By Vivek Ananth

Even in a volatile stock market, the IPO juggernaut is still going strong. This time we take a look at a service provider in the travel sector, which opens for subscription on December 7th. Omicron will have the management of this travel industry company worried about the timing of its IPO. But the company has an interesting business, the kind …

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Even in a volatile stock market, the IPO juggernaut is still going strong. This time we take a look at a service provider in the travel sector, which opens for subscription on December 7th. Omicron will have the management of this travel industry company worried about the timing of its IPO. But the company has an interesting business, the kind that many investors wouldn’t have had the opportunity to consider before this.

RateGain Travel Technologies is a software-as-a-service (SaaS) provider to the hospitality industry, online travel agencies, car rental services, meta-search companies, vacation rentals, package providers, travel management companies, etc. Essentially, the company provides services to the entire ecosystem in the travel industry.

At the end of five months ending August 31, 2021 (5MFY22), subscription-based services contributed nearly half to RateGain’s revenues, increasing from 44.2% at the end of FY21.

The company classifies its business across three major units—data-as-a-service (DaaS), distribution, and MarTech. In DaaS, the company provides rate data for hotels, airlines, car rentals, etc. to its clients based on a subscription and on a hybrid (subscription and transaction) basis to airline, car rental, and OTA customers. The distribution business unit entails connecting leading accommodation providers and their partners who generate the demand for hotel reservations.

The MarTech business unit provides digital marketing tools by managing social media handles and runs promotional campaigns for its partners from the travel industry. This service is also offered as a hybrid of subscription and transaction offerings.

Does it make sense for investors to look at RateGain’s IPO, with the travel industry only beginning to recover from the pandemic?

The fresh issue to pay off debt, acquisitions, and investment in assets

The price band of the RateGain issue is Rs 405-425. This values this loss-making company at 15 times its FY21 revenues. The Rs 1,335.70-crore issue consists of a fresh issue of shares of up to Rs 375 crore and an offer for sale of up to Rs 862.50 crore. As part of the offer for sale, the promoters and Wagner are selling shares. Post the IPO, the promoters will hold a 56.7% stake in the company.

The company plans to use the net proceeds from the fresh issue to pay off debt for Rs 85.3 crore, pay deferred consideration for when it bought DHISCO, make strategic acquisitions for Rs 80.0 crore, invest Rs 50.0 crore in technology to improve organic growth opportunities, buy capital equipment worth Rs 40.8 crore, and the rest for corporate general purposes.

Pandemic knocked the travel industry out

As the pandemic broke out, the travel industry was the worst hit. It was left to the whims of governments, as states imposed restrictions to deal with new waves of infections and new variants. This left the industry tottering, and the new Omicron variant, if it triggers severe infections, may give another shock to the industry that was hoping to cash in on year-end travel plans.

RateGain also saw its profits take a beating.

Although the company’s revenues grew considerably in FY20, its bottom line was still in the red. This continued in FY21 and for the 5MFY22 (vs YoY). This indicates that the company’s business is solely reliant in the growth in travel across the world. India paused on its plans to open up international travel recently after announcing it a few days ago. This trend is worldwide, and RateGain’s customers will continue to be impacted.

