By Suhani Adilabadkar

In the past decade, investors who invested in IPCA Laboratories (IPCA Labs) saw their wealth grow six times. IPCA Labs’ stock price increased more than 260% since 2017. Being a major supplier of chloroquine and hydroxychloroquine active pharmaceutical ingredients (API) and formulations (used for Covid-19 treatment), IPCA Labs was one of the street favourites in 2020.

Despite three of its plants under a USFDA import alert and delayed capex plans, the company reported one of its strongest performances in FY21. However, with Covid-19 tailwinds gradually ebbing, the March 2021 quarter performance was muted. The street is nonetheless upbeat on the guidance given by management and awaits completion of its API related capital expenditure (capex) plans.

Quick Takes:

-

With ongoing capex at Ratlam and Dewas plants, IPCA Labs’ API capacity will increase 10% and 25%, in Q2FY22 and Q4FY22, respectively

-

The March 2021 quarter contribution of domestic formulation (a high margin business) is the lowest, leading to lower operating margins

-

The management guided for 16-18% revenue growth for the domestic branded formulations business, and overall revenue growth guidance for FY22 is 9-10%

-

As Ratlam, Silvasa and Indore facilities continue to be under USFDA import alert for the past five years, there is no revenue contribution from the US market

-

The management has guided operating margins to be around 25.0-25.5% in FY22

Investors disappointed by Q4FY21 results

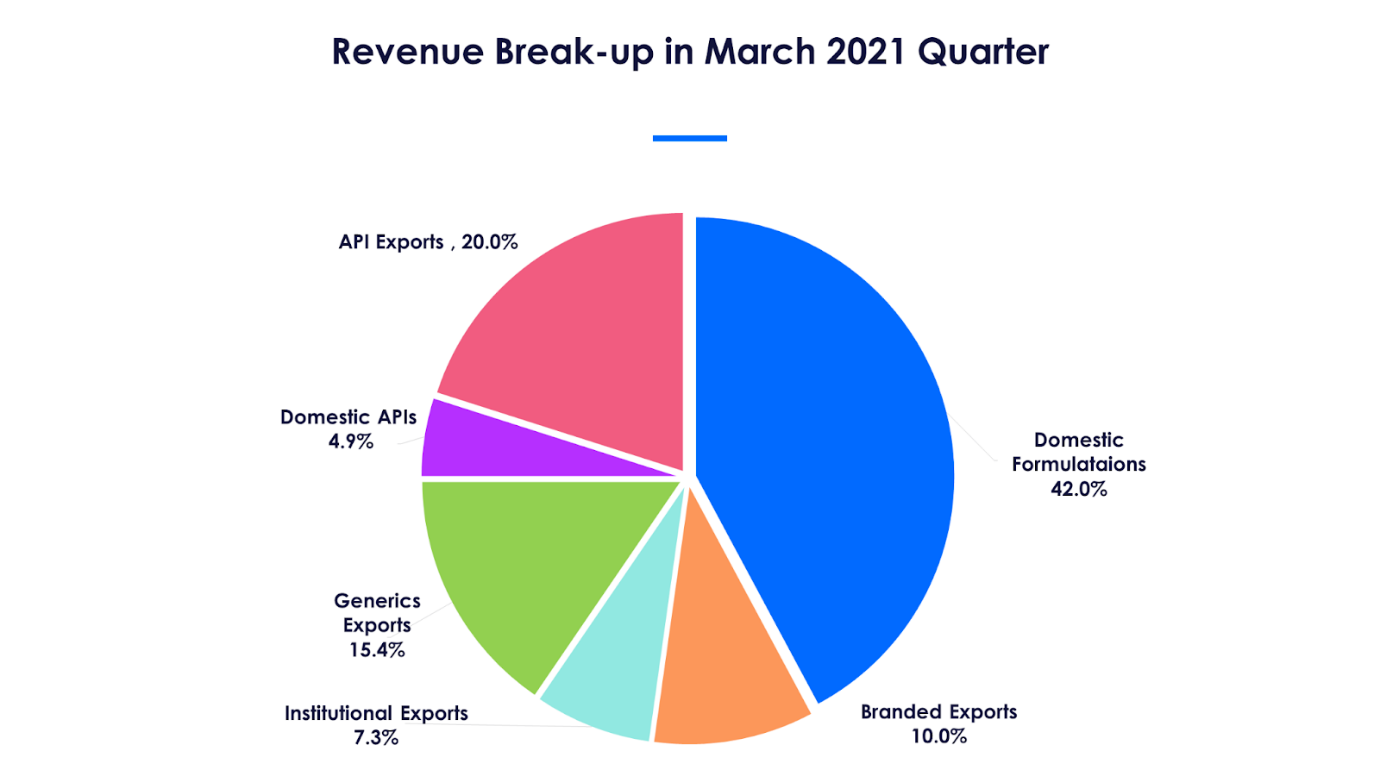

Therapy leader in India for anti-malarials with market share of more than 30%, IPCA Labs has evolved into a strong player in domestic formulations (DF) offering a wide array of therapeutic products and it produces over 80 APIs. The revenue mix of formulations and API was 70:30 out of total revenues in Q4FY21. The growth in formulations business of revenues of 8% YoY was offset by a 6% YoY decline in API revenues in the March 2021 quarter. In Q4FY21, the formulation business was made up of domestic (56% of DF revenues), branded exports (13%), institutional exports (10%) and generics exports (21%).

