It's no secret that China is in the news a lot these days. But what if the real story isn't about what China is doing, but about what America isn't? Even as China seizes opportunities, the Trump administration's policies are creating economic turmoil.

China’s lavish military parade on September 3 was breathlessly covered by the US media as an implicit threat: The Chinese showed off advanced hypersonic missiles, nuclear submarines, and a "best friends" lineup of strongmen from Moscow to Pyongyang. From the battlefield to the boardroom, Beijing is signaling that it intends to stand shoulder-to-shoulder with Washington.

President Trump claimed, with his signature modesty, that the military parade was meant for him.

Let's pause on the military parade for a moment. The real story is China's strategic moves across critical sectors. China is making calculated advances across foundational pieces of the 21st-century economy: from green energy and AI to world-class universities. Chip by chip, byte by byte, China is gaining on the US - and in some cases, overtaking it.

Sunny days for China, as it increases lead over the US in solar

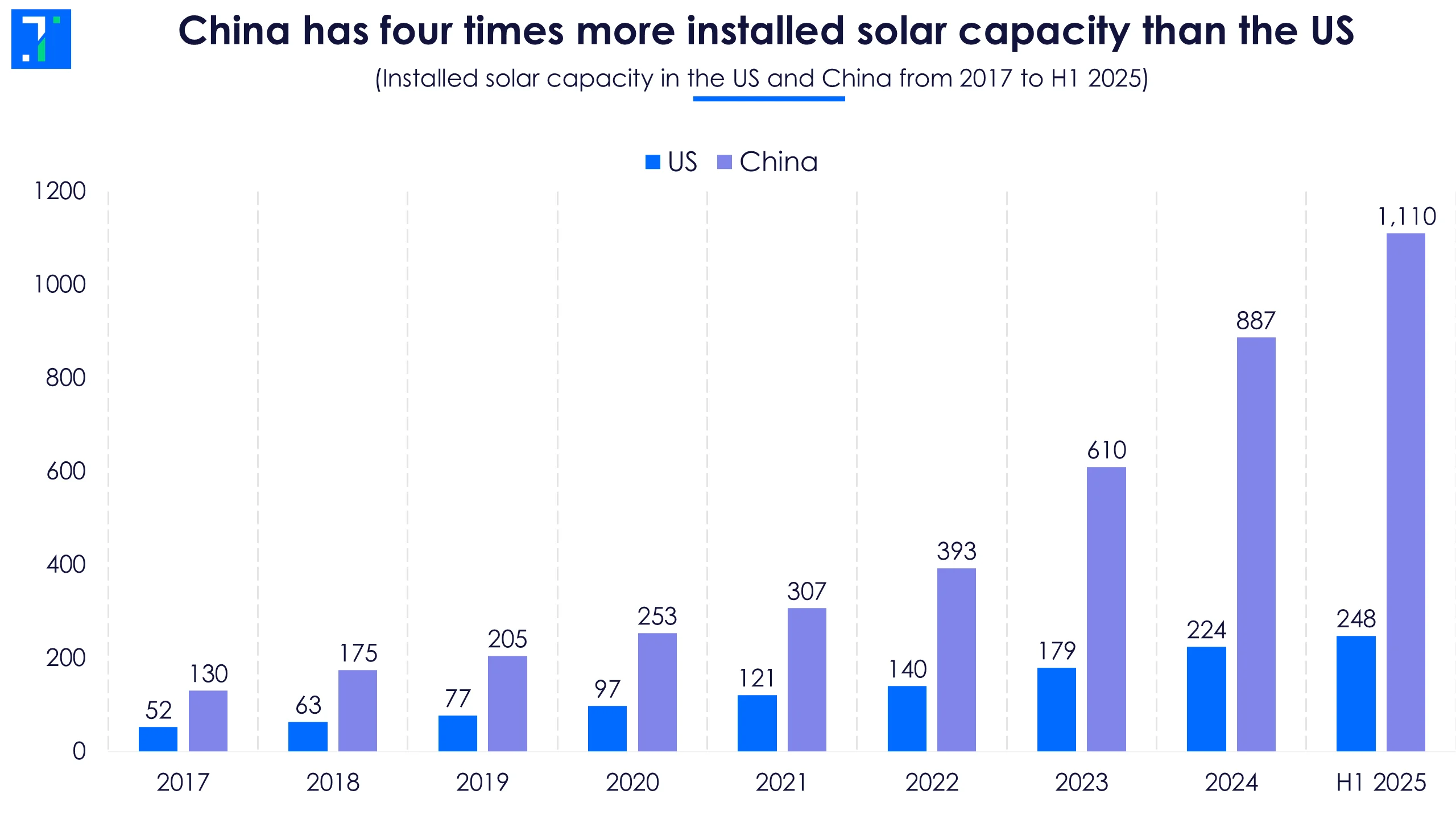

China's has become the dominant player in the solar energy sector, with its total installed capacity soaring to 1,100 gigawatts (GW) after adding over 200 GW in the first half of 2025. This rapid growth has propelled the nation past its 2030 combined wind and solar energy target five years ahead of schedule.

The US, meanwhile, appears to be stuck in the slow lane. Total installed capacity sits at just 248 GW, barely a quarter of China’s. The industry installed 24 GW of capacity in the first half of 2025, a measly ten percent of what China installed during the same period.

