When the era of lockdowns and empty malls ended in April, Indian shoppers stepped out again, eager to finally change out of their sweatpants. Happy days finally arrived for fashion and lifestyle retailers as they raked in solid sales numbers in Q1FY23.

Cut to Q2, the festive fever set in and for the first time in two years, people could socialise without restrictions. Indian retailers had little to complain about.

According to a survey done by the Retailers Association of India, the retail sector’s sales continued to rise in double-digits compared to the pre-pandemic period, between June and October 2022. Its pace of growth was even stronger in September and October, the peak of the festive season in India. Apparel and footwear segments outpaced the growth of the overall retail sector, particularly between June and September.

Young, higher income shoppers come to the rescue for Indian retailers

It is remarkable that the Indian retail sector witnessed strong consumption trends when consumer price inflation was rising. So, who are these consumers brave enough to shrug off inflationary concerns and go shopping? According to the management of Reliance Retail (subsidiary of Reliance Industries), Shoppers Stop and Metro Brands, they are individuals belonging to the higher-income strata and living in urban India. They are either millennials or Gen Z who wish to be in tandem with international trends.

These consumers also saved significantly during the pandemic years and are now out spending that money, either partying, socializing or travelling the world. They are the ones who proved to be a boon to fashion retailers in Q2FY23.

Retailers see robust growth at the higher end of the spectrum

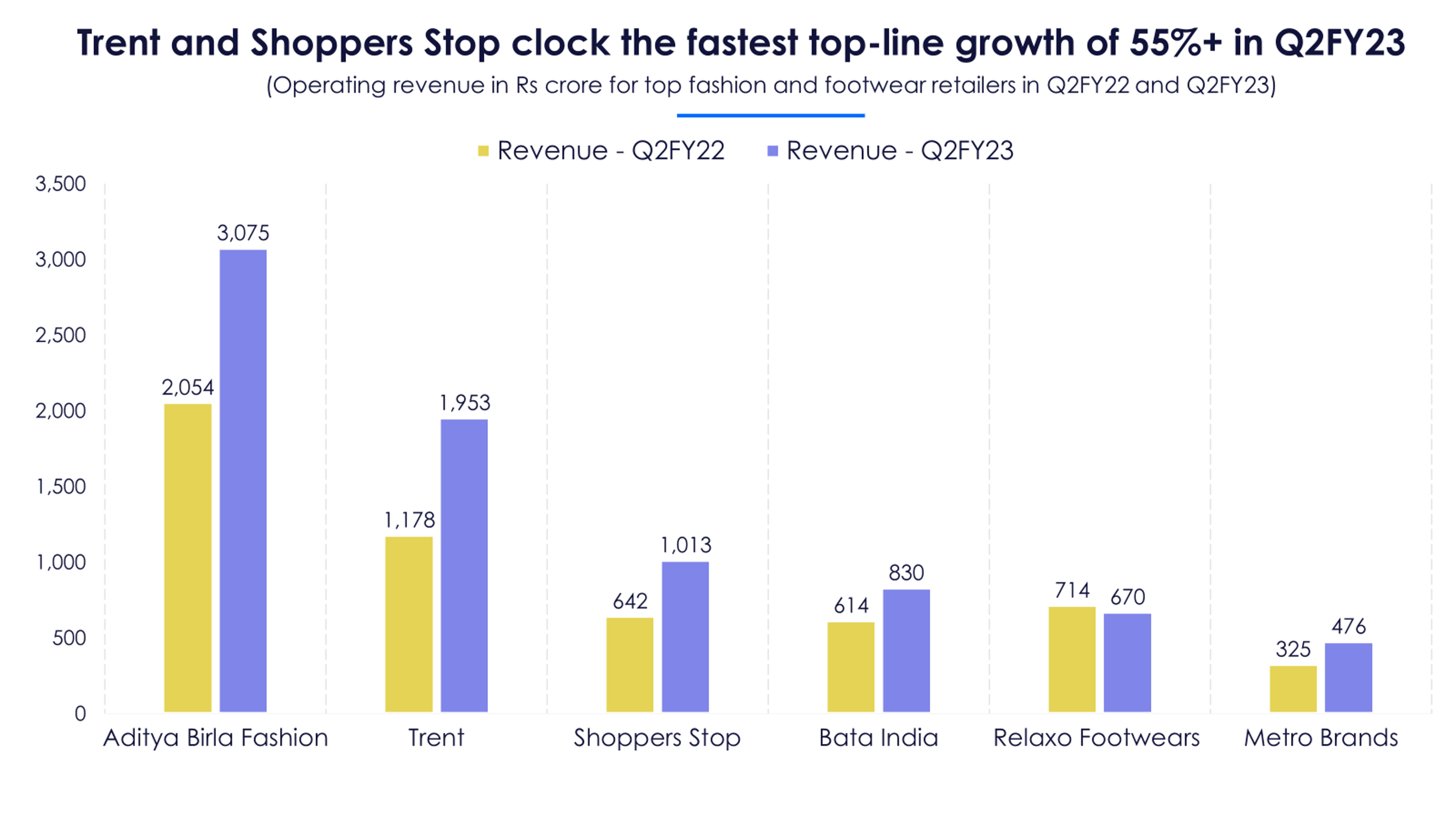

Apparel and footwear majors across the board, with the exception of Relaxo Footwear, clocked over 35% YoY growth in their top lines in Q2FY23. Trent, by the House of Tata, posted industry-leading revenue growth in Q2 backed by aggressive store additions and healthy like-for-like (LFL) performance of Westside. In fact, Westside’s LFL growth over the pre-Covid era picked up strongly in the past four quarters.

