By Deeksha Janiani

Larsen & Toubro made headlines back in October 2020 when it won a Rs 25,000 crore government funded contract as a part of the Ahmedabad-Mumbai bullet train project. Understandably, the new order inflows for the company's infrastructure segment jumped by 80% YoY in Q3FY21. Cut to Q3FY22, the order inflow momentum for the engineering major is sluggish led by slow finalization of contracts.

Many brokerages and credit agencies like BoFA Securities, Jefferies, Crisil and Fidelity International predicted a revival in capex from FY22 led by the government's infrastructure push and PLI scheme. However, is the inflection point for the much-anticipated capex upcycle still ahead of us?

Government capex slows down in Q3FY22

In Q2FY22, while the tenders floated for domestic projects were up 19% YoY, final awarding of projects by the government fell nearly 22% YoY. The same trend continued in Q3FY22 as well due to a considerable fall in the government’s capex for October and November 2021. In fact, the ratio of tenders actually awarded to L&T out of the ones floated fell to 48% in the nine months ended December 31, 2021 as against 61% a year ago. To put it simply, if the government invited bids for around 100 construction projects in Q3, it awarded only 48 of those contracts to L&T (compared to 61 last year).

This trend clearly impacted the order inflows for L&T’s infrastructure and hydrocarbons segment. Notably, new order inflows fell 44% YoY to Rs 25,300 crore for the infrastructure segment and by 39% YoY to Rs 8,005 crore for the hydrocarbons segment. The new orders in the infrastructure segment further included projects related to the metro, rural water supply, minerals and metal, public spaces and health infrastructure.

Interestingly, the order book for hydrocarbons segment (oil and gas sector) stays robust at Rs 53,676 crore driven by record onshore orders received in the previous two quarters. In Q3FY22, L&T received multiple offshore orders mostly from the middle-eastern countries.

Notably, the company witnessed a spurt in orders from the defense engineering segment. The order inflows for this segment jumped by nearly 150% YoY to Rs 1,746 crore led by a large shipbuilding order. However, the power segment continued to suffer due to ESG concerns with no major orders being received in Q3FY22. L&T primarily develops thermal power projects under this business segment.

On the whole, domestic order book remained flat in the last five quarters while international order book grew at 23% YoY to reach Rs 81,696 crore in Q3FY22. Firm oil prices boosted the order inflows from Gulf Cooperation Council (GCC) countries. Also, the order book-to-revenue ratio remains healthy at 3.3X providing the much needed revenue growth visibility.

Project execution improves further in Q3FY22

While order inflows moderated for L&T’s infrastructure segment, its revenues grew at 16% YoY to Rs 18,345 crore led by a pick-up in execution activities of some large-value projects. Notably, the last quarter of the year is a strong one for L&T due to the robust pace of project execution. This also explains the higher revenue and EBITDA numbers for Q4FY21.

Profitability of this segment improved not only sequentially but also on a YoY basis due to margin expansion and higher revenues. Margins particularly improved due to better job mix i.e., effective resource utilization and better overhead recovery. This feat is noteworthy given the higher commodity inflation in Q3FY22.

