The pharmaceutical industry is a defensive sector, one that is expected to perform well even during market turmoil. Spending above a certain level remains steady, since a person’s health and medical care remains a priority irrespective of macroeconomic factors. As a result, drug makers have a beta considerably lower than 1 – their stock prices are less volatile than the overall market. Beta is a measure of the volatility (systematic risk) of a company, compared to the market as a whole.

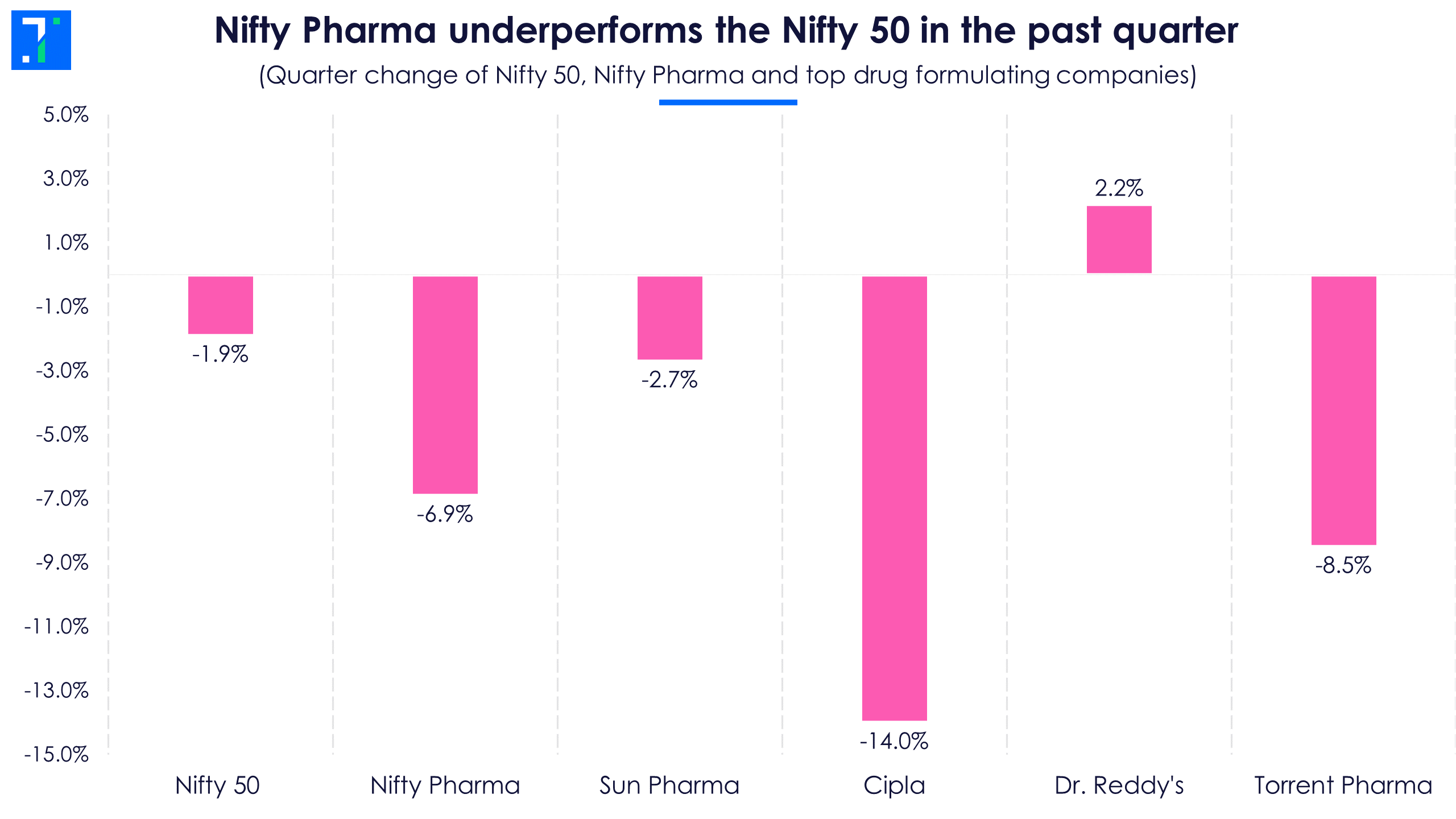

The past year has been very volatile for stock markets. The Nifty 50 rose around 4%, while Nifty Pharma fell over 9.5%. The trend has stayed the same in the past quarter as well.

A major reason for the pharma companies’ underperformance and volatility is high firm-specific risks or non-systematic risks in the pharma sector that are not captured by the beta. Indian pharma companies have been changing their growth strategy in the US business over the past two years. Generics used to be the star segment in the US over the past decade, but with the US regulator pushing for increasing competition in this space, profitability is low compared to domestic markets.

