At a mandi in Mandsaur, Madhya Pradesh, Babbu Malvi was trying to sell his onion harvest. He realised his 600 kgs of onions would fetch him just Rs. 1,200. “It doesn’t even cover my travel. I don’t have money left for a beedi,” he said.

Onions make everyone cry: families when prices rise, farmers when they collapse. The price crash is happening across many items, from vegetables to steel and oil. And it has many things driving it.

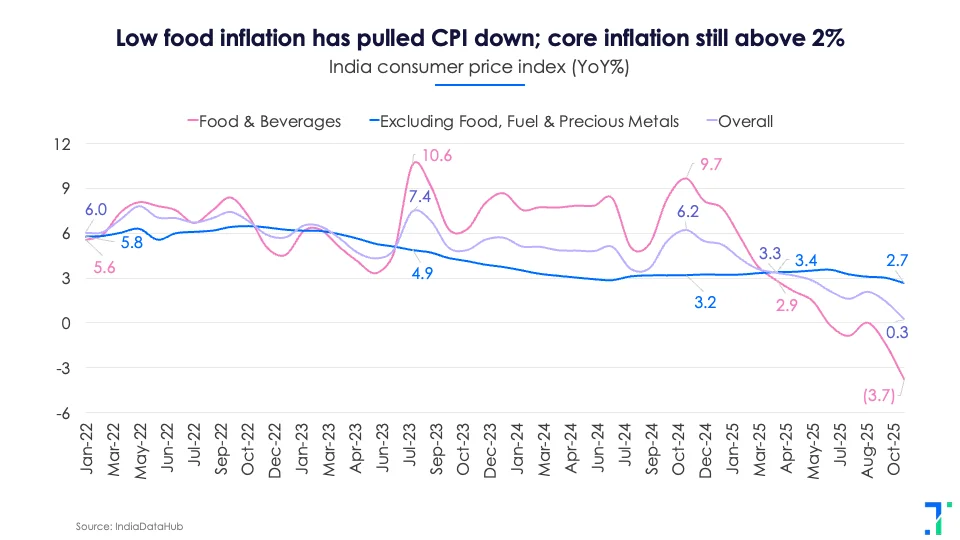

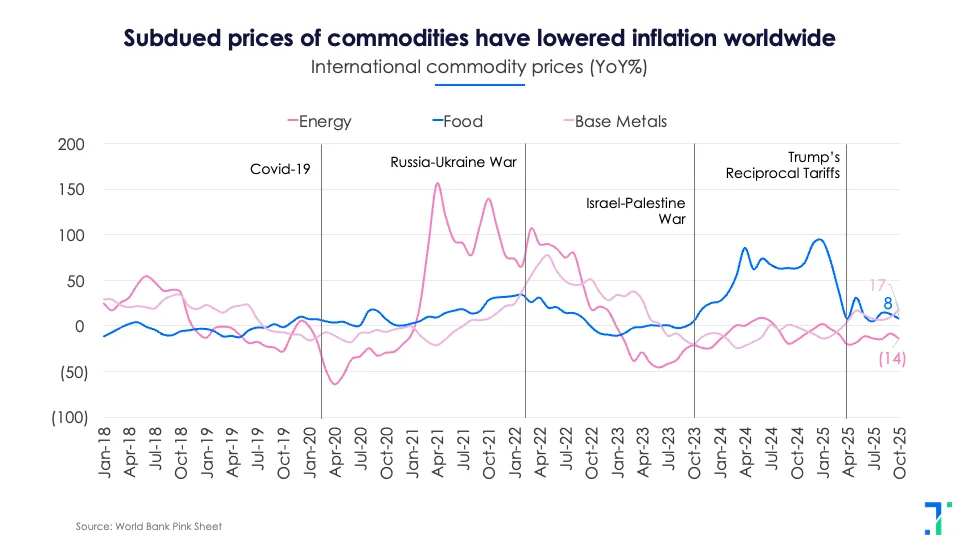

Food and commodity prices are falling so fast that they’re pushing wholesale and consumer inflation down across the world. India is getting pulled along. In October 2025, consumer price inflation (CPI) rose just 0.25% YoY, a multi-year low. Wholesale price inflation was negative for the third time this year. This has triggered high hopes for December interest rate cut from the RBI.

The problem with inflation is that it can be too high, and also too low. Both can cause different kinds of pain. And India's story of falling prices has several drivers.

Blame it on Beijing?

If you’re looking for a villain, China is happy to volunteer. Years of overcapacity have pushed China into deflation for the third straight year. Chinese customers are also suffering from a crash in property prices, and are not spending. With domestic demand too weak to absorb Chinese production, China has simply exported the problem.

Export prices are down 25% since 2022, and China's share in global exports has climbed from 13% in 2018 to 18% today. China's goods-trade surplus with developing Asia has nearly doubled.

India is squarely in the blast radius of this Chinese export juggernaut, where we imported $91B worth of goods from them in the first nine months of 2025, up from $80B last year.

