By Suhani Adilabadkar

Tata Consultancy Services (TCS) ended 2020 with a flourish with strong results in the quarter ended December 2020. TCS reported a healthy set of numbers driven by broad based growth across geographies and verticals. It operates across five key vertical clusters, banking financial services and insurance (BFSI), retail, communications, media, manufacturing, and life sciences and healthcare. Its geographic footprint runs across North America, Latin America, United Kingdom, Continental Europe, Asia Pacific, India and Middle-East and Africa. The company’s stock has almost doubled since early April 2020.

Quick Takes:

-

TCS reported revenues of Rs 42,015 crores in Q3 FY21 rising 5.4% YoY, and 4.7% sequentially

-

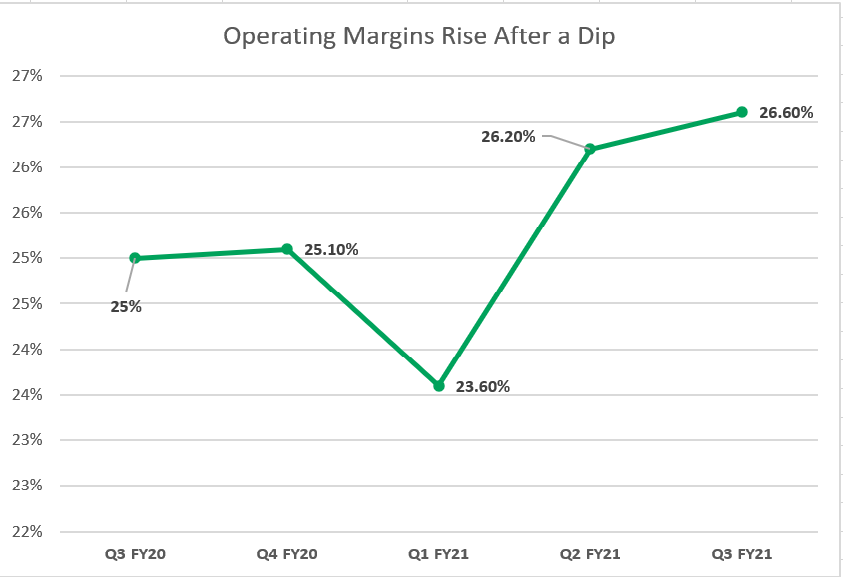

Despite salary hikes during the quarter, operating margins expanded 160 bps YoY and 40 bps sequentially to 26.6%, the highest quarterly margins in five years

-

Cloud adoption is driving a multi-year technology spending cycle, and will remain a secular growth driver for the company’s growth over the next 3-5 years

-

TCS acquired Postbank Systems AG from Deutsche Bank AG through its subsidiary Tata Consultancy Services Netherlands B.V on January 1, 2021

-

TCS entered into an agreement with Prudential Financial to acquire staff and select assets of its subsidiary Pramerica Systems Ireland Ltd (Pramerica)

Healthy December Quarter

TCS stock price was up 3% before it announced its December quarter results. And the results were better than expected. TCS reported revenues of Rs 42,015 crore in Q3 FY21 compared to Rs 39,854 crore in the same period previous year, rising 5.4% YoY and 4.7% sequentially.

Growth in revenues was driven by higher demand for core transformation services, market share gains and quick revenue conversion from earlier deals. Dollar revenues at $ 5.7billion grew 2.1% YoY and 0.4% YoY in constant currency terms. Operating income stood at Rs 11,184 crores 12% YoY with margins at 26.6% in December quarter FY21, the highest over the past five years.

Despite salary hikes during the quarter, operating margins expanded 160 bps YoY and 40 bps sequentially. Net Profit (PAT) stood at Rs 8,710 crores in Q3 FY21 against Rs 8,118 crores in the same period a year ago. On a sequential basis, PAT rose 16.4%. Total contract value signed during the quarter stood at $6.8 billion compared to $6 billion in the same period a year ago.

Recovering from the pandemic impact

The TCS management had said that growth in revenues on a YoY basis would resume from the last quarter of FY21, after bottoming out in June. It had earlier indicated that the June 2020 quarter would see a deep cut in revenues, and it eventually saw revenues fall 6.3% YoY constant currency terms and a 7.8% fall in dollar terms.

Nine months into FY21, TCS is back to showing revenue growth, and that too a quarter in advance. The management had guided that it would reach Q3 FY20 revenue and margins levels in Q4 FY21. The company achieved this one quarter early.

