I still remember signing 30-odd pages to open my first demat and trading account. There were so many forms that my signature became an unreadable scrawl by the end. To trade, you had to call your broker for almost everything, because of the complicated processes.

This wasn’t even that long ago, before you write me off as some uncle grumbling about “the offline days.”

Today, you can decide to become a trader in the morning and be buying stocks in a few hours. No paperwork, no calls.

It’s never been easier to buy or sell a stock — whether in the cash or derivatives market. The experience is frictionless. Maybe too frictionless.

A little friction creates 'thehrav', a small pause which stops you from acting impulsively.

That pause? It's gone.

Now, trading apps don’t want calm investors. They want hyperactive ones who are clicking ‘buy’ and ‘sell’ on every tiny market move. In the US, Robinhood was criticised for turning trading into a dopamine game, with digital confetti, flashy alerts, and dark patterns that kept users hooked. Those same patterns are now showing up in Indian apps as well.

A 2021 study found that India’s top trading platforms use harmful nudges like “Didn’t invest yet? It’s a good day to start” and send users sad emojis if they haven't placed any orders.

Technology has made markets more accessible, but also more impulsive.

The Rise of the One Percent and the FIRE Dream

The so-called “one percent” and “FIRE” (Financially Independent, Retire Early) movements say that without investing in stocks, you’ll never be financially independent or a millionaire.

These ideas took off during Covid, when stock markets stayed open while everything else closed down, and people discovered the thrill of trading. The bull market that followed made fortunes for many new investors.

But as investors demanded more information, we got too much of it. To win eyeballs, websites turned to clickbait headlines, dramatic storytelling, and turned every rumor into news.

What are retail investors reading? Hint: It's not the 1,000 word Economist article.

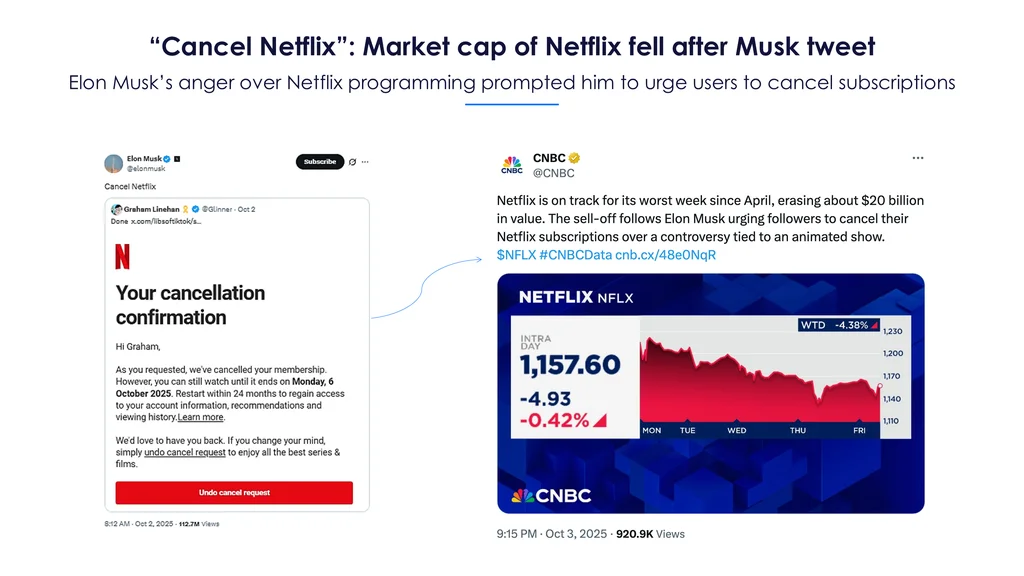

Elon Musk tweets, telling people to cancel Netflix.

Subscriptions drop.

Stock prices tumble.

$20 billion vanishes.

Markets today don’t just move with the fundamentals — they react to headlines, outrage and hot takes. A meme can make money, and a tweet from a big enough handle can trigger massive sell-offs. In this noise, are we really getting the right information? Increasingly, no. We’re getting the most clickable version of the truth.

An economy that is falling for clickbait

The clickbait approach was once limited to creators chasing views, but is now baked into mainstream financial media. Every small economic correction becomes “the next 2008 crisis.” Every cautious analyst comment is headlined as a sell signal.

This exaggeration creates a panic loop of clicks and shares. As a result, videos like “The Stock Market Crash is Your Best Chance to Be a Millionaire” go viral.

