By Suhani Adilabadkar

The street was expecting Hindustan Unilever (HUL) to post double-digit YoY growth in revenue and net profit accompanied by low single-digit volume growth in Q3FY22. HUL’s stock gained 2% after December 2021 quarter results came in line with the street’s estimates. India’s largest fast-moving consumer goods (FMCG) company reported resilient Q3FY22 numbers despite a rural slowdown and high raw material cost inflation.

While the company’s calibrated price hikes have impacted volume growth, HUL’s market share gains were the highest in a decade across all its divisions in the December 2021 quarter. HUL sacrificed volume growth to conserve its consumer franchise. It will be interesting to see how long this will continue amid unprecedented raw material price inflation and bottom of the pyramid consumer not contributing to revenue growth.

Quick Takes

- HUL’s revenues increased 10.4% YoY in Q3FY22 aided by product price increases undertaken to mitigate high raw material cost inflation

- Volume growth was muted at 2% YoY impacted by grammage reduction and rural growth moderation

- Operating margins at 25% in Q3FY22 expanded 100 bps YoY supported by calibrated price increases and lower advertisement spends

- As palm oil and crude oil prices remain elevated, operating margins are expected to remain under pressure in Q4FY22

- The management expects the raw material cost curve to flatten and taper off in the second half of CY22

- HUL’s premium portfolio is growing at 1.5-1.7x the normal growth rate of the company

Hindustan Unilever scores on all significant parameters vs peers

Investors and analysts usually wait for HUL’s results to gauge consumer sentiment and consumption growth across both rural and urban India. HUL’s revenue came in at Rs 13,092 crore in Q3FY22, a 10.4% YoY rise, aided by product price hikes.

HUL is an all-weather company. While close peer Dabur is seeing a moderation in its healthcare revenues over the past two quarters after a stellar FY21, HUL’s revenue growth resilience continues with its wide product portfolio of more than 50 brands across home care, beauty & personal care, and foods & refreshment segments. While health, hygiene, and nutrition (85% of product portfolio) stood the test of time during the initial Covid-19 disruption, the remaining discretionary and out-of-home consumption growth is also now above pre-Covid levels.

HUL is an all-weather company. While close peer Dabur is seeing a moderation in its healthcare revenues over the past two quarters after a stellar FY21, HUL’s revenue growth resilience continues with its wide product portfolio of more than 50 brands across home care, beauty & personal care, and foods & refreshment segments. While health, hygiene, and nutrition (85% of product portfolio) stood the test of time during the initial Covid-19 disruption, the remaining discretionary and out-of-home consumption growth is also now above pre-Covid levels.

To pass on high raw material cost inflation, the company hiked prices by reducing grammage in Rs 1, Rs 5, and Rs 10 price points which account for 30% of its business. This led to low volume growth of 2% YoY in Q3FY22. Thus, even with the same number of units sold, volumes fell. The volume growth story is the same for the rest of the peer group.

Despite high input cost inflation, operating margins were healthy at 25%, expanding 100 bps YoY driven by calibrated price increases and lower advertising and promotion spend.

Despite high input cost inflation, operating margins were healthy at 25%, expanding 100 bps YoY driven by calibrated price increases and lower advertising and promotion spend.

HUL’s robust operating performance led to strong net profit growth. And HUL tops the table on the net profit front too.

Home care drives growth, beauty & personal care, and foods resilient

While the third wave is still in progress, fear and anxiety have declined. This is evident from lower sales of sanitizers and multivitamins and other healthcare products. Robust vaccination drives contributed to lower anxiety and higher mobility among the general public. The increase in mobility led to higher sales of fabric wash, skin cleansing, hair care, color cosmetics, and discretionary spending on foods for HUL in Q3FY22.

Supported by a lower base and price increases, home care revenues (Rs 4,193 crore) grew 23% YoY driven by strong double-digit growth in fabric wash (Surf Excel, Rin, Wheel) and household products (Vim and Domex). Beauty & personal care revenues (Rs 5,175 crore) were up 7% YoY driven by double-digit growth in skin cleansing, color cosmetics, and hair care.

While Lifebuoy sales moderated over the past few months, the beauty & premium soaps portfolio is on a strong growth trajectory. Lux, Dove, and Pears grew in the high teens and the company maintained its market share in hair care at a 15-year high. Even with a high base of 80% YoY growth in Q3FY21, foods & refreshment revenues (Rs 3,466 crore) grew 3% YoY in the December 2021 quarter aided by tea and coffee. Horlicks and Boost witnessed a soft Q3FY22. Though growth in the December 2021 quarter is stable and encouraging across all three segments, the March 2022 quarter growth is expected to be moderate due to the high base effect.

FMCG sector faces rural slowdown and raw material cost inflation headwinds

The March 2022 quarter is going to be a tough one for the entire FMCG pack. FMCG companies will have to beat a high base (Q4FY21) in the backdrop of a rural slowdown. FMCG sector volumes declined 2% YoY in the December 2021 quarter. Accounting for about 40% of total FMCG sales and two-thirds of retail stores, rural India is slowing down over the past two quarters. This is evident from lower fertilizer sales and also tractor sales falling consistently over the past four months on a YoY basis, according to data from the Federation of Auto Dealers Association.

Rural sales which were growing at 25-26% in Q1FY22 are now contracting. Urban sales are flat. Salary cuts, job losses, high food, and fuel inflation, coupled with Covid-19 health emergencies took a toll on consumer spending in both rural and urban India. With reduced spending power, consumers purchase low-value packs, switch brands, and resort to buying cheaper brands from smaller regional FMCG players.

