by Aakash Athawasya

Cremica and English Oven are well-known brands in Indian supermarkets. Now, the company behind these brands - Mrs. Bectors Food Specialities is going public. Mrs. Bectors is also the foodservice supplier to popular quick-service restaurants (QSRs) like McDonald’s, Burger King, KFC, and Pizza Hut,

Mrs. Bectors Food Specialities was started by Rajni Bector in her backyard in 1978. And now, 40 years later, it has recorded Rs 760 crore in revenue in FY20. However, since the pandemic began, Mrs. Bectors Food Specialities’ main B2C vertical - packaged foods, and its B2B vertical - restaurants, have been hit hard. In Q2FY21, revenues for the packaged food industry declined by 12.4% on a YoY basis. With the lockdown imposed in the first half of this fiscal year, revenues for the restaurant industry dropped by 29.5% YoY and net profits were lower by 60%.

Despite this bleak backdrop heading into H2FY21, investors are hopeful of a turnaround. Investor enthusiasm in the foodservice industry was already seen in the Burger King India IPO, listing at almost double of the IPO price band, and with Mrs. Bectors Food Specialities subscribed over 11 times, at the end of the second day of bidding, the enthusiasm is set to continue.

Take two, with a smaller offering

This is Mrs. Bectors Food Specialities’ second attempt at an IPO. Back in 2018, it received approval from the Securities and Exchange Board of India (SEBI) to float a Rs 800 crore IPO. But due to poor market conditions, the offering was shelved. Since its first attempt, the benchmark Nifty has gained 23% and the Nifty FMCG index 15%, each trading at a record high. However, Mrs. Bectors Food Specialities in its second attempt has cut its offering size by 30%.

Mrs. Bectors Food Specialities’ 2020 IPO is reduced to Rs 550 crore, divided between a fresh issue of shares worth Rs 50 crore and an offer for sale (OFS) of Rs 500 crore. The IPO’s price is Rs 286 to Rs 288 per share, valuing the company at Rs 1,690 crore post the offering.

The promoters are not selling any stake and will hold a majority 51% stake in the company. The company’s institutional partners will decrease their holding. Private equity (PE) firm CX Partners, through its entity Linus Private Limited, will sell 85.6 lakh shares for Rs 245 crore, cutting its stake by 15%. Singapore-based PE firm Gateway Partners’ will sell 89.1 lakh shares for Rs 255 crore, cutting its stake by 15.6%, through its entities - GM Confectionary, GM Crown, and Mabel Private Limited. CX Partners and Gateway partners will hold 7.9% and 8.2% of Mrs. Bectors Food Specialties post the IPO.

Out of the net proceeds worth Rs 50 crore from the fresh issue, Rs 40.5 crore will be used to finance a new production line for biscuits at the company’s Rajpura manufacturing facility in Punjab. Mrs. Bectors Food Specialities estimates that the facility’s expansion will begin commercial production in April 2022. In FY19, the Rajpura facility’s installed manufacturing capacity was 15,600 metric tonnes (MT) for direct and contract manufacturing. Its other biscuit manufacturing facilities in Phillaur, Punjab, and Tahliwal, Himachal Pradesh have a much higher installed capacity of 52,800 MT and 34,200 MT respectively.

Biscuits and bakeries

Mrs. Bectors Food Specialities operates in two industries - packaged foods, makers of premium and mid-premium biscuits and food services, supplying bakery products at a retail level and a wholesale level to popular QSR operators. Under the ‘Cremica’ brand, it manufactures and sells a variety of biscuits including cookies, cream biscuits, crackers, and digestive biscuits. The biscuit business contributed Rs 294.2 crore in revenue for H1FY21 or 68% of the revenue for the period. On a YoY basis, the business saw a 34% increase in revenue.

Bakery products are manufactured and sold under the ‘English Oven’ brand which includes buns, breads, and pizza bases. This segment caters only to the premium markets of Delhi NCR, Mumbai, and Bengaluru. In H1FY21, the bakery business brought in revenues of Rs 88.3 crore, contributing 20.5% of total revenue. In the first half of the previous financial year, it recorded revenue of Rs 58.5 crore or 16% of total revenue.

The company also supplies frozen bakery products to popular QSR restaurants. Mrs. Bectors Food Specialties’ customers include Hardcastle Restaurants, owned by Westlife Development, the franchisee operator of McDonald’s India in West and South India, Rebel Foods, the Sequoia Capital-backed franchise operator of Faasos, Wendy’s, Oven Story, Burger King India, and Yum! Restaurants, the franchisee operator of KFC, Pizza Hut, and Taco Bell. In the six months ended September 2020, revenues from bakery products sales to restaurant operators were 5.6% of total revenues during the period. Due to the pandemic and resultant lockdown across the country, its restaurant customers were closed, forcing its revenue from the vertical to drop by 61% on a YoY basis.