Even professionals aren’t immune. High-frequency trading algorithms now scrape headlines and social media sentiment in real time, giving institutional analysts a similar, panic driven picture. So when the financial media plays up volatility, those headlines can literally create volatility.

Take Elon Musk’s infamous 2018 tweet: “Am considering taking Tesla private at $420. Funding secured.”

The market believed him. Tesla’s stock price jumped nearly 10%. Later, the US SEC found there was no concrete deal. Musk paid a $40 million fine and stepped down as chairman.

Closer home, earlier this year, NITI Aayog CEO B.V.R. Subrahmanyam claimed that India had overtaken Japan to become the world’s fourth-largest economy.

The internet went wild, and traditional media like The Indian Express reported it at face value. Only later did it clarify that the ranking depended on which metric was used, nominal GDP or PPP.

But India has been the third largest by PPP since 2009. As usual, the truth arrives late.

The Finfluencer effect

Sandeep Parekh, the Managing Partner of Finsec Law Advisors, said, “Today’s con artists have replaced cold calls and call centres with content creators and clickbait thumbnails.”

Remember Sadhna Broadcast Limited? Here, SEBI uncovered an orchestrated campaign of circular trading and deceptive YouTube videos, with a scripted price action. It was market manipulation rebranded as ‘financial advice’, thanks to finfluencers. In the Gensol Engineering scandal, some retail investors lost up to 95% of their wealth.

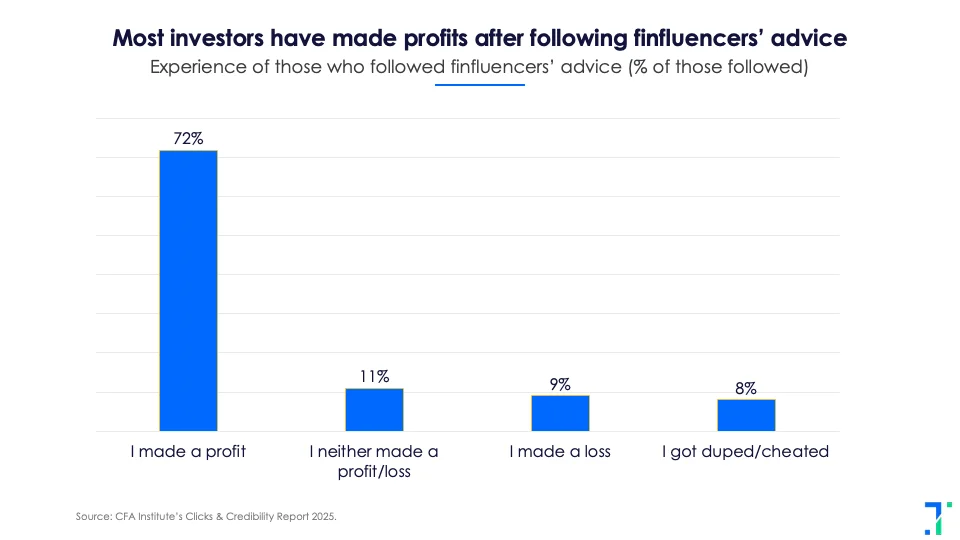

A CFA Institute survey found that:

- 17% of investors lost money following influencer advice

- 59% of Indian finfluencers have brand sponsorships

- 63% don’t disclose these sponsors

But not all finfluencers are villains. SEBI data shows that 72% of investors who follow finfluencers said they have profited from these recommendations.

Still, SEBI has flagged over one lakh instances of misleading or unlawful financial content in just the last 18 months — from stock tips to pump-and-dump schemes. A while ago, SEBI shut down a Telegram channel called Bullrun2017 that recommended micro-cap stocks. In this scam, channel admins bought shares of very small companies, recommended them to their subscribers, and then sold them for a profit. SEBI has raided the offices of multiple such Telegram scams, whose channels had many millions of subscribers.

AI doesn't fix the bias

I recently asked ChatGPT two questions:

-

Is it the right time to buy defence stocks in India?

-

Is it the wrong time to buy defence stocks in India?

When I framed the question positively, the response began with optimism — then moved to risks. When I framed it negatively, it started with risks — then moved to positives.

Large language models reflect the tone of the user’s question. They are incredibly polite, and start by agreeing with your initial framing. It's built to sound like a good friend who doesn't want to hurt your feelings.

We live in an era where information isn’t just fast — it’s fragmented, filtered, and often fabricated.

And now, thanks to AI, it’s personalised.

What’s “true” depends on who’s scrolling.