China has four times more installed solar capacity than the US

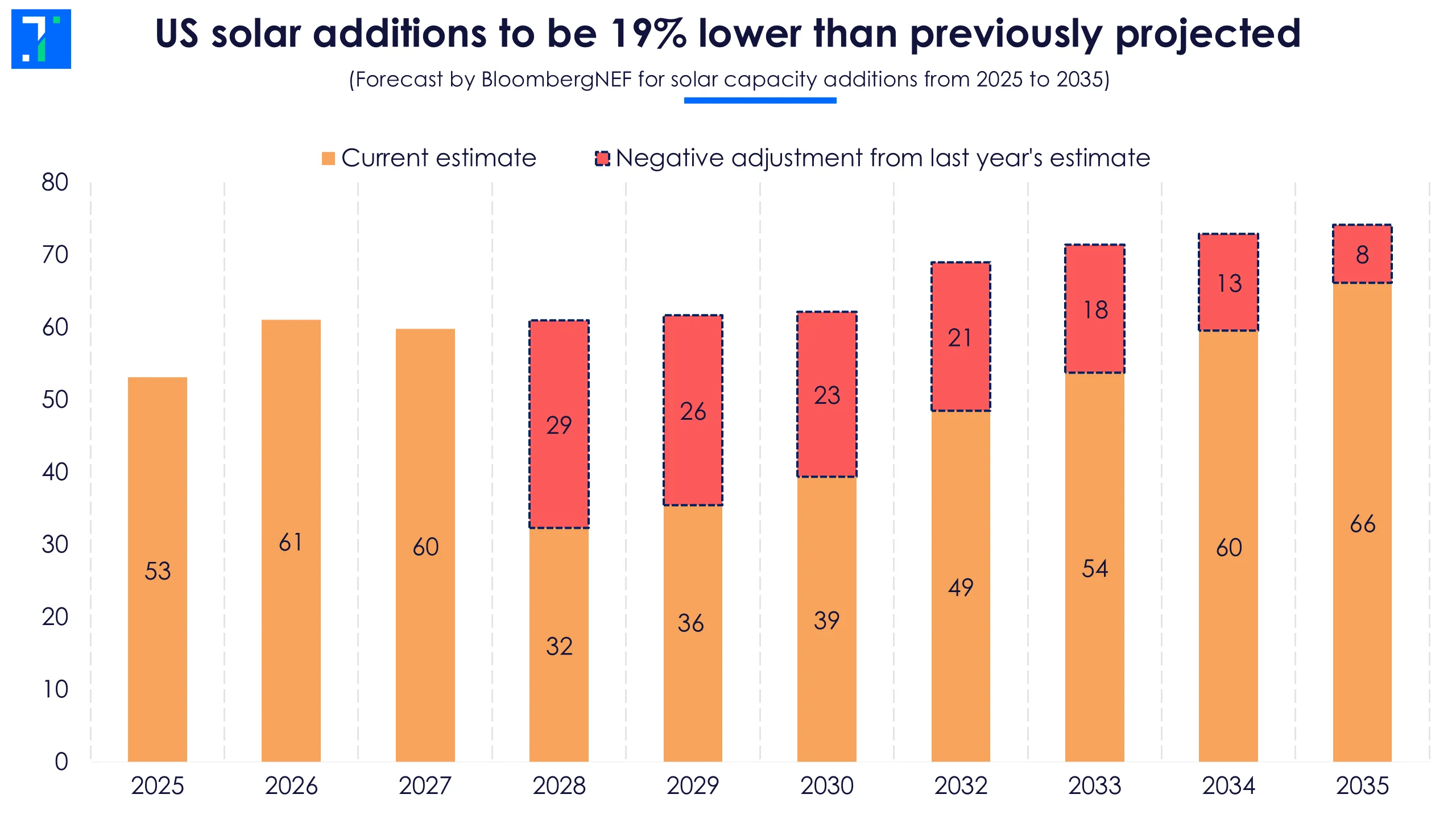

A year ago, the outlook was very different. The Inflation Reduction Act (IRA) had unleashed a wave of optimism, with Bloomberg projecting a terawatt of new solar and wind capacity by 2035. Analysts were calling it the golden age of American renewables.

That optimism didn’t last.

US solar additions to be 19% lower than previously projected

In July 2025, Washington passed the “One Big Beautiful Bill Act,” which rolled back most incentives. To secure tax credits, projects that haven’t started construction by July 4, 2026, must be completed by the end of 2027—a timeline that many in the industry say is unrealistic. In response to these changes, Bloomberg has cut its forecast, projecting that the US solar additions over the next decade will be 19% lower than previously expected.

