and cost-efficiency projects, the management saw slower deal conversion due to macroeconomic headwinds.

Weak top-line growth dents profitability

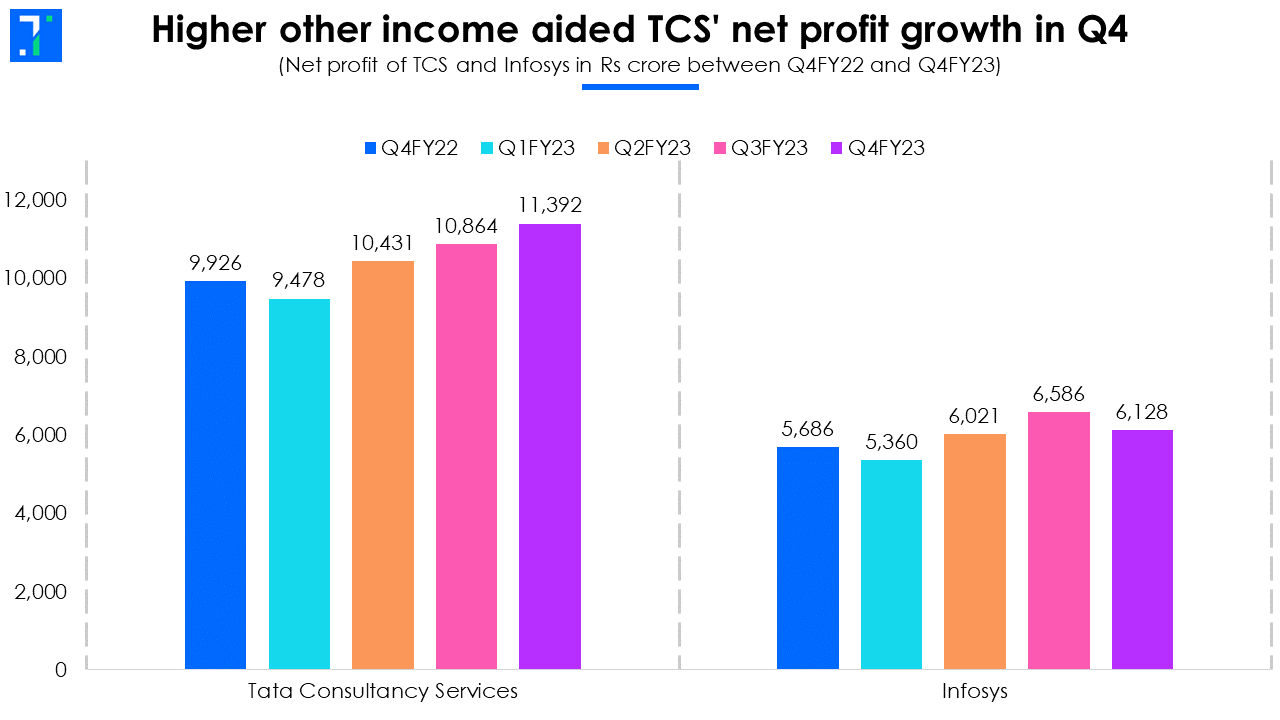

There was a stark contrast in the bottom lines of both companies, with TCS witnessing a 5% QoQ growth in net profit, and Infosys declining by 7% QoQ. However, TCS’ EBIT margin remained flat in Q4FY23, and its profit growth was helped by other income surging by 126% QoQ to Rs 1,175 crore.

Infosys saw its profit decline even as it reduced subcontractor costs, software package costs and other expenses - it was still not enough to offset the fall in revenue. The decline in discretionary spending across customers affected Infosys more as the company generates a majority of its revenue from discretionary IT spending rather than long-term projects.

