Chemical manufacturers enjoyed multiple tailwinds in FY21 and FY22. Besides low raw material costs and high end-product prices, the China plus one strategy made global companies diversify their supply chain to alternative destinations, which helped Indian companies. Investments made by Indian chemical makers to foray into different molecules (Phenolics by Deepak Nitrite for example) also paid off.

But what goes up must come down, at least temporarily.

As raw material prices started to rise in FY23, chemical companies' margins took a hit. High inflation across the globe led to lower demand amid volatile end-product prices, resulting in bottom-line growth slowing.

Pidilite Industries' management said demand in Q2FY23 was subdued by lower consumption, as inflation squeezed spending power. However, with disruptions in European markets, where companies are unable to meet demand because of energy shortages, the Indian chemicals sector may have a chance to improve exports and its global market share.

But an inevitable risk that these companies need to face is that some of their end products are commodities and, hence, they don’t enjoy pricing power. This makes them price takers, not price setters. One example is ref-gas (refrigerant segment) products, which are major revenue contributors for SRF and Gujarat Fluorochemicals (GFL). Its prices remained robust in Q2FY23, leading to higher realisation for these companies. However, a volatile price for this end product could hurt chemical manufacturers. In addition, raw material costs also affect realisations and bottom lines.

In Q2FY23, raw material prices remained high and volatile end products continued to put pressure on margins.

Chemical companies’ share prices fell in the past quarter amid weak Q1 and Q2 results

