By Melissa Koshy

Indian stock markets bounced back last week, with the Nifty 50 gaining nearly 1% and recovering from the previous week's decline. The rebound was driven by the Reserve Bank of India's latest announcements, which included a higher economic growth forecast of 6.8% for FY26 and new banking sector reforms.

The RBI held the key repo rate steady at 5.5% and maintained a neutral outlook. The central bank also lowered the inflation forecast for FY26 to 2.6% from 3.1%, thanks to lower food prices and recent GST rate cuts.

Siddhartha Khemka, Head of Research at Motilal Oswal, noted, "Sector momentum has turned positive after the GST rate cuts. This is likely to continue, helped by supportive monetary policy, a good monsoon, and a recovery in demand during the festive season."

The upcoming week is set to be a record-breaker for new stock offerings, with eight companies looking to raise over Rs 30,000 crore. Additionally, 22 companies will make their stock market debut, following the 30 that listed last week.

30 new companies listed last week; SMEs take charge

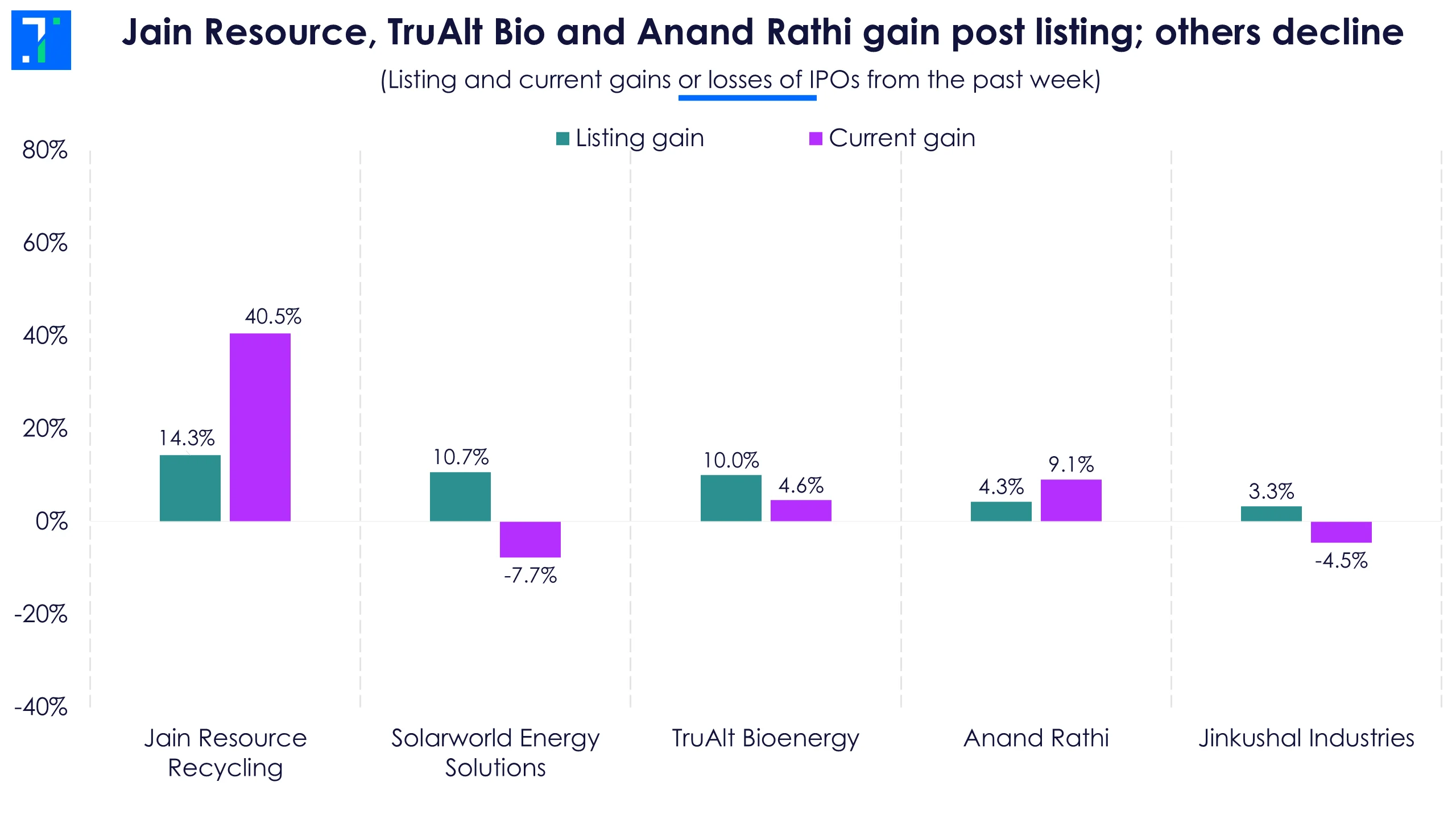

Last week's new listings saw a mixed performance, with many stocks struggling to hold onto early gains.

Jain Resource Recycling had a strong debut, opening 14.3% higher and is now trading 40.5% above its issue price.

Solarworld Energy Solutions and TruAlt Bioenergy listed at premiums of 10.7% and 10%. TruAlt is still up 4.6%, while Solarworld has fallen 7.7% below its issue price.

Anand Rathi and Jinkushal Industries listed at 4.3% and 3.3% premiums. Anand Rathi is trading 9.1% above its issue price, while Jinkushal is down 4.5%.

