By Vivek Ananth

Another initial public offer (IPO) has hit the markets, and this time it is a housing finance company—Home First Finance. The company focuses on financing buyers of affordable homes (ticket size of Rs 25 lakh and below) and uses technology to speedily process home loans.

In the 10 years since its inception, the company has managed to build a business with an AUM of Rs 3,730 crore as of September 30, 2020. The company’s loan book grew at an impressive 61% CAGR over the past five completed financial years till 2019-20. The company’s average ticket size of loan is around Rs 10 lakh, and it lends mostly to salaried and self-employed individuals.

The size of the housing finance market has grown by a compounded annual growth rate (CAGR) of 16% from 2014-15 to 2019-20 to Rs 20.4 lakh crore loans outstanding, according to CRISIL Research. It is expected to grow at 8-9% CAGR till FY2023 to Rs 26.5 lakh crore.

Out of the total housing finance market, affordable housing finance makes up Rs 9.1 lakh crore in terms of loans outstanding growing by a CAGR of 12% from FY15 to FY20. CRISIL Research expects the affordable housing finance market to grow at a CAGR of 9-10% from FY20 to FY23.

In the past couple of years, funding has been scarce for housing finance companies (HFCs) since IL&FS came undone in a Rs 90,000-crore meltdown in 2018. And after the COVID19 pandemic hit, many housing finance companies had to resort to securitisation to raise funds, including Home First Finance. The RBI’s liquidity measures of targeted long-term repo operations in 2020 helped HFCs tide over hard times by raising funds to lower their funding costs.

Offer subscribed 27 times

The IPO consists of a fresh issue of shares worth up to Rs 265 crore and an offer for sale of up to Rs 888.72 crore. The price band of the issue is Rs 517-518. The promoters and private equity investors (True North, Aether (Mauritius) and Bessemer Venture Partners) are collectively selling around 19.8% (post issue) stake in the offer for sale.

The fresh issue worth Rs 265 crore will mean an additional dilution of around 5.9% (post issue) stake in the company. The proceeds of the fresh issue will be used to shore up Home First Finance’s capital base for future growth.

As of 4:55 PM at the third and last day of bidding, the issue is oversubscribed by nearly 27 times the shares on offer.

Pandemic impacted collections

The pandemic led to Home First Finance’s disbursements dropping 67% in the first six months of FY21 ended September 2020. There was also a spike in its overdues from customers in the 30 days bucket to 3.1% in October 2020 from 1.6% in FY20. At the end of September 2020, the 30 days past due date bucket as a percentage of loans was 1.1% as customers had opted for a moratorium.

Even collections were impacted due to the pandemic falling to 63% in April and May 2020. It has now recovered to 96.1% in October 2020.

Better performance compared to peers

Home First Finance is valued at a price-to-book multiple of 3.4 times (based on post-issue net-worth). When compared to its only listed peer—Aavas Financiers at 6.8 times price-to-book value—Home First Finance is cheaper.

The company’s net interest margin for FY20 (5.4%) is lower than its listed affordable housing financier peer Aavas Financiers (6.4%). Here is how it looks in comparison to some other listed housing finance companies.

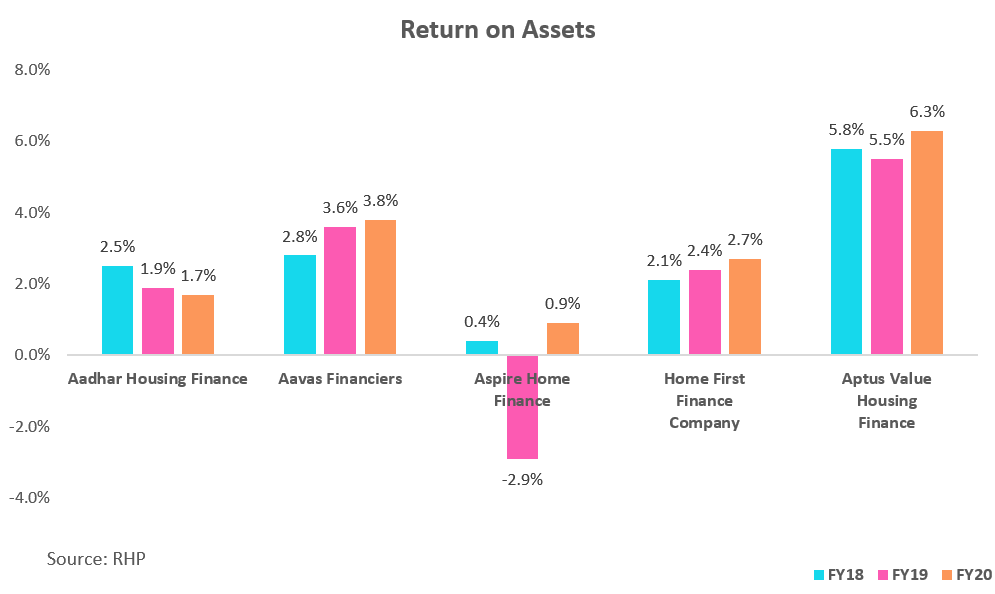

In terms of return on assets for FY20, Home First is again lower (2.7%) than its listed affordable housing finance peer Aavas Financiers (3.8%). This is how it compares with other listed housing finance players:

Even in terms of return on equity for FY20, Home First Finance is worse off (10.9%) than Aavas Financiers (12.7%). This is how it fare with other listed housing financiers-

Good financial strength

Home First Finance has maintained a capital adequacy ratio or capital-to-risk weighted asset ratio (CRAR) of over 50%. Its borrowing position is also very comfortable at less than 3 times its net owned funds. The regulations allow HFCs to borrow up to 12-14 times their net owned funds.

The company has reported a steady rise in total income over the past three completed financial years. Its total income grew at a CAGR of 76.8% from FY18 to FY20, while net profit grew at a CAGR of 122.5% in the same period.

Key concerns and risks remain

One of the key concerns with housing finance companies, be it affordable housing or otherwise, is the availability of credit. The credit crunch caused by the meltdown of IL&FS led to the collapse of DHFL. This is despite DHFL having a decent franchise. The pandemic brought another credit crunch for housing finance companies

In a risky business which is impacted by liquidity conditions in the credit markets, should investors bet on a new player like Home First Finance? Well, that depends on whether you as an investor have a high appetite for risk. If you are, Home First Finance is the stock for you.

The company will grow fast as witnessed by the break-neck speed at which its AUM has grown over the past five years, but it will also be impacted by liquidity pressures in future. Considering these factors, it appears that the offer is priced almost right for investors with a higher risk appetite who want to play the affordable housing theme.