By Vivek Ananth

KPIT Technologies is a familiar name, and many investors sometimes confuse it with its earlier avatar under the same name. But after the demerger of the erstwhile KPIT Technologies’ engineering & research and development verticals into the current entity, KPIT Tech is a pure-play automotive technology services provider. The demerger also included the merger of the erstwhile KPIT Tech’s …

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

KPIT Technologies is a familiar name, and many investors sometimes confuse it with its earlier avatar under the same name. But after the demerger of the erstwhile KPIT Technologies’ engineering & research and development verticals into the current entity, KPIT Tech is a pure-play automotive technology services provider. The demerger also included the merger of the erstwhile KPIT Tech’s enterprise business into Birlasoft,

This means any comparison to past stock performance is not possible. So let’s take a look at how the stock performed over the past few quarters.

The stock rallied in January 2022 after Goldman Sachs initiated coverage on the stock with a target price of Rs 1,040 for the end of the year. KPIT Tech rose over 33% to touch its lifetime high of Rs 801 by January 5, 2022. It was almost as if investors wanted to achieve Goldman Sachs’ target price in January itself. The highest target price for KPIT Tech, according to Trendlyne’s Forecaster, is Rs 840. And the average target price is Rs 688.3.

Eventually, sanity prevailed, and with higher volatility in stock markets globally due to the ongoing Russia-Ukraine war, and the resulting price shocks, KPIT Tech saw a correction in its stock price. Now the stock price is back to the same level it was before Goldman Sach initiated its coverage on the company.

But is the still rich valuation of 64 times its trailing twelve-month earnings justified? Is the opportunity in automotive software that huge that the market is pricing in enormous future gains?

Niche player with a large opportunity

There are two ways to look at KPIT Technologies—one, as a company that has put all its eggs in one basket, with its focus on a single industry. It has built its verticals and practices around serving the automotive space. Its legacy of building automotive software for two decades makes it a niche player with the requisite skills, in an industry that will see significant investments from automotive OEMs globally.

The second way of looking at KPIT Tech is that the concentration of revenues from one industry leaves it beholden to the economic cycles of the automotive industry globally. As we know, the automotive industry is in extreme flux right now.

The transition globally into autonomous technologies, connected car technologies, electric vehicles and shared mobility puts KPIT Technologies in an enviable position. Its capabilities as a technology integrator for OEMs, that are heavily reliant on technology to run their cars, are what all investors are enthused by at this moment.

Some of this is showing up in the quarterly numbers for the company. Take a look at the revenues in the past five quarters for a minute.

The company’s revenues grew at a compounded quarterly growth rate of 4.7% to nearly $84 million. If the company continues to grow at this rate, within four years its quarterly revenues will double. But this comes after the company’s revenues dipped in Q1FY21 and Q2FY21. The pick-up in revenue growth only started from H2FY21 onwards.

Trendlyne Forecaster’s average revenue estimate for Q4FY22 is Rs 653 crore, with net profits of Rs 74.1 crore. For FY23, the average revenue estimate is Rs 2,938 crore and net profits of Rs 345 crore.