TCS reported its strongest December quarter after nine years. Growth was broad-based across geographies and verticals. In the BFSI vertical (30% of revenues), clients were reluctant to adopt a more structured approval process and activate remote access due to regulatory concerns, leading to a fall in revenues in the March 2020 and June 2020 quarters. But with supply-side issues sorted out, demand returned with the largest vertical growing 2% sequentially and 2.4% YoY in the December 2020 quarter. As issues with respect to redundancy, security and validation persist, and companies are still experimenting with public cloud, there is significant headroom for long-term growth in BFSI.

The retail vertical (15% of revenues) maintained growth momentum seen in the September quarter, reporting 3% sequential growth despite the holiday seasonal softness and continued weakness in discretionary retail, consumer packaged goods (CPG), travel and hospitality sub-verticals. Recovery in the retail cluster was driven by US, UK and Europe regions.

Life Sciences & Healthcare (8% revenues) outperformed other verticals with revenues growing consistently above 10% YoY constant currency revenue growth over the past 16 quarters. The vertical reported 5% QoQ and 18% YoY constant currency revenue growth in Q3 FY21. Revenues from manufacturing (10% of revenues) and communications (7% of revenues) verticals fell 4% YoY and 5% YoY in constant currency terms, respectively, while technology vertical’s revenues rose 2.4% YoY in the December quarter.

In terms of regions, India outperformed with 18% QoQ and 4% YoY revenue growth, North America revenues jumped 3.3% sequentially and was flat YoY, UK surprised with 4.6% sequential growth but with a 1.6% YoY decline. Continental Europe has been TCS’ strongest territory, with revenues growing 2.5% QoQ and 3.6% YoY, while Asia Pacific revenues jumped 3.6% sequentially.

Crossing the technological hump

TCS changed its operating model and moved offshore significantly after the financial crisis in 2008. Though cost levers exist in the form of lower travel and discretionary spends, lower sub-contracting costs, pyramid rationalisation and higher traction in offshoring, Covid-19 has created a tailwind for the IT services industry as a whole.

With businesses adopting digital due to the pandemic to reach customers, virtualisation has taken over physical interaction. Cyber security, cloud services, analytics, cognitive business operations and mobile application development are witnessing robust growth. And large players like TCS invested ahead of the curve over many years through investment in research and innovation, upskilling its employees, intellectual property and partnerships in emerging technologies.

Now companies like TCS are reaping the benefits of phenomenal growth in digital transformation. Exuding confidence, Rajesh Gopinathan, CEO and Managing Director of TCS said that growth trends are not cyclical but a multi-year secular demand recovery. “Cloud adoption is driving a multi-year technology spending cycle, and this will remain a secular growth driver for us over the next three to five years with the transformation playing out over multiple horizons”.

Companies across industries are adopting new architecture – the cloud. In fact, businesses globally have crossed a big technological hump through large scale cloud adoption. And a multi-year growth cycle and the cloud opportunity is expected to unfold in three phases. First, migration of the infrastructure to cloud, utilizing native capabilities of hyperscale platforms in the second phase and finally maintenance of cloud and platform-ecosystem integration.

This multi-year growth opportunity already existed before the pandemic struck. But businesses world over were slow to adapt, underplaying the significance of resilience and security. But the COVID-19 pandemic has aided in advancing cloud migration of various businesses.

TCS has intensified its investments and created new cloud practices to gain market share to take advantage of this rapidly expanding opportunity. The company partnered with Microsoft, Amazon and Google in 2019. TCS has recently created new dedicated business units focussed on these three leading hyperscale platforms, AWS (Amazon Web Services), Microsoft Azure and Google Cloud.

Speaking in this regard, Gopinathan said, “These units have hit the ground running in Q3, and we have been winning cloud engagements from across more than 200 customers in this quarter itself”. The company provides end-to-end application, modernization and cloud migration services on these hyperscale platforms utilizing a customer-centric, productized approach accelerating client’s transformation journey. But, how long will this sustain, especially once the first phase of cloud migration is over is to be seen. There is also the likelihood that these global tech providers (hyperscalers) start competing with companies like TCS. In this ever-evolving IT landscape, TCS has remained ahead of the curve and future ready. Investors will be watching out if TCS can achieve double-digit revenue growth that the company aims in FY22.