2023 was the year of Shah Rukh Khan’s epic comeback — three blockbusters including Pathaan, record-breaking crowds, and even a National Award.

Now, it's the turn of another old Indian favourite: gold.

Gold ETFs are back in portfolios, and jewellers can’t keep up with demand (with Tanishq saying that they may even "run out" of coins). Central banks are buying like there’s no tomorrow. On October 8, gold crossed $4,000 per ounce, up from $3,500 in just 36 days. Even JP Morgan’s CEO Jamie Dimon, who is usually skeptical of the yellow metal, said owning it now felt “semi-rational.”

But not everyone’s dazzled. Investors like Zoho’s Sridhar Vembu, and Warren Buffett call gold an unproductive asset. My mom's main complaint about teenaged me on the weekends was "he just sits there without doing anything." Gold is similar — it does not generate income, dividends or profit on its own.

But gold shines brightest when everything else is uncertain. And right now, the world feels pretty uncertain.

The breakup that made gold famous

Therapists say some breakups are good for you. Gold’s big breakup came in 1971, when the US ended the dollar’s link to gold. Until then, every dollar printed had to be backed by it.

The years after were full of turmoil — the 1973 oil embargo, the Iranian Revolution, and surging inflation. The US economy stumbled, and gold became a preferred hedge against a weakening dollar. Gold rose from $35 per ounce in 1971 to $640 by 1980.

But US Fed Chair Paul Volcker entered the scene in 1981 ready to throw some punches, and raised US interest rates to nearly 20% to crush inflation. It worked, but it also killed gold’s momentum.

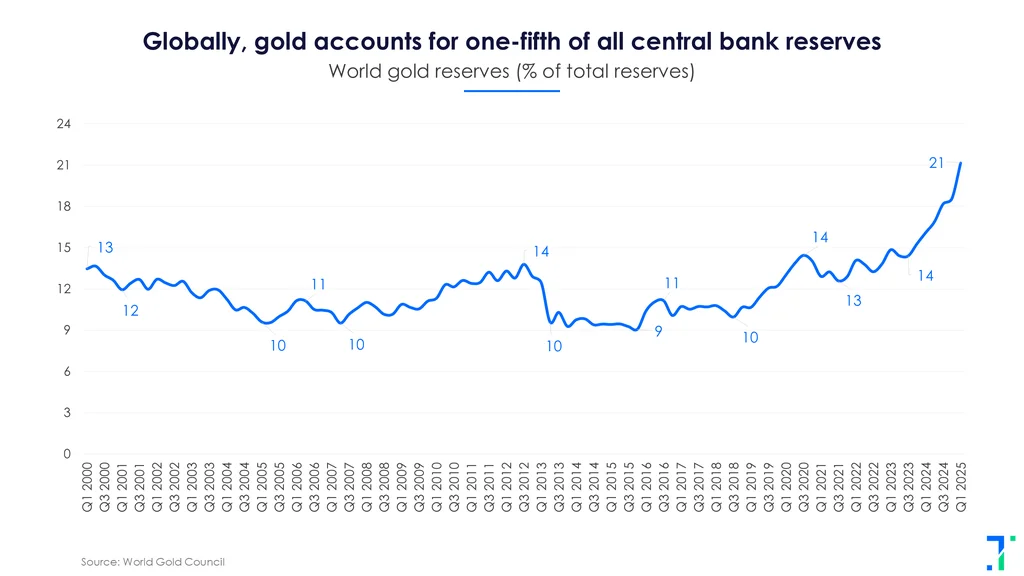

Gold didn't really recover much after that. Through the 1980s and 1990s, interest rates stayed high, stocks were booming, and central banks were selling their gold reserves. By 2001, gold had crashed to $270 per ounce, 70% below its peak.

Uncertainty is back, and so is gold

1990s kids look back at that decade as probably the last peaceful one in recent memory. The 2000s have come with shocks — the dot-com bubble, 9/11, the 2008 global financial crisis, the European debt crisis. All this economic stress pushed people back to gold. Between 2001 and 2011, gold prices jumped from $270 to nearly $1,900.

Gold’s next big move began in 2019 when the dollar started to lose its appeal. Trade tensions were rising worldwide, growth had slowed, and investors were looking for safety. But the real turning point was the pandemic and the Russia–Ukraine war.

When Western nations froze Russia’s dollar reserves in 2022, central banks across the world sat up: the US dollar, they realized, could be weaponised. The UK’s refusal to return Venezuela’s gold was another alarm bell, that even offshore gold wasn’t truly safe.