A major reason for the pharma companies’ underperformance and volatility is high firm-specific risks or non-systematic risks in the pharma sector that are not captured by the beta. Indian pharma companies have been changing their growth strategy in the US business over the past two years. Generics used to be the star segment in the US over the past decade, but with the US regulator pushing for increasing competition in this space, profitability is low compared to domestic markets.

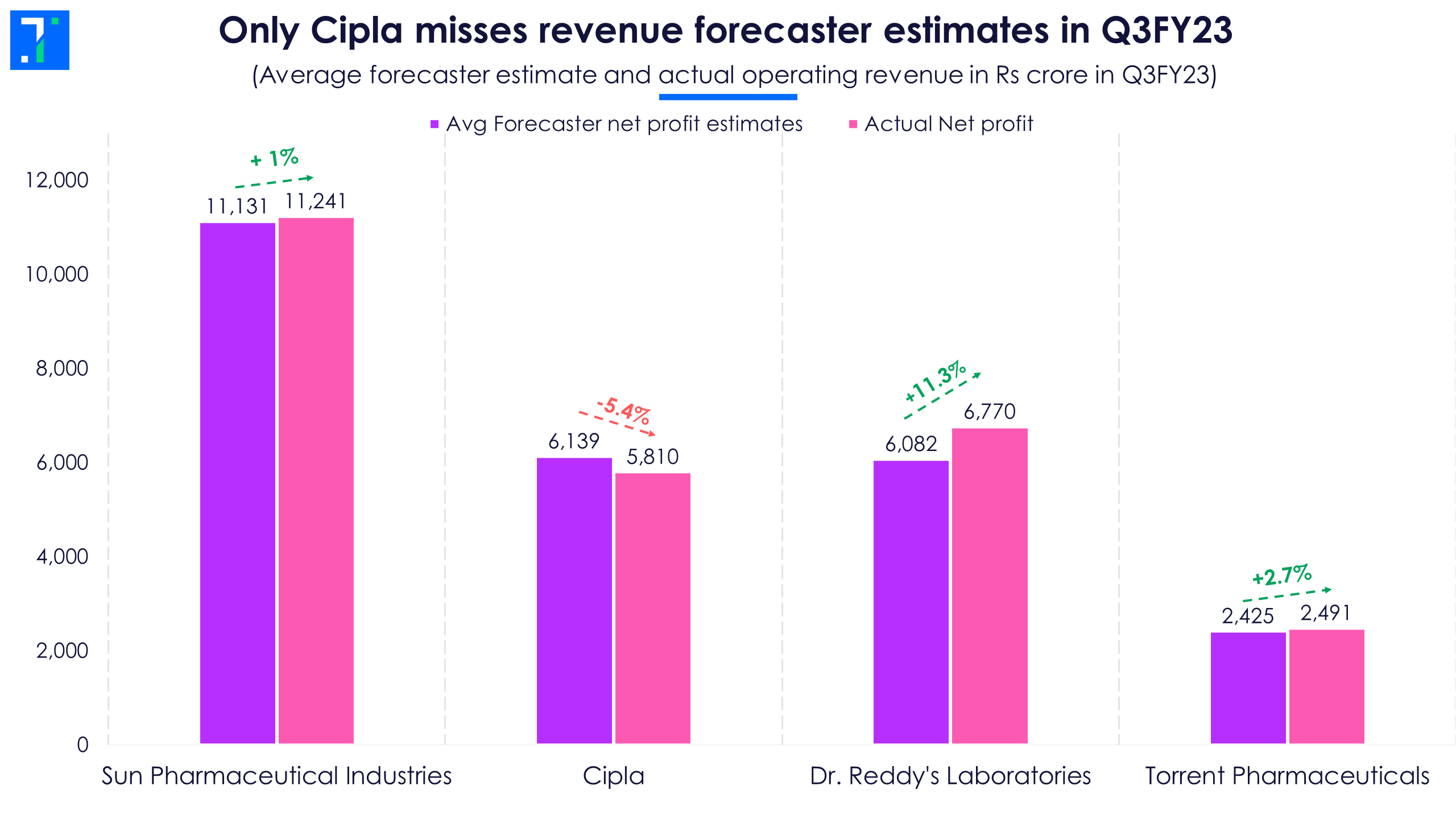

To combat price erosion in the US generics space, top drug formulators like Sun Pharmaceutical Industries, Cipla, Dr. Reddy’s Laboratories and Torrent Pharmaceuticals are now focussing on less competitive niche segments and launching new products. In addition, drug makers are increasing their footprint in India, where there’s high revenue visibility. Q3FY23 results and management commentary suggest that this strategy is helping top drug formulators’ top line to rise, and three of the four top companies have beaten the revenue forecaster estimates in Q3.

