Craftsman Automation, the Coimbatore-based engineering company’s initial public offering opened alongside Laxmi Organics. At the end of the first day of bidding, investors snapped up 55% of the shares on offer.

Craftsman Automation primarily manufactures key components for the automobile industry. But over the past few years, it has diversified into another business segment - industrial engineering. This diversification while making the company more operationally efficient resulted in the company taking on debt.

That’s not the only thing investors looking for a play on the automobile industry should keep in mind. High valuations of the company, low return on equity, and increasing raw material prices, makes Craftsman Automation an underwhelming bet.

Marquee investors trim stake

Craftsman Automation’s only promoter is Srinivasan Ravi, the chairman and managing director of the company. Prior to the IPO, he held a majority 52.8% stake. Singapore-based investment company Marina III (an investment arm of Standard Chartered) held a 15.5% stake.

Another marquee investor in the company is International Finance Corporation (IFC), an arm of the World Bank. IFC held a 14% stake in the company. Srinivasan Ravi’s brother S. Murali held a 10.6% stake in the company prior to the IPO.

The issue is worth Rs 820 crore comprising a fresh issue of Rs 150 crore and offer for sale (OFS) of Rs 670 crore. The IPO price band is Rs 1,488-1490 per share.

As part of the OFS, 45.2 lakh shares will be sold by the promoter and institutional investors - Marina III and IFC. Post the IPO, Srinivasan’s Ravi’s stake will drop to 49.2%, Marina III and IFC’s stake will be 7.4% and 6.7%, respectively. The external investors’ stake in the company will halve post the IPO. The public (including the marquee investors) will hold 40% of the company post the IPO. Craftsman Automation, at the upper end of the IPO price band, is valued at Rs 2,500 crore.

Craftsman Automation’s earnings per share (EPS) for the nine months ended December 2020 stood at Rs 25.1 per share. This gives it a price-to-earnings (PE) multiple of 79.1 based on its FY21 earnings (annualised), which is high but in line with listed peers.

Of the Rs 150 crore to be raised through the fresh issue, Craftsman Automation will use nearly 80% (Rs 120 crore) to repay debts. The rest will be used for general corporate purposes. No amount of the fresh issue is allocated for capex.

Of the Rs 150 crore to be raised through the fresh issue, Craftsman Automation will use nearly 80% (Rs 120 crore) to repay debts. The rest will be used for general corporate purposes. No amount of the fresh issue is allocated for capex.

BS-VI brings down FY20 revenue

Craftsman Automation’s FY20 revenue was Rs 1,492 crore, a drop of 18% over the previous year. Between FY18 to FY19, revenues rose by 20.3% to reach Rs 1,818 crore. The YoY drop in FY20 revenue for Craftsman Automation was due to declining sales as a result of the economic slowdown, and the automobile industry’s transition to the Bharat Stage VI (BS-VI) emission norms. This affected the top line of its listed auto-component peers as well.

For the nine-months ended December 2020, Craftsman Automation’s revenues were Rs 1,022.8 crore. Craftsman Automation’s earnings before interest and tax depreciation and amortization (EBITDA) was Rs 398 crore in FY20, a 5% decline YoY. Its EBITDA margins rose by 360 basis points between FY19 to FY20, reaching 26.7%. The company’s EBITDA margins have been consistently higher than listed peers, which highlights the company’s operational efficiency. This is because in 2019, Craftsman Automation’s Pune industrial engineering unit was commissioned, allowing it to step-up its storage solutions segment and increase its revenue.

Operational efficiency was one of the reasons Craftsman Automation’s profit after tax (PAT) rose in the nine months ended December 2020. In 9MFY21, PAT was Rs 50.6 crore, a rise of 23% in nine months. In FY20, PAT stood at Rs 41 crore, a fall of 58% on a YoY basis. Craftsman Automation is the only auto-components company to post a PAT recovery in 9MFY21.

Craftsman Automation’s PAT margins have improved to 5% in 9MFY21, from 2.8% in FY20. Between FY 18-20, the company has maintained PAT margins of 3-5%, which is in line with the industry average.