In addition to lower demand, the FMCG sector is also facing high raw material cost inflation impacting margins and profitability. Crude and its derivatives are key inputs for laundry and household care for HUL. Brent crude is up 60% YoY. High prices of palm oil and its derivatives used in skin cleansing and hair care categories have also risen considerably. According to the management, prices of packing material, plastics, paper boards also continue to be at high levels. Speaking on inflation impact, Sanjiv Mehta, CEO and Managing Director at HUL said, “In addition to palm oil, crude, freight inflation, and supply chain disruptions have also impacted certain raw materials. All of these put together impacts two-thirds of our portfolio.” Keeping this in mind, it will be tough for the FMCG sector to increase its top-line and sustain profitability amid multi-year high commodity inflation and low demand.

Price increases, premiumization, and digitisation to boost top-line and margins

HUL increased prices over the past few quarters to maintain its top-line growth. The company increased the prices of soaps and detergents up to 30% in November and 7-10% in December 2021. HUL is also applying innovation, premiumization, and digitisation growth levers to boost its top-line. The company is widening its product basket every quarter by adding innovations like Bru Beaten Coffee, Sensitive Mineral Active Pepsodent to name a few.

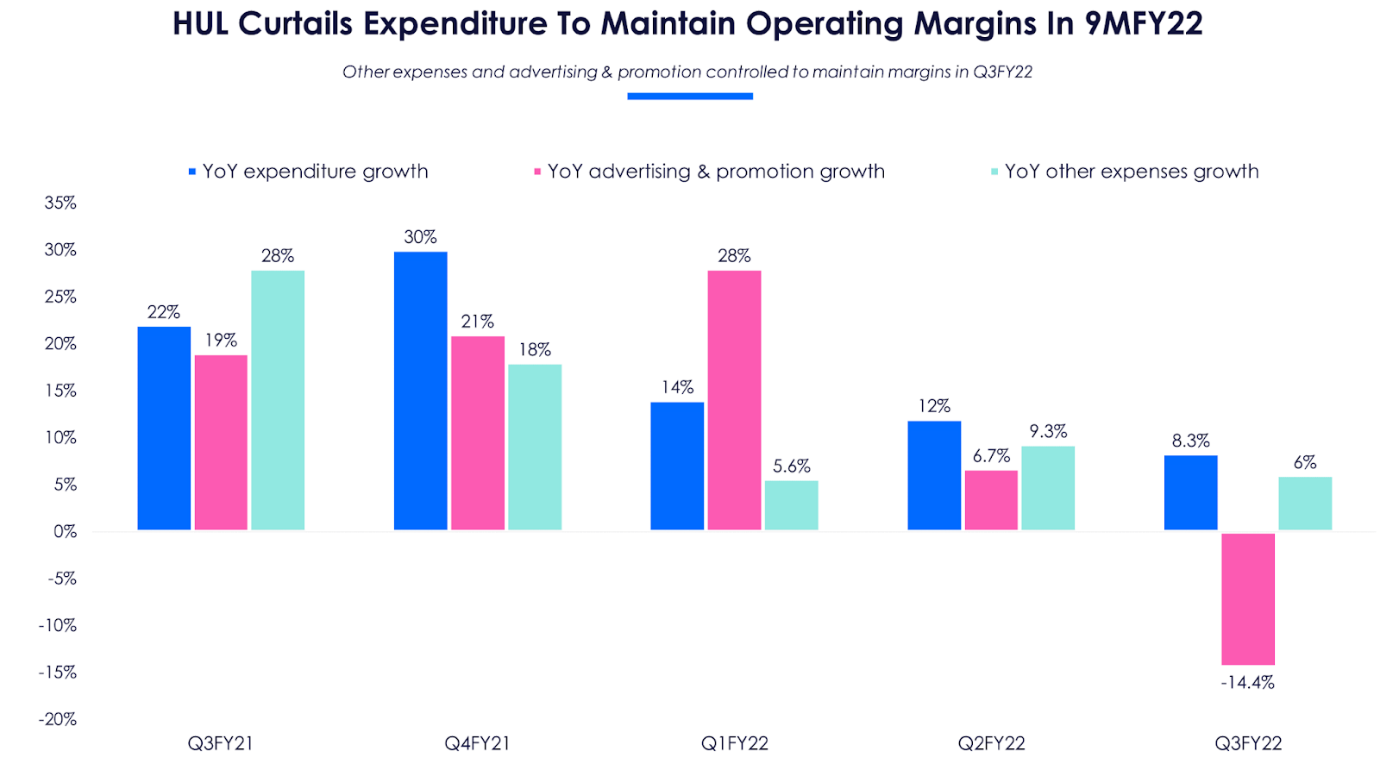

Under the premiumization growth strategy, the company is focussing on nutrient-rich food products, body washes, liquid detergents, fabric conditioners, skin serums, and hair serums. HUL is also augmenting its digital efforts through D2C channels for Lakme and Indulekha, smartpick (free trial of 25 HUL brands), UShop multi-brand D2C webstore, and digital beauty platform, BeBeautiful. Digital sales now account for about 15% of total sales providing a strong headroom for growth. Improving share of innovations, premium portfolio and digital sales will boost revenue growth and healthy margins. Over the past three quarters, expenditure was curtailed by controlling other expenses and advertising & promotion to maintain margins.

HUL’s operating margins were in a healthy range over the past five quarters, but with the consistent rise in raw material costs, operating margins are going to be under pressure in Q4FY22.

The recent budget will trigger consumption revival in rural and urban India, but in the long term. In the near term, lower disposable incomes at the bottom of the pyramid are a major worry for consumption growth. Putting more money in the hands of people and lower raw material costs aiding in lower prices would drive growth. And not to forget the benevolence of the rain gods.