By Suhani Adilabadkar

Cipla had surprised analysts with a strong double-digit domestic formulation (DF) revenue YoY growth in Q3FY22 against expectations of a slowdown due to low Covid-19 revenue contribution. The US business also reported its highest ever quarterly revenues in the December 2021 quarter.

The question is if the company can do it again.

While the India business, which constitutes more than 40% of the revenue mix, is expected to benefit from Covid-19 tailwinds in Q4FY22, the street is awaiting Cipla’s key product launches in the US market to materialise in H2FY23.

Quick Takes:

- Three key product launches are expected in H2FY23, Revlimid, Abraxane and Advair in the US market

- Cipla received approval of its major peptide asset, Lanreotide injection, expected to be launched in Q4FY22

- Revenues at Rs 5,479 crore grew 6% YoY, supported by strong growth in India and the US formulation business in Q3FY22

- US revenues grew 7% YoY to $150 million in Q3FY22, driven by respiratory franchise which grew 36% YoY

- Operating margins contracted 100 basis points to 22.5% due to high raw material cost and lower contribution by Covid-19 portfolio

- The recent Central Drugs Standard Control Organisation (CDSCO) nod to conduct local trials for Pfizer’s anti-Covid-19 pill Paxlovid has pleased investors

Strong traction in trade generics business, consumer health yet to breakeven

Cipla’s India business, known as ‘One India’ constituting trade generics, consumer health, and branded prescription, contributed 46% to total revenues in Q3FY22.

Cipla’s trade generics vertical (more than 150 brands) is the largest trade generics business in the country, focussing on patients in tier-3 and tier-4 towns with a robust supply chain of 5,500 stockists. The trade generics business is witnessing strong traction across flagship brands and key therapeutic categories.

The company launched 10 brands in 9MFY22 across cardiology, thyroid and derma categories expected to gather strong momentum in the coming quarters. Speaking on trade generics, Umang Vohra, Managing Director and Global CEO at Cipla, said, “Some of our flagship generic brands in our trade generic business have grown past the Rs 100 crore mark and few others are crossing the Rs 50 crore mark.” The company plans to launch more than 60 products in FY23, which include high growth categories like anti-diabetic and injectables.

Cipla’s consumer health business, mainly in India and South Africa, is also shaping up strongly. The consumer health business contributed 8% YoY to the 9MFY22 topline. Consumer health is witnessing robust traction in anchor brands such as Omnigel, Cofsils, Clocip, Cheston, Nicotex, Maxirich during the December 2021 Quarter and 9MFY22 said Vohra.

The management expects at least four of these brands to cross Rs 100 crore revenue in the coming quarters. While India branded prescription business is the most profitable followed by trade generics, consumer health (spun off as a separate subsidiary, Cipla Health in 2014) is expected to break-even in the coming quarters. According to the management, the consumer health business is expected to contribute 10% revenue share by FY25.

In-licensing deals support branded prescription business growth

In-licensing deals support branded prescription business growth

Overall, the India business was driven by strong momentum in Q3FY22 across core therapies (respiratory, chronic, urology, anti-infectives) with robust traction in flagship brands. Branded prescription business constitutes 70-75% of total ‘One India business’ and trade generics and consumer health the remaining balance.

Branded prescription business is on track to achieve the one-billion-dollar mark, building a formidable franchise in India, said Vohra. The company expects in-licensing deals with global pharma companies to support growth and aid in diversifying and expanding its branded prescription business. According to the management, in addition to changing formulations and launching generic versions, Indian pharma needs to partner with global pharma companies to augment new product launch frequency. For more innovative products in India, which are patent protected, partnering with global multinational corporations (MNCs) is a must, said Vohra.

Cipla licensed tocilizumab, trastuzumab and rituximab from Roche for oncology and sacubitril, Valsartan from Novartis for cardiology. The company has one of the largest cardiology and diabetes product portfolios in the industry. For diabetes, Cipla licensed products such as inhaled insulin from Mannkind, insulin glargine from EliLilly, vildagliptin from Novartis, and canagliflozin from Janssen.

Cipla expects annualised non-Covid business of Rs 500 crore from in-licensed deals and partnerships in the near future.

Cipla also maintains a robust Covid-19 portfolio by partnering with global pharma majors like Gilead (Remdesivir), Roche (Covid antibody cocktail), Merck (Molnupiravir) and Eli Lilly (Baricitinib). The recent CDSCO approval to conduct local trials on Pfizer’s anti-Covid-19 pill Paxlovid is another growth opportunity for Cipla. Though Paxlovid’s revenue potential might be low with the receding Covid-19 pandemic, tailwinds from the third wave will be witnessed in Q4FY22 for Cipla’s India business.

Cipla also maintains a robust Covid-19 portfolio by partnering with global pharma majors like Gilead (Remdesivir), Roche (Covid antibody cocktail), Merck (Molnupiravir) and Eli Lilly (Baricitinib). The recent CDSCO approval to conduct local trials on Pfizer’s anti-Covid-19 pill Paxlovid is another growth opportunity for Cipla. Though Paxlovid’s revenue potential might be low with the receding Covid-19 pandemic, tailwinds from the third wave will be witnessed in Q4FY22 for Cipla’s India business.

India business grew 13% YoY to Rs 2,518 crore in the December quarter on a higher base and with low Covid-19 contribution. Cipla’s core prescription business in India excluding Covid grew strongly at 16% YoY in December 2021 Quarter lending strong confidence to investors.

Speaking on India business growth, Vohra said that the Indian pharma market is expected to grow by 10-12% YoY excluding Covid-19 contribution. Cipla expects to beat market growth in the coming quarters. The recent 10% price increase of essential drugs (over 800 drugs) under the National List of Essential Medicines (NLEM) allowed by India’s drug price regulator is another strong tailwind for Cipla. The company’s exposure to NELM stands at 25-30% of its total India business.