Jain Resource, TruAlt Bio and Anand Rathi gain post listing; others decline

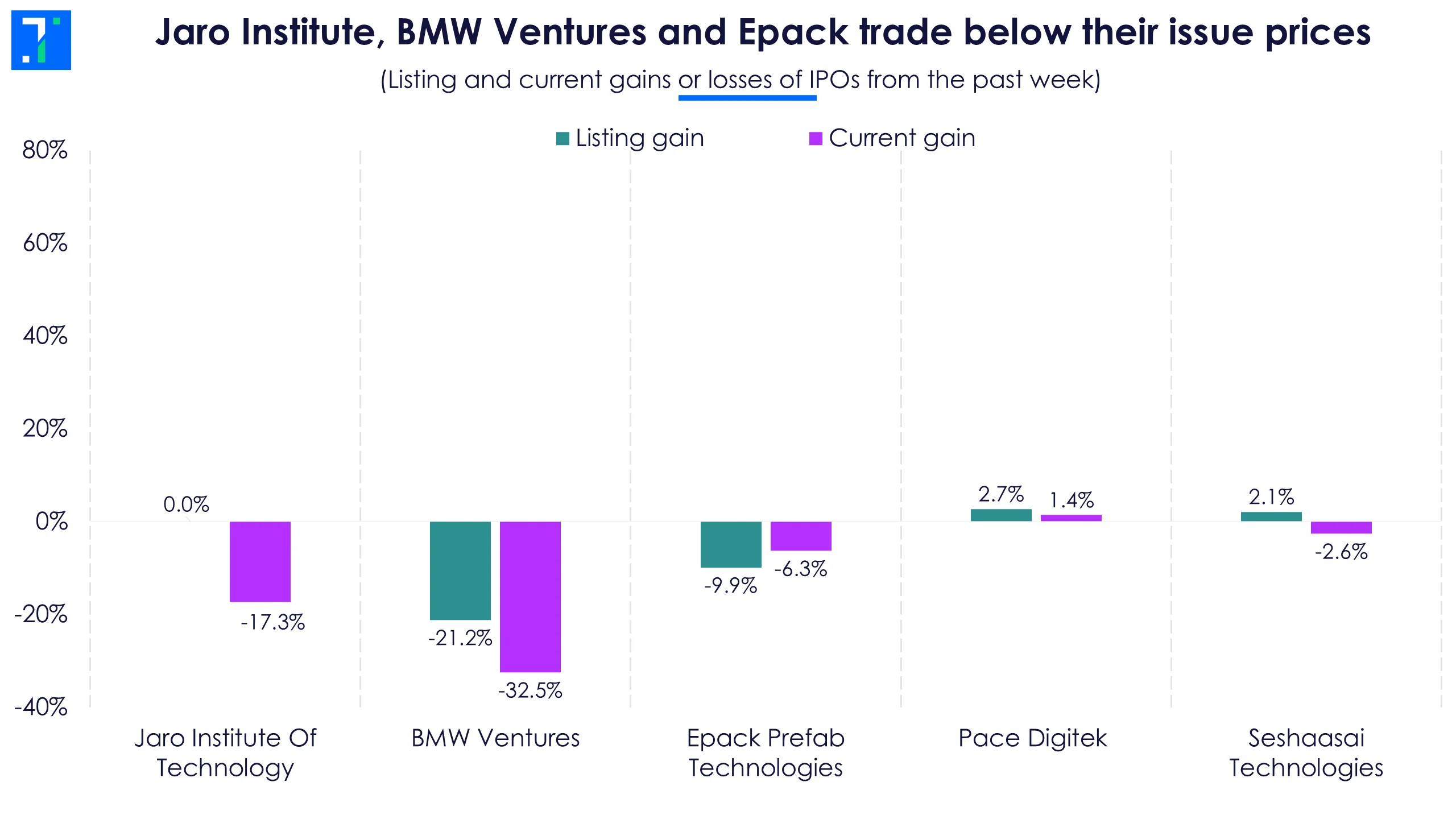

Seshaasai Technologies and Pace Digitek listed at 2.1% and 2.7% premiums. Seshaasai is trading 2.6% below its issue price, while Pace Digitek is up 1.4%.

Jaro Institute Of Technology made a flat debut at Rs 890 and is currently trading 17.3% below its issue price. Meanwhile, BMW Ventures and Epack Prefab Technologies had a weak start, listing at 21.2% and 9.9% discounts, respectively.

Jaro Institute, BMW Ventures and Epack trade below their issue prices

Among SME debuts, Manas Polymers and Energies had a strong debut. The company listed at a 90% premium. KVS Castings, Chatterbox Technologies and Aptus Pharma listed at premiums of 18.4%, 17.4% and 15.4%, respectively.

MPK Steels, BharatRohan Airborne, and Telge Projects had positive debuts, listing at 1.3%, 5.9% and 3%, respectively. Earkart listed at a modest 0.4% premium, while Bhavik Enterprises and Ameenji Rubber debuted at 2.1% and 1% premiums.

True Colors and Praruh Technologies had flat debuts. Meanwhile, Justo Realfintech, Ecoline Exim, and Matrix Geo Solutions listed marginally lower by 0.1%.

Systematic Industries and Solvex Edibles debuted at 0.6% and 5.6% discounts, respectively. Gurunanak Agriculture and Gujarat Peanut both listed at 20% discounts, and are now trading well below their issue prices.

Rukmani Devi Garg Agro Impex also had a weak debut, listing at a 20% discount.

