Continuing the initial public offering (IPO) rush of FY21 is Macrotech Developers. This is the first IPO of FY22. The Mumbai-based real estate company’s share offer has been a long time coming.

Macrotech Developers has 93% of its projects in the Mumbai Metropolitan Region (MMR), and the rest in Pune. The real estate company, formed in 1986 as Lodha Developers primarily develops residential projects for affordable and premium housing.

The first time the company planned to hit the bourses was in 2008. But does investing in a real estate company in the current economic and market environment make any sense for investors? We find out.

Share sale primarily to pay off debt

This is the third time Macrotech Developers is attempting to go public. The first attempt was in 2008 with a Rs 2,800 crore issue size. Markets were haywire during the days of the global financial crisis, and the IPO was shelved. The second attempt was in 2018 with a Rs 5,500 crore issue. Due to “past violations” by its subsidiary Roselabs Finance owing to insider trading in 2003, SEBI suspended the IPO. However, Roselabs Finance’s violation occurred before Macrotech Developers acquired it in 2010.

Macrotech Developers’ promoters are the Lodha family and their holding company Sambhavnath Infrabuild. The realty company’s IPO issue size is Rs 2,500 crore and is a complete fresh issue of 5 crore equity shares. The IPO price band is Rs 483-486 per share.

Post the IPO, the promoters’ stake will drop to 88% (from 100%), and the public will hold 12% of the company.

At the upper end of the price band, Macrotech Developers is valued at Rs 21,700 crore, making it the third-largest listed realty company behind DLF and Godrej Properties by market capitalization. DLF’s 2007 share sale made a big listing splash, but the momentum fizzled out due to a slew of regulatory controversies. The national capital region (NCR) realty company’s shares shortly after issue (at Rs 525 per share) jumped to Rs 1,050. DLF’s shares have not hit that level since.

From the proceeds of the fresh issue of Rs 2,500 crore, 60% or Rs 1,500 crore will be used to repay borrowings, 15% or Rs 375 crore will be used for capital expenditure (capex), and the rest (Rs 625 crore) will be used for general corporate purposes.

Taking the upper end of the Rs 486 price band, Macrotech Developers is valued at 7.5 times its 9MFY21 revenue. This is higher than smaller realty firms like Prestige Estate Projects (2.4 times) and Sobha (2.6 times) but lower than its competitors in the MMR market - Phoenix Mills (17.8 times) and Oberoi Realty (16.5 times).

PAT turns negative in FY21

PAT turns negative in FY21

Macrotech Developers’ FY20 revenues were Rs 12,442 crore, a 4% rise YoY. Between FY 18-20, revenues declined by 8%. For the nine months ended December 2020, revenues were Rs 2,915 crore, a massive 70% decline YoY. Macrotech Developer’s 9MFY21 revenue decline was worse than its MMR competitors - Oberoi Realty (22% decline) and Phoenix Mills (54% decline).

Due to the high debt, the company’s finance costs are rising. Between FY18-20, finance costs jumped 91% to Rs 731 crore. The company’s debt has dropped by 18% between FY 18-20 but its debt-to-equity ratio is 3.5 times. EBITDA for FY20 was Rs 2,370 crore, a 26% decline YoY with margins of 19%, a 780 basis points drop YoY. For 9MFY21, EBITDA was Rs 563 crore, a 72% decline YoY.

Due to the high debt, the company’s finance costs are rising. Between FY18-20, finance costs jumped 91% to Rs 731 crore. The company’s debt has dropped by 18% between FY 18-20 but its debt-to-equity ratio is 3.5 times. EBITDA for FY20 was Rs 2,370 crore, a 26% decline YoY with margins of 19%, a 780 basis points drop YoY. For 9MFY21, EBITDA was Rs 563 crore, a 72% decline YoY.

The company’s bottom line was shrinking before the Covid-19 pandemic. In FY20, its net profit was Rs 744.8 crore, a decline of 55% over the previous year. Between FY18-20, its net profit declined by 60%. For 9MFY21, Macrotech Developers reported a net loss of Rs 264 crore, against a net profit of Rs 503 crore in the same period a year ago. This is the highest net loss compared to its listed realty peers for the same period. Macrotech Developer’s wider loss is because of its reliance on the Mumbai region’s realty market, and high unsold inventory in premium housing.

