The IT industry has been one of the biggest wealth creators for investors over the last decade and helped generate a significant number of jobs, directly and indirectly. It is becoming a major sector in driving the services economy forward. While the focus is mostly on TCS, Infosys and HCL Technologies, the largest IT service companies in India, the underlying growth story of tier-2 IT companies cannot be overlooked.

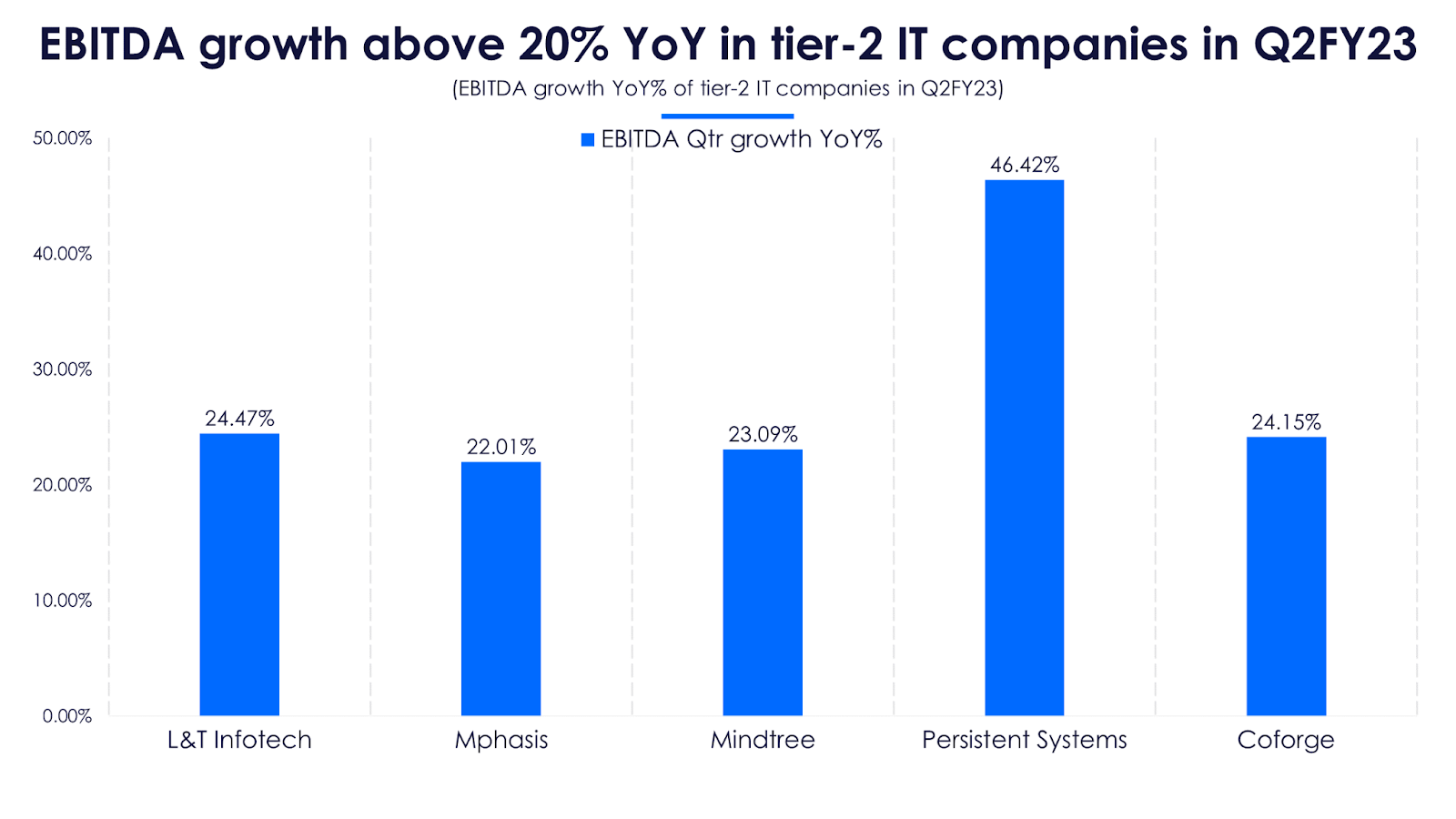

The recent Q2FY23 results showed tier-2 IT companies like L&T Infotech, Mphasis, Mindtree, Persistent Systems and Coforge delivering robust results, with healthy growth in revenues as well as profits. Persistent Systems particularly stands out for its YoY growth of 51.6% in revenues and 36.0% in net profits this quarter.