Big week ahead: LG Electronics, Tata Capital open for subscription

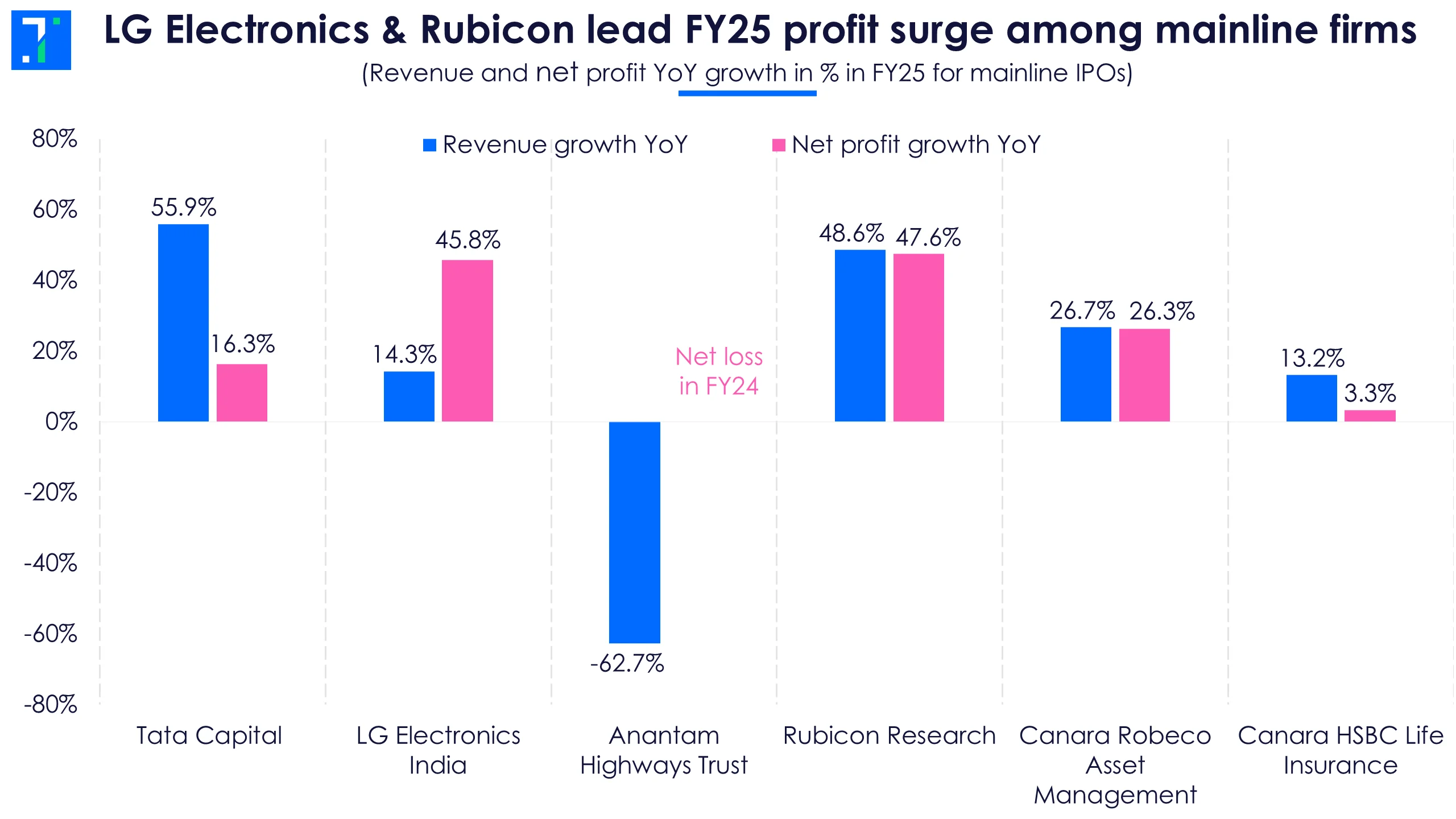

Tata Capital is the largest IPO from the Tata Group and is set to become the biggest NBFC listing in India. It plans to raise Rs 15,511 crore, with a price band of Rs 310-326. Tata Capital’s IPO opened on October 6, will close on October 8, with this listing scheduled for October 13.

Global consumer durable leader LG Electronics India plans to raise Rs 11,607 crore with a price band of Rs 1,080-1,140. It manufactures and distributes home appliances and consumer electronics (excluding mobile phones). LG’s IPO will be open from October 7-9, and will list on October 14.The issue is entirely an offer for sale by the parent company.

Canara Robeco Asset Management serves as the investment manager for Canara Robeco Mutual Fund. The company offers a wide range of investment options, including equity, debt, and hybrid schemes. The Rs 1,326.1 crore issue opens on October 9 and closes on October 14, with listing on October 16. The price band is set at Rs 253-266.

