Hindustan Unilever (HUL) was the first FMCG major to release its Q3FY23 results. Being the largest company in the FMCG sector, its results gave investors an early peek into consumer trends and how the rest of the industry might perform.

The British multinational’s Indian arm delivered a strong Q3 performance, partly as a result of raising prices. Observers had worried that this could put off India’s rural customers, who are a mainstay of the business, but HUL posted a healthy set of numbers with underlying volume growth.

Although inflation has seen a gradual decline, cost pressures still persist for FMCG companies. Sanjiv Mehta, CEO and Managing Director of HUL, said, “Year-on-year inflation is moderating from its peak, and consumer price inflation has also softened in recent months. (But) commodities remain at an elevated level when compared to long-term averages.” Along with elevated costs, the Indian rupee’s depreciation against the US dollar has added to the woes.

The management nevertheless believes that the worst is behind them. Ritesh Tiwari, CFO of HUL, said, “We remain cautiously optimistic in the near term. We believe peak inflation is behind us, and this should aid the gradual improvement of consumer demand.”

Price hikes continue to drive revenue growth

HUL’s revenue has grown by a healthy margin of 16.1% YoY to Rs 15,597 crore. As prices of key commodities are still relatively expensive, growth continues to be driven by price hikes. The management indicated that urban demand was still stronger than rural demand and premium products continued to outperform mass products. On the bright side, rural demand grew sequentially as inflation softened compared to the past quarter.

Net profit has improved 7.7% YoY to Rs 2,474 crore with growth across all segments. The management claims over 75% of its portfolio gained market share in Q3. The average quarterly revenue and net profit growth of the FMCG sector is 10.6% and 9.5% respectively. However, FMCG stocks fell by 1.4% over the past week in a volatile market.

Segment-wise, home care, and beauty & personal care performed the best with double-digit growth, and made up more than 70% of HUL’s revenue. The home care segment’s strong performance was backed by value and volume growth despite calibrated price hikes.

The beauty & personal care segment posted healthy growth even as the skincare sub-segment was hit by the delayed winter. The management also pointed out that its soup portfolio was aided by falling palm oil prices, as the company passed on the benefit of lower prices to customers.

Gross margins improve sequentially on lower inflation

The firm’s gross margins have contracted by 460 bps YoY to 47.5% but grew sequentially by 170 bps. The volatility in margins is due to the sensitivity of the company’s margins to commodity prices. The improvement in margins on a QoQ basis is mainly due to declining inflation rates.

According to the management, net material inflation in Q2FY23 was at 22%, and price increases were at 12%, making the price versus cost gap 10%. In Q3, net material inflation lowered to 18% and pricing was at 11%, bringing down the price versus cost deficit to 7%.

HUL plans to depend less on a decline in inflation to improve its margins. It is focusing on premiumisation, scale leverage and market development.

