One could picture the stock market as a high-level chess match. Some players take bold risks, pushing their queen out early. Others play it safe, holding back their key pieces, and waiting for the perfect moment to strike.

Warren Buffett is playing defense. His cash reserves have hit a record $330 billion, signaling he’s waiting for a deeper correction. More than 80% of this capital sits in Treasury bills.

This doesn't mean his love for stocks has faded. Even as he nears ninety-five, he insists his appetite for risk is unabated. “Despite what some commentators view as an extraordinary cash position at Berkshire, the great majority of your money remains in equities,” Buffett wrote to his shareholders in his 2024 annual letter. “That preference won’t change”.

Meanwhile, the Nasdaq plunged into correction territory, down over 10% from its peak. The S&P 500 teeters on the edge of a similar drop, and the Dow is slipping as economic fears mount. Treasury Secretary Scott Bessent calls the correction a “healthy reset.”

Fisher doubles down, while others sell

Warren Buffett calls tariffs “an act of war”. So Trump's approach to global trade can't be encouraging. Buffett's net worth is down by 36% over the past two years, mostly driven not by losses but by the stake cuts in his top bets. Berkshire Hathaway’s Apple stake has shrunk to 2%, down from around 6% in September 2023.

In contrast, Ken Fisher steadily accumulated Apple, NVIDIA, and Microsoft. His portfolio of over 750 stocks, mostly dominated by market leaders, has fueled a 30% surge in his net worth over the past two years. Ray Dalio, on the other hand, cut stakes in Alphabet, Meta Platforms and NVIDIA - a move that, combined with market corrections, dragged his net worth down 4%.

Buffett & Cathie lose over 35%; Fisher & Ackman make strong gains

Diversification is key, but over-diversification doesn't necessarily over-deliver. Ken Griffin holds over 4,000 stocks, but his portfolio has gained just 10% over the past two years. Meanwhile, Jim Simons, with over 3,000 stocks, has seen his portfolio drop 20% since June 2023.

Top investors’ net worth fall from their peak in 2024

Cathie Wood, a Tesla bull, has seen her portfolio take a beating (No surprise then, that she's talking up the stock). Tesla, Roku and Palantir Technologies, her top holdings, are down at least 30% from December highs.

Warren Buffett’s portfolio plunged over 25% from its peak in June 2024 after he cut stakes in his top long-term holdings. From over 13% in June last year, Berkshire’s stake in Bank of America is down to just under 9% as of December-end.

Who are the big winners and losers across superstar portfolios?

AppLovin Corp drives gains for both Griffin and Dalio

In Buffett's portfolio, broadcasting company Sirius XM Holdings has been the top performer over the past year, surging 505%. In Fisher's case, internet retail Alibaba Group leads with an 87% gain. Packaged software firm AppLovin in Ken Griffin’s holdings soared 341%, while broking firm Robinhood Markets and Spotify, which are in Cathie Wood’s and Jim Simons’ portfolios gained 142% and 126%.

Intel and AMD drag Griffin, Fisher & Dalio’s portfolios

If we look at the top losers, Occidental Petroleum, an oil production company in Warren Buffett’s portfolio slid 25%, while semiconductor firm AMD in Ken Fisher’s holdings fell 41% over the past year. Intel in Ken Griffin’s portfolio plunged 43%, while biotechnology company CRISPR Therapeutics and AMD in Cathie Wood’s and Jim Simons’ holdings dropped 42% and 41%, respectively. Nike in Bill Ackman’s portfolio also slid 27%.

Buffett bets $1 billion on booze

Q4 was relatively quiet in terms of new bets taken by superstar investors. Warren Buffett took a position in Constellation Brands, an alcoholic beverage maker, with a current holding value of $1 billion. He also nearly doubled his holding in Dominos Pizza, another consumption-driven stock, to $1 billion.

Superstar investors take new stakes in mass consumption stocks

Meanwhile, top investors like Steve Mandel, Frank Sands, and Ole Andreas Halvorsen each grabbed over 1% of Flutter Entertainment, a major player in sports betting and gambling.

Tariff-led actions are squeezing some sectors

Rising tariffs are squeezing banks and businesses alike. Higher interest rates are slowing capital demand, making it tougher for banks to grow. Over the past quarters, Warren Buffet has been offloading his stake in Bank of America and Citigroup.

Meanwhile, Bill Ackman trimmed his stake in Chipotle Mexican Grill, which sources most of its avocados and tomatoes from Mexico. With tariffs driving up costs, serving the same menu at the same price is getting harder. Analysts expect this to hit Chipotle’s gross margins this quarter and beyond.

