By Vivek Ananth

Affordable housing finance is a fragmented market with many large housing finance, non-banking finance companies and banks battling it out with pure-play affordable housing finance companies like Aavas Financiers and Home First Finance. With record low-interest rates available right now, apart from the real estate sector, the housing finance sector is making waves.

Home First Finance held a conference …

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Affordable housing finance is a fragmented market with many large housing finance, non-banking finance companies and banks battling it out with pure-play affordable housing finance companies like Aavas Financiers and Home First Finance. With record low-interest rates available right now, apart from the real estate sector, the housing finance sector is making waves.

Home First Finance held a conference call with analysts a couple of weeks ago to give an update on how its business has panned out. The company’s Managing Director and CEO Manoj Viswanathan said that the stress that the company saw in some borrowers’ accounts (200 customers in Q1) has receded now.

The company had allowed these 200 customers to restructure their accounts by converting their unpaid interest into loans. Viswanathan said in mid-September 2021 to analysts that “the situation is cured by 90%.”

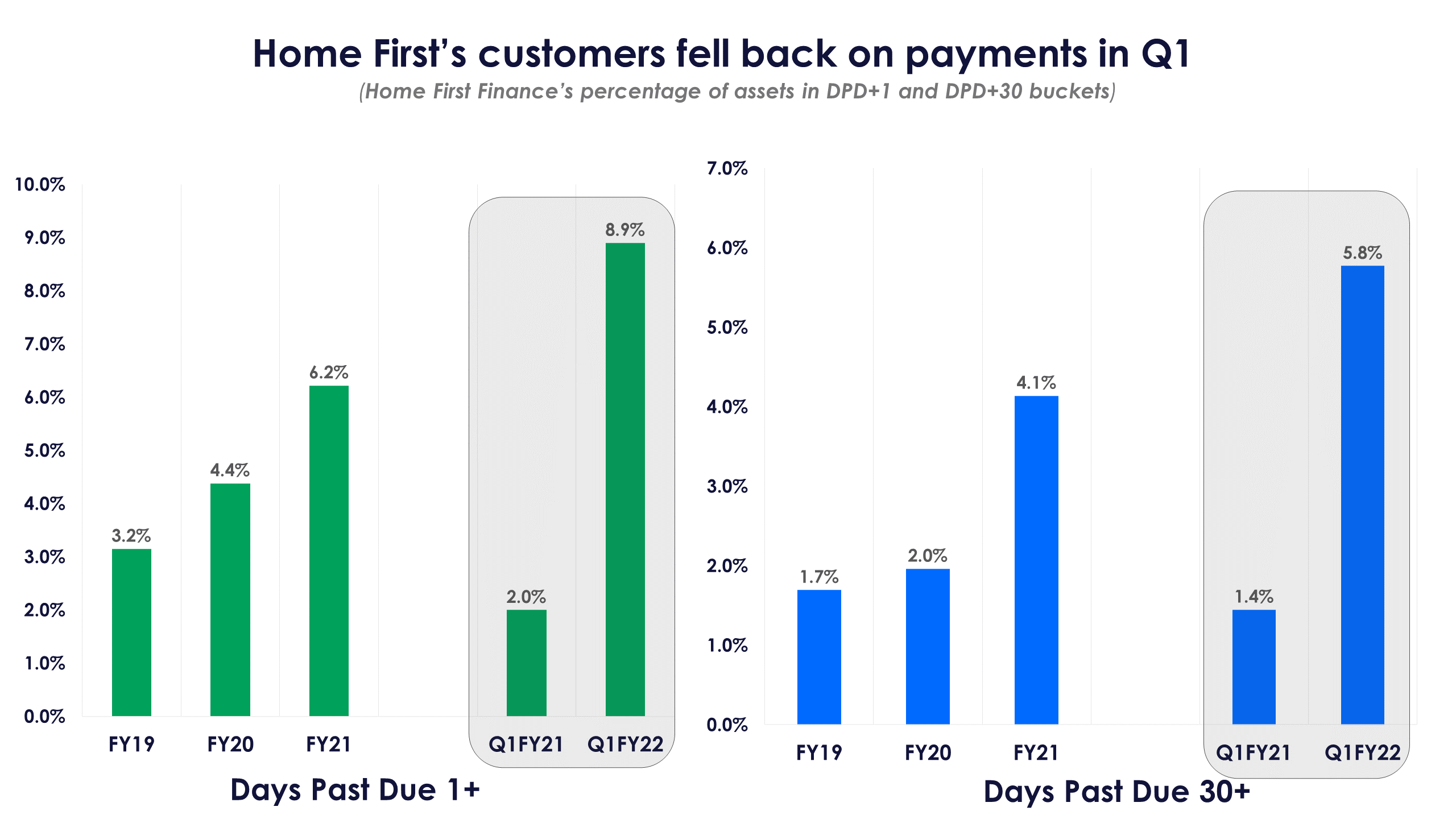

It is worth mentioning that although the company’s business was not as badly impacted due to the second wave of the pandemic compared to the first wave, there were some signs of stress that can be seen in its Q1FY22 ‘days past due’ (DPD) disclosures.

Before the pandemic set in, the company’s 30 dpd+ accounts used to be in the range of 3-4%, Viswanathan said in the conference call. He added that the majority of these are customers who had temporary cash flow problems, to whom the company counsels to pay instalments as and when they can.

The accounts that turn into NPAs are usually due to the borrower facing a medical emergency, which leads to long-term cash flow problems. In case of long-term problems, Viswanathan said, the company usually advises the borrower to sell the property and clear the loan. These are usually just 1% of the company’s assets under management (Rs 4,294 crore as of June 30, 2021).

There was also a marginal 10 bps rise in gross NPA (or stage 3 accounts) in Q1FY22 to 1.9% over Q4FY21. But when compared to Q1FY21, there has been a considerable rise. This is because of the overhang of the pandemic.

10-2-1 framework in play