US business – street awaits key product launches

Cipla’s US business was range-bound between $135-$140 million over the past seven quarters. It reported a new, and highest-ever revenue base of $150 million for its US business in Q3FY22. While Cipla’s US portfolio includes drugs like Diclofenac (pain), Sertraline and Escitalopram (antidepressants), and Esomeprazole (esophagitis), its respiratory franchise is the major growth driver. US revenue growth was at 7% YoY in Q3FY22 driven by respiratory franchise which grew 36% YoY. Cipla received USFDA’s first generic approval for the commonly used Albuterol Inhaler in May 2020. Cipla’s market share currently stands at 15.9% in the total US Albuterol market. Another star drug, Arformoterol Tartrate inhalation solution also continues to do well with a market share of 26.8% in overall Arformoterol market. According to the management, $150 million sales is the new quarterly run-rate for its US business in the coming quarters.

The management guided three product launches in H2FY23, Revlimid, Abraxane and Advair. While Advair (asthma) will further boost the respiratory portfolio, Abraxane (breast and lung cancer) and Revlimid (blood cancer) are other high-value product launches with expected incremental revenue of $300-500 million annually in the next two years. Cipla’s robust respiratory pipeline also includes two more programs in advanced stage and another five programs under early stages of development. The management expects its respiratory products to cross the $150 million revenue mark in FY22.

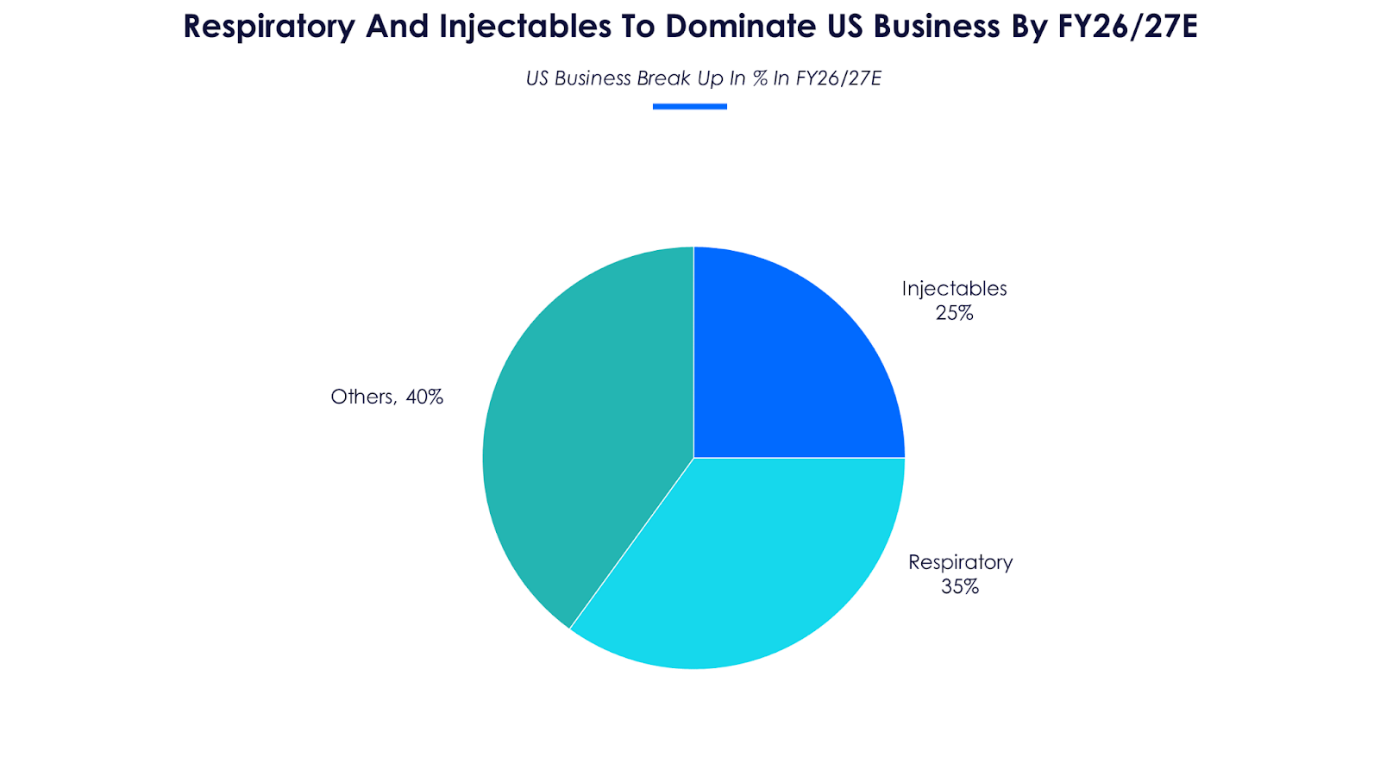

Cipla also received approval of its major peptide asset, Lanreotide injection (neuroendocrine tumors), expected to be launched in Q4FY22. Market size of Lanreotide injection is estimated to be around $860 million. Cipla has two more peptide assets under approval and expects a complex generics injection in FY24. The share of injectables currently 5% of US revenue mix in FY22 is expected to touch 25% in the next five years.

According to the management, while strong launch momentum is a key tailwind, commodity inflation is a major headwind for Cipla. And also, the pending USFDA’s Goa facility inspection for new drug approvals for the past two years. Investors are hoping for a timely inspection as key product Abraxane will be manufactured from the Goa facility.