By Melissa Koshy

The market snapped a four-week winning streak, with the Nifty 50 falling marginally by 0.3%. The decline was mainly due to fading hopes of another Federal Reserve rate cut in December, as well as renewed selling from foreign investors.

Lenskart’s Rs 7,278 crore IPO has received bids for 1.9X the shares on offer so far, even as, at Rs 402 per share, the valuation implies a steep 260x earnings multiple. This is considered high for a company that turned profitable just a year ago.

Analysts at Bonanza said, "Despite its large scale, Lenskart’s profitability remains weak. A normalised 1.96% net margin on over Rs 6,650 crore in revenue is concerning, especially when smaller peers show stronger profitability. The Rs 69,726 crore valuation against a Rs 130 crore normalised profit is difficult to justify, implying much of the optimism is already priced in."

The action stays hot in the IPO market this week with six new offerings opening for subscription. Meanwhile, three companies are set to make their stock market debut, following a new listing last week.

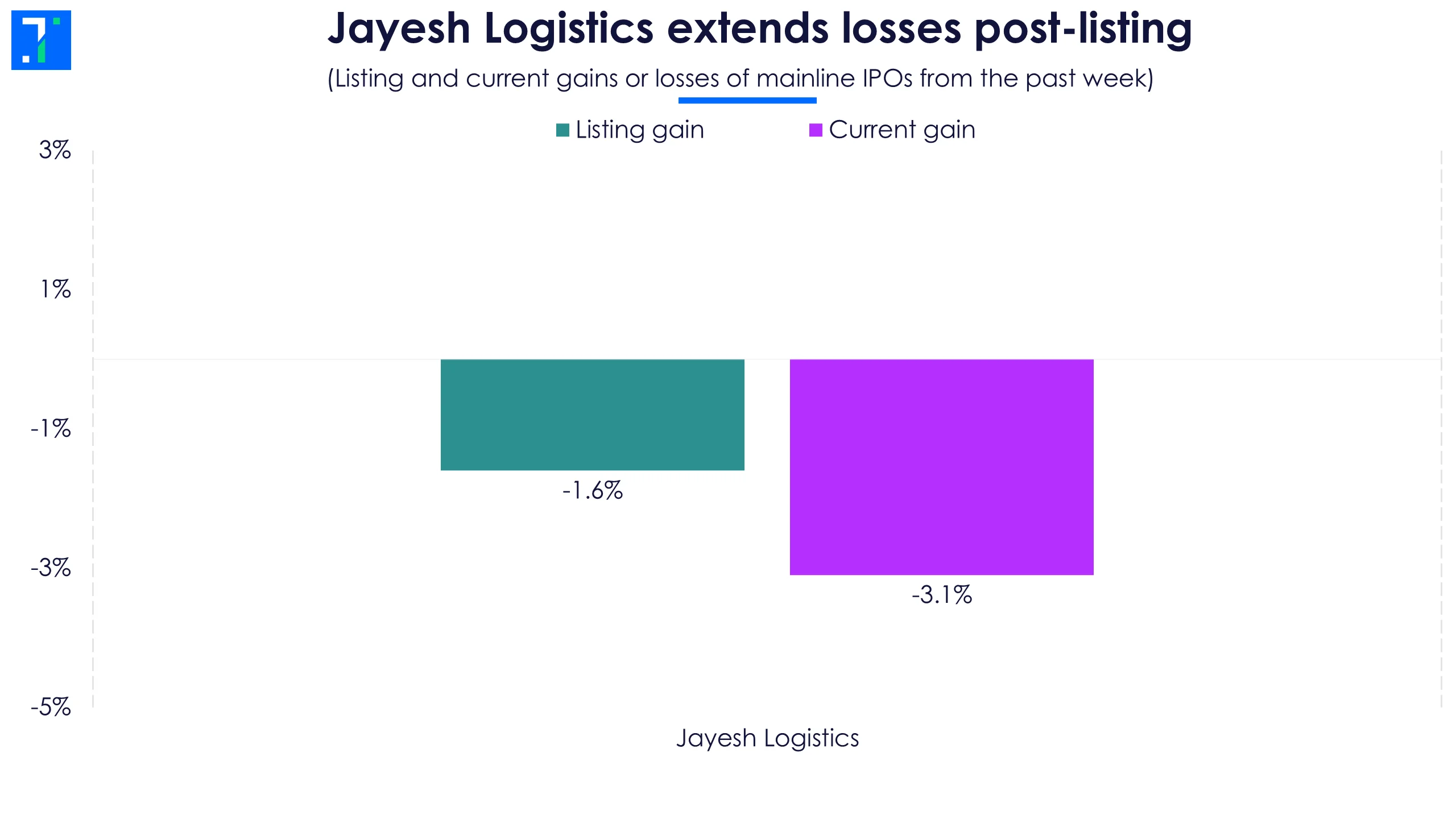

SME firm Jayesh Logistics sees weak debut

Last week saw just one listing, SME firm: Jayesh Logistics.

Jayesh Logistics extends losses post-listing

Logistics provider Jayesh Logistics made its debut on November 3, trading 1.6% below its IPO price of Rs 120. Its Rs 28.6 crore IPO had drawn strong demand, subscribed 61.3X, with demand from HNIs hitting 173.5X the shares on offer. The company is currently trading 3.1% below its issue price.

Jayesh Logistics specialises in cross-border cargo movements along the Indo-Nepal Corridor. It serves a range of sectors, including consumer goods, retail, automotive, and healthcare.