Gold became the alternative that couldn’t be sanctioned. Central banks were buying less than 20 tonnes of gold a month before the war. Now, they’re buying over 80 tonnes, and keeping it inside their own borders.

According to the economist Mohamed El-Erian, central bank purchases are the main engine behind the current rally. Countries are reducing their dependence on the dollar via a gold safety net.

The gold rush isn’t over yet

Even at record prices, gold is still seeing heavy demand. A World Gold Council survey found that 95% of central banks expect global gold reserves to rise next year. 43% expect their own holdings to increase, and not a single one predicts a fall. That’s a strategic shift away from currency and bond holdings.

Some analysts believe governments in the US and Europe will let inflation run hot to manage their massive debts, while keeping interest rates low. High inflation plus low rates equals negative real yields on government bonds — and that’s when gold shines brightest, since it looks much more stable in comparison.

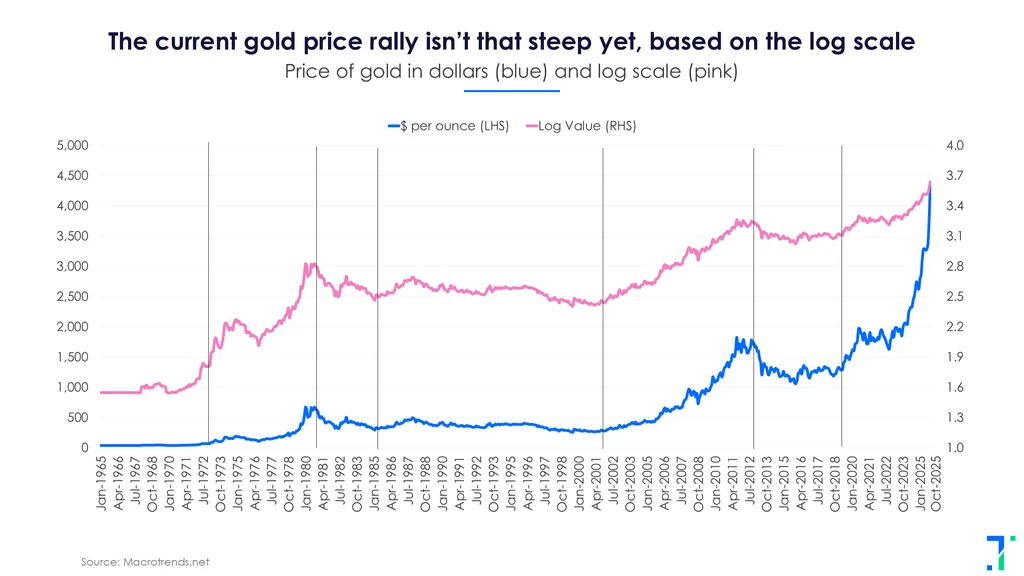

Look at gold’s price on a logarithmic scale, and the bull story is even more convincing. By that measure, we’re still in the early to mid-phase of a long bull cycle. Forecasts for gold prices in 2026 range between $4,400 and $5,000 — a 10–15% upside, smaller than this year’s fireworks but still impressive.

What could end the party?

Some analysts have a different view on gold: that we are in the late innings of the gold rally.

Remember the 2020 spike in gold prices during the pandemic? That fizzled out fast, and gold took nearly three years to reclaim those highs, as Jon Mills of Morningstar says. When investors start chasing silver and platinum, and those metals weaken, it usually signals the end of a gold cycle.

Robin Brooks of Brookings adds that when everyone is obsessed with something, the rally’s probably stretched.

So there are a few things could cool the gold frenzy: tighter credit, a stronger dollar, weaker consumer demand, or easing geopolitical tensions. Another big factor is if the Fed surprises everyone by raising interest rates. Louis-Vincent Gave of Gavekal Research says, “Higher interest rates are the most obvious killer of gold bull markets.”

Gold is also an imperfect substitute for currencies and bonds. “Whoever thinks currencies and bonds can be replaced by bitcoin and gold needs a reality check,” says Shoki Omori of Mizuho Securities. Evidence backs him up: US stock markets are strong, demand for Treasuries is solid, and long-term yields haven’t gone wild.

As Francesca Fornasari of Insight Investment notes, most investors aren’t betting on dollar collapse. They’re just buying gold as a tail hedge against rare but painful shocks.

Still, gold looks better placed than its been for a long time. This rally might cool down, but the forces driving it — monetary uncertainty, central bank diversification, and rising geopolitical tension — aren’t fading anytime soon.

Warren Buffett once said, people buy gold out of fear. Looking around at today’s world, the worried crowd isn’t shrinking.