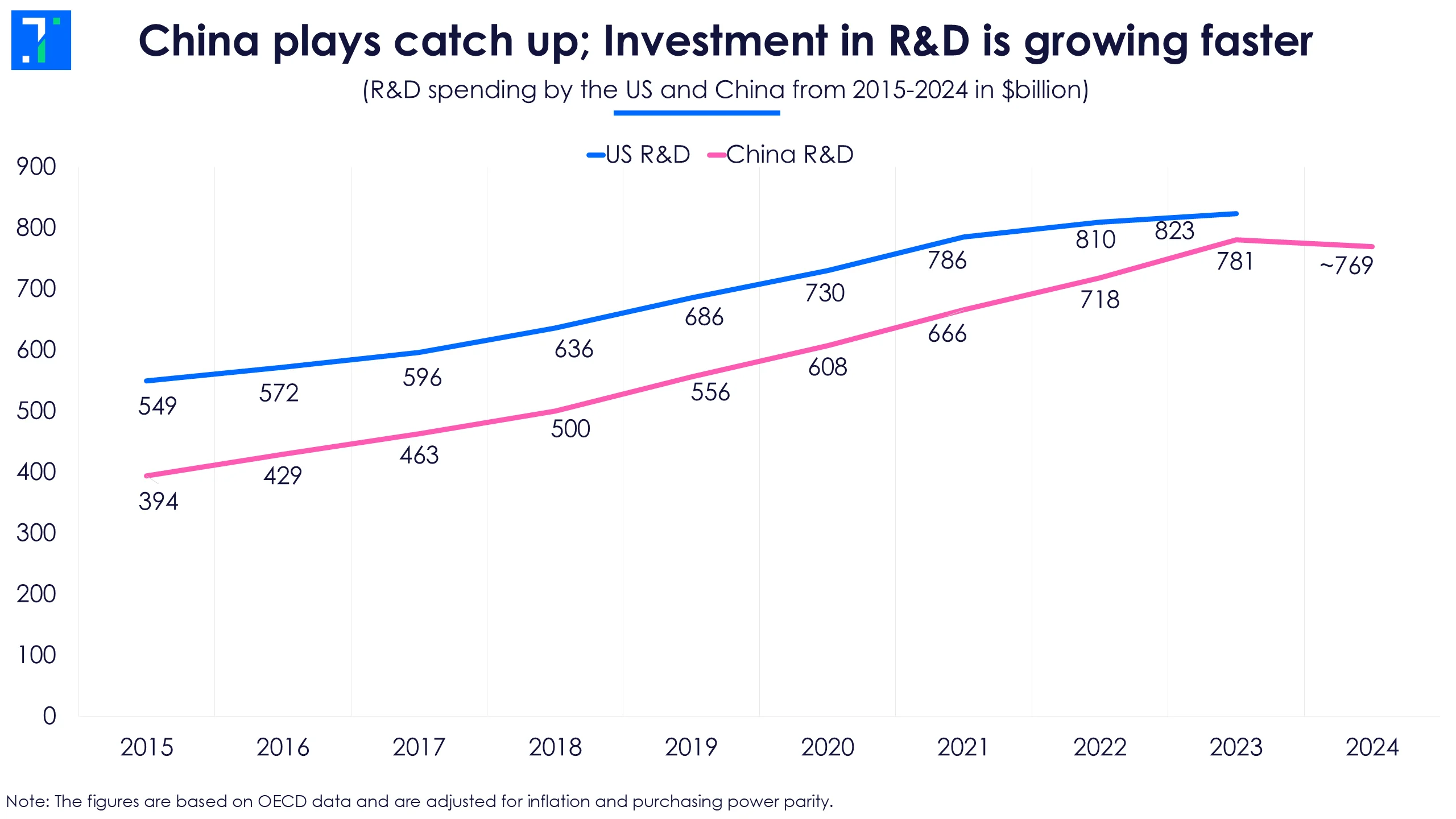

The new scientists: China closes R&D spending gap with the US

For decades, America has been the undisputed champion of science and technology. But a new rival is rising. China is catching up as the race to innovate becomes more intense.

China plays catch up; Investment in R&D is growing faster

When it comes to research and development (R&D), the US has long been the world's biggest spender. The real story, however, is the speed of its rival. China is closing the spending gap.

Top-tier scientific research in particular shows a clear shift in power. According to the latest Nature Index, which tracks which institutions publish the most in leading science journals, only one American university is left in the top 10: Harvard. The rest of the top spots are dominated by Chinese institutions, including Tsinghua and Peking University, which have produced leaders like Xi Jinping and Nobel Prize winners.

Meanwhile, US universities are facing some trouble at home. The Trump administration has cut research funding and made it harder for international students and scientists to get visas. This could make it more difficult for America to attract the world's best and brightest, potentially harming its long-held leadership in research. Simon Marginson, an Oxford University professor, said, "There is a slow, long-term strengthening of the position of the global power of universities in China. And the turmoil in US higher education will speed up that trend. The present Administration has given international rivals a chance to get ahead."