Specialty and complex respiratory product portfolios continued to drive US business growth for Sun Pharma and Cipla respectively in Q3FY23.

Specialty and complex respiratory product portfolios continued to drive US business growth for Sun Pharma and Cipla respectively in Q3FY23.

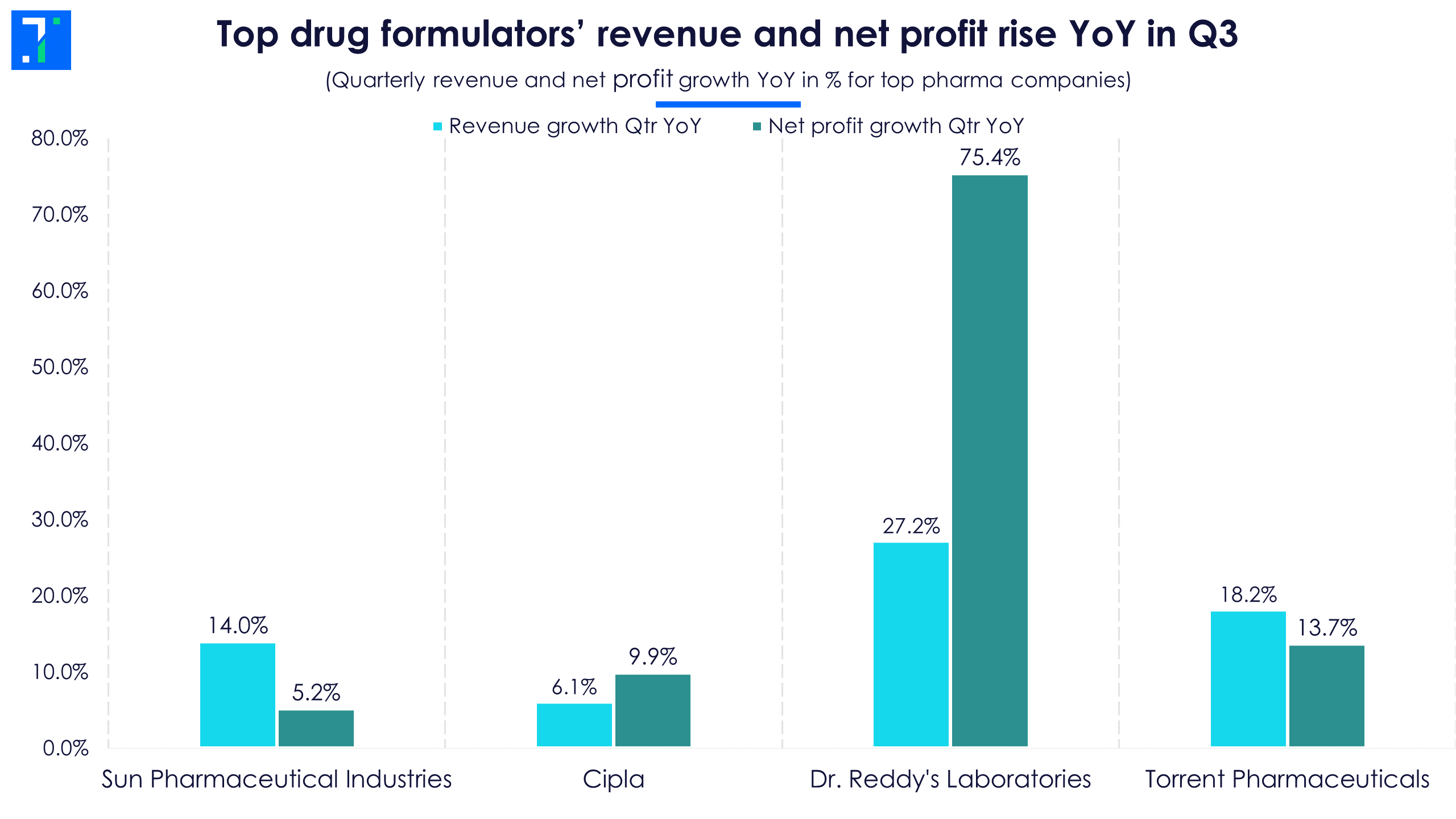

Overall, strong US business growth, new product launches and traction in the Indian market helped pharma companies beat forecaster estimates. In fact, the revenue and net profit of all companies in focus rose YoY in Q3FY23.

