Weather, geopolitics and financial markets have come together to bring intense volatility this year. This has left people wanting stability more than ever. The prolonged Russia-Ukraine conflict, supply shortages and erratic climate patterns have sent prices soaring, not sparing the prices of evenfood grains.

International prices of staple cereals and pulses like wheat, corn, rice and soybeans touched their all-time highs between April and May 2022. Although they cooled off around 10-20% from their record levels in Q2FY23, they were still trending higher on a YoY basis. According to agrochemical major UPL, the price hike was fueled by a fear of depleting food grain stock.

Take the case of Chicago wheat futures. After touching a six-month low in the third week of August, wheat futures gained 20% by November 1 owing to the uncertainty surrounding Black Sea grain deal. This deal, which allows the safe passage of cargo ships to and from Ukraine’s Black Sea ports, was due for renewal on November 19. The agreement has now been extended for another 120 days.

The buoyant trend in the prices of agricultural commodities globally worked to the advantage of one sector back home–agrochemicals.

Notably, agrochemical companies manufacture formulations for fungicides, herbicides and insecticides used to protect crops from pests and diseases, enhancing the overall yield. A farmer’s need to increase yield (production) and take advantage of the better crop prices raises the demand for agri-inputs and boosts their pricing as well.

Higher realisations drive revenue growth in Q2FY23

Agrochemical majors like UPL and Sumitomo Chemical saw higher sales realisations drive their double-digit revenue growth in Q2FY23. However, UPL saw its sales volumes fall 7% YoY in Q2 owing to the poor offtake in the Latin American region. The company’s management attributes this decline to its strategic focus on high-margin products in the region.

Coming to PI Industries, the company witnessed the strongest revenue growth among the larger players in Q2FY23. Robust volume growth of more than 20% in both export and domestic market segments propelled its topline growth. The company also saw strong sales traction in its newly launched products for cotton and horticultural crops.

All large players, except for Bayer Cropscience saw their EBITDA margins expand by over 100 bps YoY in Q2FY23 on superior realisations. For PI Industries, it was the complete pass-through of higher input costs to its export clients and the benefit of higher operating leverage that did the trick. Margin expansion and robust topline growth resulted in the EBITDA of the top three players rising over 25% in Q2.

Among the smaller agrochemical players, Astec Lifesciences saw its revenues jump nearly 2X YoY in Q2 on higher realisations in both the domestic and exports market. However, the company suffered a material margin contraction of over two percentage points in Q2 as it was unable to pass on the complete rise in input costs to its customers.

Export markets gain traction for most agrochem players in H1FY23

Although India received higher than average rainfall this monsoon, it was slightly delayed and mostly uneven across the country, and trends were consequently mixed for key Kharif crops. The acreage fell for paddy, pulses and oilseeds, while it rose for cotton and coarse cereals. According to Sumitomo Chemical, paddy now drives material agrochemical consumption.

Sumitomo suffered a 40% YoY fall in the volume of its key product Glyphosate, a herbicide, in Q2FY23. Notably, Sumitomo enjoys a 40% market share for this product and derives around 16-17% of its revenues from the same. The impact of such a sharp fall in volumes was not visible on the company’s topline as it got better pricing for the units it sold.

These subdued trends in the domestic market caused the agrochemical players to look to the export markets for higher growth. Sumitomo Chemical, which predominantly serves the domestic market, saw its export revenue jump over 50% YoY in H1FY23 led by strong traction in European, African and American markets.

Agrochemical market leader UPL, mainly an exporter, also saw strong growth in the North American and Latin American markets. The growth in these markets was driven by its offerings in the herbicides segment. On the other hand, UPL’s European and Indian market segments grew the slowest in H1FY23.

Smaller players like Astec Lifesciences and Anupam Rasayan witnessed much bigger traction in their export divisions. Anupam Rasayan saw a jump in the contribution of European markets to its revenues in H1FY23. The company also finalised two new deals with a European crop protection company in Q2FY23.

Astec Lifesciences consciously shifted some of its capacities to the exports division, which saw over 150% YoY growth in H1FY23. The company also saw more than 10% of its revenues coming in from the contract manufacturing side. Both Astec and Anupam are working to secure more of the contract business.

Under such an agreement, players sign a long-term deal with a foreign client to manufacture complex molecules. The agreement provides more certainty on the sales front and is based on a cost-plus model. Cost-plus basically means that the manufacturer will charge a fixed margin on whatever cost they incur, so passthrough of higher costs is very efficient.

Inventory levels rise on supply concerns and robust demand outlook for H2

Agrochemical players across the board reported more than 20% rise in their inventory levels at the end of H1FY23. However, UPL reported the biggest jump in its inventories and attributed it to a robust demand scenario for H2FY23 and sustenance of supply-related challenges.

Sumitomo Chemical highlighted another reason for the elevated stock numbers. Raw material costs (linked to crude prices) have started trending lower for agrochemical players from July onwards. However, players are still carrying a higher cost of inventory from the previous season.

UPL dropped a hint on another key trend witnessed in one of its markets. The company’s sales channels in the western US region were struggling with high stocks as dry weather conditions resulted in lower offtake from farmers. Its inability to sell the stocks might be an underlying reason for this inventory build-up and not just anticipation of a strong H2.

UPL’s working capital level also rose owing to higher inventories resulting in doubling of cash ‘outflow’ from operations to over Rs 4,500 crore. The company is now focused on reducing its working capital requirement and increasing cash generation in H2FY23.

