The Covid-19 pandemic was a trying time for the average Indian fashion and lifestyle retailer. His brick-and-mortar shop was shut intermittently and his stock became outdated owing to the loss of two fashion cycles. Even when his store re-opened, customers postponed their purchases as they were mostly working from home and feared going to crowded places. The little that they did shop was mostly from the online channels.

Cut to the present. As the economy gets off its sick-bed and recovers, and corporate offices and schools reopen, retailers are seeing healthy traction in their monthly sales. Will FY23 herald a new growth era for Indian retailers?

The market size for the Indian retail sector had shrunk by 8% YoY in 2020 while private household expenditure fell only by 4% YoY, according to data by CMIE. This is understandable given the fact that retail shops were shut for the most part of Q1FY21, but spending on essential goods was still on.

Even in 2021,the sector lagged the broader recovery with household expenditure favoring other categories.

While January 2022 was another lackluster month for the sector, it finally started to see some meaningful growth from February 2022. According to a recent survey by Retailers Association of India (RAI), retail sector sales jumped over 20% in April and May 2022 as compared to the pre-pandemic months of April and May 2019. Retail sales here includes the apparel, footwear, electronics, furnishing and grocery segments.

Apparel and footwear segments (discretionary) also grew at a faster clip of 24%+ especially in month of May. This is despite the soaring food price inflation since March 2022.

It’s not that only these two recent months were fruitful for Indian retailers. The H2FY22 festive and wedding season brought back long-awaited footfalls for listed retailers like Aditya Birla Fashion, Trent, Vedant Fashions, Bata India and Metro Brands.

Indian retailers see a resilient recovery in FY22

The majority of these retailers apart from Aditya Birla Fashion (ABFRL) and Bata India saw their FY22 toplines cross the pre-pandemic levels of FY20. Moreover, ABFRL’s FY22 revenues were only 7% below FY20 levels. However, Bata India’s FY22 revenue was still far away from full recovery given its reliance on the office and school-wear segments.

Even though Bata lagged others in terms of revenue growth, it was ahead of them in establishing online sales channels as a formidable revenue source between FY20-22.