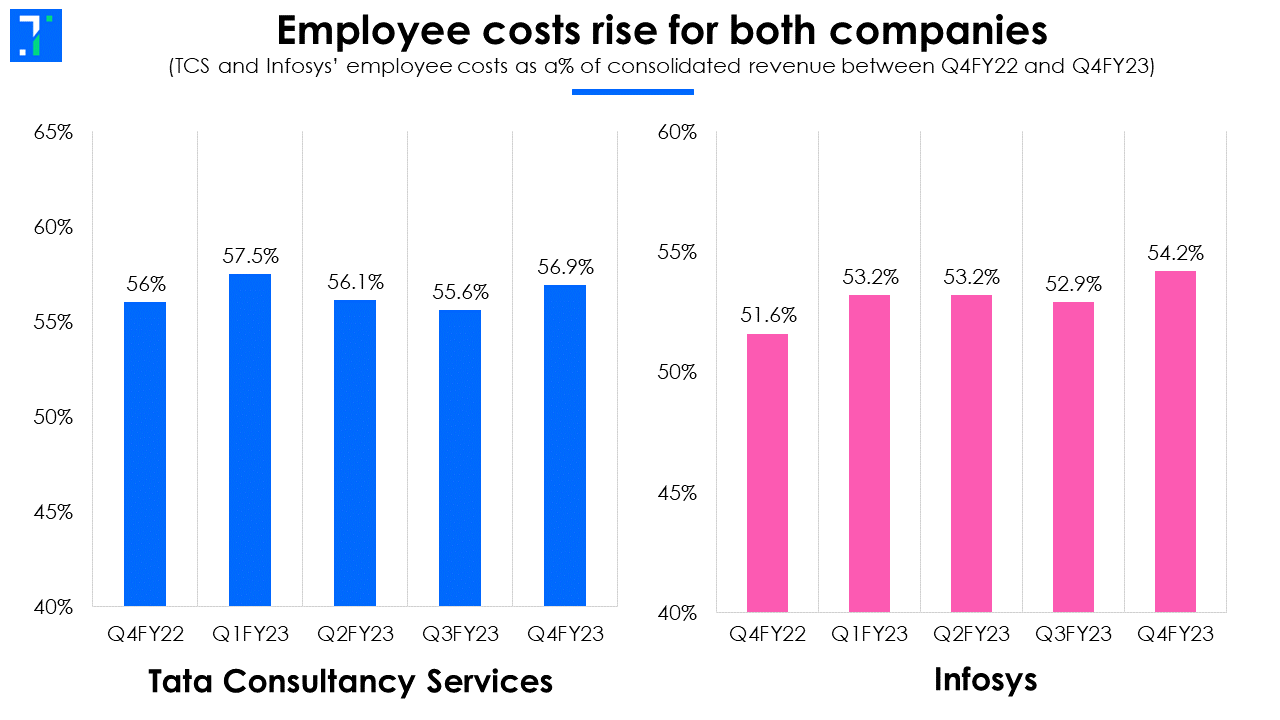

Employee costs rise as employees return to office

Employee costs as a percentage of consolidated revenue increased for both companies in Q4FY23. Expenses related to travel and facilities have also increased as more employees are returning to offices.

TCS’ employee costs as a percentage of revenue rose 130 bps QoQ as the company replaced some subcontractors with full-time employees, and increased local hiring.

Infosys also saw its employee costs rise by 130 bps QoQ, despite a 1% decline in employee headcount.

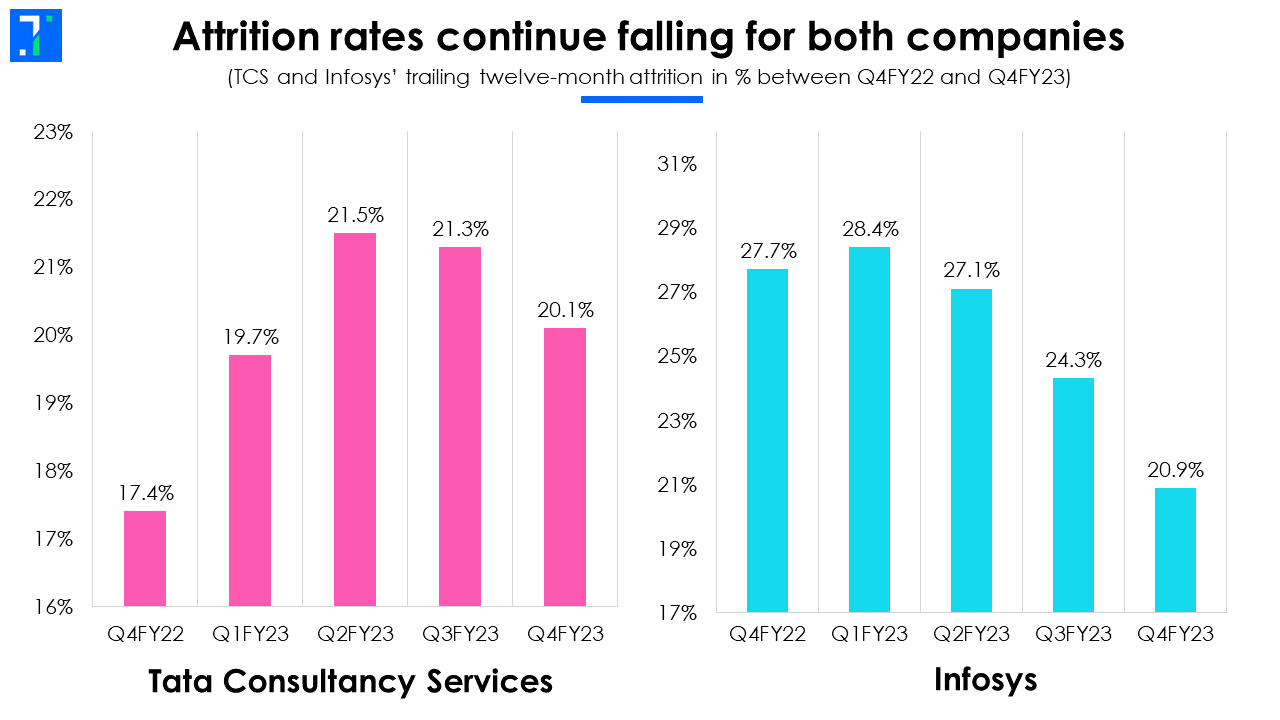

Attrition levels continue to fall

Attrition rates continued to fall, with supply-side constraints subsiding and churn levels declining. Infosys’ attrition rates declined sharply by 340 bps QoQ to 20.9%, falling for the fourth consecutive quarter. The management expects to further reduce attrition rates in the coming quarters.