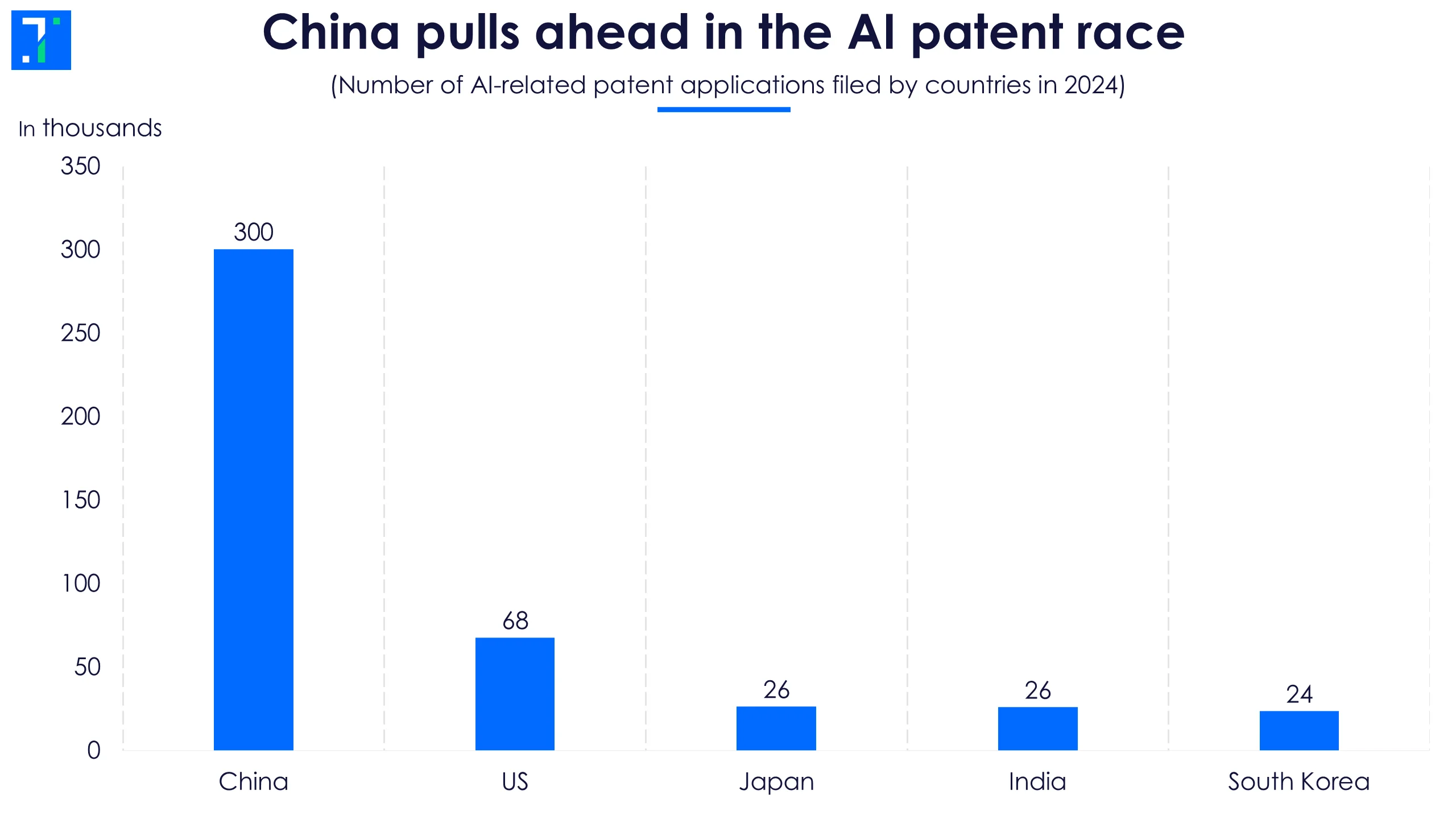

Patents: A tale of quantity versus quality

The competition is especially fierce in the field of artificial intelligence. In 2024, China filed over 300K AI-related patents, while the US filed far fewer.

China pulls ahead in the AI patent race

China's number of AI patent filings has skyrocketed over the years. In areas from speech recognition to self-driving cars, companies like Huawei, Baidu, and Tencent are patenting their ideas at a rapid pace.

But numbers don’t tell the whole story: while China is winning in terms of quantity, US patents are for now, often considered of higher quality. US firms like Google, Microsoft, and NVIDIA are focused on building the core infrastructure for machine learning and generative AI platforms.

Think of it this way: China is building a huge library, while the US is focused on writing a few game-changing bestsellers.

China has cornered the electric car market

For decades, America has led the world in technology. While the US still dominates in key areas, China is surging ahead in others, creating a new global dynamic.