Canara Bank promoted private life insurer Canara HSBC Life Insurance Company’s IPO will be open from October 10-14, with the listing scheduled for October 17. This is the second subsidiary of Canara Bank launching its IPO this week. The issue is an offer for sale of around 23.8 crore shares.

Anantam Highways Trust is an infrastructure investment trust (InvIT) focused on investing in road infrastructure. Its IPO will be open from October 7 to October 9, and will list on October 17. The company aims to raise Rs 400 crore via a fresh issue. The price band is set at Rs 98- 100.

Rubicon Research is a pharmaceutical formulations company focused on research and development, with a portfolio of speciality and drug-device combination products targeting regulated markets, especially the US. Its Rs 1,377.5 IPO will be open from October 9-13, with the listing scheduled for October 16.

LG Electronics & Rubicon lead FY25 profit surge among mainline firms

This week will see two SME IPOs opening for subscription. Mittal Sections is engaged in the manufacturing of basic iron and steel products. It manufactures mild steel sections and structural steel products, including MS flat bars, round bars and more. It plans to raise Rs 52.9 crore with a price band of Rs 136-143. Mittal Sections will be open from October 7-9, and will list on October 14.

SK Minerals & Additives is involved in the manufacturing, processing, and supply of industrial minerals and speciality chemicals. It plans to raise Rs 41.2 crore with a price band of Rs 120-127. SK Minerals will be open between October 10-14, with its listing scheduled for October 17.