Dr. Reddy’s leads the pack in revenue and net profit growth YoY in Q3FY23 due to a sharp increase in its US business top line, which rose on the back of new product launches. The net profit of all four companies jumped as freight and raw material costs fell in Q3. This helped the operating profit margin rise YoY.

Dr. Reddy’s leads the pack in revenue and net profit growth YoY in Q3FY23 due to a sharp increase in its US business top line, which rose on the back of new product launches. The net profit of all four companies jumped as freight and raw material costs fell in Q3. This helped the operating profit margin rise YoY.

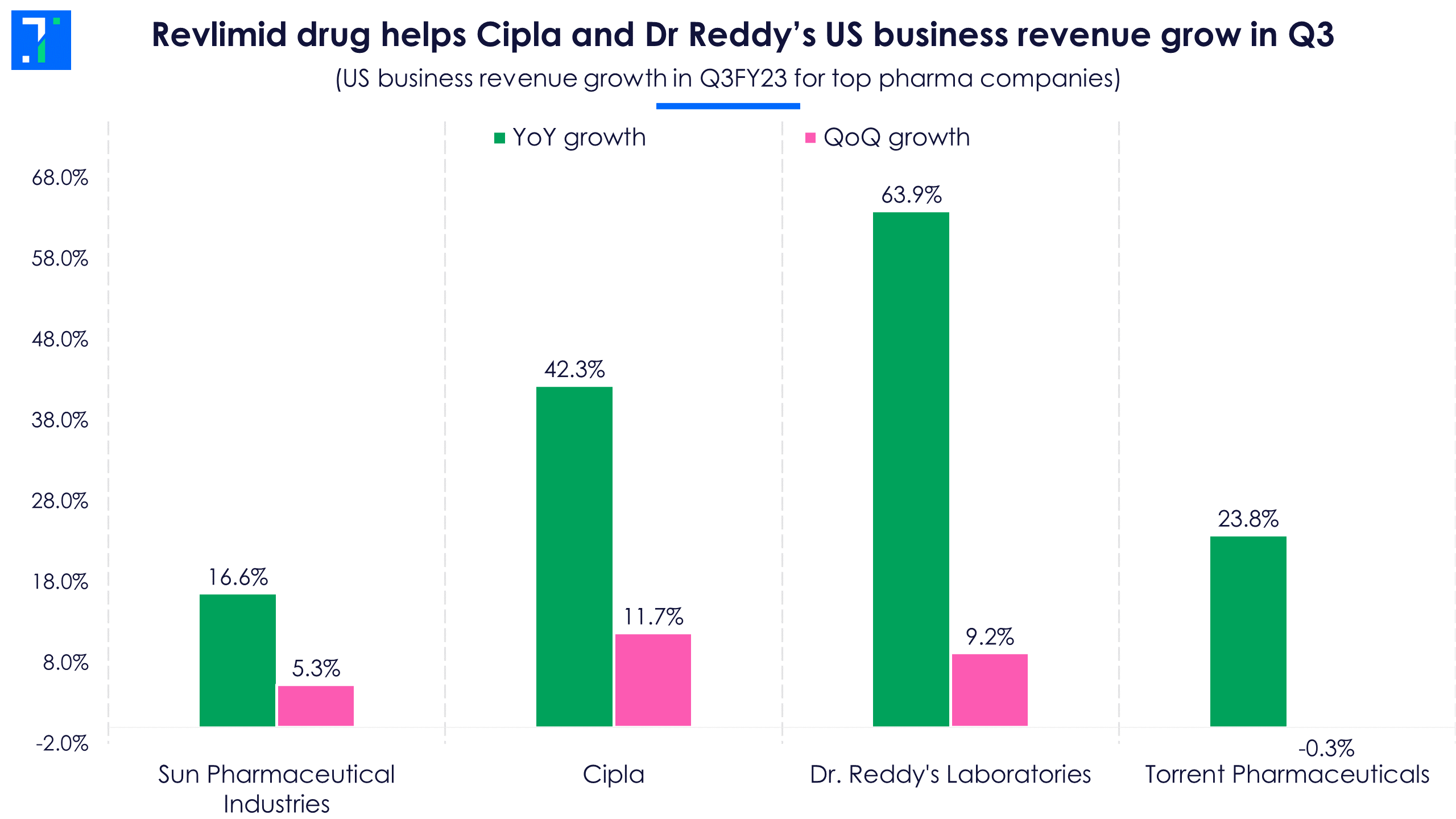

Product mix diversification away from the generics segment has also helped drug makers’ profitability. Revlimid, a generic cancer drug, significantly boosted revenue and margins in the US for Dr. Reddy’s and Cipla. 2021 was the last year of exclusivity for Bristol Myers Squibb’s Revlimid, which is used to treat multiple myeloma. Several Indian drug makers have since launched generic versions of the drug in different strengths. According to IQVIA data, Revlimid’s annual sales as of December 2021 is $2.3 billion. Sun Pharma is also expected to launch this drug, as it received US Food and Drug Administration (FDA) approval on February 10.

