As the bulls charged ahead in Indian markets, Nifty IT emerged as a key beneficiary, riding high on the AI-fueled buzz in the US technology space. By July 18, it had recovered sharply from its April lows. But as Q1 results rolled in, dreams have collided with reality. The IT index became one of the biggest losers in the past week.

Q1FY24 proved to be challenging for IT companies, as discretionary spending in the US and Europe was impacted. Amit Chadha, CEO at L&T Technology, said, “Any project which doesn’t have an associated profit pool and is undertaken for the ‘love of mankind’ is being delayed right now.”

Additionally, the banking and financial services industry is also struggling in most developed markets. Mortgage lending activity has been especially affected due to the rise in interest rates. Given these factors, mid-tier IT players fell short of analyst growth expectations in this quarter.

However, all is not gloom and doom. The automotive and aerospace sectors stayed resilient, and certain parts of the banking industry showed signs of recovery. Strong deal wins have also kept the faith alive.

Yet, the question remains: are better days ahead for mid-tier IT players or will this weakness persist?

Revenue growth moderates for mid-tier IT players in Q1, BFSI plays spoilsport

Persistent Systems led the mid-tier pack with strong QoQ top-line growth in Q1. In contrast, LTTS and Mphasis saw their revenue fall sequentially in constant currency. For Mphasis, this is the third consecutive quarter of negative growth. The company derives half of its revenues from the banking and financial space. It is exposed to the mortgage space as well.

In Q1FY24, LTTS integrated L&T’s smart world and communication business into its telecom and hi-tech vertical of the company. A poor showing by the SWC business and weakness in the semiconductor, consumer electronics and media verticals affected the performance of this segment in Q1.

However, L&T Tech’s transportation segment clocked healthy growth in Q1, driven by off-highway, electric and software-defined vehicles. This segment targets automotive OEMs and the aerospace industry and has grown consistently over the past 3-4 years. Another ER&D player, Tata Elxsi, also saw decent growth from this division.

But Tata Elxsi had minimal growth in its media and communication division. According to the management, the industry itself is experiencing a downturn. The company is exposed to the OTT (over-the-top media) market, where service providers are making lower profits due to pricey content, reduced subscriber counts, and weak advertising revenues.

BFSI helps for some, like Persistent and Coforge

Coming to other IT services players, the BFSI segment drove the revenues of Persistent Systems and Coforge. This is despite the weakness in the industry and is likely due to their lower exposure to mortgage lending and superior execution capabilities.

Persistent saw a sequential decline in revenue from its healthcare segment, with the scientific instruments and medical devices verticals being most affected.

Sandeep Kalra, CEO at Persistent, said, “A few of our customers saw a revenue windfall because of their Covid play. Their revenues are now going down and they are recalibrating to their new reality”.

Margins remain steady for most, attrition situation improves

In Q1, the EBIT margins of most mid-tier IT players were relatively stable, with only Coforge seeing an impact due to salary hikes, higher visa costs, and employee additions. Companies like LTTS and Persistent will likely undertake salary increases in Q2FY24.

Trailing twelve-month attrition rates continued to decline for the mid-tier players, as hiring moderated in the IT sector. Higher demand for talent and a resignation frenzy impacted the margins of these companies between FY22 and H1FY23.