22 companies are lined up for listing this week

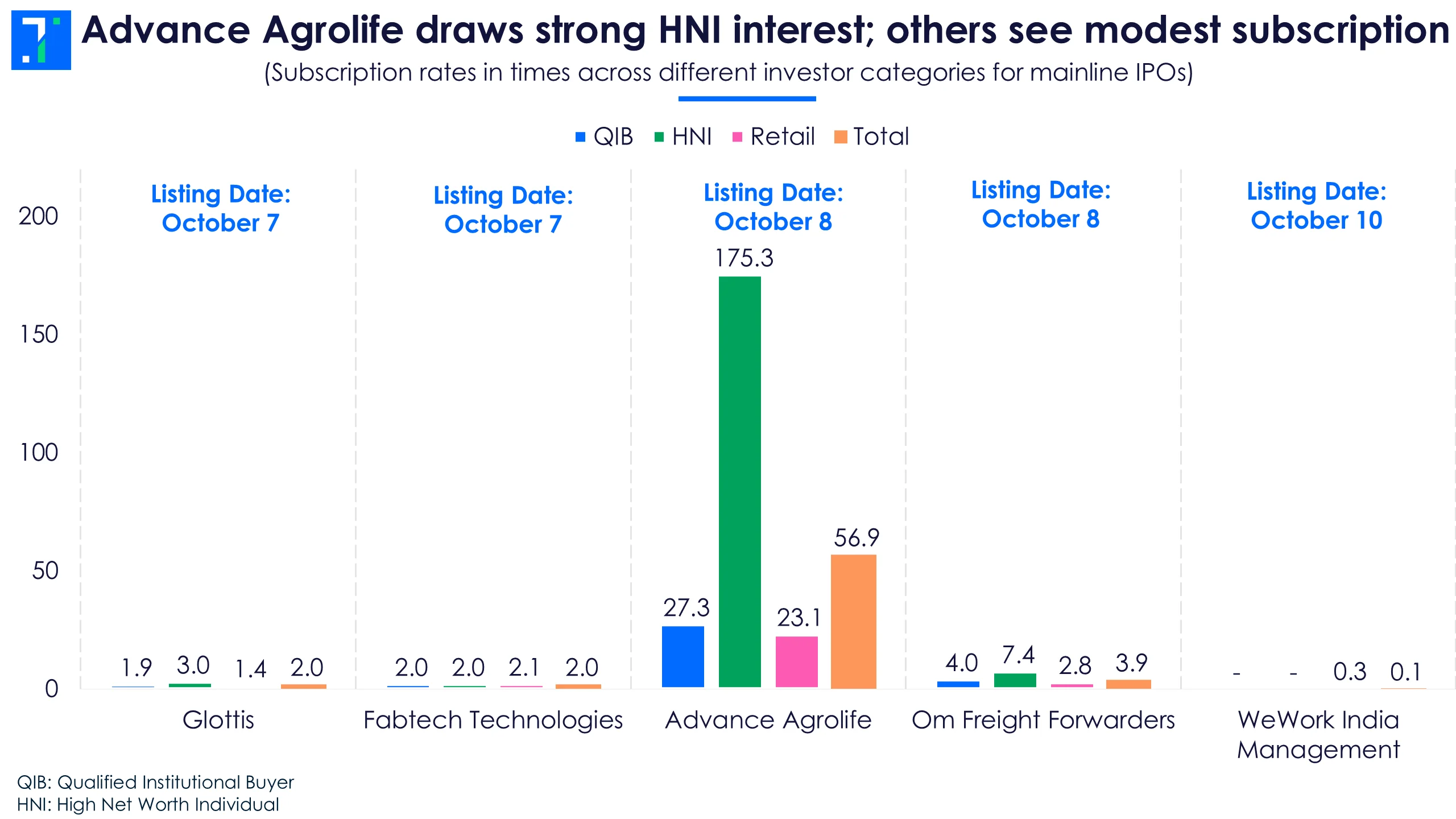

Among mainline IPOs, Advance Agrolife stood out with bids for 56.9X the shares on offer, with HNIs showing strong interest at 175.3X. The company is set to list on October 8. Advance Agrolife manufactures a wide range of agrochemical products that support the entire lifecycle of crops.

Logistics player Om Freight Forwarders received bids for 3.9X the shares on offer. The company is set for listing on October 8.

Advance Agrolife draws strong HNI interest; others see modest subscription

Biopharma engineering company Fabtech Technologies received bids for 2X the shares on offer. Logistics solutions player Glottis was also oversubscribed at 2X. Both these companies are set for listing on October 7.

WeWork Management is scheduled for listing on October 10. The company offers flexible workspace solutions, including custom buildings, enterprise suites, managed offices, private offices, and co-working spaces. Its IPO was undersubscribed on day 1; it received bids from the retail segment for 0.1X the shares offered.

17 SMEs are also scheduled for listing this week:

- Dhillon Freight Carrier and Om Metallogic are set for listing on October 7. Dhillon Freight’s IPO received bids for 2.8X the shares on offer, while Om Metallogic was oversubscribed at 1.4X.

- Sodhani Capital, Suba Hotels, and VijayPD Ceutical are also set for listing on October 7. Their IPOs were subscribed 4.6X, 14.3X, and 1.4X, respectively.

- Sheel Biotech, Zelio EMobility, and Munish Forge will list on October 8. Sheel Bio was oversubscribed at 14.9X, while Zelio and Munish Forge received bids for 1.5X and 3.4X the shares on offer.

- Valplast Technologies, BAG Convergence, and Sunsky Logistics will also list on October 8. Valpast received bids for 1.2X the shares offered, BAG Convergence Sunsky were both undersubscribed by 1.4X.

- Infinity Infoway and Chiraharit are scheduled for listing on October 8. Infinity Infoway was a top performer among the SME lot as it received subscriptions for 258.5X the shares on offer. Meanwhile, Chiraharit was oversubscribed by 1.8X.

- Shlokka Dyes, Greenleaf Envirotech, and DSM Fresh Foods will list on October 9. As on day 3, IPOs of Greenleaf and DSM Fresh were subscribed 0.3X and 0.9X respectively, while Shlokka Dyes was heavily undersubscribed.

- NSB BPO Solutions is scheduled to list on October 10. Its IPO received bids for just 0.1X the shares offered as on day 8.