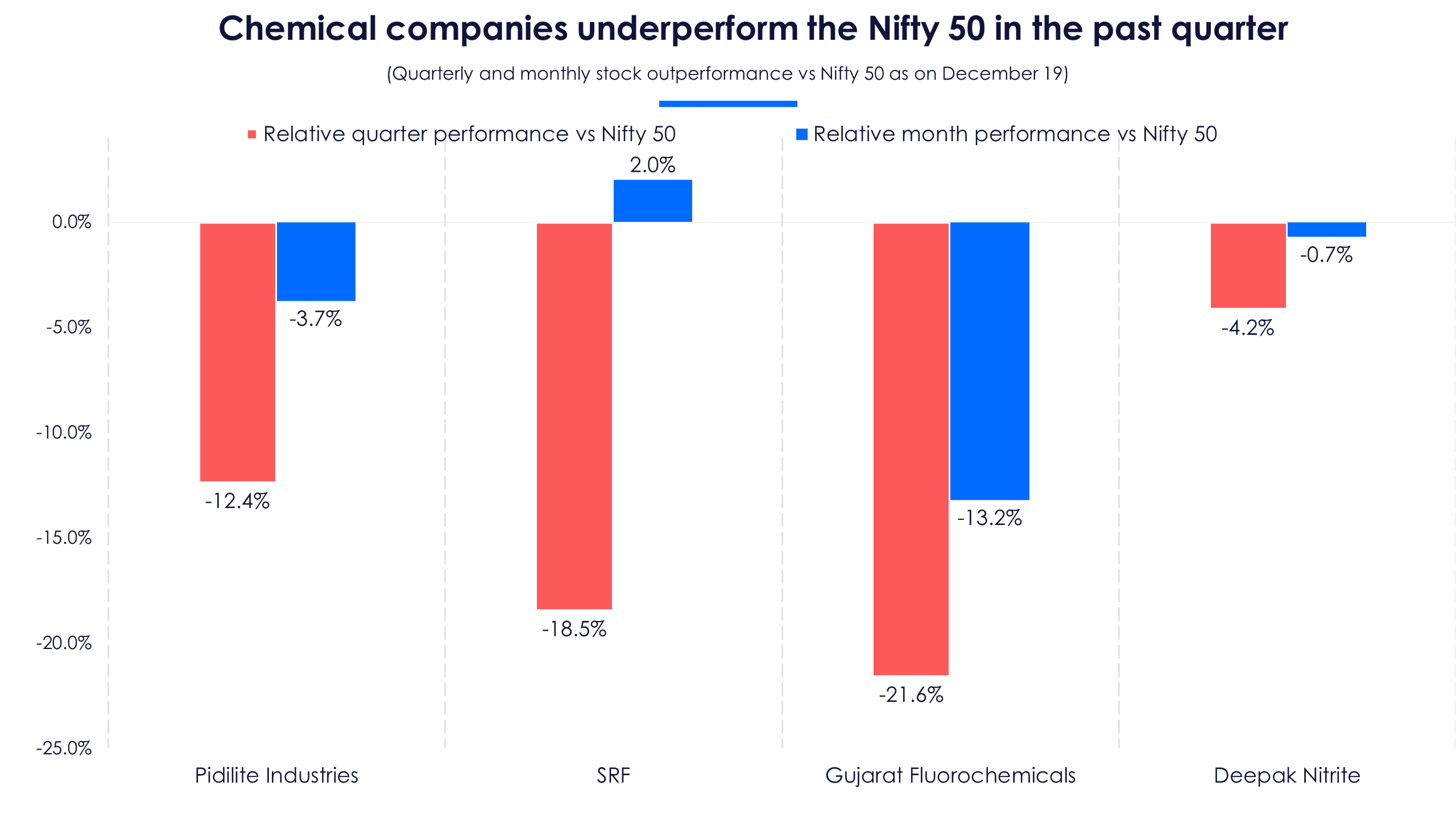

All chemical companies in focus–Pidilite Industries, SRF, Gujarat Fluorochemicals and Deepak Nitrite–underperformed the Nifty 50 in the past quarter. Investors are worried about declining margins in FY23.

Chemical makers’ share prices fell by as much as 21.6%, while Nifty 50 rose around 3% in the past quarter. One factor that added to the fall in share prices was the net profit of these companies missing forecaster estimates, as operating profit margins fell by more-than-expected levels due to key raw material prices continuing to stay elevated.

Chemical makers’ share prices fell by as much as 21.6%, while Nifty 50 rose around 3% in the past quarter. One factor that added to the fall in share prices was the net profit of these companies missing forecaster estimates, as operating profit margins fell by more-than-expected levels due to key raw material prices continuing to stay elevated.

However, raw material costs are expected to normalise soon. In addition to missing forecaster estimates, net profits of Pidilite Industries and Deepak Nitrite fell YoY by 11.3% and 31.4% respectively.

However, raw material costs are expected to normalise soon. In addition to missing forecaster estimates, net profits of Pidilite Industries and Deepak Nitrite fell YoY by 11.3% and 31.4% respectively.

Despite missing net profit estimates, the revenues of companies in focus rose YoY mainly due to price hikes and strong domestic demand. With the easing of commodity prices, SRF plans to cut prices or at least maintain the current levels in Q3FY23. In the Q2 earnings call, SRF's management said that the demand in Q2FY23 was lower than expected on account of lower consumption due to inflation. But it expects the demand to pick up in rural and semi-urban regions in the coming quarters.

Despite missing net profit estimates, the revenues of companies in focus rose YoY mainly due to price hikes and strong domestic demand. With the easing of commodity prices, SRF plans to cut prices or at least maintain the current levels in Q3FY23. In the Q2 earnings call, SRF's management said that the demand in Q2FY23 was lower than expected on account of lower consumption due to inflation. But it expects the demand to pick up in rural and semi-urban regions in the coming quarters.

Raw material prices make or break margins for chemical companies

Pidilite Industries, which houses major brands like Fevikwik, Fevistik and Dr. Fixit, saw its net profit fall YoY mainly due to a sharp increase in the price of its key raw material–Vinyl Acetate Monomer (VAM), which is derived from ethylene. The average consumption cost of VAM increased nearly 12% YoY to US$2,491/MT, affecting the company's EBITDA margin, which fell 433 bps to 16.6%. This is much lower than its pre-Covid EBITDA margin range of 21-22%.

The management believes the EBITDA margin will recover to its pre-covid level from H2FY23, supported by the easing of raw material prices and improved product sales mix. The recent fall of VAM to around $1200-1400/MT will help the company's margins to recover.

Deepak Nitrite's YoY fall in net profit was mainly due to margin contraction in the company's star segment (Phenolics) in the past couple of years. EBIT margin from this segment fell to 8%, the lowest since Q4FY20. The phenolics space has a lower EBIT margin when compared to the advanced intermediates segment (20% EBIT margin). The sharp drop in margins is a worrying sign for investors. The performance was also adversely affected by the fire accident in its Nandesari site, but the plant has been running at full capacity since October.

Net profits of SRF and Gujarat Fluorochemicals, on the other hand, rose due to strong performance in the fluorochemicals segment. The Fluorochemicals business derives revenue from the sale of refrigerants, pharma propellants and industrial chemicals. SRF is the domestic leader in the refrigerants space. Its market share further increased with the launch of a new chemical, 'F 600a', which is a hydrocarbon that is becoming increasingly popular due to its low global warming potential.

Net profits of SRF and Gujarat Fluorochemicals, on the other hand, rose due to strong performance in the fluorochemicals segment. The Fluorochemicals business derives revenue from the sale of refrigerants, pharma propellants and industrial chemicals. SRF is the domestic leader in the refrigerants space. Its market share further increased with the launch of a new chemical, 'F 600a', which is a hydrocarbon that is becoming increasingly popular due to its low global warming potential.

Hydrofluorocarbons (HFC) are the most widely known refrigerant gases in the market. High demand and prices of HFC in Q2FY23 led to higher top line and bottom line for SRF and GFL. Revenue from refrigerant gas jumped 2.9x for Gujarat Fluorochemicals in Q2, driven by new fluoropolymers. The company's management said prices of R-125 (a type of ref gas) have remained stable at Q1FY23 levels and have not shown any sign of weakness yet. It is of the view that HFC prices may remain elevated for at least 12 more months.

