By Suhani Adilabadkar

With retail inflation rising to an eight-year high of 7.7% in April 2022, markets seem tetchy. The Nifty 50 fell 9% over the past one month and defensive bets like IT services and pharma are also not offering investors much refuge. Although the fast-moving consumer foods (FMCG) sector is a defensive space, high input and commodity cost could play spoilsport.

FMCG companies’ stocks like Dabur, Marico, Nestle, Britannia, Tata Consumer and ITC fell in the range of 2-10% over the past 30 days. Hindustan Unilever or HUL’s stock gained 2% over the same period. The company beat Trendlyne Forecaster estimates with revenues rising 11% YoY in Q4FY22, supported by aggressive price hikes.

But how long will this price hike fueled revenue growth continue?

Quick Takes:

- HUL’s revenues rose 11% YoY to Rs 13,462 crore supported by price hikes in Q4FY22

- Operating margin fell 30 basis points YoY to 24.1% in Q4FY22 amid high commodity cost inflation supported by price hikes and cost control measures

- Home care revenues grew 24% YoY Q4FY22 driven by price increases in fabric wash and household categories

- The management sees higher commodity price inflation in the next 2-3 quarters and expects operating margins to fall in the near term

- The company plans to launch bridge packs in the near term to shore up its volumes

Strong price led growth in Q4FY22

Mounting inflation, aggravated by geo-political pressures, weighed on overall consumption sentiment in the March 2022 quarter. FMCG volumes fell 8% YoY (according to Nielsen) in Q4FY22 as persistent inflation hurt consumer wallets across both rural and urban India. HUL reported flat volume growth in Q4FY22. Close peers Dabur and Marico also moved on a similar low volume growth trajectory reporting 2% and 1% growth, respectively, during Q4FY22. Though HUL reported flat volumes, revenue growth was the highest. Revenues came in at Rs 13,462 crore in the Q4FY22, a 11% YoY rise, driven by aggressive price hikes.

Market leader HUL has been leading the FMCG pack implementing price hikes over the past three quarters to pass on crude, palm oil, logistics, and other agri-commodity inflation. The company has been raising prices consistently since October 2021 and hiked prices to the tune of 3-20% across product categories every month in Q4FY22.

Market leader HUL has been leading the FMCG pack implementing price hikes over the past three quarters to pass on crude, palm oil, logistics, and other agri-commodity inflation. The company has been raising prices consistently since October 2021 and hiked prices to the tune of 3-20% across product categories every month in Q4FY22.

This high pricing power is on the back of strong market share expansion in FY22 amid high inflationary pressures. Operating margins came in at 24.1% in Q4FY22 compared to 24.4% a year ago. Higher revenues and restrained expenditure, employee benefit expenses (flat YoY) and advertising expenses (down 9% YoY) restricted operating margin contraction to 30 basis points (bps) YoY despite high commodity cost inflation. The management expects operating margins to fall in the near term as it expects high commodity inflation to continue unabated in the next 2-3 quarters

Supported by price-led double-digit revenue growth and stable operating performance, net profit grew 9% YoY to Rs 2,327 crore in Q4FY22. HUL increased prices by up to 20% in April, and 15% in May 2022 across various product categories. While net profit might report softer growth (due to operating margin compression) in the next few quarters, revenue growth in the near term is expected to be on a strong platform led by price hikes.

Supported by price-led double-digit revenue growth and stable operating performance, net profit grew 9% YoY to Rs 2,327 crore in Q4FY22. HUL increased prices by up to 20% in April, and 15% in May 2022 across various product categories. While net profit might report softer growth (due to operating margin compression) in the next few quarters, revenue growth in the near term is expected to be on a strong platform led by price hikes.

Home care leads the way, foods & refreshment grow on a high base

Home care leads the way, foods & refreshment grow on a high base

HUL has three major business segments, home care, beauty & personal care and foods. Homecare reported revenues of Rs 4,750 crore, up 24% YoY in Q4FY22 driven by double-digit revenue growth in both fabric wash and household care categories.

But as Brent crude oil (major input) remains above $ 100, up 60% YoY, calibrated price increases will be taken by the company at regular intervals. Thus home care’s five-quarter revenue growth outperformance is expected to continue, supported by the fabric wash category, as mobility is back to pre-Covid levels. Surf Excel with 18-20% market share in the Indian detergent segment and Wheel and Rin’s dominant position in the economy fabric wash segment will enable the company to increase prices in the near term. In the household category, market leader Vim and Domex performed well despite price hikes and are expected to maintain growth momentum.