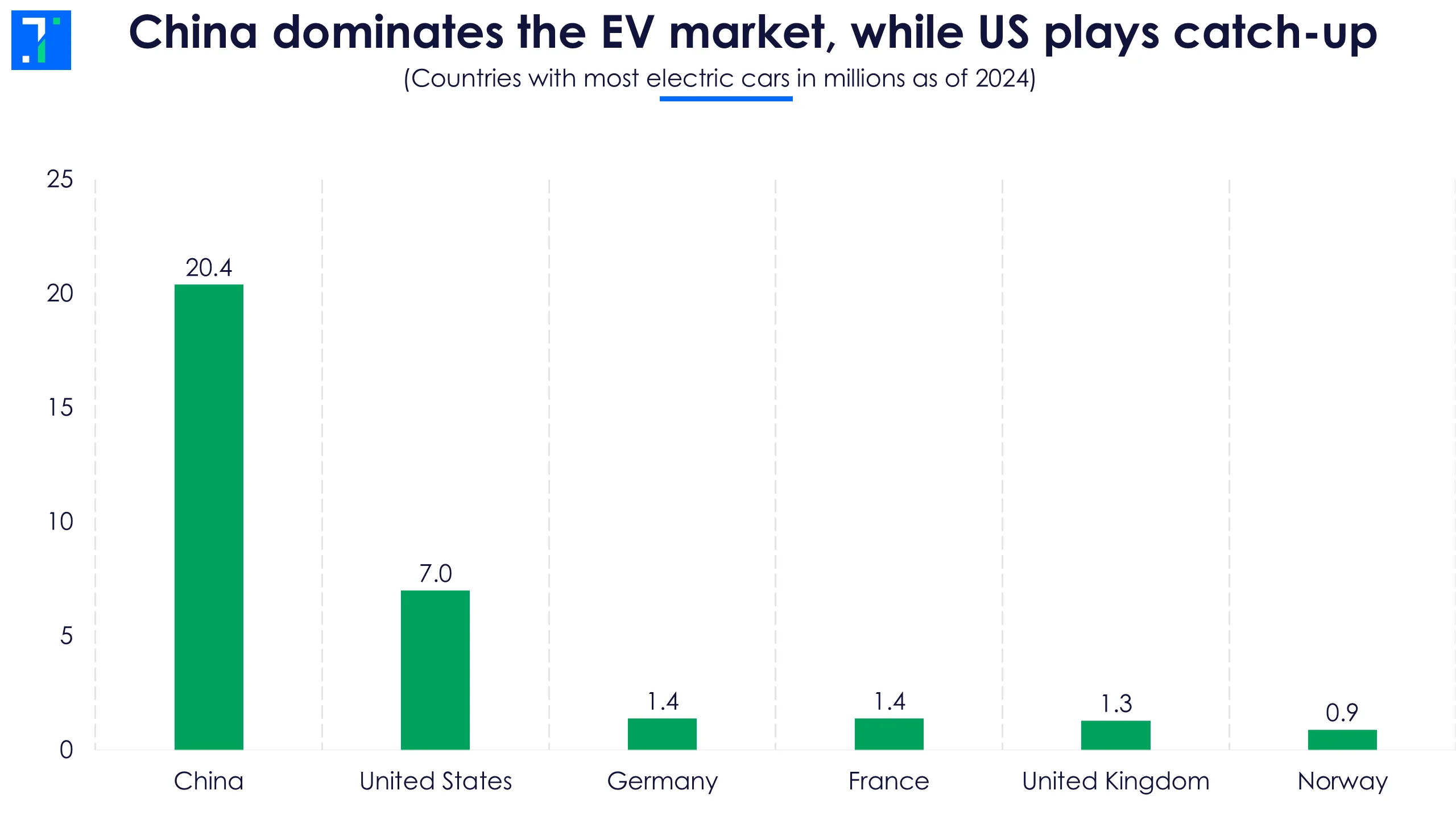

China dominates the EV market, while US plays catch-up

The most stunning shift is in Electric Vehicles (EVs). Last year, China produced an incredible 12.4 million EVs, accounting for over 70% of the world's total output. In the meantime, US production fell by 7% to just 1.3 million.

China has also built an entire EV ecosystem that is tough to copy. A major reason for China's success is its control over a critical battery technology. It holds a 94% share of Lithium Iron Phosphate (LFP) battery capacity. These batteries are essential for making affordable EVs, handing Chinese manufacturers a powerful cost advantage and leaving the US heavily reliant on imports.

The turnaround has been swift and decisive. A decade ago, Elon Musk famously laughed when asked about Chinese competitor BYD. Today, the Warren Buffett-backed company sells more EVs than Tesla. Their strategy is vertical integration: BYD makes its own batteries and many of its own components, allowing it to build cars (like its popular Seagull) for under $10,000—a price unthinkable for its American counterparts.

The AI arms race: A new cold war

While China dominates in EVs, the US is fighting to keep its lead in artificial intelligence, especially in the advanced AI chips that power it. To slow China down, the US has restricted the export of these crucial components.

But this move has had an unexpected result: it has pushed China to become more self-reliant. For example, Cambricon Technologies, often called "China's NVIDIA," saw its shares surge by over 553% in the last year, driven by a wave of domestic investment aimed at closing the technology gap. When one door closes, China builds its own.

NVIDIA CEO Jensen Huang noted, “When you look at the AI ecosystem, 50% of the world’s AI developers are Chinese.” This, he explained, makes the US strategy of restricting technology risky, as it may push China to build its own independent AI system.