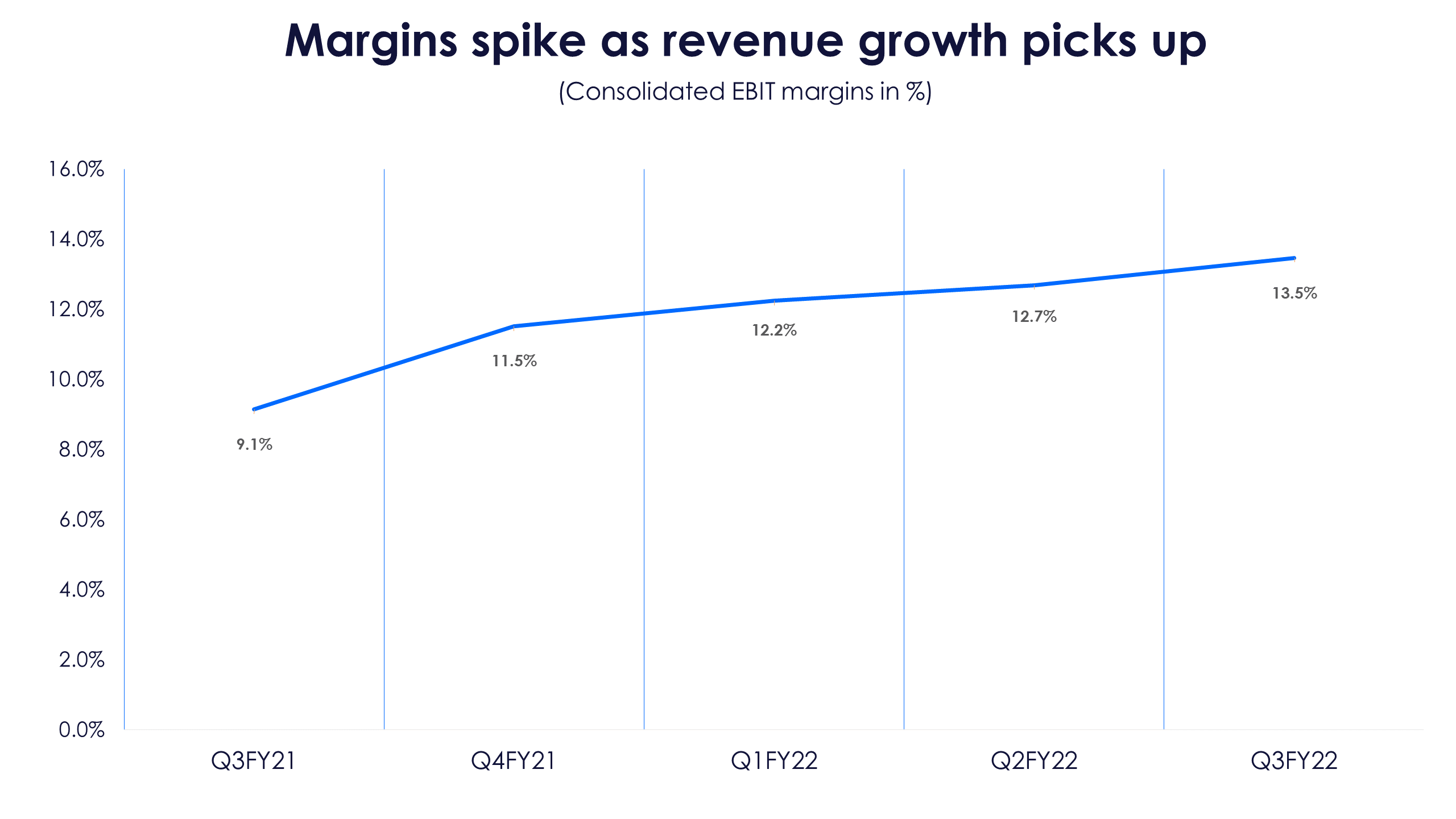

The robust revenue growth over the past four quarters led to a rapid rise in the company’s quarterly net profit till Q3FY22. This is mainly led by a robust increase in the company’s margins. Although the company gave an EBITDA margin guidance of reaching 20% in the next two years, this is what its EBIT margins look like over the past few quarters.

Investors who are evaluating this stock should know that the company beat the timeline to reach an 18% EBITDA margin level within the three years it had guided. It doesn’t seem 20% EBITDA margins will be that difficult with the demand environment being robust.

Some of the margin improvement is also because many projects were moving offshore, accelerated by the onset of the pandemic. The company’s management said in their post Q3FY22 earnings call that this will not lead to a surge in margins any longer. The company plans to reinvest any margin gains from the offshoring of projects into the business.

Not immune to attrition; client concentration is a key risk

The management said in their post Q3FY22 earnings call that the company’s attrition touched 20% in Q3FY22. This is one of the key risk areas for KPIT Tech. Being a niche player, it requires talent with niche skills. If the market opportunity in automotive engineering and research and development is huge, then there will be a surge in demand for talent as well, both from KPIT and its rivals.

The problem with high attrition for a company that requires niche skills is that employees become more difficult to replace. This means the company will have to resort to hiring generalists and create a pipeline of talent by training them. This will, apart from reducing attrition, also improve margins in the long run. But this is not exactly a short-term fix. This will take at least a couple of years to fructify.

The company doesn’t break up its numbers like other IT services companies do, down to granular data points. It assured investors that it will make suitable changes to its reporting of data to investors when it announces its Q4FY22 results.

The company’s top 21 customers contribute nearly 83% to its revenues. As a whole, the company had 58 customers at the end of Q3FY22. That's a severe concentration of revenues. But there is another side to this. The largest spenders in the world in automotive research and development are not many, and the company has 21 of the top 25 spenders as its customers.

If investors are enthused by the company’s prospects, they should note that this client concentration and niche talent attrition issue is a double-edged sword. That should be one of the key considerations while evaluating KPIT Tech as an investment