The auto industry is one that seems to have fully recovered from the setbacks during the pandemic. The Nifty Auto Index is up almost 25% since the start of 2022 and is currently trading at its all-time high. The rise has been supported by the outperformance of a few auto companies over the past few quarters, including Mahindra & Mahindra (M&M).

M&M released its Q1FY23 results on August 5. The company has delivered a consistently improving quarterly performance over the last four quarters. It posted its highest ever quarterly revenue in Q1FY23, and this sent the company’s stock to its all-time high.

M&M’s recent auto launches have received a good response, which is one of the key drivers of its performance. While semiconductor issues have caused delays of six months to a year from booking for customers, there have been a limited number of cancellations, and as the shortages eased in Q1FY23, sales picked up. The newly launched Scorpio-N has also received a record number of online bookings.

Quick Takes

- Highest ever quarterly standalone revenue at Rs. 19,851.2 crores in Q1FY23, up 67% YoY in Q1FY23

- Standalone net profit stood at Rs 1,430 crores up 67% YoY in Q1FY23

- M&M maintains its leadership in the SUV segment with a market share of 17.1% inQ1FY23

- Farm equipment vertical recorded the highest ever domestic quarterly wholesale volumes of 1,12,300 tractors and 5,100 tractor exports

- The new launch, Scorpio-N saw more than 100k bookings within 30 minutes of launch and a total booking value of Rs 18,000 crore

- Leadership in electric 3W with a market share of 75.4% in Q1FY23

Good performance from all segments makes for a stellar Q1

Over the past two years, M&M and other carmakers were plagued with a number of issues like the rapid slowdown of demand during the pandemic, and subsequent chip shortages causing a delay in production. Though chip shortages eased in Q1FY23, the production of SUVs is still lagging. But M&M’s farm equipment segment more than made up for this as it recorded its highest ever quarterly sales of 1,18,000 units in Q1.

Revenues during the quarter grew 65.8% YoY to Rs 19,851.2 crore, and 20.8% sequentially. The net profit also rose around 67% YoY to Rs 1,430.2 crore and was up 16% sequentially. YoY growth is of course, much higher due to a lower base in Q1FY22, which was severely impacted by the second wave of the pandemic.

Anish Shah, Managing Director & CEO, said that M&M saw good momentum across all their group companies, led by the strong results of the Auto and Farm sector.

Anish Shah, Managing Director & CEO, said that M&M saw good momentum across all their group companies, led by the strong results of the Auto and Farm sector.

The strong order backlog in SUVs will continue to boost performance, aided by lower raw material costs. Steel prices stabilized over the last few months after the imposition of an export tax on steel products by the Centre. Stability in the tractor business will be a key performance driver for FY23.

The farm equipment vertical was the highlight of this quarter, not only for the high volume of sales but also for the highest EBIT among all the verticals. EBIT for the auto vertical stood at Rs 703.5 crore on revenues of Rs 12,306.3 crore.

The farm equipment vertical delivered an EBIT of Rs 1,073.5 on revenues of Rs 6,688.6 crore. Part of this growth in revenue can be attributed to the good monsoon this year as well as the launch of new tractor models and the strength of its dealership network in tractors, which is the highest in India.

The farm equipment vertical delivered an EBIT of Rs 1,073.5 on revenues of Rs 6,688.6 crore. Part of this growth in revenue can be attributed to the good monsoon this year as well as the launch of new tractor models and the strength of its dealership network in tractors, which is the highest in India.

The management guided that the tractor industry will grow 3-5% in FY23 despite a near-normal monsoon, and the area under cultivation close to last year’s total cultivation area. Even then, there are risks like unfavorable trading terms for farmers in case of price fluctuations, lower demand for produce, and lower government spending on agriculture.

Rise in quarterly wholesales improve financials

The recovery in wholesales across different verticals has helped M&M’s stock touch new highs. Sport utility vehicle wholesales rose considerably in Q1FY23. The newly launched Thar and XUV 700 SUVs got an impressive response since launch, and now have a waiting period of more than a year.