Favourable crop prices and new product launches to underpin growth story of agrochemical players

Sumitomo Chemical and UPL are positive on the outlook for the domestic market backed by the anticipation of a good rabi season. Pre-showers in September and October have ensured good reservoir levels, which will drive higher acreage (area sown) and use of agri-inputs.

Crop prices are also going strong globally, backed by supply-side concerns induced by extreme weather conditions and geopolitical uncertainties. The ‘La Nina’ phenomenon has caused extreme dry weather in the US, which may impact the country’s corn yields. Argentina is witnessing drought-like conditions and it may hamper its wheat production.

Seeing these trends, UPL, Sumitomo Chemical and PI Industries have lined up quite a few product launches in the near term. PI Industries aims to commercialise 4-5 new products in its custom synthesis segment in H2FY23. Its main focus is on rice, wheat, cotton and horticulture crops. On the other hand, UPL plans to launch a new herbicide for sugarcane and seed treatment products for wheat, potato and cumin in H2.

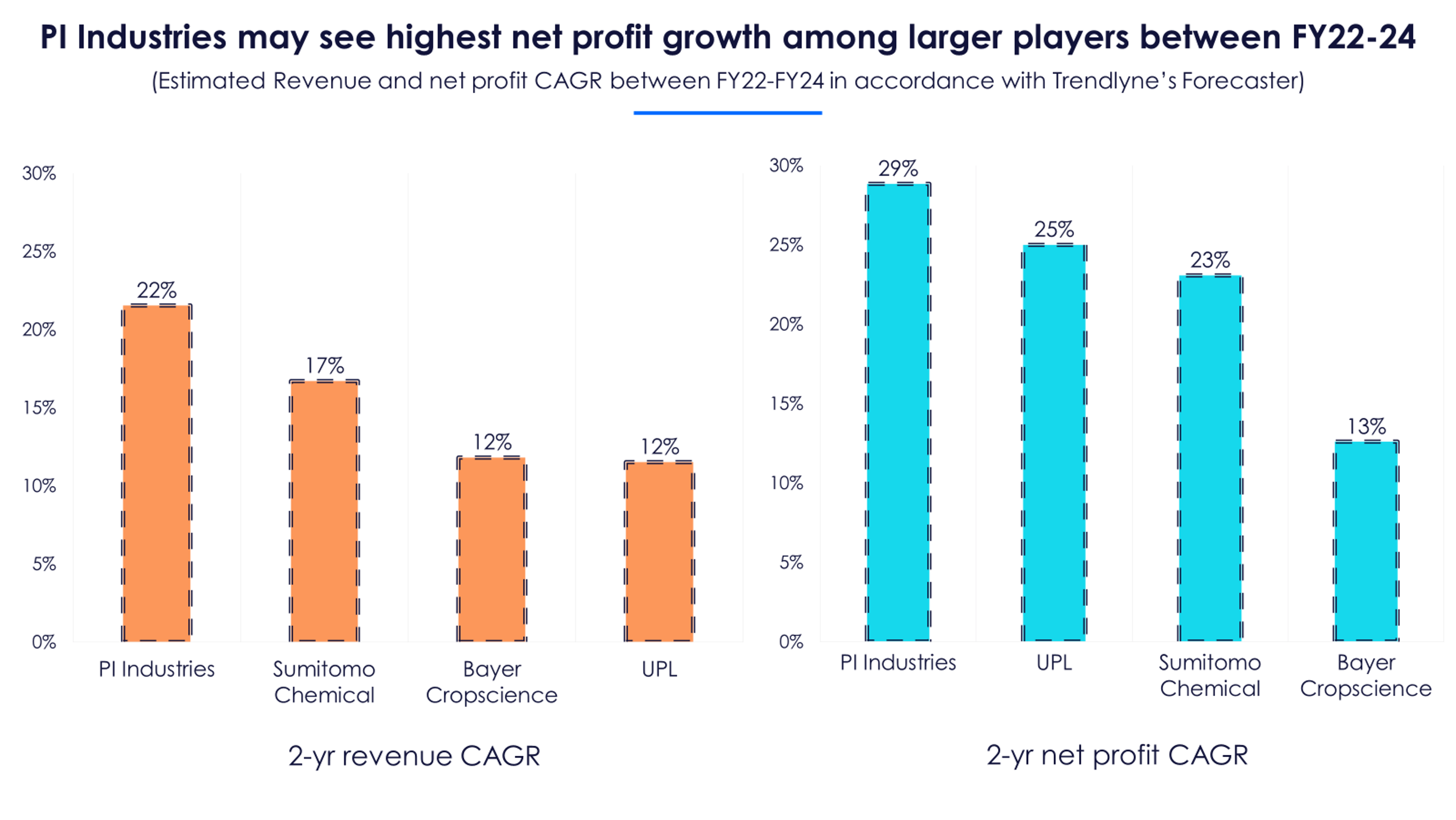

UPL expects a revenue growth of 12%-15% YoY in FY23, backed by these new launches and better realisations. PI Industries is confident of clocking over 20% growth in revenues in FY23, backed by its exports segment. Analysts are working with similar growth estimates and expect all larger players to clock over 12% revenue CAGR in the next two years.

Anupam Rasayan and Astec Lifesciences are also seeing a good number of contract manufacturing enquiries, especially from European countries. Analysts see these companies clocking over 20% revenue growth between FY22-FY24, according to Trendlyne’s Forecaster.

Agrochemical players have managed to navigate through this volatile year so far. But their future hinges on how well they can leverage the opportunities being created out of the follies of major world powers.