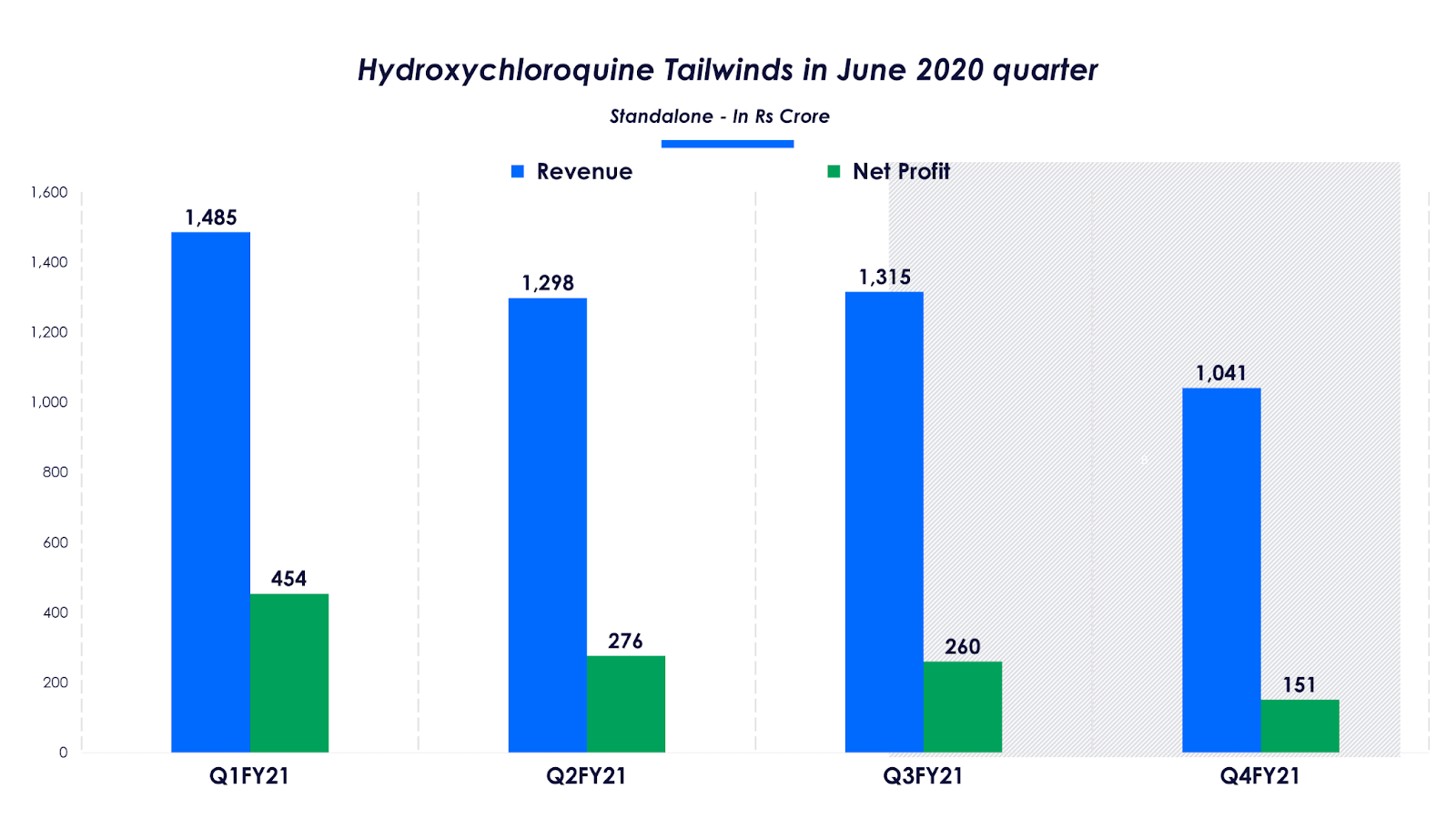

Overall standalone revenues in the March 2021 quarter grew at the slowest pace in FY21 at 3.6% YoY. Revenues fell 21% sequentially in Q4FY21 to Rs 1,041 crore as formulations and API revenues were down 19% and 26% QoQ, respectively.

Operating margins came in at 20.8% expanding 163 basis points YoY (bps) aided by prudent raw material procurement (raw material contracts at lower prices) and cost efficiencies. Net profit increased to Rs 151 crore in Q4FY21, a rise of 18% YoY. On a sequential basis, net profit fell 42% in the March 2021 quarter. In response to this muted performance in Q4FY21, IPCA Labs’ stock price plunged 9%.

Hydroxychloroquine spurs revenue growth in FY21

Hydroxychloroquine (HCQ) is used for rheumatoid arthritis, malaria, lupus (autoimmune disease) and also to treat diabetes. It is also one of the earliest drugs used as preventive medication for Covid-19. Hydroxychloroquine stimulates the immune system to fight the virus present within the body. India accounts for 70% of the world's hydroxychloroquine supply. Laurus Labs, Cipla, Zydus Cadila and IPCA Labs are some of the major Indian pharmaceutical companies engaged in HCQ production.

For IPCA Labs, the June 2020 quarter numbers were supported by Rs 259 cores (17% of revenue mix) additional HCQ revenues. In fact, the US FDA partially lifted its import ban from its three facilities in Ratlam, Silvasa and Indore to supply HCQ. Total revenues in Q1FY21 and PAT grew 42% and 244% YoY, respectively. Additional HCQ business of Rs 259 crore was included in both domestic formulations and APIs.

But as Remdesivir and Favipiravir were approved by drug authorities all over the world, HCQ demand diminished. HCQ demand is now at its normalized levels. However, the high sales of the June 2020 quarter due to additional HCQ sales creates a high base for revenue growth in the upcoming June 2021 quarter. So, with the withdrawal of Covid-19 tailwinds, investors are now looking again at IPCA Labs’ original growth driver, the domestic formulations business.

Domestic branded formulations to recover in FY22

IPCA Labs is one of those few Indian pharma companies largely dependent on its domestic market for revenues. It’s domestic branded formulation (DF) business accounted for about 42% of total revenues at Rs 434 crore in the quarter ended March 2021. DF business consists of antimalarials, dermatology, gastro intestinal, neuro, nutraceuticals, pain management and cardiovascular therapeutic.

Pain therapy accounted for about 50% of DF revenues. In Q4FY21, its revenues rose 9% YoY. Cardiovascular, with roughly 20% revenue contribution to DF revenues, grew 6% YoY. Pain management has been a significant growth driver growing at a CAGR of 18% from the past 5-6 years. This was aided by mega brand Zerodol and its sub-brands outperforming competing brands. Zerodol contributes roughly 25% of total DF business.