Playing the long game: Deepak Nitrite eyes solvent manufacturing, GFL ups fluoropolymer production capacity

Chemical companies need to be on their toes to understand and analyse the long-term demand for different molecules in various segments and allocate the capex accordingly.

Deepak Nitrite, for example, bet big on the phenolics segment and it paid off. Deepak Phenolics, which was set up in 2014, was funded 60% by debt and the rest through Qualified Institutional Buyers (QIBs). Its management recognised the demand for phenol and acetone and made an import substitution play. In Q2FY23, the phenolics segment contributed over 50% of the company's revenue. Long-term vision and demand recognition is key for chemical companies.

All companies in focus are expected to increase their capex in FY23. Gujarat Fluorochemicals and Deepak Nitrite's capex are expected to jump 43% and 80% respectively in FY23. Deepak Nitrite's management plans to invest Rs 700 crore in solvent manufacturing and aims to become the largest player with a play on import substitution. It is eyeing forward and backward integration in phenol and acetone chemicals.

All companies in focus are expected to increase their capex in FY23. Gujarat Fluorochemicals and Deepak Nitrite's capex are expected to jump 43% and 80% respectively in FY23. Deepak Nitrite's management plans to invest Rs 700 crore in solvent manufacturing and aims to become the largest player with a play on import substitution. It is eyeing forward and backward integration in phenol and acetone chemicals.

GFL’s management has announced capex of Rs 250 crore for the next two years. GFL increased its capex guidance to Rs 250 crore over FY23-24 from Rs 225 crore earlier as the company intends to expand its capacity in the fluoropolymer segment. This seems like a good move as fluorochemicals has been the star segment for the company. Battery chemicals and battery-grade PVDF plants are expected to be commissioned in FY24. However, the benefits of these plants will only be seen from FY25. SRF announced capex of Rs 1,250 crore year-to-date. The company plans to allocate a major portion of the capex to the speciality chemical segment and also for capacity expansion in the lucrative fluorochemicals segment.

Given the rising demand and elevated prices of fluorochemicals, GFL is expected to gain the most from its capacity expansion in the segment. Its revenue is expected to rise nearly 30% YoY.

SRF, which is a market leader in the ref-gas segment, is also expected to post strong revenue growth in Q2FY23 and FY23. Revenues of all companies in focus are expected to rise anywhere between 13% and 30% in FY23.

SRF, which is a market leader in the ref-gas segment, is also expected to post strong revenue growth in Q2FY23 and FY23. Revenues of all companies in focus are expected to rise anywhere between 13% and 30% in FY23.

Chemical companies’ expensive valuations demand high growth

Despite the fall in share price in the past quarter, TTM PE ratios of three out of four companies (Pidilite, SRF and Deepak Nitrite) in focus are higher when compared to their historical levels, pushing these companies to the PE Sell Zone. PE ratios are typically high when the growth of the company is expected to rise at a fast rate.

Only SRF's TTM PE is below both its historical and sector PE. Given its low valuation and decent growth prospects, analysts see a 15% price upside in the company's share price. In fact, SRF has a consensus recommendation of 'Buy’ with 17 analysts rating it as 'Strong Buy'.

Pidilite, with its expensive valuation, has a consensus ‘Sell’ rating. GFL has a 'Buy' rating, while Deepak Nitrite has a 'Hold' rating.

Pidilite, with its expensive valuation, has a consensus ‘Sell’ rating. GFL has a 'Buy' rating, while Deepak Nitrite has a 'Hold' rating.

Chemical companies boast of high durability scores, but valuation a concern

The durability score of all companies in focus is over 55, indicating strong financial health. But valuation score is a concern for investors. Except for Gujarat Fluorochemicals, all other companies have a 'bad' (less than 30) valuation score, indicating expensive valuations.

Chemical companies' revenues are rising at a fast rate amid robust demand but what's concerning is their margins falling due to volatile raw material and end product prices. However, one common thread from the management of these chemical makers is that the margins are set to improve starting H2FY23, as input prices are starting to ease.

Chemical companies' revenues are rising at a fast rate amid robust demand but what's concerning is their margins falling due to volatile raw material and end product prices. However, one common thread from the management of these chemical makers is that the margins are set to improve starting H2FY23, as input prices are starting to ease.

Chemical companies betting big on the fluorochemical segment are expected to post better profit margins as the end product prices in this segment are elevated. But a sudden fall in the prices of end products remains a risk always. In addition, as companies spend huge amounts on capex to foray into different segments, any supply-demand mismatch in products can hurt in the long term.

This analysis by Trendlyne is meant for investor education - to help understand companies and make informed investment decisions on their own. It should not be considered an investment recommendation.