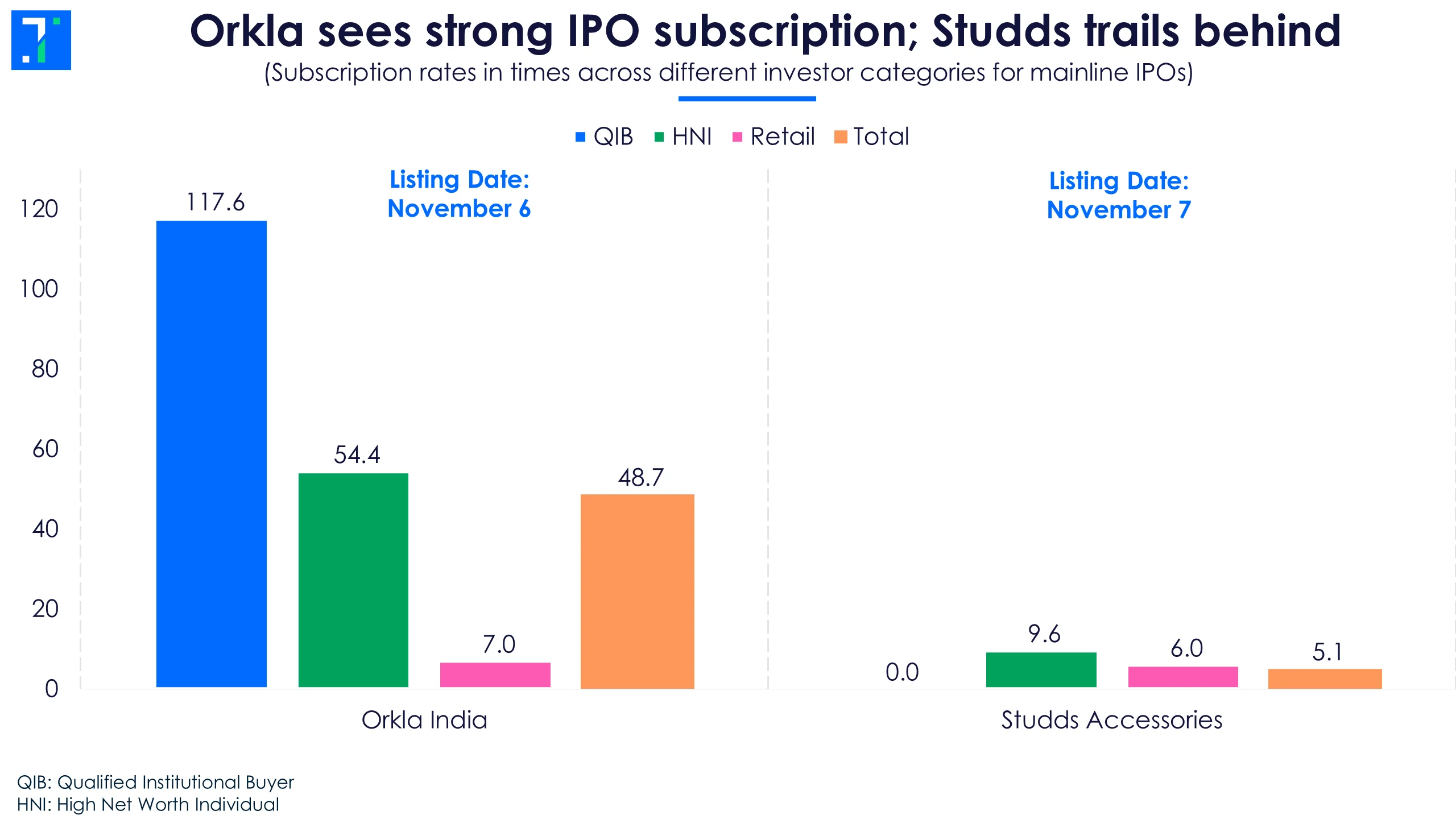

Orkla, Studds lead this week’s listings

Orkla India offers a wide range of food products, from breakfast to lunch and dinner, snacks, beverages, and desserts. It houses iconic brands such as MTR Foods, Eastern Condiments, and Rasoi Magic. The company is set to list on November 6, after its IPO saw strong demand, with bids for 48.7X the shares on offer.

Orkla sees strong IPO subscription; Studds trails behind

Studds Accessories manufactures two-wheeler helmets and motorcycle accessories under the “Studds” and “SMK” brands. Its products include helmets, two-wheeler luggage, gloves, helmet security guards, rain suits, riding jackets and eyewear. The company is set for listing on November 7. As on day 2, it received bids for 5.1X the shares on offer.

Two SME companies will also make their stock market debut this week.

Fabrics maker, Game Changers Texfab, is set to list on November 4, after its IPO saw modest demand, with bids for 1.2X the shares offered. The company specialises in sourcing high-quality fabrics based on customer specifications, selecting suppliers, negotiating prices, and ensuring fabric quality and sustainability for textile production.

Safecure Services is a security and facility management company that provides services such as private security and e-surveillance. The company will make its debut on November 6. Its Rs 30.6 crore IPO was subscribed 1.8X.