A concern for investors, however, is the low return on equity (RoE). Listed auto-component companies recorded RoE in the range of 16-20% in FY20. This is much higher than Craftsman Automation’s FY20 RoE of 5.8%.

Strong cash generation

The cash generation of Craftsman Automation is strong and growing. Cash generated from operating activities in FY20 was Rs 305 crore, a 15% drop on a YoY basis. For the nine months ended December 2020, operating cash flows were Rs 242 crore.

Craftsman Automation has been consistently decreasing capital expenditure (capex) since FY19. Between FY19 to FY20, capex decreased by 75% to Rs 120 crore from Rs 456 crore. The company was increasingly allocating capex to set up its industrial engineering segment.

For the nine months ended December 2020, capex was Rs 50 crore. This is why the company’s free cash flows have been consistently increasing since FY19. On the other hand, since the company’s capex allocation is decreasing, its cash and cash equivalents are increasing.

Borrowings decrease but D/E still high

Craftsman Automation’s debt is high, but it’s falling. In FY20, total borrowings were Rs 912 crore, a 10.2% YoY growth. However, by December 2020, the company managed to reduce its debt by 24% to Rs 690 crore.

For the nine months ended December 2020, Craftsman Automation’s debt-to-equity ratio was 1.1 times. This is lower than the debt-to-equity ratio of 1.4 times in March 2020, its highest in three years. Since the company’s intended use from the proceeds of the fresh issue is to reduce debt, and the capex cycle is ramping down, Craftsman Automation’s leverage will reduce going forward. That being said, its high debt-to-equity ratio is still not comforting.