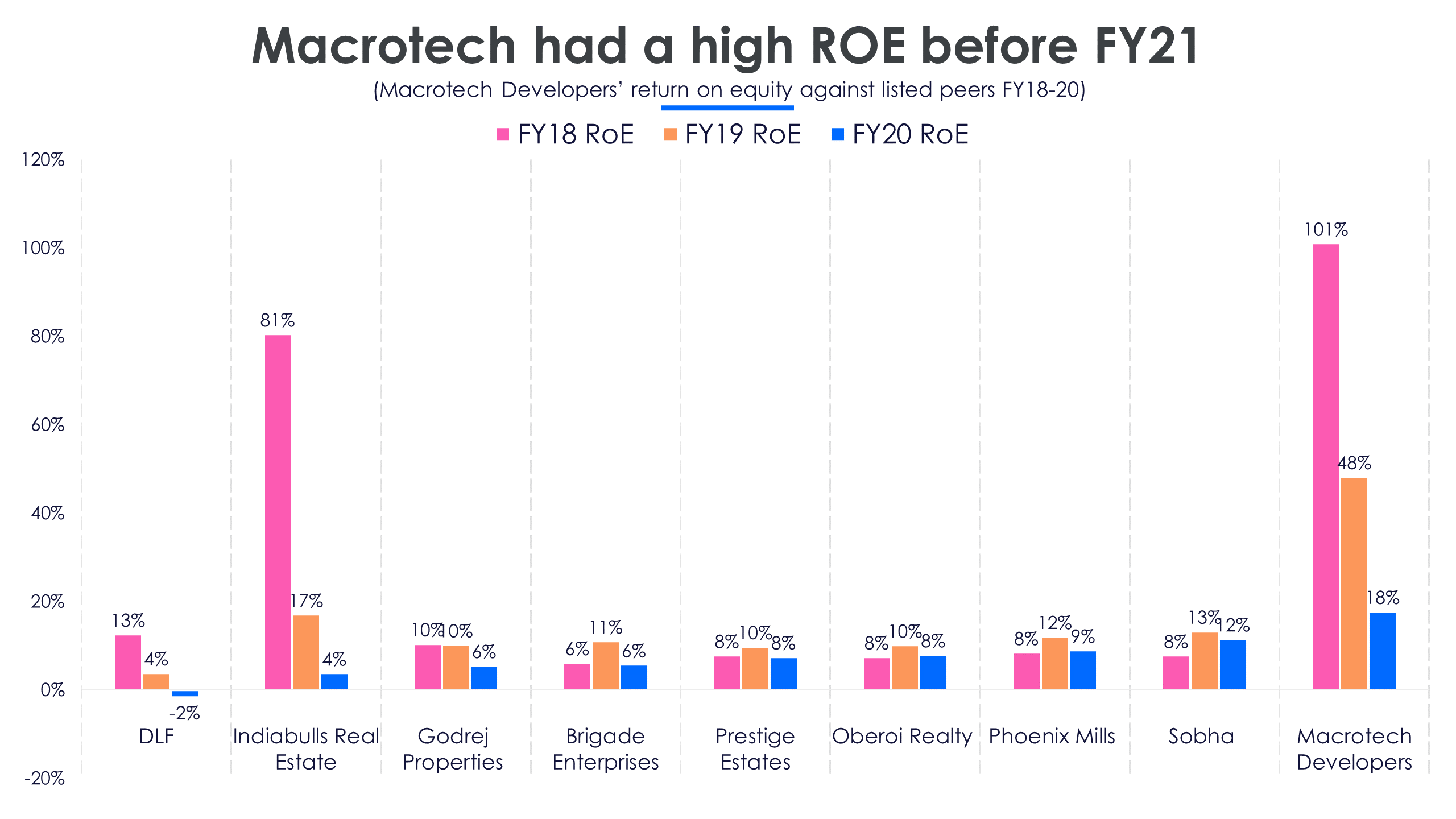

Macrotech Developers’ return on equity (RoE) was the highest in the listed realty market between FY18-20. However, its return on equity has been consistently decreasing. In FY18, its RoE was 101%, and by FY20 it dropped to 17.8%. For 9MFY21, RoE was negative as the company recorded a net loss.

