Top cement companies ended Q2FY22 with a positive outlook for H2FY22 on hopes of higher infrastructure spending by the central government. However, the situation worsened for the sector in Q3FY22 in line with analysts’ expectations. Notably, the stocks of the top six companies fell nearly 22% on average in the last 3 months. Is the cement sector headed for better days ahead? Or is the current weakness likely to persist?

Higher costs and subdued demand weigh on cement space in Q3FY22

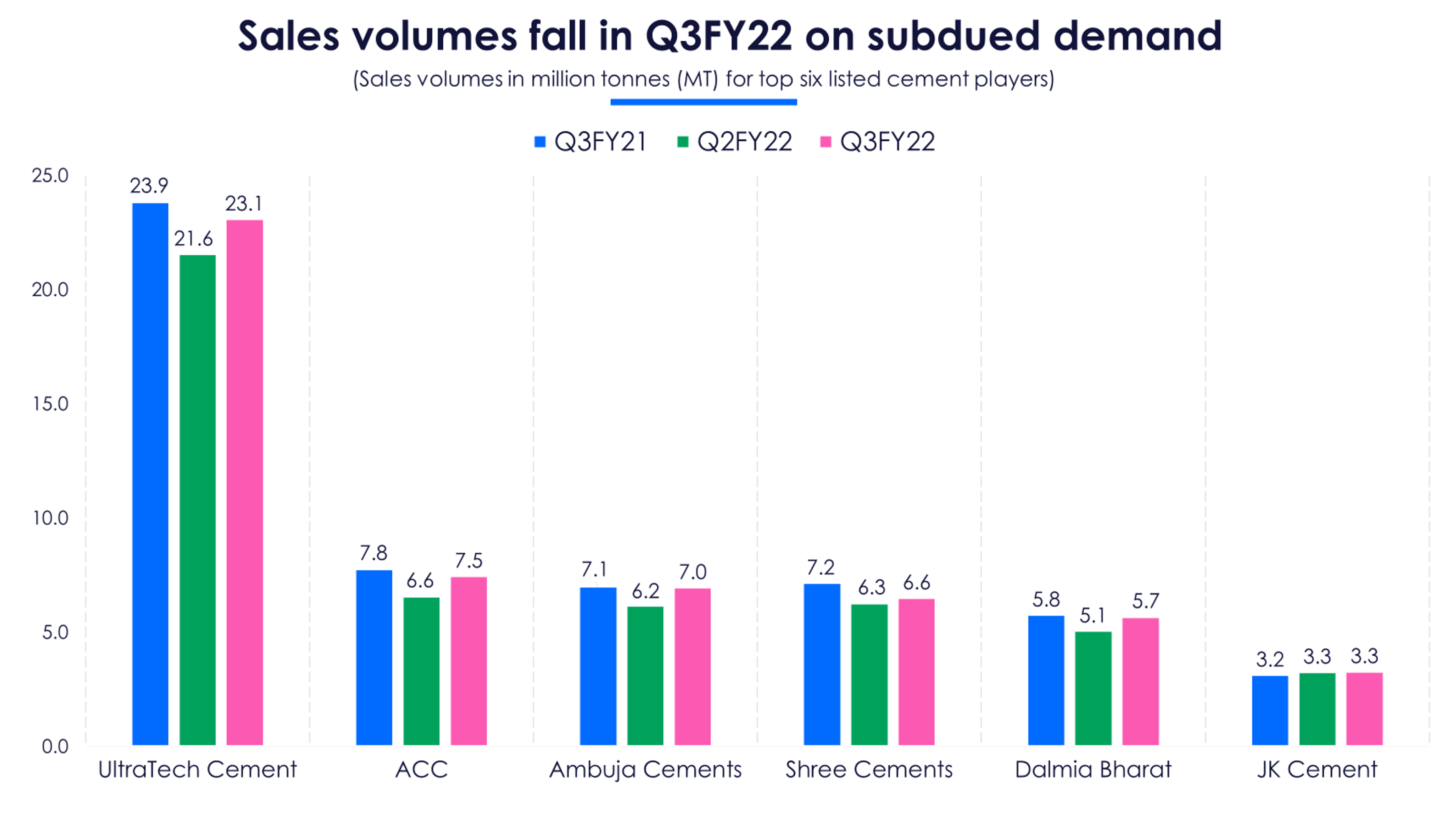

All cement players except JK Cement, reported a single-digit YoY fall in their sales volumes in Q3FY22 due to weak demand from India’s eastern and southern regions. Cement demand in these regions was hit by extended monsoons, unavailability of labourers, high sand prices and a transporters’ strike in the state of Chhattisgarh.

JK Cement however sells primarily in the northern and western regions of India. Hence, it was the only player which managed to post a rise in sales volume of 5% YoY in Q3FY22. On the other hand, Shree Cements’ volumes fell 9% YoY to 6.6 million tonnes (MT) led by dismal demand trends in east, central and southern regions. Interestingly, when it comes to QoQ growth sales volumes for the listed players in question improved by an average of over 8% sequentially in Q3 as Q2 is a seasonally weak quarter for the sector.