The company is witnessing a growing number of bookings every month and very few cancellations despite the long waiting period for delivery. M&M also dominates the electric 3-wheeler market and has doubled its sales YoY in this segment to 20,100 in Q1FY23.

The company is witnessing a growing number of bookings every month and very few cancellations despite the long waiting period for delivery. M&M also dominates the electric 3-wheeler market and has doubled its sales YoY in this segment to 20,100 in Q1FY23.

Scorpio-N is a case study of a highly successful online launch

A highlight of Q1FY23 was the launch of the new version of the Scorpio called the Scorpio-N. Following its successful strategy of online bookings for vehicles, the unprecedented response to the launch of Scorpio-N is a case study for the auto industry.

As soon as the bookings opened, M&M got more than 25,000 orders online within a minute and more than 100,000 bookings within the next half an hour. In total, the company got total bookings worth Rs 18,000 crore.

Through online bookings, the company has seen a shift in the demand for the Scorpio (old model) that is still in production compared to the new Scorpio-N. While the older model still sees more than 50% of its demand coming from rural areas, the Scorpio-N gets more than 75% of booking from urban cities.

Through online bookings, the company has seen a shift in the demand for the Scorpio (old model) that is still in production compared to the new Scorpio-N. While the older model still sees more than 50% of its demand coming from rural areas, the Scorpio-N gets more than 75% of booking from urban cities.

The increasing use of online bookings has helped M&M claw back some of its SUV market share. M&M led this segment with a 53% market share a decade ago. This came down to 15% in FY22. It has improved its share in this segment to 17.1% in Q1FY23. Since its launch, 5% of the Thar SUVs wholesales were booked online, while it was nearly 13% for the XUV 700 and 26% for the Scorpio-N with 72% of the bookings done online.

The increasing use of online bookings has helped M&M claw back some of its SUV market share. M&M led this segment with a 53% market share a decade ago. This came down to 15% in FY22. It has improved its share in this segment to 17.1% in Q1FY23. Since its launch, 5% of the Thar SUVs wholesales were booked online, while it was nearly 13% for the XUV 700 and 26% for the Scorpio-N with 72% of the bookings done online.