TCS’ attrition rates fell for the second consecutive quarter, declining 120 bps QoQ to 20.1% in Q4FY23. However, the management stated that these rates have stayed high due to the unprecedented churn levels seen in the past few quarters. According to reports, the company plans to offer salary hikes in order to retain employees and lower attrition further. It aims to reduce attrition to 13-14% by the second half of FY24.

Infosys sees EBIT margin contract, while TCS’ remains flat

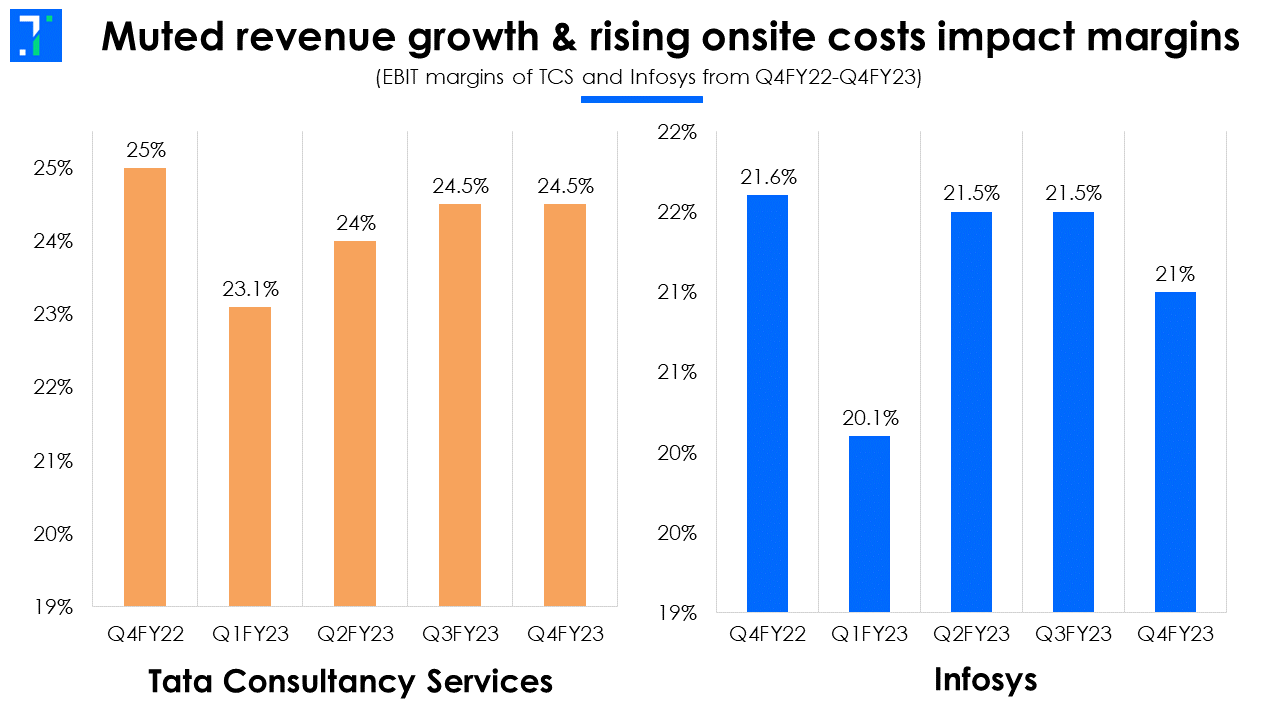

EBIT margins of the two IT behemoths remained flat or contracted on account of muted revenue growth and higher employee costs. While both companies benefited from currency tailwinds and lower attrition rates, they were offset by higher onsite expenses, lower utilisation and higher employee expenses.

TCS’s margin remained flat at 24.5% on a QoQ basis. On the other hand, Infosys’ margin fell 50 bps QoQ to 21% due to a drop in utilisation and project ramp-downs. The company gave an EBIT margin guidance of 20-22% for FY24, which is lower than its guidance of 21-23% for FY23.

Recent banking crisis may derail recovery in tech spends

IT companies were expecting Q4FY23 to be a stronger quarter as they anticipated a recovery in spending, but the recent closure of two mid-sized US banks and the Credit Suisse crisis have made banks more conservative with their cash. This anxiety in the BFSI sector is likely to continue for a few more quarters, keeping demand subdued.

Both companies expect continued weakness across sectors in the US market, mostly due to the impact of the banking segment. Rajesh Gopinathan, the outgoing CEO of TCS, had expected the US market to perform better in Q4 but the banking crisis impacted market sentiments. He added, “We expected the US market to come back strongly in the New Year. That has not happened and that's the scenario that we are in. And the weakness is not just coming out of BFSI, it is coming across sectors in North America”.

Although macroeconomic headwinds continue to pose concerns, TCS and Infosys are taking steps to mitigate the impact of declining technology spending among clients. Both companies are focusing on lowering their attrition rates through salary hikes, robust deal wins and cost-efficiency initiatives to improve margins and profitability.