Higher valuations driven by sharper growth

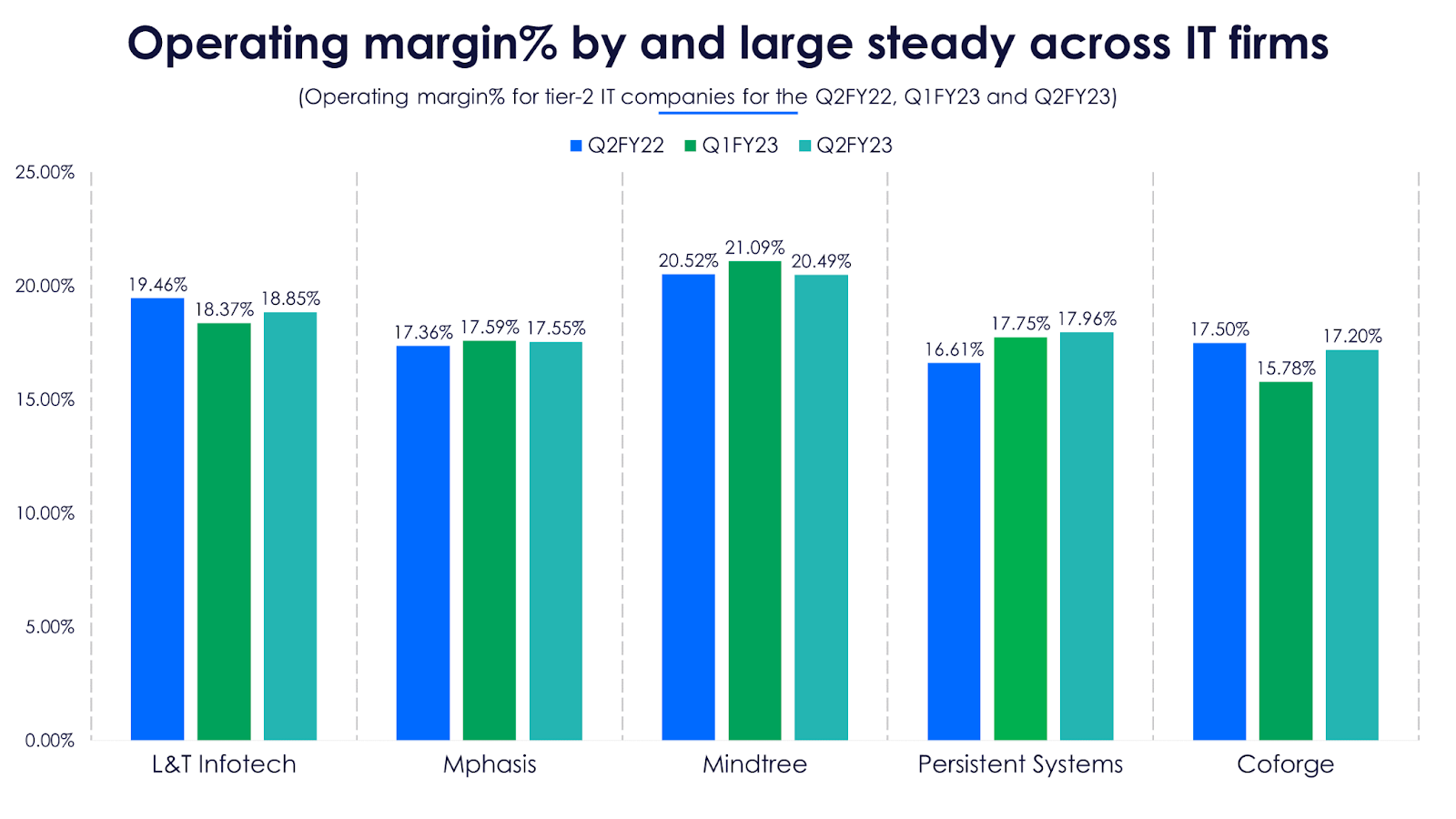

According to analysts who track the IT sector, tier-2 IT companies tend to get higher valuations because they behave like growth stocks and are not just necessarily defensive. If larger IT companies can grow 10-13%, a lot of tier-2 IT companies have the potential for 15-20%. The majority of these companies have a revenue growth of 17-18%, margins higher than 20%, ROE at 25%, even as some of them are hitting the billion-dollar revenue mark. The management of these companies are optimistic about achieving higher targets in future.

