By Ruchir Sankhla

The Nifty 50 rebounded on Monday, February 2, after falling 2% in a rare Sunday Budget session. The decline was due to a hike in the Securities Transaction Tax (STT) on derivatives. Finance Minister Nirmala Sitharaman raised STT on Futures to 0.05% (from 0.02%) and Options to 0.15%, hitting brokerage and exchange-linked stocks.

Vinod Nair, Head of Research at Geojit Investments, said, “The budget supports sectors affected by global trade tariffs and focuses on emerging areas of development, including data centres, GCC, semiconductors, biopharma, rare earth elements, and manufacturing.” The Budget also offered sector-specific relief, such as customs duty exemptions for lithium-ion cells and aircraft services.

With the Budget behind, focus shifts back to the Q3 earnings season and the Reserve Bank of India’s monetary policy meeting this week to see if the central bank mirrors the US Federal Reserve, which kept interest rates unchanged.

While the domestic focus remains on the Budget, global markets are tracking developments in the Middle East after US President Donald Trump said Iran is “seriously talking” with Washington on a possible nuclear deal. Trump also said that India has agreed to increase purchases of Venezuelan oil as part of efforts to reduce reliance on Iranian supplies.

IPO action continues at a steady pace, with four SME issues opening this week and five companies set to list, after five listings last week.