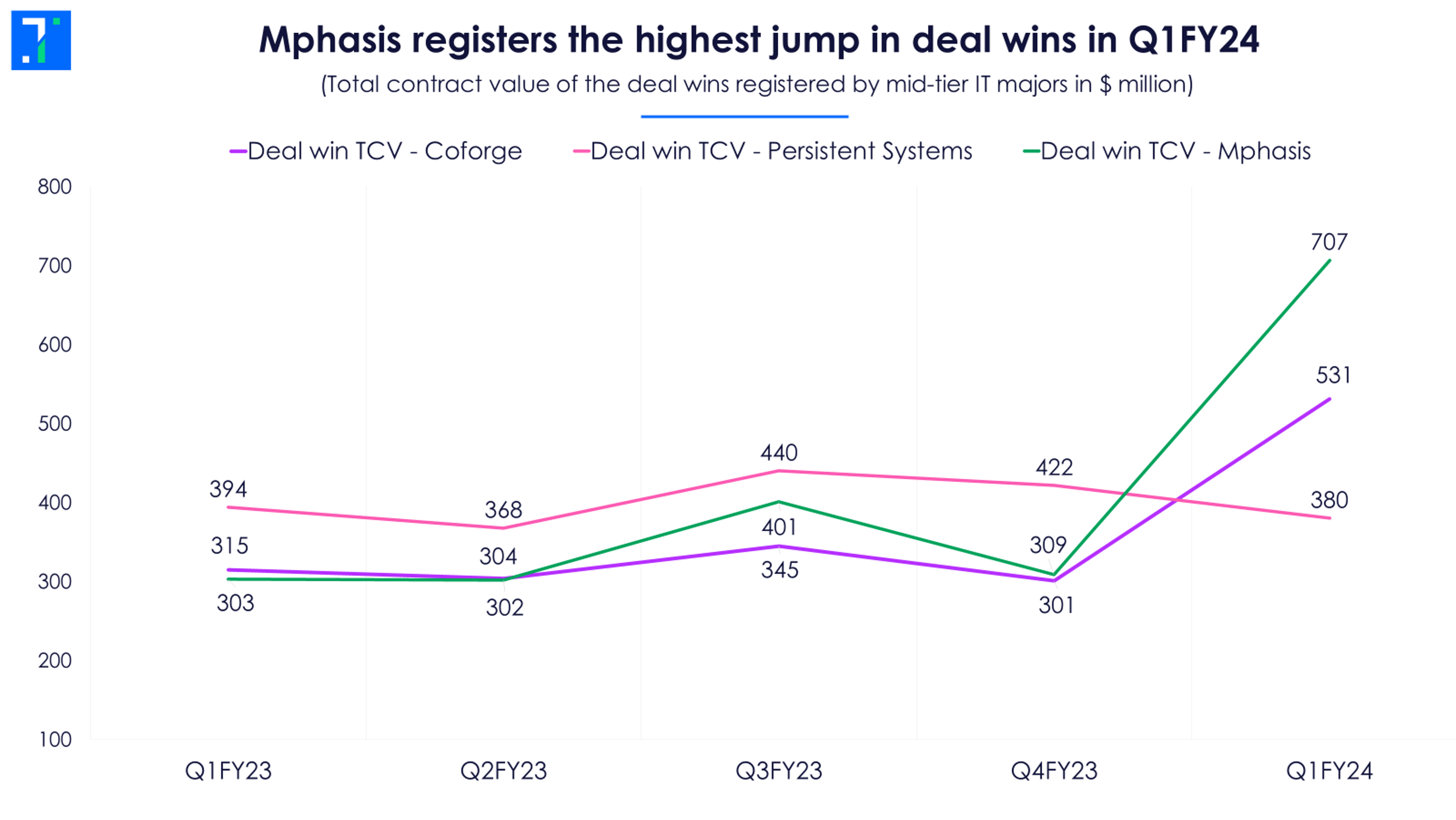

Strong pace of deal wins brighten Q1 outlook

Despite the lackluster Q1 growth numbers for mid-sized players, robust deal wins were a silver lining. LTTS won six deals with a total contract value of over $100 million. This includes a $50 million deal in the telecom segment. According to the management, deal closures have picked up since mid-June, with a good pipeline ahead.

Mphasis saw a stellar rise in Q1 order wins, with one-third of them related to the artificial intelligence (AI) domain. The majority of the deals were won outside of the banking segment. Coforge also saw a good jump in its orders, winning a large deal worth over $300 million from an existing client in the BFSI space. This proves its client-mining prowess.

Mid-tier players brace themselves for AI revolution

AI, particularly Generative AI, has become the new buzzword in the IT sector. The Gen AI algorithm can generate diverse content ranging from audio, code, images, text, simulations, and videos. Consumer-based programs like ChatGPT have taken the world by storm for their ability to write perfect college assignments, and make a travel plan for you to say, Italy.

According to an estimate by Bloomberg Intelligence, the Gen AI market is set to grow at a superlative CAGR of 42% over the next decade. Companies in India are gearing up to capitalise on this opportunity. LTTS is accelerating its investments in this cutting-edge technology, focusing on software-driven vehicles and cybersecurity. It is focusing on delivering AI-enabled solutions within the auto, manufacturing and medical segments.

Persistent is working with industry giants like Amazon, Google and Microsoft to develop generative AI strategies and proof of concepts. It is also implementing a ‘customer zero’ programme by applying Gen AI within its own departments like HR and marketing.

The company says it is currently in talks with over 50 clients for projects in this domain. It expects to start making revenue from Gen AI-based projects in the coming quarters. However, one should remember that this technology is still in a nascent stage and has limited use cases.

Companies expect demand revival in H2

The current demand scenario remains challenging, especially in the BFSI space. Companies like Persistent expect a strong recovery in overall client spending after a gap of 1-2 quarters. Even LTTS sees better sales growth in the second half of the fiscal year, especially with reference to its newly acquired SWC business.

Commenting on the current situation in banking, Sudhir Singh, CEO at Coforge, said, “Things haven’t changed much. However, based on my recent interaction with a CIO of a large bank, retail and commercial outside of mortgage business are looking up”.

The management at Coforge is confident of achieving a top-line growth of 13-16% in FY24 (constant currency) despite subdued demand. LTTS also stands firm on its original revenue growth guidance of 20%. Analysts foresee mid-tier IT companies, excluding Mphasis, clocking double-digit revenue growth in the next two years.

But the estimated growth is nowhere close to the previous performance of mid-sized players. Despite their efforts to win business, tech spending and budgets are lower than they used to be. Investors should wait for a broader recovery before considering these pricey bets.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.