Macrotech Developers’ return on equity (RoE) was the highest in the listed realty market between FY18-20. However, its return on equity has been consistently decreasing. In FY18, its RoE was 101%, and by FY20 it dropped to 17.8%. For 9MFY21, RoE was negative as the company recorded a net loss.

Declining and erratic free cash flow

Declining and erratic free cash flow

Macrotech Developers’ operating cash flow in FY20 was Rs 3,773 crore, against negative operating cash flows of Rs 463 crore in FY19. For 9MFY21, operating cash flows declined 36% YoY to Rs 1,436 crore.

The realty company’s capex in FY19 was Rs 105 crore, which was used for the acquisition of land in Jogeshwari, Mumbai. Capex for 9MFY21 was Rs 1 crore, against Rs 55 crore in the same period a year ago.

Due to a fall in capex, Macrotech Developers generated a free cash flow of Rs 3,735 crore in FY20. Free cash flow for 9MFY21 was Rs 1,435 crore, a 35% YoY fall.

High debt in a highly indebted realty market

In FY20, total borrowings was Rs 18,414 crore, a 27% decrease YoY. Short-term borrowings accounted for 88% of total borrowings. For 9MFY21, the total debt was Rs 18,633 crore, a decline of 21% YoY.

The company’s debt-to-equity ratio was 3.6 in FY20, but this is down from a debt-to-equity ratio of 10 in FY18. For 9MFY21, its debt-to-equity was 3.9, down from 4.7 in the same period a year ago. Macrotech Developers’ debt-to-equity ratio is at least twice that of its listed peers.

Macrotech Developers’ mounting debt has been a problem for a few years. In 2019, the company laid off 400 staff members due to its high debt and the resulting rise in interest expenses. In FY19, its finance costs were Rs 731 crore, 32% higher than FY18.

Foraying into commercial real estate

As of December 2020, it had 127 completed and ongoing projects and 18 planned projects. Out of these 78% were in the affordable housing space. In 2019, the company forayed into developing commercial real estates like office parks and retail spaces. While affordable housing remains its primary focus, its secondary focus has shifted to commercial real estate from premium housing.

In addition to its domestic operations, Macrotech Developers has invested in two properties in the United Kingdom. The investment was worth GBP 208 million (Rs 2,100 crore.) This was financed through debt. As of December 2020, 21% of its UK real estate portfolio (2 lakh sq ft) is lying unsold, and the net debt from these projects is GBP 402 million (Rs 4,097 crore).

In India, the company has an unsold inventory of 2.1 crore sq ft (9.5% of the Mumbai region’s total unsold inventory is Macrotech’s), out of which 48% is premium residential properties. The company has plans to enter the national capital region (NCR), Bengaluru, and Hyderabad realty markets in the coming years.

Diversification cannot hide its debt levels

All signs point to a domestic realty recovery. Between Q1 to Q3, the realty market was depressed due to declining cement, steel production, low residential real-estate demand, and inventory overhang. However, by Q4, with economic activity resuming, the real estate market’s absorption rate (the rate at which units are sold within a one-year period) jumped to 86% of pre-Covid levels. This was helped by low real estate prices, home loan interest rates, and reduction in stamp duties by state governments.

Macrotech Developers has a high dependence on the Mumbai region, a market that is riddled with oversupply and falling prices post-pandemic. Nearly 10% of the inventory overhang in the market is attributable to Macrotech Developers’ projects.

Even before the pandemic and lockdown induced stress on the realty market, Macrotech Developers’ debt was alarming, its interest costs were rising (finance costs increased 92% between FY 18-20) which was eating into its bottom line. There are other companies, with better financial metrics, available for investors looking for developers who will benefit from the expected 18% compound annual growth between FY20-25 in the sector.