Talking about the Q2FY23 results, CEO of Persistent Systems, Sandeep Kalra, said, “We aim to be a $2-billion revenue company in four years." He made the statement a day after the company achieved $1 billion in annualised revenue in Q2FY23. Kalra said the company's quarterly revenues stood at $125 million three years ago. As the target is higher now, the rate of doubling will take longer, he added.

Indian technology companies were growing at a rate of 15-20% in FY22, but there was a shift-down to 10-15% in FY23. Analysts believe that these numbers are sustainable as the demand for India’s IT services is non-discretionary. It is focused on application development and maintenance of technology platforms, digitisation, etc. Demand for these services is usually not very volatile.

“We are now focused on carving an accelerated growth path to achieve a revenue of $2 billion,” said Sudhir Singh, CEO and ED, Coforge. But he declined to specify a time by which they would achieve this milestone.

Singh added that the company has plans to increase its net headcount by around 20% or 4,500 people in line with net revenue growth numbers. The company also expects the attrition rate to remain unchanged at 16.4% for the next one or two quarters.

While there has been a significant rise in employee costs of the company, Singh insisted it was a conscious choice. “The rise in employee costs has been offset and margin has been maintained because offshoring revenue increase was significant too,” he added.

Without exception, all these companies have delivered higher revenue and profit growth on YoY and QoQ basis in Q2FY23. Analysts had expected a muted quarter owing to global issues like the slowdown of the US and European economies, as these companies have client bases there. But the results proved otherwise, and there is still room for growth and adoption of newer technologies under these circumstances.

High attrition rates continue to bite

One issue that has affected the IT industry over the past few years is the attrition rate. While it has been higher in the top-tier companies at an average of 22-25%, tier-2 companies logged 17-20%.

As interest rates rise, movement to cloud services may slow

Money became costlier as central banks around the world raised interest rates to tame inflation. The global economic slowdown took hold and the expectation was that the accelerated shift to cloud services would continue at the same pace. But it looks like the rate at which businesses around the world moves to the cloud is likely to be slower than earlier expectations.

Mphasis CEO Nitin Rakesh said that the entire value chain of IT consumption is moving away from an onsite model to a off-site model, with more services being remotely managed. ''This migration is seen in every aspect of technology–on-premise-as-a-service, software-as-a-service, infrastructure-as-a-service, security-as-a-service and network & data,” he added. This shift was possible as almost everything is available on demand now. You don't need to own those assets, but can be rented, Rakesh explained.