Demand from the infrastructure space was subdued for all regions except the north, owing to lower government capex. Government capex fell 24% YoY to Rs 23,919 crore in October 2021 and by 54% to Rs 20,360 crore in November 2021. On the housing front, demand from the rural segment grew YoY while urban housing demand slowed down, according to UltraTech Cement.

Coming to realisations, cement players like UltraTech Cement and Shree Cement witnessed over 9% YoY growth in their sales realisations/tonne. This shows they still have pricing power in the market. However, Dalmia Bharat saw its realisation/tonne fall 3% YoY to Rs 4,791 due to a steep fall in prices in the eastern region. The company derives 60% of its top line from this region.

For a sector reeling under cost inflation pressures, it is imperative that sales performance is strong enough to soften this impact. However, the top six players witnessed dismal average revenue growth of 4% YoY in Q3 led by subdued volumes and lacklustre growth in realisations.

The rise in energy costs on a YoY, as well as sequential basis, impacted the EBITDA margins of cement companies yet again. Imported thermal coal and petcoke prices spiked another 15-20% and 35% QoQ respectively in Q3FY22. This comes after these costs doubled,on a YoY basis in Q2FY22. Understandably, the power and fuel costs of cement companies rose by an average of over 40% YoY in Q3.

Shree Cements’ power and fuel costs/tonne saw the steepest rise of 60% YoY to Rs 1,233 in Q3. This especially comes as a surprise for the company since it is historically known for its cost competitiveness among its peers.

The cost pressures for cement might persist well until Q1FY24. Imported pet coke and coal prices did correct by 30-35% between November 2021 and January 2022. However, they are on an uptrend ever since the start of February 2022 on account of the Russia-Ukraine conflict. No clear trend can be established for energy costs from hereon, but costs may rise as industries diversify their energy spending.

Cost pressures and subdued realisations led to an average EBITDA margin erosion of seven percentage points for cement companies in Q3FY22 compared to Q3FY21. ACC saw the lowest fall in margins on account of savings in cost due to cost optimisation measures underway.

On the other hand, its holding company Ambuja Cements saw the highest contraction amongst the top six listed players in its EBITDA margins (14.3%) in Q3 i.e., of 863 bps. This was due to higher other expenses particularly higher branding, maintenance, and packaging costs coupled with higher fuel costs.

JK Cement was the only player which could maintain its EBITDA margin at 19.3% on a QoQ basis in Q3. The company also saw its EBITDA/tonne rise on a sequential basis to Rs 1,116 buoyed by better realisations.

Essentially, Q3FY22 proved to be a washout for the sector as net profit of all listed companies except UltraTech Cement, fell over 35% YoY in. Market leader UltraTech Cement’s posted Q3 net profit rose 8% YoY to Rs 1,708 crore, mainly on account of deferred tax adjustments.

On a positive note, the management of companies like UltraTech and Shree Cementremain hopeful of a rebound in the sector from Q4FY22 and onwards.

Riding on the hope of higher infrastructure spending and housing upcycle in FY23

The Centre stepped up the capex target by 35% YoY to Rs 7.5 lakh crore in the Union budget of 2022-23. This target is 2.2 times more than the spend of FY20 and will provide a much-needed demand boost for the cement sector - provided this capex actually takes place on the ground.

Another boost for the cement space comes from the real estate sector. Top realtors are not only planning a couple of launches in Q4FY22, but are also investing in acquiring new land parcels for further development. Players like Godrej Properties, Oberoi Realty and Mahindra Lifespaces bought land in Mumbai and Bangalore in Q2FY22 and Q3FY22 to develop new residential projects.

Notably, the government allocated Rs 48,000 crore towards its affordable housing scheme i.e., PM Awas Yojana, for FY23 in line with the FY22 figure. This also augurs well for the cement sector.

Buoyed by a higher infrastructure budget and bright outlook on the housing front, cement companies are firm on their capex plans for the next two years. Infact, Ambuja Cements announced a new investment plan of Rs 3,500 crore in Q3FY22 which involves setup of a 7 MT cement and 3.2 MT clinker plant in the east.

Coming to the near-term outlook, top players such as UltraTech Cement and JK Cement saw a meaningful demand recovery between December 2021 and February 2022. Cement companies also hiked prices by Rs 5-10/bag in the northern region and Rs 15-20/bag in the southern region. With the waning of the third Covid wave and resolution of intermittent issues like labour unavailability and extreme weather conditions, analysts expect a double-digit revenue growth for FY23 led by higher realisations and volumes.

An important thing to note here is that unless there is a robust rise in the companies’ revenues, they can’t possibly think of growing their earnings meaningfully. This is because costs are already spiralling. Plus, there will be added pressure of higher depreciation expenses on account of capex plans. In fact, brokerages like Motilal Oswal have cut FY23 earnings estimates by 2-4% for companies like UltraTech Cement and ACC.

However overall, the analysts remain positive on the earning prospects of this sector in FY23 as they believe that the worst is over on the cost front.

At this juncture, it's best for investors to wait and watch on the performance of top cement players in the upcoming quarters and see whether the actual topline growth is encouraging enough. Without that, the risk of a potential derating looms large for this sector.