In the calendar year 2019, Mrs. Bectors Food Specialities contributed 12% of the total Indian biscuit exports, according to Technopak. Within the export market, it holds a majority exporter position in Uganda and South Africa among Indian biscuit makers and exports more than 25% to China in terms of value. In FY20, it exported biscuits to 64 countries. Revenue from biscuit exports was Rs 167.6 crore in FY20, contributing 22% of total revenues. In the six months ended September 2020, revenue from exports was Rs 105.6 crore, against Rs 76 crore in the year-ago period.

Steady revenue but volatile profits

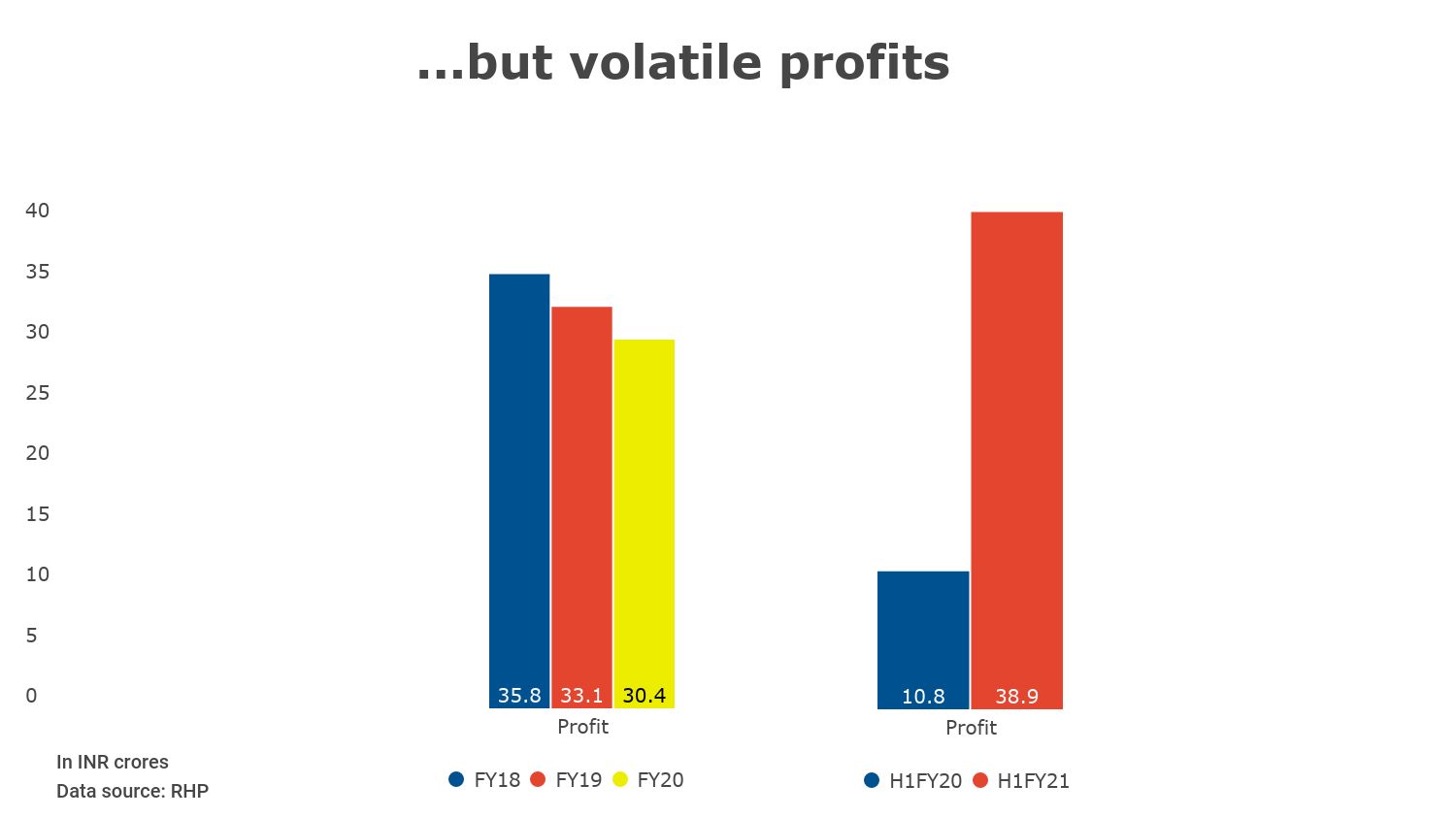

In FY20, Mrs. Bectors Food recorded Rs 762 crore in revenue, lower by 2.7% against the previous year. Revenues rose by 12.9% YoY in FY19. A sign of worry is the declining annual net profits. Its net profit has been falling for two consecutive years. In FY19, net profit was Rs 33.1 crore, a fall of 5.4% against FY18’s net profit. In FY20, net profit was Rs 30.4 crore, a drop of 8.3% on a YoY basis.

However, the numbers for the first half of 2020, against the year-ago period, stand in contrast to the annual numbers. In the first quarter of FY21, revenue rose by 16% YoY, despite the lockdown between April to May. Net profits during the quarter were 15.8 crore, a four-fold jump from the year-ago period.

The same was true in the second quarter of FY21. In Q2, revenue stood at Rs 228 crore, a 20% jump on a YoY basis. Sequentially, between Q1 and Q2, revenues rose by 12.5%. Net profit for the quarter was Rs 23 crore a four-fold growth on an annual basis. Profit margins from Q1 to Q2 rose from 7.8% to 10.1%. The growth in revenue and net profits for the second half of the year was driven by its biscuits and its retail bakeries business, despite the 61% revenue drop in supply of bakery products to restaurants.

Mrs. Bectors Food Specialities’ earnings per share (EPS) for FY20 was Rs 5.9. Taking the upper IPO price band of Rs 288, its price to earnings (PE) stands at 48.9 times its FY20 earnings.

A small player in large markets

According to Technopak, India’s retail packaged food industry grew at a compounded annual growth rate (CAGR) of 10.7% between 2015 to 2020. It is estimated to grow at a similar clip for the next five years reaching Rs 2.6 lakh crore by 2025. Within the packaged food industry, the Indian biscuit and bakery market is valued at Rs 45,000 crore and is expected to grow at a CAGR of 9% in the next five years. Rusks, wafers, and tea cakes in which Cremica finds its niche contribute 89% of the biscuit and bakery market.