Six new companies to open for subscription

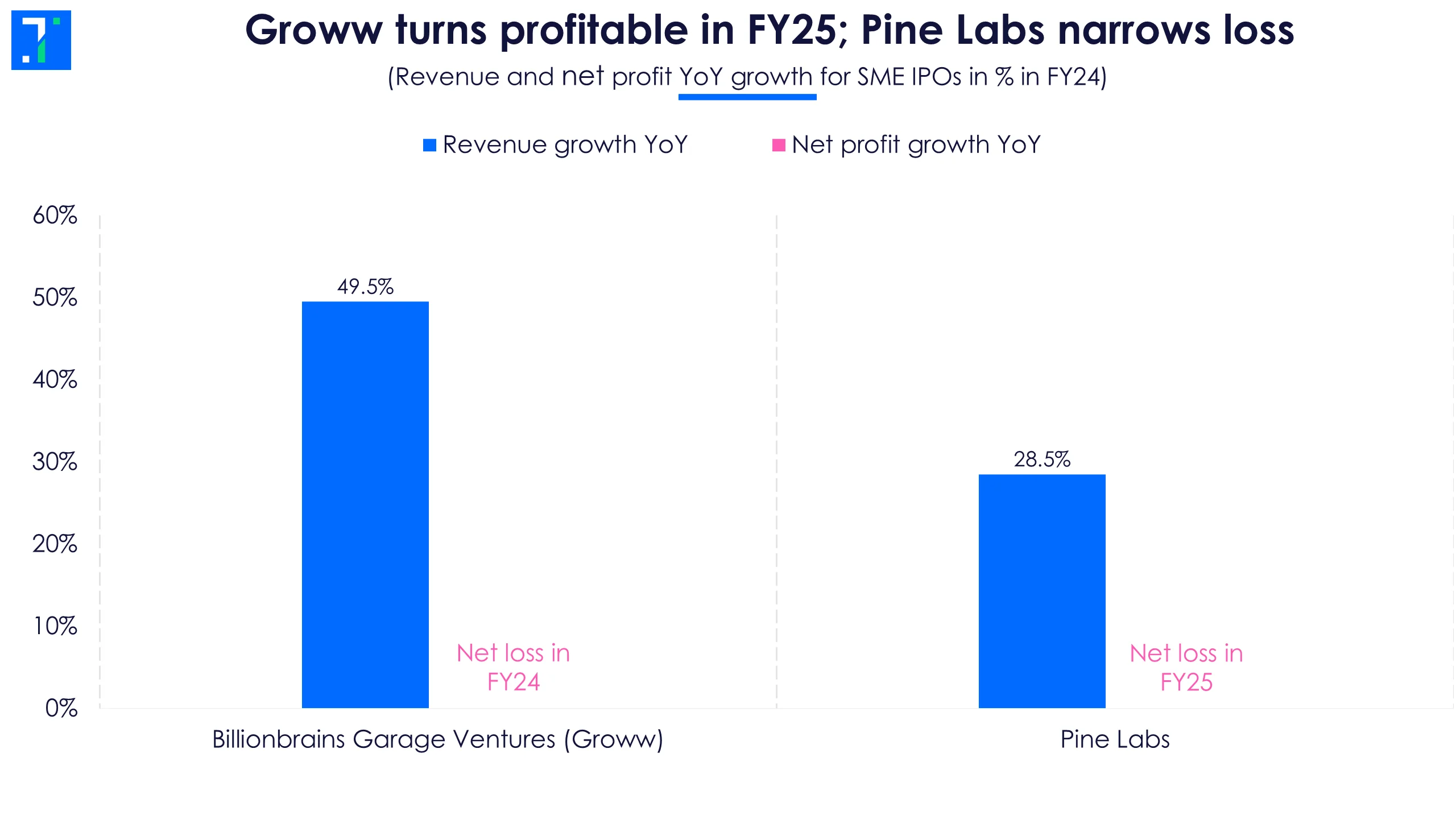

The Indian primary market stays in action, with Billionbrains Garage Ventures and five other IPOs.

Billionbrains Garage Ventures is the parent of the leading stock broking platform Groww, launching this week’s biggest IPO. Groww offers a platform to invest in mutual funds, stocks, F&O, ETFs, IPOs, digital gold, and US stocks.

The company plans to raise Rs 6,632.3 crore, with a price band of Rs 95-100. The IPO will be open for subscription from November 4 to November 7, with the listing scheduled for November 12. The IPO consists of a fresh issue worth Rs 1,060 crore and a Rs 5,572.3 crore offer for sale.

The company turned profitable in FY25, reporting a net profit of Rs 1,824 crore, a major turnaround from last year's loss. This gain was mainly driven by revenue growth, reduction in employee benefit expenses and a Rs 23 crore deferred tax credit.

Groww turns profitable in FY25; Pine Labs narrows loss

Pine Labs is a leading Indian merchant commerce platform that provides point-of-sale (POS) solutions, payment processing, and merchant financing services. It offers digital payment and issuing solutions for merchants, brands, and financial institutions in India and global markets.

The company aims to raise Rs 3,899.9 crore, with a price band of Rs 210-221 per share. The IPO will be open between November 7 and November 11, with the listing scheduled for November 14. The IPO comprises a fresh issue worth Rs 2,080 crore and an offer for sale of Rs 1,819.9 crore.