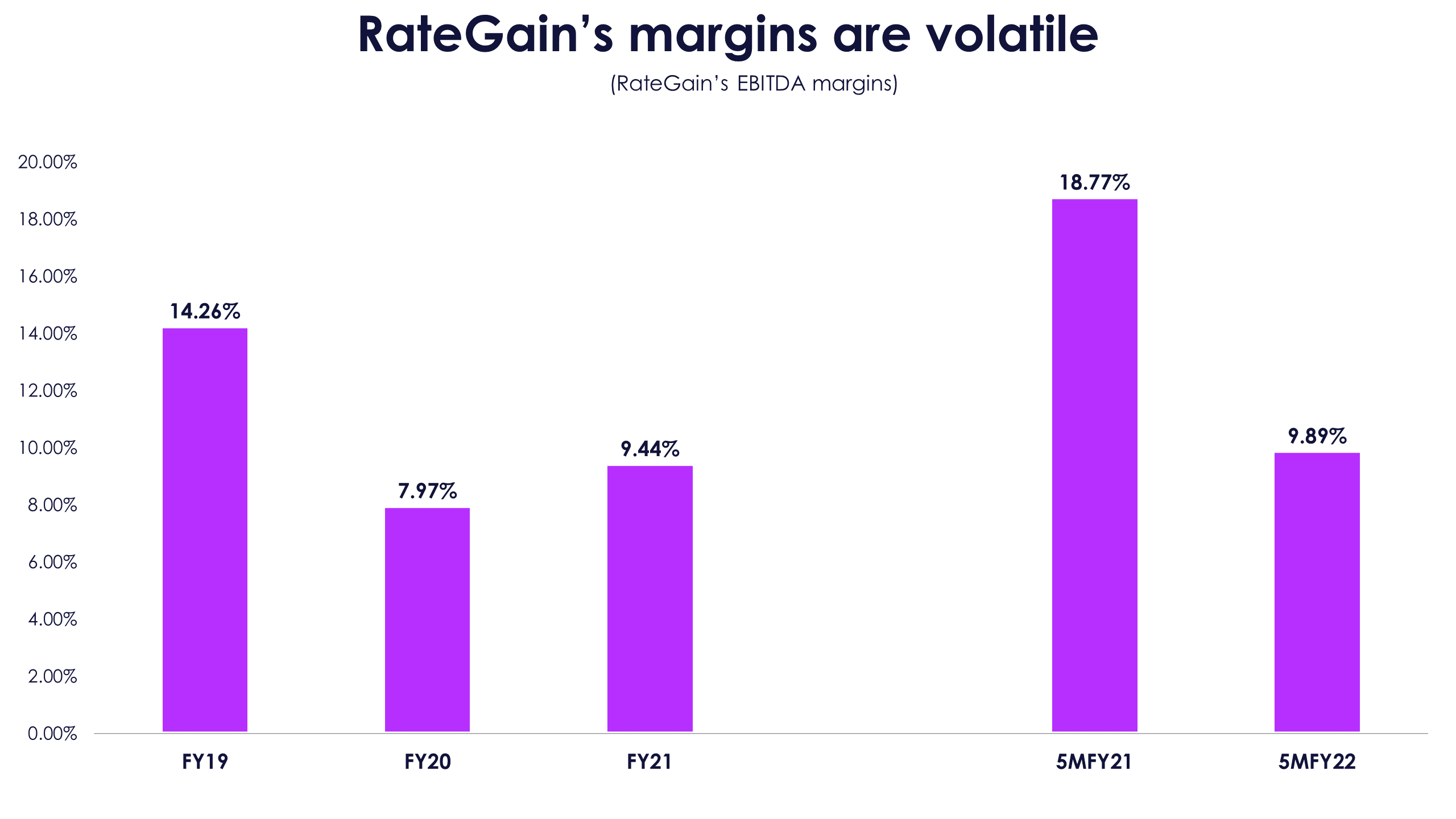

The volatility in profits is mirrored by the company’s EBITDA margins, which remained in single digits (%) for the past two complete financial years, and 5MFY22 and 5MFY21.

What is heartening is that despite the impact on its margins and bottom line, the company’s cash flows remained firm. This suggests that the company’s operating model will continue to churn out cash at a higher revenue growth rate.

The majority of RateGain’s revenues come from its distribution business unit, though the MarTech business unit’s revenues have increased considerably over the past three years. But the latter is a competitive space.

Travel industry needs countries to free up restrictions

The company’s reliance on the travel industry makes it wholly dependent on the industry’s growth rate to boost its top line. This means the restrictions that many countries impose due to the pandemic will directly impact its revenue growth and bottom line. The profits the company can generate is heavily reliant on free travel without restrictions.

Right now, restriction-free travel is still at least months away. Investors should keep this important factor in mind before they make a decision about investing in this IPO. It’s eventually based on how fast global travel will restart.