Amid high inflation, consumers are tightening purchases and prioritizing essentials over discretionary consumption. Everyone’s hair gets a little less shiny - expenses on hair oil, shampoos, and premium soaps are curtailed and cheaper alternatives are being adopted by consumers. Regional competition and smaller companies offering lower-priced products come into play as consumers control their discretionary spending.

Amid high inflation, consumers are tightening purchases and prioritizing essentials over discretionary consumption. Everyone’s hair gets a little less shiny - expenses on hair oil, shampoos, and premium soaps are curtailed and cheaper alternatives are being adopted by consumers. Regional competition and smaller companies offering lower-priced products come into play as consumers control their discretionary spending.

Beauty & personal care revenue at Rs 4,712 crore reported muted growth of 4% YoY. While the soap category reported double-digit revenue growth driven by pricing, hair care and cosmetics were impacted by lower discretionary spending. In the near term, HUL’s wide soap portfolio - Dove, Pears, Liril, Rexona, Lux straddling across the entire price pyramid will stand in good stead despite price hikes, cosmetics, and hair care is expected to grow at a muted rate. Close peer Marico's Parachute volumes declined 1% YoY and Dabur too reported a 7% YoY volume decline in hair care in Q4FY22.

Foods & refreshment segment revenues came in at Rs 3,698 crore, a strong rise of 5% YoY on an exceptionally high base of 96% YoY growth, a year ago. Tea, coffee, ketchup, jams, soups, and ice creams grew in double digits. HUL’s Brooke Bond controls almost 20% of the Indian tea segment, Bru Coffee is the second runner-up after Nescafe and Kissan Jams and Sauces are market leaders. Foods segment is expected to continue with its stable growth as consumers manage their household budgets to reduce volumes but stick to large established brands for tea, coffee or routine discretionary products like jams and sauces.

Inflation through the roof, bridge packs to shore volume growth

Net material inflation increased 4.5x YoY for HUL. Crude, plastics, soda ash, and palm oil have spiraled up in the past year. The palm oil export ban by Indonesia in April created a furore globally. Indonesia accounts for about 60% of total palm oil output globally. Palm oil is used in processed foods like chocolates, jams, ketchups, noodles, and home care products like detergents, shampoos, soaps, and cosmetics.

According to Sanjiv Mehta, Chairman and Managing Director at HUL, the palm oil issue is not long-term and he expects Indonesia to start exporting supplies after its domestic prices come under control. Mehta said that HUL uses palm fatty acid distillate (PFAD) which is not under the export ban and is obtained after refining crude palm oil. And he does not expect the company to face challenges in PFAD availability in the near term.

As a high inflation scenario is expected to continue in the near term and the leverage of grammage reduction gradually wears off, the company is planning to improve its volumes. HUL is developing bridge packs, a middle price pack between a low unit price pack (LUP) and a large pack in terms of volume and price. For instance, introducing a Lifebuoy soap bar of Rs 20 between LUP of Rs 10 and Rs 35 large packs. The company might vacate certain LUPs and incentivize consumers for higher volume consumption. HUL is implementing a bridge pack strategy across all the impacted low volume growth product categories.

As a high inflation scenario is expected to continue in the near term and the leverage of grammage reduction gradually wears off, the company is planning to improve its volumes. HUL is developing bridge packs, a middle price pack between a low unit price pack (LUP) and a large pack in terms of volume and price. For instance, introducing a Lifebuoy soap bar of Rs 20 between LUP of Rs 10 and Rs 35 large packs. The company might vacate certain LUPs and incentivize consumers for higher volume consumption. HUL is implementing a bridge pack strategy across all the impacted low volume growth product categories.

Waiting for rural recovery, HUL might be on an acquisition prowl

Rural India, which accounts for about 40% of total FMCG sales and two-thirds of retail stores reported a 10% fall in volume growth over the past three months (as per Nielsen). The FMCG sector is betting on rural recovery by H2FY23. Strong monsoons, a good rabi harvest, government capex spend of Rs 7.5 lakh crore and high agriculture prices are improving farmer incomes. If geopolitical crises settle down and commodity prices taper off, demand revival may be in the offing.