Five IPOs debuted last week, including Shadowfax Technologies

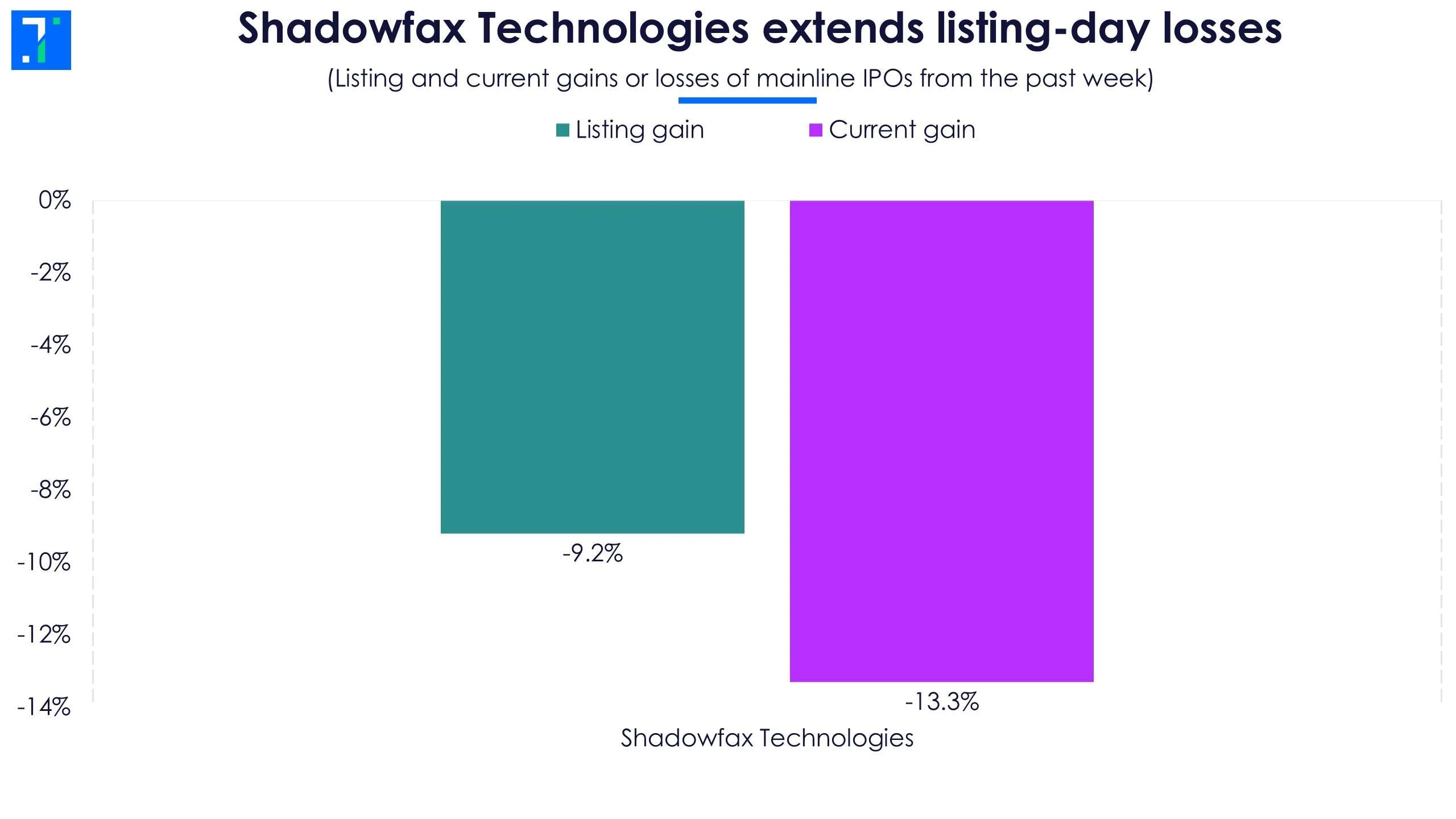

Shadowfax Technologies, a logistics firm, made a weak debut on January 28. The Rs 1,907.3 crore IPO, which was subscribed 2.7X, listed at a 9.2% discount. The stock is currently under pressure, trading 13.3% below the issue price as the market reacts to its thin margins in the competitive quick-commerce sector.

Shadowfax Technologies extends listing-day losses

Four SME IPOs were listed last week, with mixed outcomes.

Shayona Engineering, a precision engineering firm, debuted flat on January 30. The Rs 14.9 crore IPO was subscribed 5.2X, with strong interest from non-institutional investors. The shares listed at the issue price of Rs 144. The proceeds are earmarked for the purchase of new plant machinery and working capital.

KRM Ayurveda, a Delhi-based healthcare network, delivered a strong performance on January 29. The Rs 77.5 crore IPO was oversubscribed 64.3X, leading to a robust listing at a 27.5% premium. The stock is currently trading 18.9% above its issue price of Rs 135.

Digilogic Systems, an aerospace and defence solutions provider, had a weak start on January 28. Despite its specialised niche, the Rs 81 crore IPO, subscribed 1.1X, listed at a 20% discount to its issue price of Rs 104. The company plans to use the funds to establish a new manufacturing facility in Hyderabad.

Hannah Joseph Hospital, a multi-speciality healthcare provider, debuted on February 2 (today). The Rs 42 crore IPO was subscribed 1.5X and listed 7.1% below its issue price of Rs 70. The hospital intends to utilise the capital to establish a dedicated Radiation Oncology Centre to expand its cancer treatment capabilities.

This week features five SME IPO listings

This week sees five IPOs debuting with no contribution from the mainline.