Other fashion retailers like Aditya Birla Fashion and Shoppers Stop were not far behind Trent in terms of revenue growth. ABFRL witnessed strong LFL growth of over 25% YoY for its ‘Lifestyle’ brands, with women and kids’ segments standing out performance-wise. These businesses were propelled by the festive season as well as the discounts offered during end-of-season sales.

ABFRL’s Madura segment, which houses the lifestyle brands, continued to grow ahead of its value-fashion brand, Pantaloons. Pantaloons has faced a difficult business environment since FY21 owing to higher input cost pressure, intense competition from the likes of Zudio and falling spending power of its end consumer. Yet, it did manage to surpass the pre-covid sales level in H1FY23.

Among the major footwear retailers, Metro Brands grew the fastest in Q2FY23, as it witnessed healthy demand in its target segments. The company primarily serves the mid and premium shoe segments (shoes priced above Rs 1,000 per pair). In fact, the share of the premium segment in its revenue pie has increased consistently over the past 2.5 years, while the share of mass and economy segments fell.

Bata India, a leader in footwear retail, also saw greater traction for its premium brands like Hush Puppies, North Star and Floatz. The stellar growth trajectory of the sneaker product category continued in this quarter as well. However, the company's formal shoe segment grew only 8% over the pre-covid period.

Relaxo Footwear suffered the most in Q2 owing to its dependence on consumers at the lower end of the pyramid. Its revenue actually fell by over 6% YoY on account of a double-digit fall in sales volumes. Its target customers in the flagship ‘hawai chappal’ segment shifted to cheaper alternatives. Higher product prices and a GST rate hike of 7% in January 2022 weighed negatively on the demand in mass and economy shoe segments.

Higher operating costs take a bite out of retailers’ profits in Q2

While Indian retailers witnessed a robust momentum in their revenues, their bottom-line growth fell materially short of analyst expectations in the past quarter. Companies across the board suffered a YoY fall in their EBITDA margins owing to higher marketing spends and aggressive store expansions. ABFRL saw its overall marketing costs rise 2.5X YoY, which had a negative impact on its margins. Its ethnic subsidiaries also posted higher operational losses in Q2.

Retailers generally see lower gross margins in the second quarter of a fiscal owing to the offers and discounts during end-of-season sales. Trent saw its gross margins contract by five percentage points due to seasonal effects as well as the rising share of the low-margin Zudio brand in its sales mix. Of the footwear retailers, Relaxo suffered a sharp contraction in its EBITDA margins as it was stuck with higher costs of inventory in Q2.

Indian Retailers rush to bring premium international brands home

For many years, the higher-income class travelled abroad to buy products of their favourite foreign brands, as it worked out cheaper owing to lower taxes there. Which upper-middle class Indian hasn’t dreamt of owning a Gucci or Prada handbag at some point in their lives? Indians have long been aspirational - it explains the ‘Guci’ and ‘Reefok’ knockoffs you find in Delhi street markets.

However, foreign travel was restricted in India in the two years of the pandemic and even when it resumed, it had become costlier than ever before. With the higher-end consumer driving overall demand and showing an increased appetite for global brands, retailers sensed an opportunity.

ABFRL and Reliance Retail, trendsetters in their association with foreign brands, recently partnered with ‘Galeries Lafayette’ and ‘Balenciaga’ respectively to open outlets in India. Now, other retailers are following suit. After an association with UK-based casual footwear brand ‘fitflop’ earlier this year, Metro Brands announced the acquisition of 100% stake in Cravatex Brands.

Cravatex Brands holds an exclusive long-term license for the Italian sportswear brand, FILA. With this acquisition, Metro will make an official entry into the fastest-growing footwear segment – sportswear and athleisure. However, the major challenge for it would be to turn around this loss-making company in the near future.

Another major retailer, Shoppers Stop, bought exclusive sales rights for some of the brands of L’Oréal and Clarins. These brands belong to the niche fragrances segment in the overall beauty domain and include the likes of Ralph Lauren, Atelier cologne, Prada and Valentino. The sales from these brands will begin mostly towards the end of December 2022.

Retailers optimistic about upcoming winter and wedding season in H2FY23

According to the management of Shoppers Stop, there are over 32 lakh weddings lined up in India between November 15 and the end of February 2023. The markets are bustling as shoppers plan for upcoming weddings and holidays. Retailers and e-commerce sites have attempted to make the best of this positive consumer sentiment during the recent ‘Black Friday’ sale, a newly imported event from the US.

Anticipating a robust season in H2, most retail companies have made higher investments in inventory so that there are no stock-outs and loss of sales. Major retailers like ABFRL and Bata India have also guided higher advertising spends in the coming quarters on the back of healthy demand trends.

ABFRL particularly looks to make ‘deeper’ marketing investments to scale up its recently acquired ethnic brands like Tasva, Sabsyasachi and House of Masaba. New stores planned for Lifestyle brands and Pantaloons will get higher advertising spends. Notably, the company added 125 new stores in H1FY23 and seeks to expand its store count by over 25% in the next 18 months.

Higher discretionary spends at the premium end of the market have caused analysts to bake in higher growth estimates for most fashion and footwear retailers. Consensus estimates, according to Trendlyne’s Forecaster, see all top retailers, except Relaxo, clocking over 30% revenue CAGR between FY22-FY24.

The high-end consumer in India is coming of age and retailers have come out of the doldrums of FY19-22 to realise the possibilities they offer. It will be interesting to see if this wave of consumerism, which has swept the creamy layer of India, actually sustains, filling the coffers of retailers in coming years.