An automobile component maker that is entering new segments

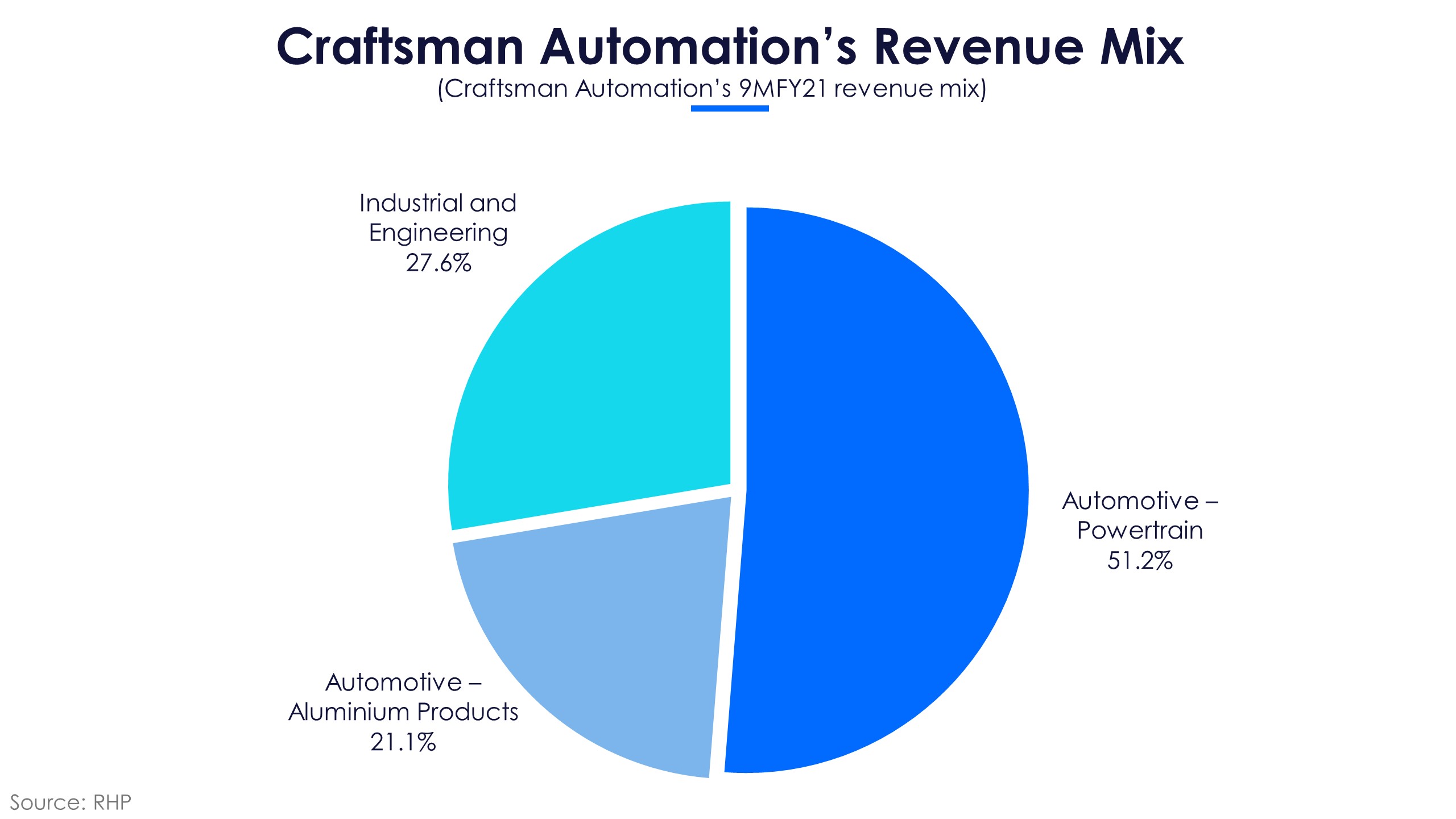

Craftsman Automation manufactures components for the automobile industry, mainly commercial vehicles and tractors. It makes powertrains, aluminum products (like crankcases, cylinder blocks, etc.), and industrial and engineering components.

The industrial engineering segment is a recent diversification. Under this segment, Craftsman Automation provides storage solutions to FMCG, e-commerce, and pharmaceutical companies, and manufactures precision aluminum products on a contract basis. The storage solutions business (started in 2012) has grown at a compounded annual growth rate (CAGR) of 204% between FY18-20. It contributed 6% of the 9MFY21 revenues, up from 0.5% in FY18.

Craftsman Automation provides powertrains and aluminum products to several automobile original equipment manufacturers (OEMs) including Tata Motors, Daimler India, TVS Motor Company, Royal Enfield, Mahindra & Mahindra. Its industrial and engineering products are used by Siemens and Mitsubishi Heavy Industries. The top-10 customers by order value made up over 59% of 9MFY21 revenue.

The company primarily caters to the domestic market. For the nine months ended December 2020, less than 10% of revenue came from exports. Export revenues as a percentage of total revenues have hovered at around 8-10%, mainly sourced from the exports of industrial and engineering products.

Powertrain and storage to grow but metal prices spike

After declining for two years (FY 18-20), the market for powertrains is set to grow at a CAGR of 14% between 2020 to 2024 to reach Rs 84,600 crore from Rs 50,800 crore.

However, a key concern for the market, and indeed Craftsman Automation, is the rising global and domestic price of aluminum and iron.

The global price of alumina rose to $300 per tonne (~Rs 21,700) in Q3 from $225 per tonne (~Rs 16,300) in Q1 due to supply shortage and increasing demand. On the other hand, the price of iron ore jumped to Rs 4,350 per tonne in Q3 from Rs 1,960 per tonne in Q1. This is why several automobile manufacturers like Maruti Suzuki India, Mahindra & Mahindra, and Tata Motors hiked their prices in Q4, and are planning to hike them in Q1FY22 again.

On the other hand, the company has diversified into a growing market. In 2019, the company’s Pune unit was commissioned to manufacture storage solutions. It will form part of the organized storage market which is expected to capture the growth in the overall market between FY 21-24. The storage solutions market was worth Rs 2,100 crore in FY20 and is expected to grow at a CAGR of 21% to reach Rs 3,800 crore by FY24.

The company’s net profit has risen above the previous year’s levels while maintaining strong operating margins owing to the diversification. While Craftsman Automation’s main market (powertrain) and diversified market (industrial storage) are both growing, the company’s fundamentals remain shaky. The high debt levels and low and erratic RoE are a cause for concern. The rallying metal prices could also eat away at the company’s resurgent bottom line. Investors willing to pay more for a company that underperforms its peers on certain metrics would look only for listing gains if any.