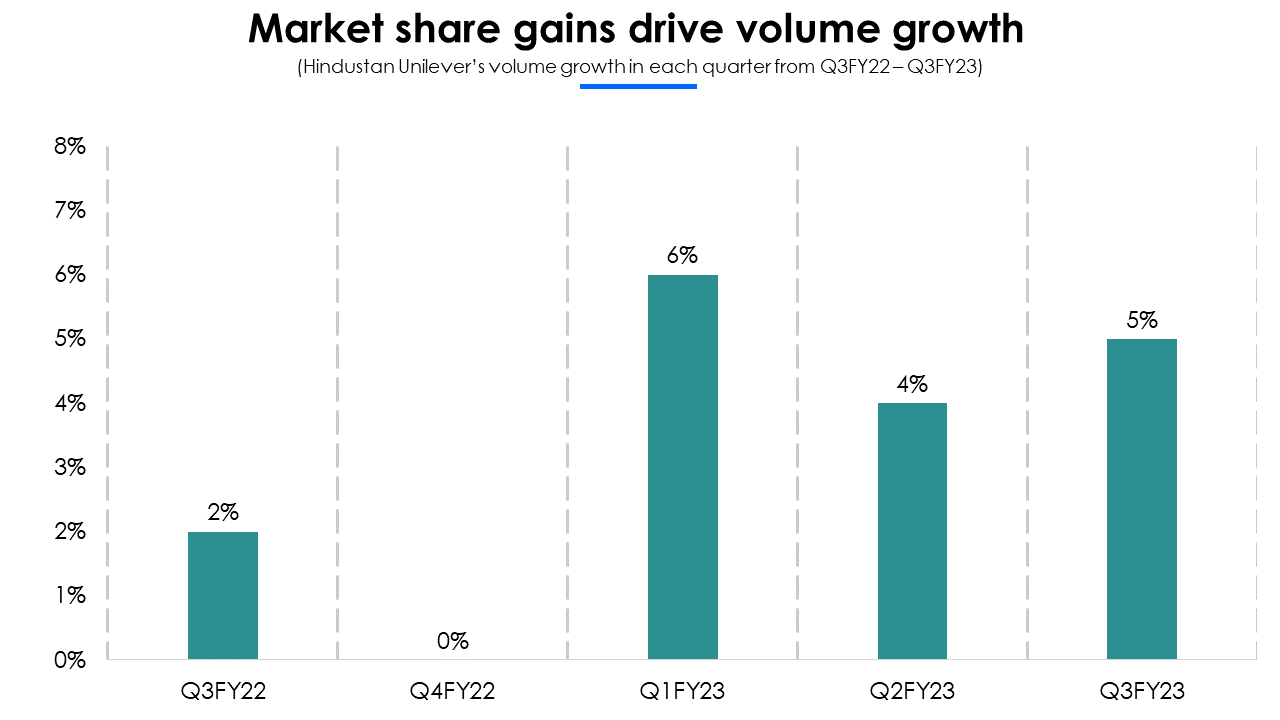

Volume continues to grow, focus on rural demand

As rural demand sees gradual improvement and urban demand gains traction, underlying volume grew by 5%. This growth rate is better than the last quarter and the same period last year. Whereas, the industry’s volume growth rate has declined by 4% in Q3FY23.

This slight improvement in volumes is most likely due to rural demand finally seeing some signs of recovery. According to Sanjiv Mehta, “Despite high inflation, people in rural areas, when it comes to real rupee prices, have been spending more than last year, and certainly on our brands”.

The management believes that a meaningful recovery in volumes is contingent upon the rural demand improving. It believes that rural consumer spending may start to rise in the near term due to lower inflation, strong winter crop sowing and signs of pickup in farm incomes.

Advertising spending increases, anticipating demand improvement

The management has increased advertising spending as announced in the past quarter. A&P spending finally grew on a QoQ basis after two consecutive quarters of decline, although it remains lower on a YoY basis. It looks like the company is more optimistic about the demand picking up and inflation bottoming out.

Over the past few quarters, most FMCG companies have been lowering the advertisement spends as demand was lukewarm. With HUL increasing A&P spending as a percentage of revenue, it will be interesting to see whether other FMCG giants will follow suit.

Board approves increasing royalty & central services fee by 80 bps to 3.45%

Even though HUL posted a set of healthy numbers in Q3, investors have not been upbeat about the stock. This is mostly due to the company’s board approving the proposal to enter into a new agreement with Unilever for the provision of technology, trademark licenses and services. Under the new agreement, the royalty and central services fee will increase by 80 bps over a three-year period to 3.45% of revenue. The agreement will come into effect from February 1, for a period of five years.

While many view this as an increase in expenses, the management believes it will not affect growth prospects. It pointed out that this will enable the company to have continued access to Unilever’s technology and R&D, helping improve its product portfolio.

Motilal Oswal concurs that this rise in royalty fees will not hamper growth and the benefits HUL will receive from its parent company makes up for it. The brokerage also points out that a fee of 3.45% is still lower compared to peers like Nestle India and Colgate Palmolive, which are close to 5%.

Inflation expected to soften further; management optimistic

Trendlyne’s Forecaster estimates HUL's annual revenue to grow 13.5% YoY in FY23. The management is optimistic about the near-term prospects for the company. The company expects commodity prices to soften further and is unlikely to increase any time soon. They believe this bodes well for the FMCG industry and will lead to an improvement in consumer demand.

However, the management expects growth to be price-led in the near-to-medium term, although the level of price growth will start to decline gradually. The company also expects rural demand to start improving.

Despite this positivity, the company is sensitive to external factors such as inflation and changes in government schemes in rural India. If these macroeconomic factors do not pan out the way HUL expects, the recovery in consumer demand may be delayed.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.