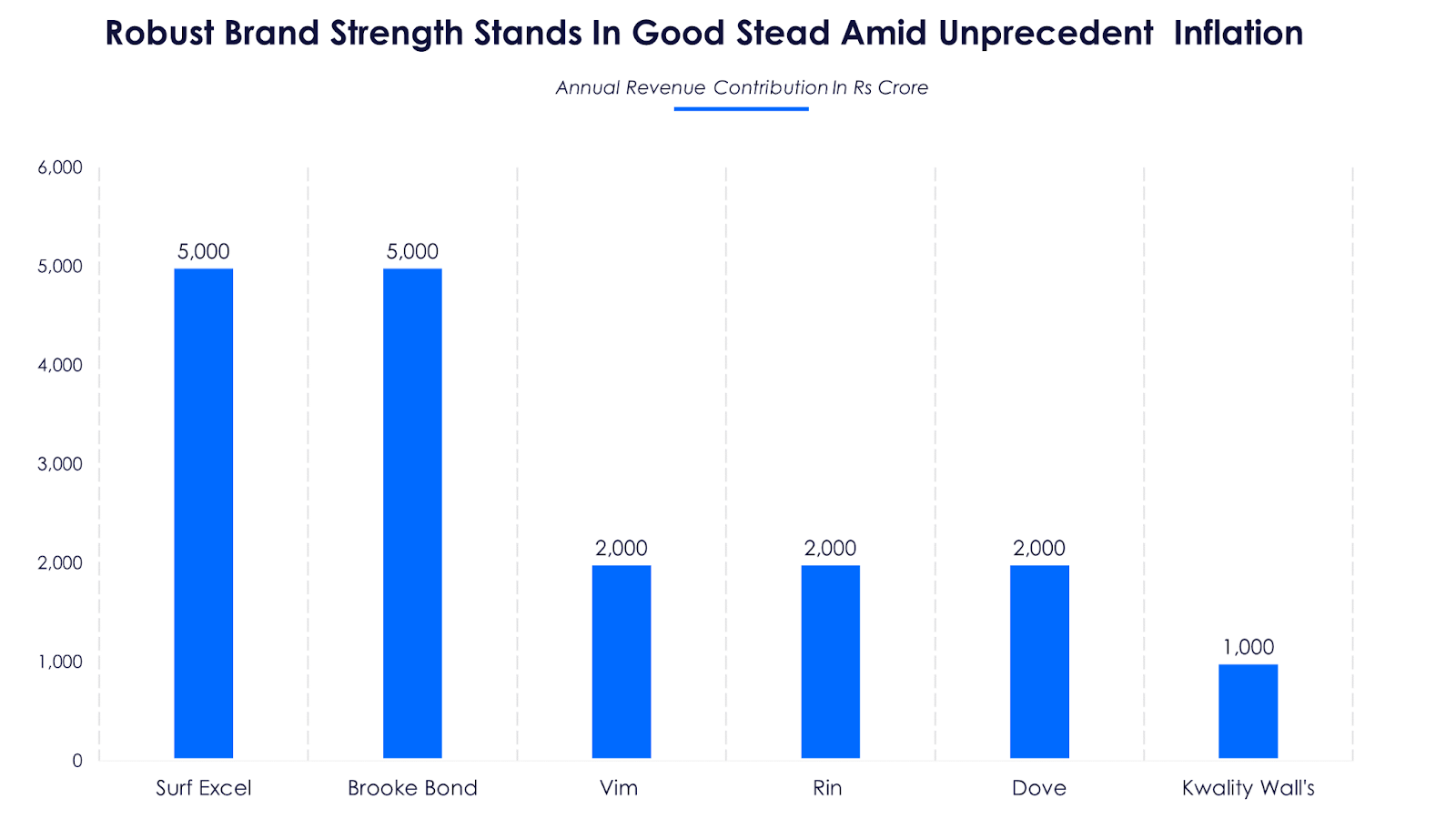

While inflationary winds blow hard, it may be essential to hold on to a deep-rooted FMCG tree trunk like HUL ( currently in Trendlyne’s potential Buy zone). It is a must-have stock during uncertain times, mainly due to its unrivaled robust product portfolio. Surf Excel and Brooke Bond individually contribute more than Rs 5,000 crore annually and Vim, Rin and Dove are in the Rs 2,000 crore revenue club. Kwality Wall’s crossed Rs. 1,000 crore turnover mark in FY22. 16 brands with more than Rs 1,000 crore turnover comprise 75% of HUL’s top line.

The annual brand turnover of any of HUL’s top three brands--Surf Excel, Brooke Bond, and Vim would surpass the annual turnover of Dabur or Marico. For a behemoth like HUL, as high commodity inflation and low volume growth wreak havoc on smaller peers and regional players, the time might be ripe for an acquisition prowl. With JioMart expected to disrupt FMCG turf in the near future, this seems to be a necessity for HUL.