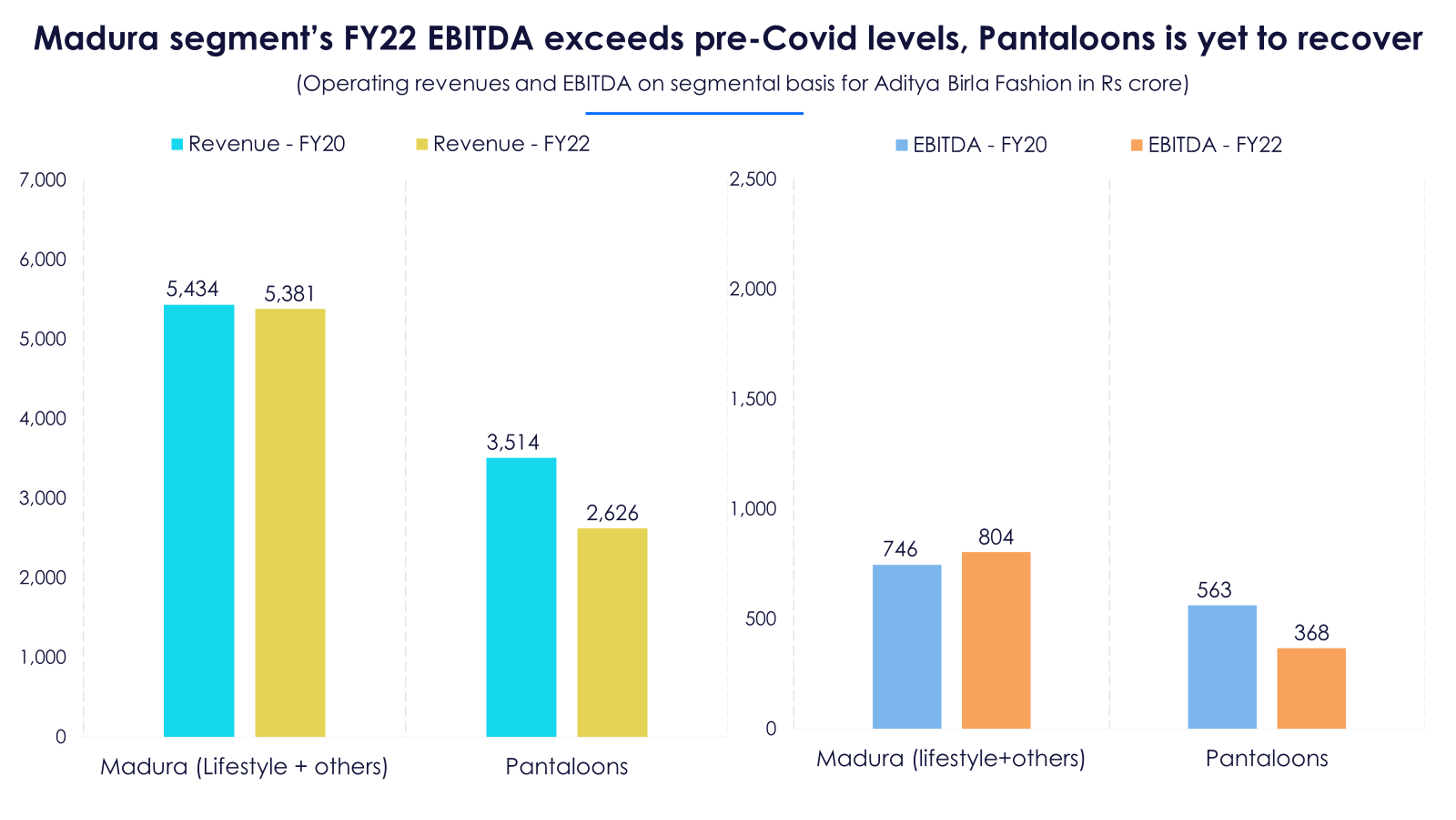

ABFRL’s Madura segment, which primarily consists of its Lifestyle brand fared well in FY22 and almost reached the pre-pandemic revenue level; Madura segment’s EBITDA grew 8% over FY20 levels on margin expansion. Savings on advertising costs particularly aided the margin growth of 120 bps (14.9% in FY22) here.

However, Pantaloons, which is ABFRL’s value fashion format, could recover only 75% of its pre-pandemic revenues. This is quite peculiar considering that Zudio, a value fashion brand operated by Trent, saw its revenues jump 2.3X to Rs 1,108 crore in FY22 vis-a-vis FY20.

Ideally, the value fashion segment sees greater traction in times of inflation as consumers prefer cheaper goods. ABFRL’s management attributed the slow growth of Pantaloons to the fact that most of its stores are situated in malls which witnessed closures in the second wave and restrictions in the third wave. However, Pantaloons could also be facing higher competition from the likes of Zudio and other unorganized players in this segment.

On the margins front, Metro Brands and Vedant Fashions (Manyavar) achieved a material improvement of more than five percentage points in their EBITDA margins between FY20 and FY22. Metro Brands was actually able to increase its sales in the premium shoe segment over the past two years, which ultimately reflected on its margins.

After finally leaving behind the pandemic for good, apparel and footwear retailers are now gearing up for the future and readying their growth strategies in this regard.

Making up for lost ground: Retailers stock-up, go aggressive on store expansion plans

The last two summer seasons were mostly a washout for the Indian retailers in question. However, they hoped to rake in the moolah in Summer’22 season. Accordingly, they increased their closing inventory levels at the end of FY22 to successfully capture the consumer demand as well as beat the input cost inflation. Basically, retailers intended to build-up their inventory levels at a lower cost should there be more price rise in Q1FY23. Going by the data released by RAI, their demand-related expectations were right on point.

Enthused by the favorable demand trends, concerned retailers intend to expand their store count (area in case of Vedant Fashion) by over 30% on an average in the next two years. Vedant Fashions, which already has presence in over 200 cities across India, wishes to enter over 120 new cities through its store area expansion. Aditya Birla Fashion on the other hand intends to tap the potential of tier 3 and 4 cities especially with regard to its Lifestyle brand.

Bata India looks to expand its store presence by only 13%, slowest amongst its peers, in the next 2 years. It seeks to achieve this expansion primarily through the franchise mode. Basically Bata, which hitherto operated through company-owned stores, seeks to adopt an asset-light mode of expansion through this plan. Brokerage house HDFC Securities believes that the pivot to a different growth channel will not be as easy as it seems for this footwear major.

Trent and Aditya Birla Fashion see opportunity in value fashion

In the recent annual general meeting, Noel Naval Tata, Chairman of Trent, said that they are indeed seeing very strong demand for cheaper fashion goods. Of the 250+ store additions that they are planning on doing, 200+ are for their value fashion brand ‘Zudio’ itself, remaining being for ‘Westside’. The offerings of this brand are targeted at a younger demographic and priced below Rs 999.

ABFRL is also not far behind as it seeks to expand Pantaloons stores by 150+ in the next two years from 377 currently. A larger part of the equity capital raised from GIC i.e., Rs 2,195 crore will actually go into expanding the Pantaloons brand.

Footwear retailers bet big on sneakers and casuals

According to the management of Bata India, it saw roughly 40% rise in the demand for sneakers in the past two years. Moreover, it derived nearly 20% of its revenues from just sneakers in Q4FY22. Millennials are increasingly preferring sneakers as they go beyond the basic functional aspect of comfort. For this generation, sneakers are a fashion statement which reflects one’s style and matches one’s ‘vibe’.

Bata is offering sneakers across price-points through its in-shop and online sneaker studios. However, it will compete with popular international labels like Nike, Adidas, Reebok and Puma. in this space. Another category which grew in prominence in the pandemic years was casual and comfort footwear. In recognition of this trend, Metro Brands associated with a UK based brand namely ‘Fitflop’. This brand basically offers flip flops in the premium category. Metro already opened the first ‘Fitflop’ store in April 2022 and plans to open 5 more in FY23.

FY23 may put the retail sector on the fast track

According to a recent report by Boston Consulting Group, the Indian retail market size is all-set to grow at a CAGR of 9-10% to reach roughly Rs 146 trillion by FY32. Another report by Technopak sees the apparel and footwear segments growing much faster (20%+) than the broader retail market between FY21-25.

Retailers have so far witnessed positive consumer demand trends in FY23. Consensus estimates of analysts, according to Trendlyne’s Forecaster, see the top retailers clocking at least 29% YoY revenue growth in FY23.

However, the forward valuations remain pricey for listed retailers and any miss on the growth targets can bring in more pain for investors.

FY23 will prove to be a litmus test for the Indian retailers. Ultimately, the positive consumer sentiments identified early on in this fiscal should sustain for the sector to truly prosper in the upcoming decade.