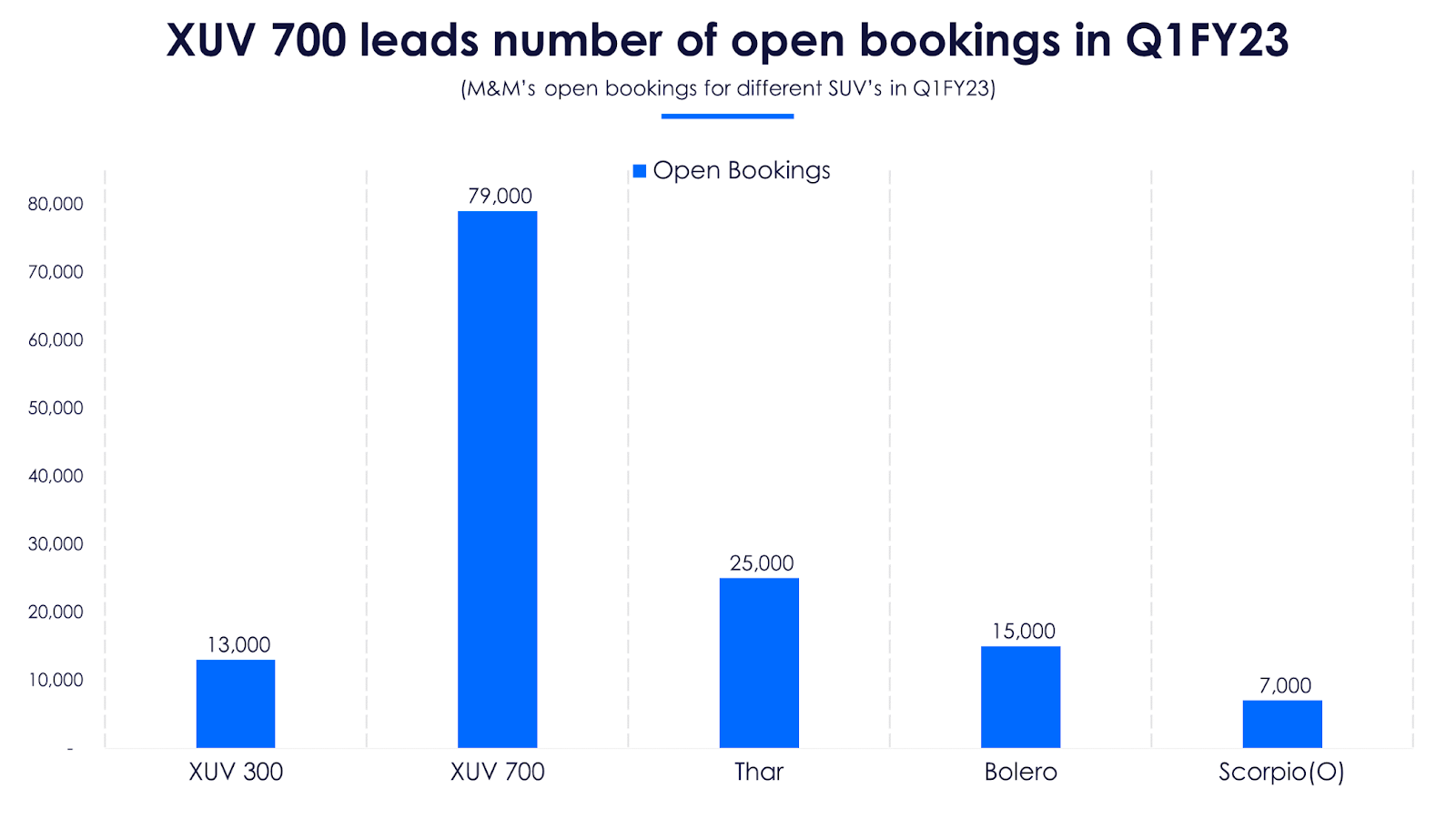

While the Scorpio-N has seen a record number of bookings at launch, the earlier models each have a steady order flow at the end of Q1FY23 with open bookings led by the XUV 700.

The number of open bookings in Q1FY23 demonstrates the growing popularity of the XUV 700. It’s a clear indication that M&M's larger SUVs are preferred by customers against the compact SUV, XUV 300, or the more earthy and rugged Thar.

The number of open bookings in Q1FY23 demonstrates the growing popularity of the XUV 700. It’s a clear indication that M&M's larger SUVs are preferred by customers against the compact SUV, XUV 300, or the more earthy and rugged Thar.

M&M’s strategy is focused on new EV models in future

M&M does not plan to launch many new ICE (Internal Combustion Engine) SUVs in the next 12 months, except for the refresh of Scorpio Classic in August and some pick-ups. It is focusing on new launches in the EV space and towards this end, M&M inaugurated its state-of-the-art EV design studio in the UK in August.

M&M is looking to substantially expand capacities in phases as it doesn’t want the waiting period to exceed beyond three-to-four months. Semiconductor supply issues have resulted in a 10% production loss in Q1FY23.

The company is also focusing on the form factor of its vehicles, to sustain the buzz. Its emphasis on cutting-edge design is visible in its recent marketing, particularly around EVs. Mahindra Advanced Design Europe (M.A.D.E) is a planned global design centre of excellence to push this forward.

While M&M has taken a lead in electric 3-wheelers, it has a long way to go in the PV (passenger vehicle) segment. Tata Motors has already taken the lead here with its Nexon EV becoming the highest-selling EV car. A lot of other car makers already have EV models for sale in showrooms. It remains to be seen if M&M can gain significant market share despite a late entry in the segment.

M&M's next leg of growth hinges on the success of the Scorpio-N and other SUVs as well as gaining market share with its planned lineup of EVs.