Product mix diversification away from the generics segment has also helped drug makers’ profitability. Revlimid, a generic cancer drug, significantly boosted revenue and margins in the US for Dr. Reddy’s and Cipla. 2021 was the last year of exclusivity for Bristol Myers Squibb’s Revlimid, which is used to treat multiple myeloma. Several Indian drug makers have since launched generic versions of the drug in different strengths. According to IQVIA data, Revlimid’s annual sales as of December 2021 is $2.3 billion. Sun Pharma is also expected to launch this drug, as it received US Food and Drug Administration (FDA) approval on February 10.

Top drug makers’ shifting strategies in the US pay off, helped by new product launches

After Indian drug formulators faced intense competition in the US generics space, they planned to diversify and focus on less competitive segments like injectables, biosimilars, peptides, complex generics and specialty products.

This strategy seems to have paid off for the top drug formulators. Sun Pharma invested significant capital in specialty products in the past three years, and is now reaping its benefits in the US. Sun Pharma’s specialty business has grown 21.6% YoY in Q3 to $222.5 million, largely on the back of Cequa, Illumya and Winlevi prescriptions. However, research and development costs are also higher for specialty products. Sun Pharma’s management said the R&D for specialty business was 26% of the total R&D cost during the quarter and the new product pipeline includes four molecules in this space, which are currently undergoing clinical trials.

Cipla relied on its respiratory and peptide products to drive US market growth. The company currently enjoys a 17.6% (16% in Q2) market share of the total Albuterol market and a 38.5% (38% in Q1) share of the Arformoterol market. Its Lanreotide drug reached a 14.1% market share in Q3 vs 9.6% in Q2 and the management expects it to further increase to 15% by Q4.

Cipla relied on its respiratory and peptide products to drive US market growth. The company currently enjoys a 17.6% (16% in Q2) market share of the total Albuterol market and a 38.5% (38% in Q1) share of the Arformoterol market. Its Lanreotide drug reached a 14.1% market share in Q3 vs 9.6% in Q2 and the management expects it to further increase to 15% by Q4.

Meanwhile, US revenue of Dr. Reddy’s sharply rose by 63.9%, mainly due to strong Revlimid sales and new product launches. These two factors offset price erosion in its base products. The management said that although pricing pressure eased marginally in Q3, it still remains elevated. Dr. Reddy’s launched five new products in Q3 and the management expects the momentum to continue into Q4 as well.