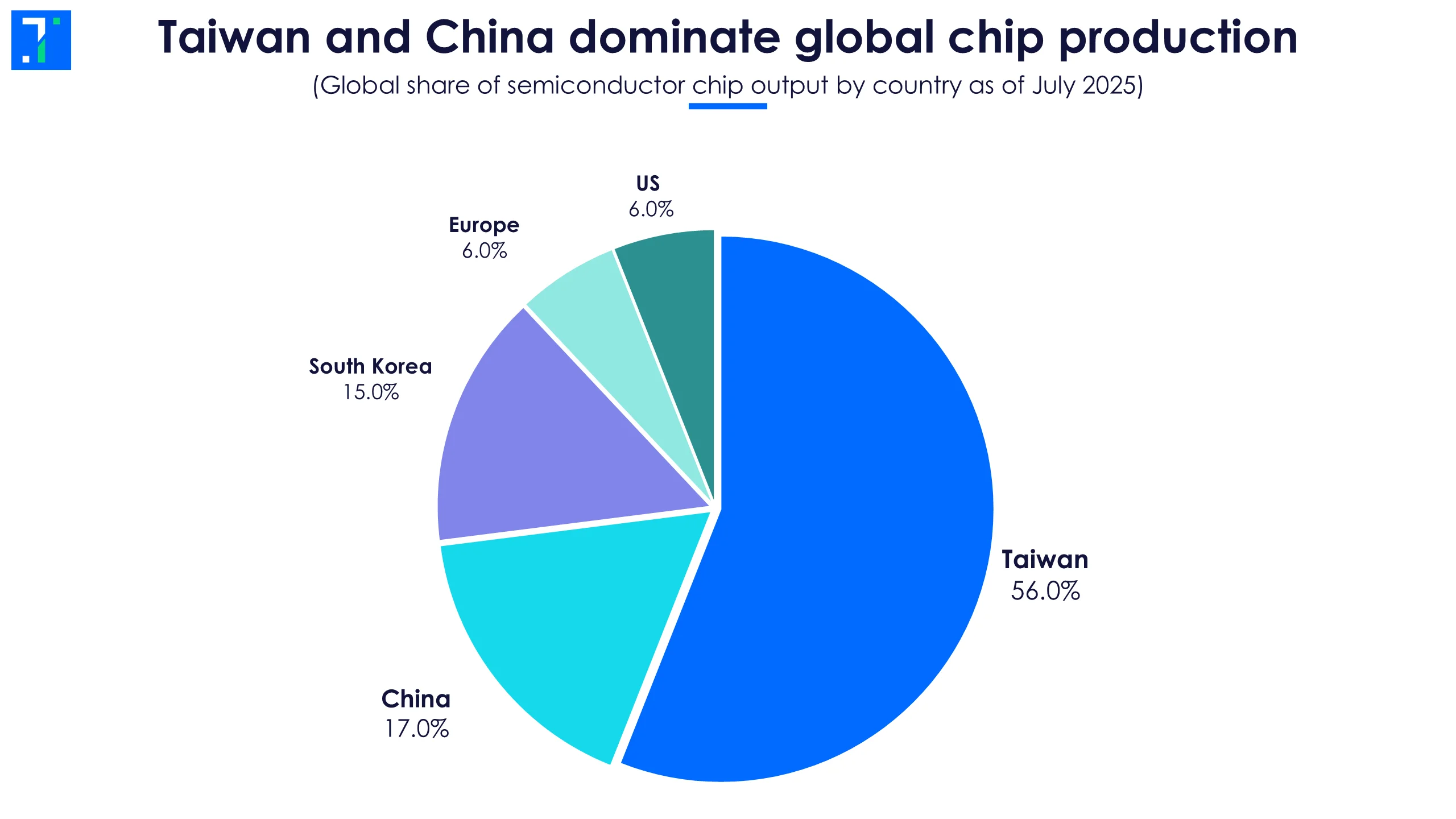

Taiwan and China dominate global chip production

The chart shows the global share of semiconductor output: China makes 17%, ahead of the US at 6%, but much of China’s production is in older, less advanced chips. The real crown lies with Taiwan, which produces about 90% of the world’s most advanced semiconductors. Taiwan may physically manufacture the chips, but the designs, machines, and software behind them are largely American – which is why American export controls are so effective.

Yet, this battle has a deeper layer. US AI firms currently enjoy far healthier profit margins – according to UBS, cloud companies in the US boast profit margins of around 70%, while their Chinese counterparts are closer to 50%.

This difference feeds directly into research. US firms reinvest their large profits into research, with R&D spending at about 13.5% of their revenue, compared to China's 8%. This creates a powerful cycle of reinvestment into next-generation research.

Chinese AI companies, facing slimmer margins, are driven by a different imperative. For them, it is a necessity to optimize their AI services, focusing on cost-effectiveness and broad, practical applications to become profitable. This pressure could foster a unique kind of innovation, one centered on efficiency and scale.

We should be worrying less about the military parade. The bigger picture - our leadership loss across critical tech - is more concerning.