Caplin Point Laboratories is an export-oriented pharmaceutical company that generates its entire revenues through exports. The majority of its revenues comes from the less regulated markets of Latin America, where it has established a strong presence over the last two decades. In recent years, the company has also entered the US market and is planning on expanding its presence there. Latin American markets accounted for 90% of its revenues, and the US for the remaining 10% in FY22.

Caplin Point’s product mix is composed of generics, branded generics, specialty molecules and injectables, having over 4000 registered products across 36 therapies with the latest focus on therapies like oncology and opthamology.

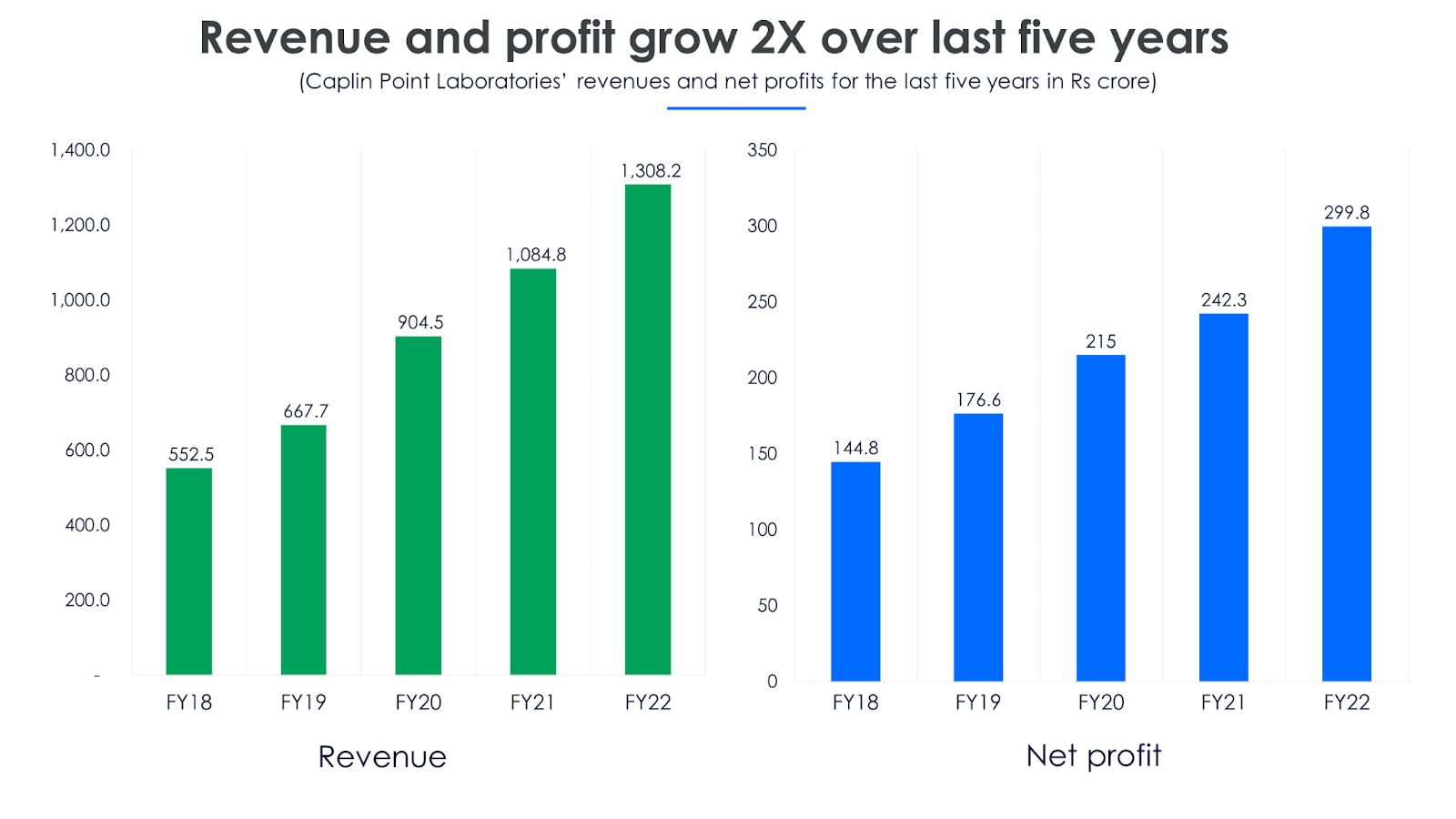

Among the pharmaceutical companies in India, Caplin Point stands out for its performance with revenue growth of 26% CAGR over the last five years till FY22 and a net profit CAGR of 25.7% for the same period. The FY22 results saw the company consecutively generate higher revenue growth with 20% YoY growth in FY22.

Quick Takes

- Consolidated revenues for Q4FY22 stood at Rs 350.8 crore, a YoY growth of 21%, and net profit stood at Rs 79.1 crore, a YoY growth of 19.1%

- Consolidated revenues for FY22 stood at Rs 1,308.2 crore in FY22, a YoY growth of 25% and net profit stood at Rs 299.8 crore, a YoY growth of 20%

- The company has filed a total of 21 ANDAs, of which 18 were approved by the USFDA

- Expansion plans in highly regulated markets of US, Mexico, Brazil, Europe, South Africa, and CIS countries

- The management guided for 15-20% revenue growth over the next financial year, while it expects to maintain current margin levels

- The US subsidiary Caplin Steriles is likely to break even in FY23

Growing strength in LatAm market, and tighter inventory management leads to strong Q4FY22

During FY22, the company won tenders in two LatAm markets, Ecuador and El Salvador for $21 million. It is focusing on Mexico and Chile as the next immediate avenues for growth in the region. The company has one product approved in Mexico, with six more approvals expected in the next few quarters, while it currently has 66 product registrations in Chile.