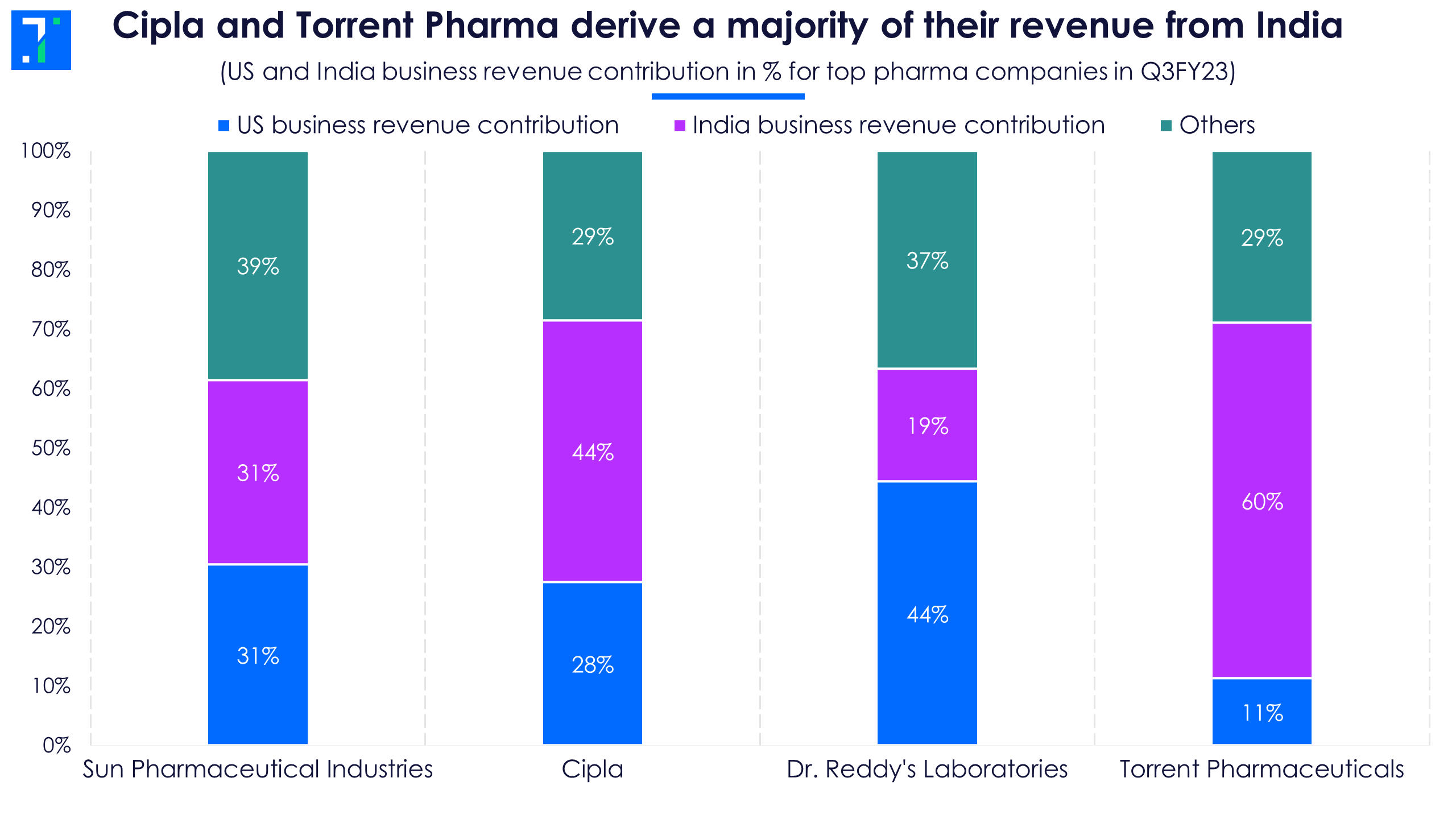

Torrent Pharma is an outlier among the top four drug formulators in terms of geo mix, as it derives only 11% of its total revenue from the US. As much as 60% of its revenue comes from Indian businesses, and its export destinations are mainly Brazil and Germany. In Q3, Torrent Pharma continued to see price erosion and the top-line growth in its US business was mainly due to low base and forex gains.

Indian business grows despite high Covid base

With multiple factors at play in the US, top drug formulators have been focussing on the domestic business over the past two years. EBITDA margins are higher at 25%-35% in India due to lax regulatory requirements and lower competition, compared to 15% in the US market. Cipla and Torrent Pharma have strong footing in India as they both derive over 40% of their revenue from here.

Indian market revenue growth in Q3FY23 was lower than the growth in the US on the back of a high Covid base. However, new product launches and price hikes helped drug makers post revenue growth YoY.

Indian market revenue growth in Q3FY23 was lower than the growth in the US on the back of a high Covid base. However, new product launches and price hikes helped drug makers post revenue growth YoY.

Typically, price increases, new product launches and volume growth are the key factors that drive top line for pharma companies. In Q3, the first two factors were bigger contributors to growth, due to last year’s high Covid volume base. Torrent’s management said it hiked the prices of drugs sold in India by an average of 8% in Q3 and expects to increase the prices by that much again in Q4.

Typically, price increases, new product launches and volume growth are the key factors that drive top line for pharma companies. In Q3, the first two factors were bigger contributors to growth, due to last year’s high Covid volume base. Torrent’s management said it hiked the prices of drugs sold in India by an average of 8% in Q3 and expects to increase the prices by that much again in Q4.

To satisfy the rising demand for their products in India, Sun Pharma and Torrent Pharma have planned to increase the number of medical representatives who pitch and distribute newly launched drugs to doctors.

PE ratios moderate as drug makers’ share prices fall, but valuation still remains elevated