The Indian biscuit market is divided between Britannia Industries, Parle, and ITC, which collectively hold a 65% market share, while Cremica holds 1% of the market. The company’s biscuit brand has a wider reach in the mid-premium and premium biscuits, where it holds 4.5% of the market in North India. Its products are more popular in the states of Punjab, Jammu & Kashmir, Himachal Pradesh, and Ladakh where it is second to Britannia Industries as the leading biscuit company.

India’s food services market is valued at Rs 4.2 lakh crore and is expected to grow at a CAGR of 9% over the next five years, according to Technopak. The organized market, which accounts for 40% of the total market is estimated to grow at a CAGR of 15% in the same period. Due to the pandemic, the market is forecasted to contract by 53% in FY21. Within the organized sector, the chain market is worth Rs 39,700 crore or under 10% of the total food services market. This market is dominated by Domino’s, Subway, and three of Mrs. Bectors Food Specialities customers’ McDonald’s, KFC, and Burger King. The five QSRs have a 45% market share.

Bakery offerings and customers drive enthusiasm

Mrs. Bectors Food Specialities is not just a biscuit maker, and investor enthusiasm is representative of its bakery offerings. The Indian mid-premium and premium biscuit market is already dominated by heavyweights like Britannia’s Good Day, Bourbon and NutriChoice biscuits, Parle Biscuits’ Parle G, Monaco biscuits, and ITC’s Sunfeast brand. Mrs. Bectors Food Specialities’ Cremica brand holds just 1% of the domestic market. In the northern states of Punjab, Jammu & Kashmir, Ladakh, and Himachal Pradesh, the Cremica brand is a household name. But a 4.5% market share in states which contribute less than 25% of the domestic biscuit market is not what caught investor’s enthusiasm.

A reason why its IPO is subscribed more than 11 times with the retail portion booked over 16 times, at the end of the second day of bidding, is potentially its prowess in the bakery range. The foodservice offerings, both at a retail level and a wholesale level offer three advantages. First, a diversified offering beyond biscuits, as the bakery products brought in over 25% of revenue for the six months ended September 2020. Second, the revenue of the retail bakery products grew by 51% YoY in H1FY21. Third, three of the five restaurant chains served by the company – McDonald’s, KFC, and Burger King India, bring in 57% of the total revenue in the QSR chain market.