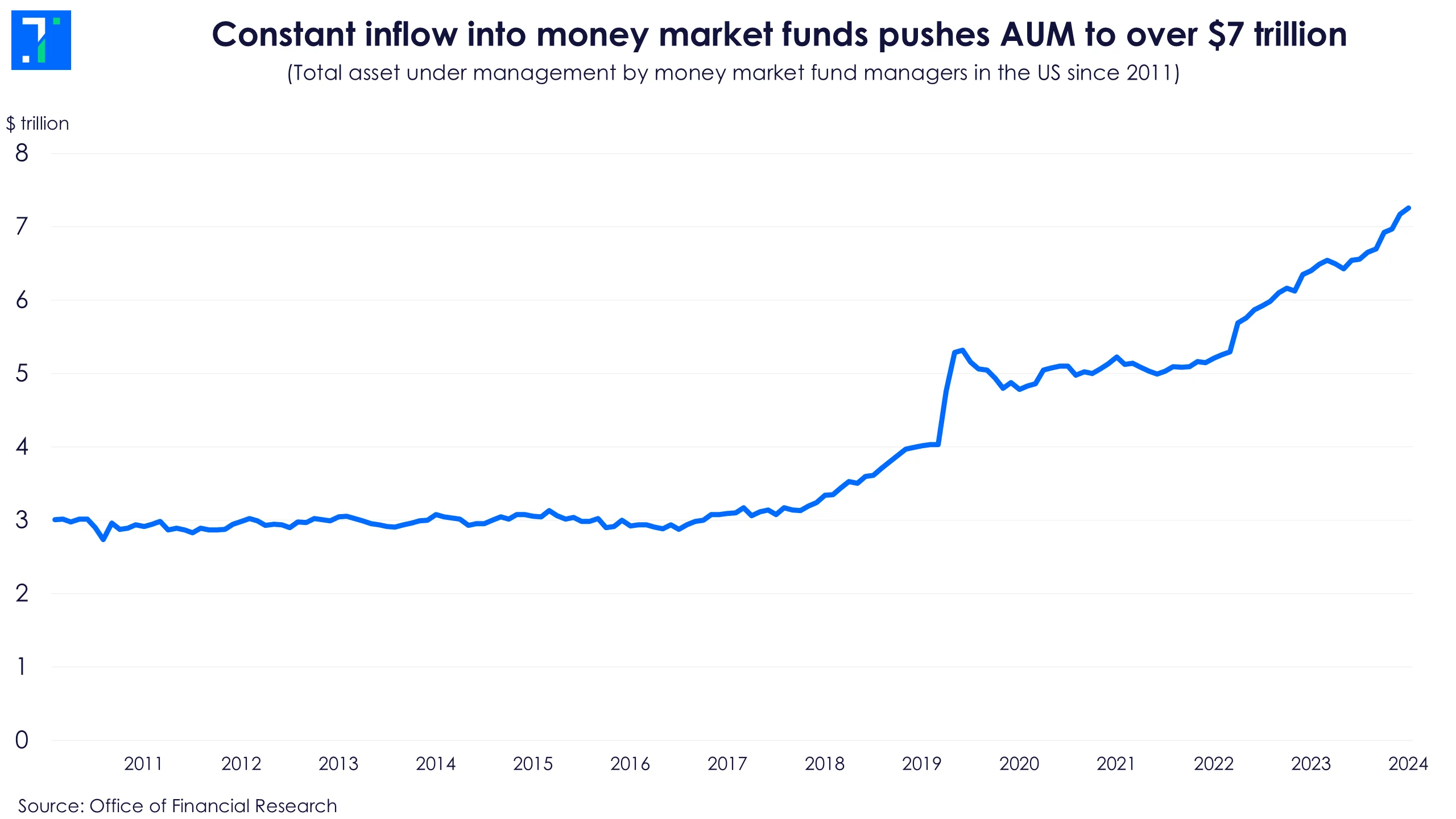

AUM of money market funds top $7 trillion

If investors are pulling out of the stock market, you might wonder where all the money is going. Rising asset under management (AUM) of money market funds, which invest in bonds maturing in less than a year, can be one place investors are parking their money.

Constant inflow into money market funds pushes AUM to over $7 trillion

US money-market funds now have more than $7 trillion in AUM, a milestone for an industry that’s skyrocketed in popularity among investors over the past two years. The top three managers — Fidelity, JP Morgan and Vanguard — control over 40% of the total AUM.

Gold has also surged to record highs of over $3,000 per ounce as investors flock to safe havens. According to Macquarie Group analysts, its burgeoning allure as a safe haven could push it up another $500 during the third quarter.