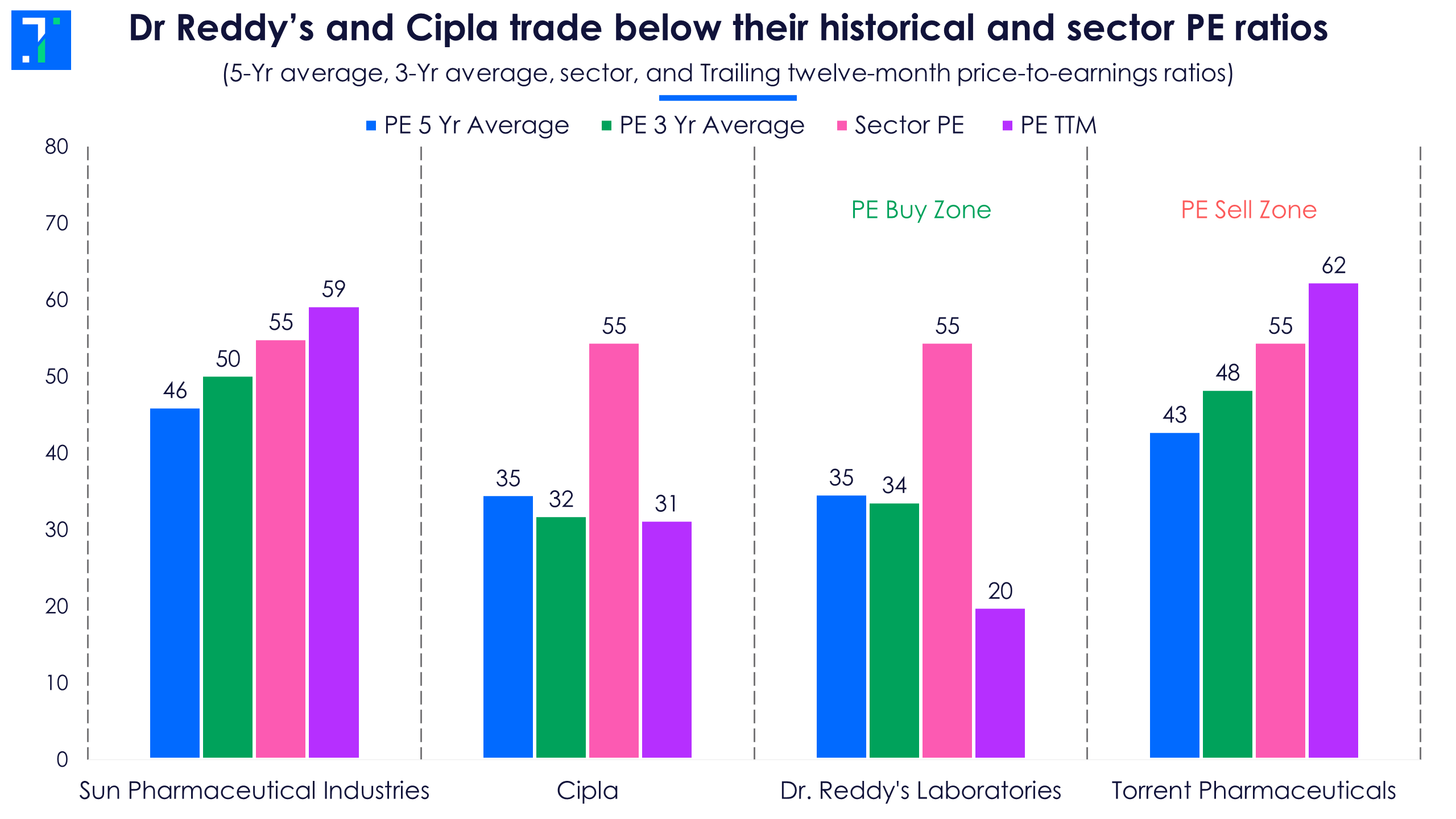

TTM PE ratios of the top drug formulators have cooled down in the past quarter with their falling share prices. However, Torrent Pharma still trades in the sell zone as its TTM PE is trading above its historical levels. Despite a high PE, analysts see a 17.4% upside in its share price in the next 12 months.

Dr Reddy’s and Cipla have TTM PE ratios lower than their historical averages and that of their sector as well. Dr. Reddy’s, which is in its PE buy zone, has an average share price upside of 8.3%, according to Forecaster.