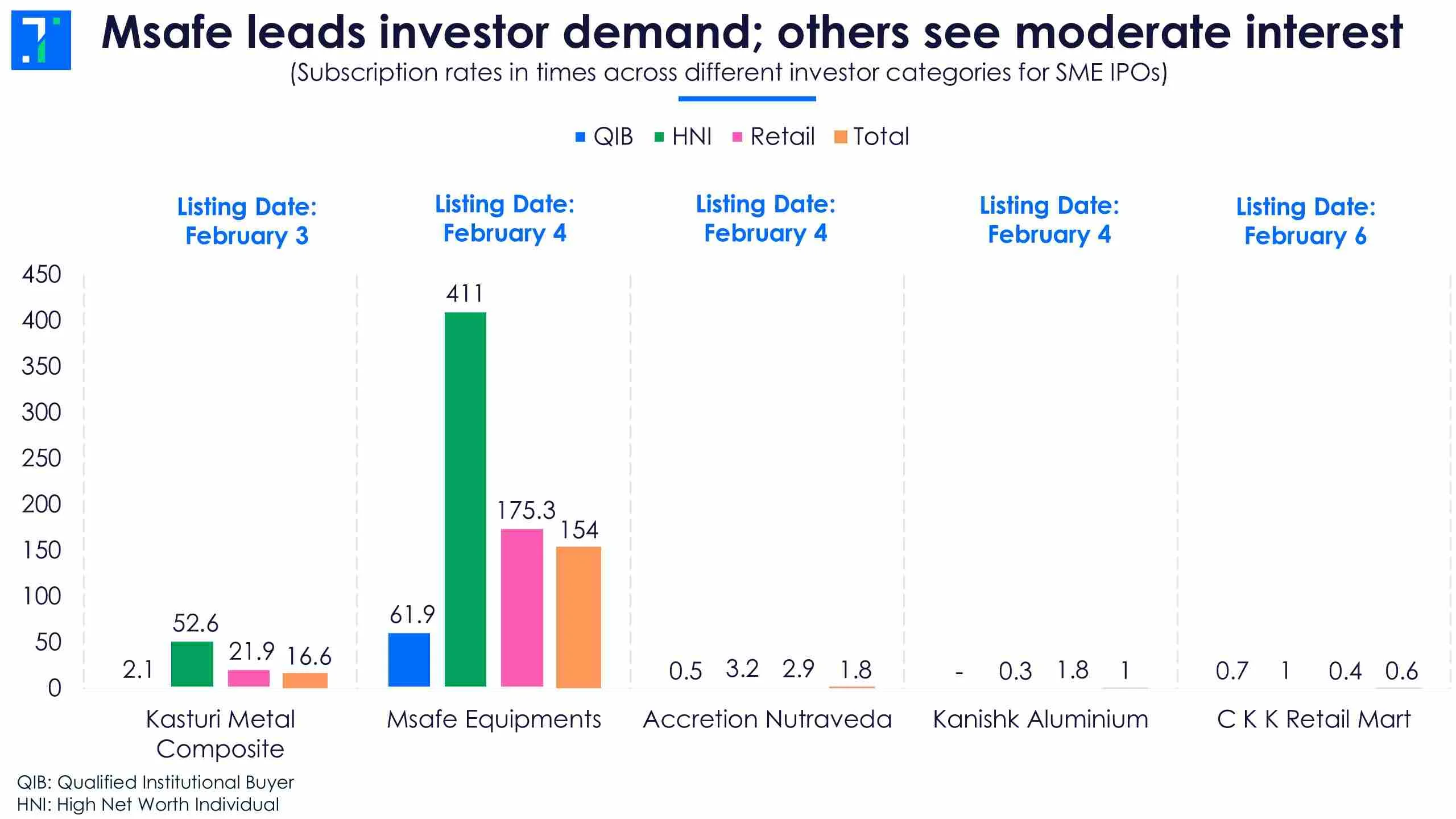

Kasturi Metal Composite, a producer of steel wool fibres, closed its Rs 17.6 crore IPO on January 29. The issue, priced at Rs 61–64 per share, received steady interest from investors, with a total subscription of 16.6X. The company plans to utilise the funds to establish a new manufacturing unit in Maharashtra and will list on February 3.

Msafe Equipments, a provider of height-safety solutions, closed its Rs 66.4 crore IPO on January 30. The offering, a mix of a fresh issue and an offer for sale, saw strong participation and was subscribed 154X. The company will debut on February 4.

Msafe leads investor demand; others see moderate interest

Kanishk Aluminium, an aluminium products manufacturer, closed its Rs 29.2 crore fixed-price IPO on January 30. The issue, priced at Rs 73 per share, saw a moderate response with subscription of 1X. The company will list on February 4.

Accretion Nutraveda, an Ayurvedic products manufacturer, closed its Rs 24.8 crore IPO on January 30. The issue saw a moderate subscription of 1.8X and will list on February 4. The proceeds are earmarked for automating existing facilities and setting up new production lines.

C K K Retail Mart, a distributor of packaged products, closed its Rs 88 crore IPO for subscription on January 30 and will close on February 3. The issue has a price band of Rs 155–163 and includes a significant fresh issue component of Rs 71.8 crore to fund warehouse acquisitions. The shares will list on February 6.