In Q4FY22, the LatAm market and those in the RoW (rest of the world) like Africa contributed to 90% of the revenues. The balance of 10% came from US markets, which was higher by 2% YoY.

Consolidated revenues for Q4FY22 stood at Rs 350.8 crore, a YoY growth of 21% and net profit sood at Rs 79.1 crore, a YoY growth of 19.1%.

In the US market, the company applied for a total of 21 ANDAs (abbreviated new drug applications) in FY22. Out of these, 15 were directly through the company, while six others were through partners. A total of 18 ANDAs were approved in FY22 by the US FDA. The management expects the remaining three ANDAs to be approved in the next 2-3 quarters. It plans to file another 12 ANDAs by end of FY23, including five for ophthalmic and two more for complex injectables segments. The management expects to start production of these products by Q4FY23, a niche segment with limited generic competition.

What really worked well for Caplin Point Laboratories in FY22 was keeping inventory closer to the customer. This helped it achieve shorter sales turnarounds in challenging times. When other competitors did not have inventory, Caplin Point Labs’ distributors stocked up higher levels of inventory in advance.

Shipping costs went up drastically in FY22, with difficulty in the availability of vessels. Adding to this was shipping transit time increased by more than 50% in some periods. In such a situation, the strategy to keep the inventory closer to the customer has helped the company achieve better than expected sales.

Consolidated revenues for FY22 stood at Rs 1,308.2 crore in FY22, a YoY growth of 25% and net profit stood at Rs 299.8 crore, a YoY growth of 20%

.

.

Caplin Point Laboratories’ LatAm business continues to drive top line and bottom line growth, while the US-focused subsidiary Caplin Steriles grew 44% YoY to Rs 122 crore in FY22. Speaking on Caplin Steriles during an investor concall, the management said that despite all the macroeconomic challenges that the world faces like the Covid-19 pandemic, the Ukraine war, and lockdowns in China., revenues grew by 44%.

The management added that the company achieved this growth despite a shutdown in one of the production lines for almost four months last year. Another line was not operational because it was not approved for production. Caplin Strelies is currently constrained by the fact that a lot of expenses are incurred in filing the ANDAs as well as R&D. The management is hopeful that the subsidiary will break even and post profits in FY23.

Expansion across existing new facilities and new ones to cater to different markets

Caplin Point Laboratories is planning to increase its capacity to widen its product portfolio and backward integration via APIs (active pharmaceutical ingredients) for final products. It also plans to enter more regulated markets such as Canada, Australia, China, Russia/CIS countries as well as the bigger LatAm markets of Mexico and Brazil. The total planned capex for all projects put together is Rs 400 crore.

For the expansion of the Oncology facility, the company has received the OSD (oral solid dosage) equipment and civil construction is expected to be completed by Q1FY23. The equipment for the injectables line at the same plant is expected to be delivered by H2FY23 and production would begin on completion of plant installation and approvals.

The company is evaluating inorganic options for the API plant. The API facility will cater to the US as well LatAm markets, and the upcoming Oncology facility. The company is planning on backward integration by manufacturing its own APIs for 70% of all filings in the US by FY24. The company has zeroed in on an API facility in Vizag, which they plan to buy out. They are planning to set up two labs, one for general injectables and the other one for the Onco products API, for the US market.

For the RoW (rest of the world) CP-1 facility, the addition of a new softgel line and expansion of the warehouse is expected to be complete by December, 2022. This will aid production in the less regulated RoW markets wherein approvals for new products are already complete. The tentative timelines for Caplin Steriles – Phase 2, are the pre-filled syringes line by November 2022, vial filling lines by February 2023, and Lyophilizer by November 2022. This plant on commissioning is expected to generate annual revenues of Rs 160–180 crore. Overall project completion is expected by Q1FY24.

Exploring a possible opportunity in Russia

Caplin Point Laboratories is looking at opportunities in Russia post the Russia-Ukraine conflict. Since the escalation of the conflict, 63% of the western products are out of the Russian market.

On exploring the Russian market, the management said, “Arms race dynamics helps arms manufacturers, but it also helps companies which could find an opportunity in adversity and Caplin also found opportunities in war zones. Hopefully, we may find some opportunity in the Russian market too”.

The management is guiding for 15-20% growth going ahead, while it expects to maintain current margin levels. Caplin Steriles is close to break-even, the only roadblock being the high R&D and filing expenses. The management expects to break even in FY23. Currently, 75% of revenue comes from product sales and 25% revenues is from milestones/profit shares. The management guided the current break-up to sustain. To quote the management, “The public statement that we have made, and we continue to stick to that, is that by 2026 we expect this to be a $100 million business.”

The management believes they are at a stage where it is difficult to judge the expansion and capacity utilization because of production of exhibit batches and commercial production being carried out simultaneously. However, the management is confident that once the new lines come in, they would be comfortable at least for the next three to four years.

Caplin Point Laboratories has a differentiated business model as compared to other pharmaceutical companies which helped the company post higher than average returns across key financial metrics. With the company exploring options like Russia and Mexico, its success in these markets will depend upon how fast they are able to secure approvals for its products. In most of these countries, the lead time for approval is around two years. So even if these plans work out, the results will take time. Another concern is whether Caplin Steriles will break even in FY23. Considering all the factors, while Caplin Point has the potential to continue its growth journey, meaningful returns may take time.