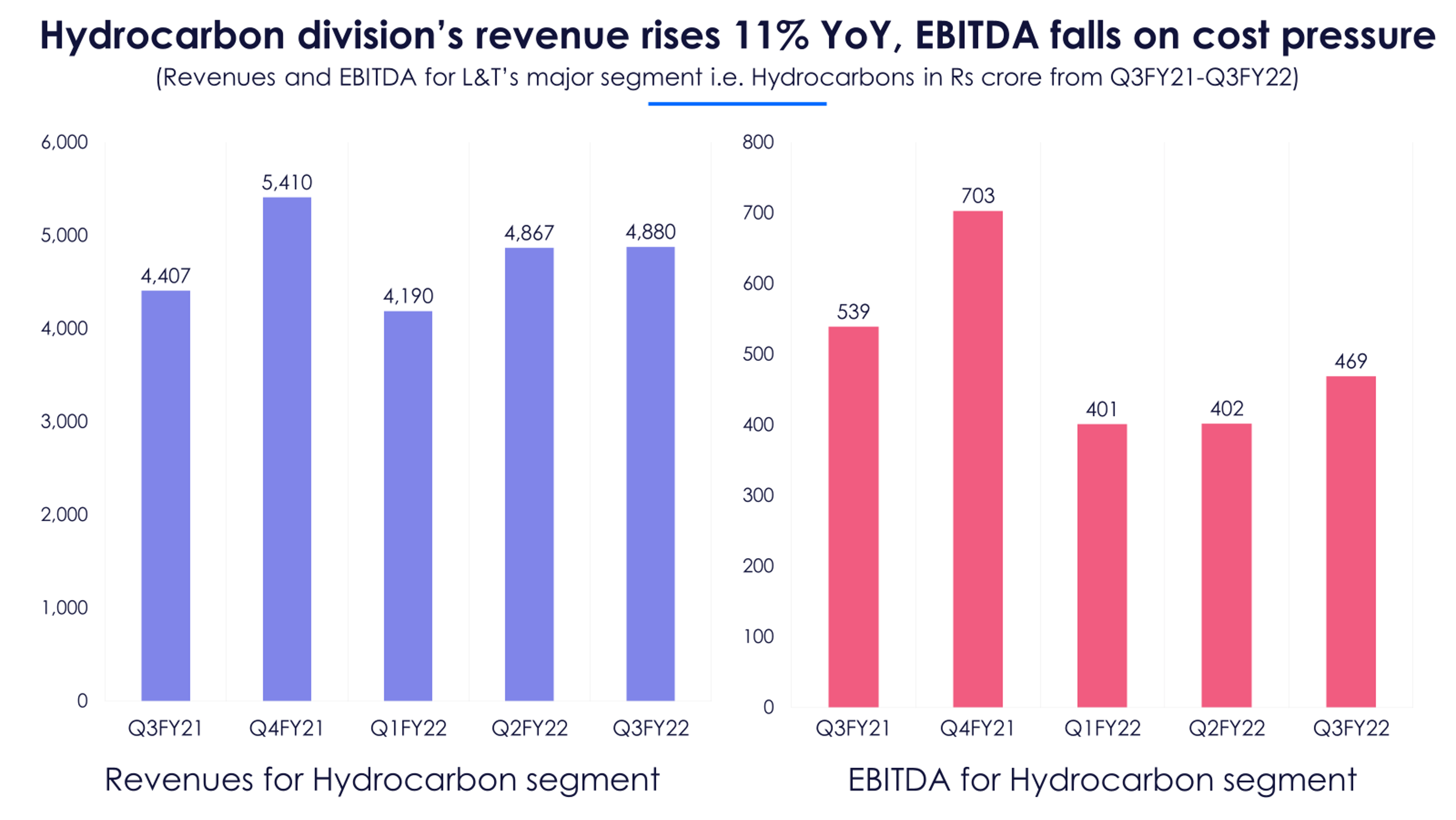

The revenues for L&T’s second major division i.e. hydrocarbon grew over 10% YoY to Rs 4,880 crore in Q3FY22 led by the ramp-up in execution of the onshore projects won in Q1 and Q2. However, the segment’s EBITDA fell 13% YoY to Rs 469 crore due to unfavorable job mix and cost escalations.

The EBITDA margin for L&T’s core project and manufacturing business fell by over 150 bps to 8.5% in Q3FY22. This contraction was mainly due to a bulk commercial property sale recorded by its realty segment in Q3FY21 and commodity price inflation witnessed by its hydrocarbon segment.

The revenues generated by L&T’s defense engineering segment fell both on a YoY and QoQ basis due to slower execution of shipbuilding projects. On the other hand, the power segment’s revenues grew 19% YoY to Rs 1,065 crore as existing thermal power projects witnessed a healthy execution drive.

According to L&T’s management, the Hyderabad Metro project generated a positive EBITDA of Rs 40 crore led by a rise in average daily ridership in Q3FY22. However, the business’ bottom line is still in the red and continues to generate losses for the company on a net level. Recently, L&T refinanced the bank debt of Rs 13,600 crore on this metro project with commercial papers and NCDs in order to reduce the interest costs. This refinancing will save L&T around Rs 360-400 crore annually on the consolidated level.

Additionally, the company's heavy engineering segment saw its EBITDA fall by 27% YoY to Rs 107 crore owing to an adverse settlement claim arising from an international order.

In all, the revenues for L&T’s core business rose by 9.4% YoY to Rs 27,220 crore backed by a higher progress achieved on its existing projects despite the extended south-west monsoon season. Although the infrastructure segment clocked healthy EBITDA growth in Q3, EBITDA for the core business fell by 9.3% YoY to Rs 2,305 crore mainly due to the underperformance of the realty sub-segment.

Riding on the wave of healthy order prospects in Q4FY22

In anticipation of a strong Q4FY22, the management retained its FY22 revenue growth guidance of nearly 15% YoY and EBITDA margin guidance of 10.3%. Additionally, the management highlighted that new order prospects for the upcoming quarter stand at Rs 3.92 lakh crore. Over 70% of the bid pipeline is from the transportation, water treatment, heavy civil engineering, oil refining and public healthcare domains. Also, 85% of the prospective orders are from the government’s end and 15% are from the private sector, primarily the minerals and metal companies.

Even if L&T was to convert 16% of these prospective projects into actual orders, the likely order inflows for Q4 could be around Rs 62,720 crore. This translates to an expected YoY growth of over 55% in the new order inflows. However, given the government’s poor track record of awarding projects in the last nine months, L&T might witness some spillover of order inflows to Q1FY23. This also explains why the company holds a cautiously optimistic view of higher capex spends in FY23. Infact, even brokerage Motilal Oswal has its eyes on the potential order pick-up in Q4 before any further re-rating of L&T. Notably, Motilal Oswal maintained a ‘BUY’ stance on the company but reduced the target price by 6% post the Q3 results.

With the Centre raising the target for capex by 35% YoY to Rs 7.5 lakh crore in the Union Budget of 2022-23, the tenders floated by government as well as the final awards could see a material rise in upcoming quarters. If that happens the domestic tide could very well turn in L&T’s favor going forward.