Four SME IPOs to watch this week

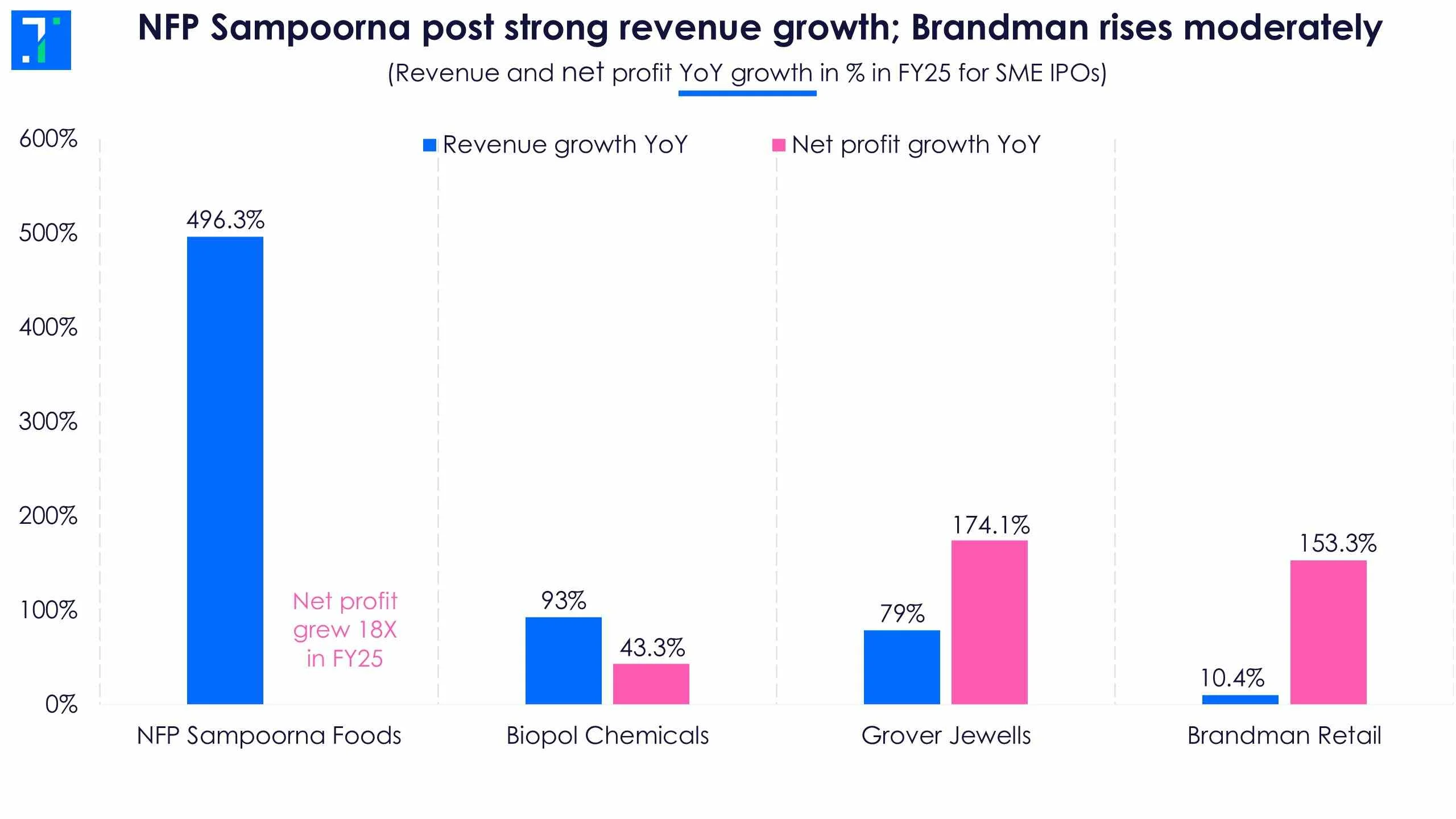

NFP Sampoorna Foods, a dry fruits distributor, is set to launch its Rs 24.5 crore IPO from February 4 to February 6. The price band is fixed at Rs 52–55, with the listing scheduled for February 11. The issue consists entirely of a fresh issue of 44.6 lakh shares.

NFP Sampoorna post strong revenue growth; Brandman rises moderately

Biopol Chemicals, a speciality chemicals manufacturer, will open its Rs 31.3 crore IPO for subscription from February 6 to February 10. The price band has been set at Rs 102–108, with the stock expected to list on February 13. This 100% fresh issue will fund the acquisition of new industrial land in Gujarat and the repayment of debt.

Grover Jewells, a gold jewellery manufacturer, will open its Rs 33.8 crore IPO from February 4 to February 6. The price band is set at Rs 83–88, with the listing scheduled for February 11. The offering is a fresh issue of 38.4 lakh shares.

Brandman Retail, a footwear distributor, to launch its Rs 86.1 crore IPO between February 4 and February 6, with a price band of Rs 167–176. The company will list on February 11. It is entirely a fresh issue of 48.9 lakh shares, and the proceeds will be used to launch 15 new retail outlets.