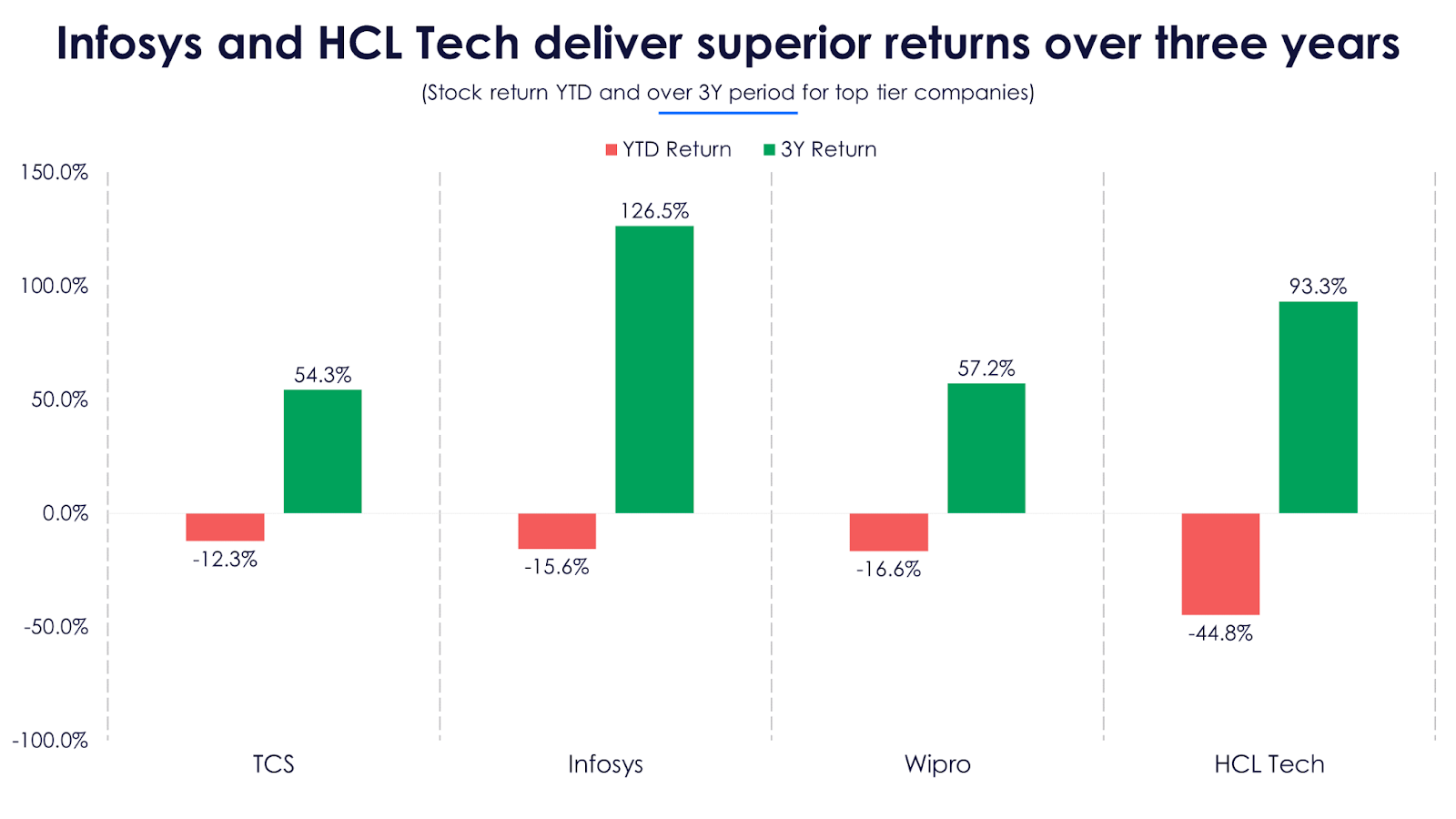

Correction time: Mid tier and top tier tech deliver weak returns in past year

Evaluating returns of the top-tier IT companies, only Infosys and HCL Technologies have been able to deliver superior returns over a three-year period. This year, all top-tier IT companies delivered negative returns.

Margins of IT companies have come down from the highs in FY21, causing the valuations to come off quite significantly. Stock prices have corrected but the likelihood of seeing a correction of more than 10-12% in IT stocks is slim.

When we compare the year-to-date and three-year performances of tier-2 IT companies, they outshine their larger counterparts significantly. Stock prices of all the companies under consideration have more than doubled over the past three years, with Mindtree and Persistent Systems giving almost 5X returns. Year-to-date returns have been negative, but this can be considered a corrective phase after such a strong run over the previous two years.

These companies are expected to have a strong run on the exchanges over the next three to five years. The rationale is that while IT spending may be deferred by a few quarters, it would have to be done sooner or later. Given that the speed of change in technology is rapid, delay in implementing IT upgrades can have consequences. Therefore, it can be assumed that these companies will probably outperform the top-tier companies again in the next few years, even though there was a decline this year.

In Q3FY23, L&T Infotech and Mindtree will have completed their merger and will be among the top-tier IT companies in India. Whether it grows at the same pace as a merged entity will be closely tracked by investors. This also leaves room for many smaller IT companies to join the club with Mphasis, Persistent Systems and Coforge and get higher returns.