India's imports include electronics, plastics, metals, chemicals, machinery — basically the entire backbone of India’s manufacturing. And prices in these categories are tumbling everywhere you look:

-

PCs: –12%(Apr–Oct 2025)

-

PVC:–6%

-

Organic chemicals: –2%

-

Man-made fibres:–3%

-

Pig iron: –12%

-

Steel bars: –4%

-

Consumer electronics, appliances, auto components: –2%

When your biggest supplier slashes raw-material prices like this, domestic producers can’t keep up. They’ve asked for protection from the government, and India has responded with anti-dumping investigations on 30+ products, from steel to rubber. But these moves are band-aids that don’t shift wholesale inflation in the short term.

Logan Wright of the Rhodium Group says it bluntly: China’s deflation is systemic. A government stimulus won’t fix it. If India keeps importing from China, goods inflation will stay soft.

China aside, GST rate cuts have also cooled prices. And with food making up 40%+ of CPI, India’s inflation lives and dies by the farm. Right now, the farm sector has benefited from full water reservoirs, a solid monsoon, strong harvests, and stuffed government godowns. But bumper harvests have landed in the middle of a three-year global slide in food, fuel, and metal prices, and 2026 is likely to see a similar trend.

Some of the problem is self-inflicted, by our domestic policies. The Indian government's export bans on staples — wheat, rice, sugar, onions, you name it — keep domestic prices from rising, and also keep farmers poor by preventing them from exporting to more profitable markets. So these products flood the local market and tank prices. It’s the same consumer-first instinct that has stalled the India–US trade deal.

Look at onions: when exports were banned in 2024, wholesale prices in India crashed. In the UAE or Sri Lanka, farmers could’ve earned almost 10X the local rate. During this time, customs busted an onion-smuggling racket where onions were being labelled as grapes and exported, to evade the ban.

Some prices are still rising

Food prices may have dropped 4% YoY, but the rest of our monthly budget hasn’t got the memo. Housing prices have jumped 3%, health is up 4%, while education has risen 4% in the same period. This is core inflation — the slow-moving, stubborn part that excludes food, fuel, and metals. While goods are cooling rapidly, services have stayed expensive.

More and more, India’s inflation now dances to the tune of global commodity prices, not domestic trends. The RBI has limited control over that.

RBI forecasts are missing the mark

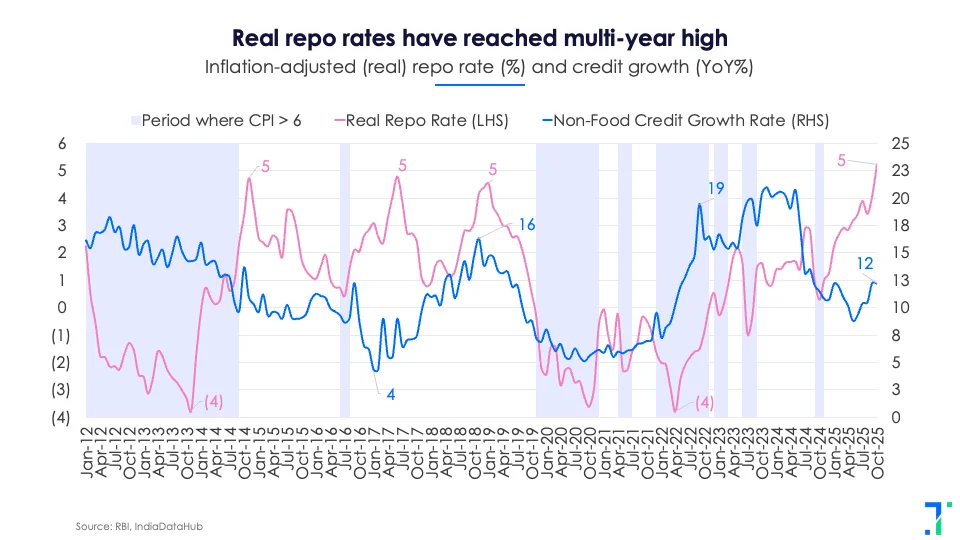

This shift towards global factors is also confusing the RBI’s models. Since Feb 2025, the RBI has cut its FY26 inflation forecast by 220 bps — from 4.8% to 2.6%. Even those revised numbers have turned out too high.

This matters, since the RBI sets its interest rates based on expected inflation. But by overestimating inflation for months, it kept interest rates much higher than needed. Emkay economist Madhavi Arora doubts these forecasts are useful anymore. The RBI seems to agree, as Governor Sanjay Malhotra has ordered a full review of the approach.

At these high interest rates, borrowing is expensive, so households and businesses pull back spending. A high repo rate also means that banks prefer parking cash with the RBI rather than lending it out. This has been a big driving factor in the slowdown in private sector capex that the government has been so frustrated about. Credit growth has sunk overall.

The economist Sanjeev Sanyal estimates the economy could save around 200 bps in financing costs with a rate cut, enough to break out of the low-spending loop.

RBI should (probably) be more aggressive

The RBI is facing one of the trickiest rate calls in recent memory. Inflation is near zero, but services inflation is sticky, and global forces like import costs and commodity prices are in the driver’s seat.

Still, with consumer demand still weak and prices likely to remain low, the RBI has room for a cut, and a chance to make up for months of forecasting misfires.

One thing that could slow a conservative Central Bank is if the upcoming GDP numbers blow past expectations. This would give the RBI another excuse to keep pressing the brakes.

As always,

The Trendlyne team