One of the targets the company set for itself was achieving a 10% bounce rate (of instalments), 2% 30 dpd+ and 1% NPA. This is the longer-term target that it conveyed to investors. The company’s bounce rate increased by 100 bps in Q1FY22 to 18.3% from the previous quarter. This is far better than the 36.4% in Q1FY21, and it shows that the impact of the second wave wasn’t as bad as the first.

Viswanathan had previously in the company’s post Q1FY22 earnings call alluded to the fact that Home First Finance wants to gradually reduce its gross NPA ratio by 10 bps each month to bring it within the 10-2-1 framework. At the end of June 30, 2021, the gross NPA ratio was 1.9%, nearer to 2%. Viswanathan said that achieving the 1% target would take a bit of time and that it would not happen within the next three quarters. Essentially, reaching a 1% GNPA ratio is a medium-term target for the company.

On the 30 dpd+ bucket of accounts, Viswanathan noted that collections are improving from these customers. But it will take some time before the company is able to reach its aspirational 3% target. As pointed out earlier, even before the pandemic, the company’s 30 dpd+ bucket was around 3-4%. So, this might be the hardest nut to crack.

Home First has made its mobile app available to its customers. This helps them to make small lump sum payments of nearly Rs 1,000 against the principal outstanding. This way the company is also able to provide customers the ability to bring down their EMIs by paying remotely.

Pandemic impacts return ratios as profits slow

The increase in the NPA ratios and higher bounce rates over FY21 led to Home First Finance’s return ratios falling marginally. Although the company’s net interest income and net profit grew in FY21, in Q1FY22, net profit fell marginally when compared to the same period in FY21.

This shows that the NPA stress is showing on its financials. Although it’s not too bad, this is a point of concern for investors.

Its return on equity climbed back above 10% in Q1FY22 after falling below that level in FY21. But the return on equity was on the rise in Q4FY21 (10.4%) before dipping marginally in Q1FY22.

What must enthuse investors is the considerable rise in the spread that Home First Finance is earning over its cost of borrowing. Viswanathan said in the Q1FY22 post-earnings call that the cost of borrowing should come down further. Some of this high spread is due to record low-interest rates prevalent in India.

Home First Finance is an aggressive affordable housing player, which means that the company will continue to chase more customers over the next few quarters. The fact that affordable housing gets a push from the government in terms of sops and tax deduction bodes well for the company. It will be interesting to see whether the current flurry of real estate activity will continue and if companies like Home First Finance can ride this gravy train.