DF business grew 3.6% YoY in FY21. Excluding HCQ business, growth would be even lower. The absence of a strong Covid portfolio - unlike its peers, Zydus Cadila, Cipla and Dr Reddy’s Lab - impacted IPCA Labs’ domestic business in FY21. In the March 2021 quarter, revenues grew by just 1% YoY. According to the management, the revenue slide was due to lower stocking by wholesalers and lower productivity of its medical representatives especially in the last 10 days of March 2021. Q4 also usually sees seasonal variations due to which it accounts for only 20% of total DF business throughout the year.

However, the company started FY22 on a strong note in April-May 2021 and according to the management, strong growth was seen in anti-malarial, anti-bacterial and cold & cough segments. These three segments had reported declines throughout FY21.

The Covid-19 second wave is more widespread and has not spared rural India. Anti-malarial, anti-bacterial and cold & cough drugs are being initially prescribed by a lot of medical professionals before confirmation of Covid-19. Thus, these segments are witnessing a strong surge in rural as well as urban areas. The management is cautiously optimistic and has guided for 16-18% revenue growth for the domestic branded formulations business in FY22.

The Covid-19 second wave is more widespread and has not spared rural India. Anti-malarial, anti-bacterial and cold & cough drugs are being initially prescribed by a lot of medical professionals before confirmation of Covid-19. Thus, these segments are witnessing a strong surge in rural as well as urban areas. The management is cautiously optimistic and has guided for 16-18% revenue growth for the domestic branded formulations business in FY22.

Withdrawal of HCQ tailwinds to impact domestic API business in Q1FY22, robust capex plans on the anvil

Indian API manufacturers were favourably placed in 2020. This was mainly due to supply disruptions from Chinese counterparts due to Covid-19 and global pharmaceuticals aiming to de-risk their API supplies. In addition to this, high API prices also benefited Indian manufacturers bolstering their revenue base. IPCA Labs’ API business (25% of total revenues) mainly caters to cardiovascular, antimalarials and pain management constituting 75-80% of its API revenue mix. In the March 2021 quarter, API revenues were reported at Rs 260 crore. API exports (80% of total API revenues) were flat at Rs 209 crore while domestic APIs revenue base declined 21% YoY.

HCQ business in March 2021 quarter was Rs 20 crore compared to Rs 37 crore, corresponding quarter, a year ago. As Covid-19 cases decline across the world, HCQ business has returned to its normalized levels. The management has guided 28% YoY decline for domestic API business in June 2021 quarter mainly due to a higher base in the corresponding period, a year ago. For exports, the outlook is relatively positive and the management expects overall API revenue growth of 10% in FY22.

HCQ business in March 2021 quarter was Rs 20 crore compared to Rs 37 crore, corresponding quarter, a year ago. As Covid-19 cases decline across the world, HCQ business has returned to its normalized levels. The management has guided 28% YoY decline for domestic API business in June 2021 quarter mainly due to a higher base in the corresponding period, a year ago. For exports, the outlook is relatively positive and the management expects overall API revenue growth of 10% in FY22.

As IPCA Labs’ API business has been growing at a CAGR of 26% over the past three years, robust capex plans are underway to expand capacity. The company has been facing capacity constraints and bottlenecks, and is creating capacities within the existing infrastructure. To reduce capacity constraints, IPCA Labs is setting up a new API plant at Ratlam with a capex of Rs 100 crore and another two API plants at Dewas for about Rs 300 crore.

As IPCA Labs’ API business has been growing at a CAGR of 26% over the past three years, robust capex plans are underway to expand capacity. The company has been facing capacity constraints and bottlenecks, and is creating capacities within the existing infrastructure. To reduce capacity constraints, IPCA Labs is setting up a new API plant at Ratlam with a capex of Rs 100 crore and another two API plants at Dewas for about Rs 300 crore.

In addition to this, the company also aims to set up a new 50 tonnes automated plant for producing intermediates in Aurangabad and another one in Nagpur for which environment clearance is pending. Total capex for FY22 stands at Rs 550-600 crore.

With the withdrawal of HCQ tailwinds and absence of Covid-19 drug portfolio, investors would be keenly watching the domestic formulations growth trajectory and execution of capex plans in the near future.