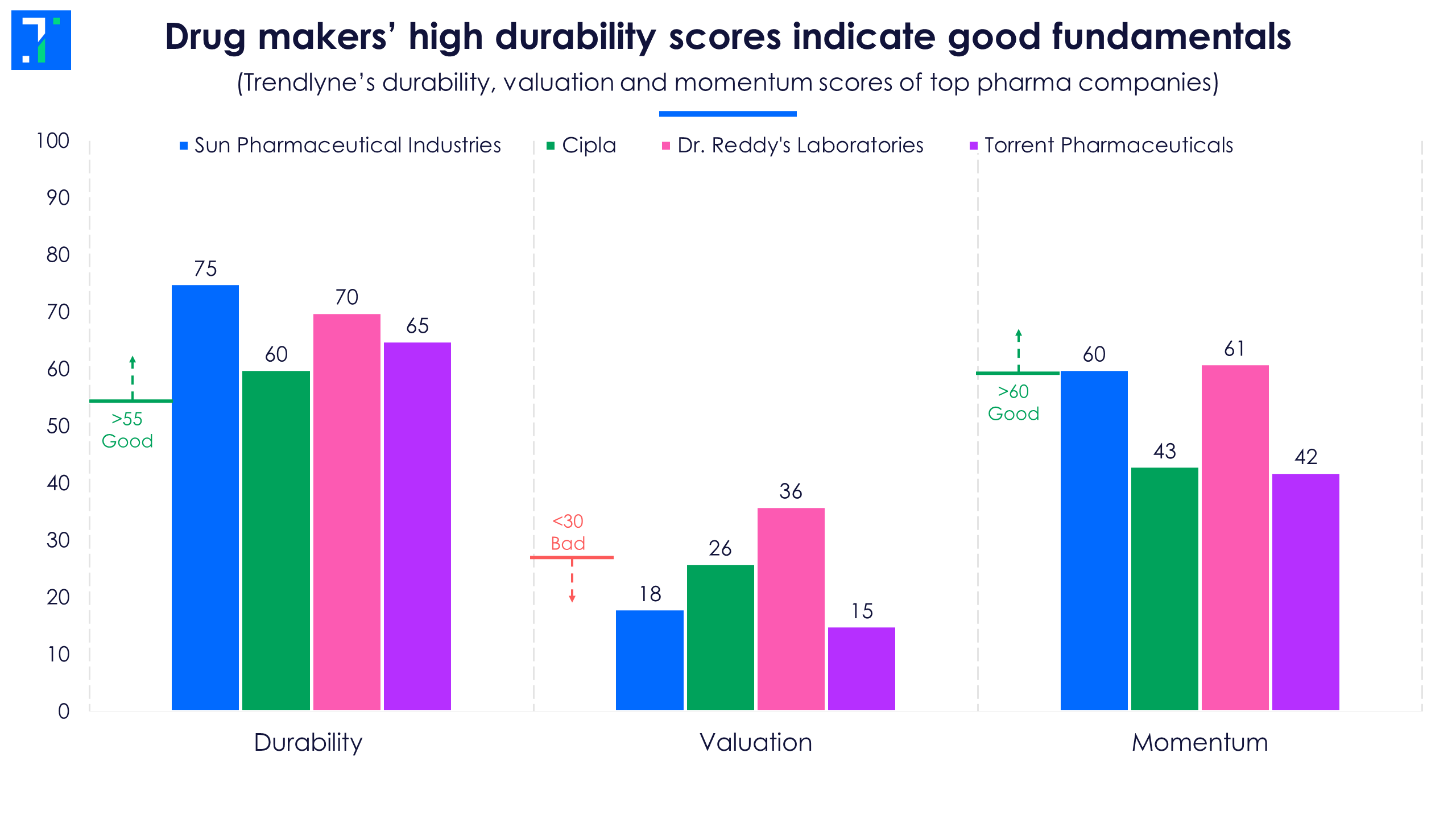

Barring Dr. Reddy’s, the other three companies are classified as ‘Expensive Performers’, according to Trendlyne’s DVM classification. With expensive valuations, these drug makers score low in Trendlyne’s valuation score.

However, all pharma companies in focus fall under the ‘good’ category when it comes to durability score. The durability score is based on the quality of a company’s financials, management and long-term performance.

However, all pharma companies in focus fall under the ‘good’ category when it comes to durability score. The durability score is based on the quality of a company’s financials, management and long-term performance.

Outlook bright for adaptable pharma players, but FDA alerts can delay launches

Top drug formulators’ revenue is expected to rise by at least 11% in Q4FY23 as analysts expect new product launches and continued strong traction in the domestic market.

Product launches continue to be a key factor in top-line and bottom-line growth for Indian drug makers. Margins are also high for new products as they have lower competition in the beginning. But USFDA clearances for manufacturing facilities and drug approvals are prerequisites to launch new products. Any delays in these could hurt financials as another company could get the first-mover advantage.

Product launches continue to be a key factor in top-line and bottom-line growth for Indian drug makers. Margins are also high for new products as they have lower competition in the beginning. But USFDA clearances for manufacturing facilities and drug approvals are prerequisites to launch new products. Any delays in these could hurt financials as another company could get the first-mover advantage.

In December, Sun Pharma’s Halol facility was put under import alert by the USFDA. This stopped shipments from Halol and led to a decline in US generics sales. Halol is a key manufacturing site for Sun Pharma and it accounted for 3% of the company's consolidated revenue in FY22.

Cipla’s share price fell over 5% on February 20 after its major manufacturing unit in Pithampur received 8 USFDA observations.

Regulatory hurdles for US products continue to be a key risk for Indian drug makers. This is also one of the reasons why the Indian pharma market, with its relatively less stringent regulation, looks attractive for drug makers. But companies will continue to target US markets as there are lucrative opportunities in the lower competitive segments.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.