Pine Labs narrowed its losses in FY25, mainly due to lower depreciation costs and impairment of non-current assets.

Four SME IPOs will also open this week:

Shreeji Global FMCG offers a unique variety of spices, grains, and other food products under its "SHETHJI" brand. It plans to raise Rs 85 crore through a fresh issue, with a price band of Rs 120-125 per share. The IPO will be open for subscription from November 4 to November 7, and will list on November 12.

Finbud Financial Services is a loan aggregation platform in India, assisting individuals in obtaining personal, business, as well as home loans from banks and non-banking financial firms. The company aims to raise Rs 71.7 crore through a fresh issue, with a price of Rs 140-142 per share. The IPO will be open between November 6 and November 10, with the listing scheduled for November 13.

Curis Lifesciences is a pharmaceutical company specialising in tablets, capsules, oral liquids, and sterile ointments. It aims to raise Rs 27.5 crore through a fresh issue with a price band of Rs 120-128. The IPO will open on November 7, close on November 11 and will list on November 14.

Shining Tools designs and manufactures high-performance solid carbide cutting tools like end mills, drills, reamers, and thread mills under the "Tixna" brand for various industries in India. The company plans to raise Rs 17.1 crore with a price of Rs 114 per share. The IPO will be open from November 7-11, with the listing set for November 14.