Ever seen a stunning travel video of a place, only to find out on arriving that it is a crowded mess? That's the "Instagram vs. Reality" trap. The low scenery to people ratio can ruin your vacation.

After returning from this holiday, I was back to checking my portfolio. Here too, I found that my hopes had crashed into the hard wall of reality. The Fed had cut interest rates by 25 basis points that week — a move that investors like me had hoped would spark a bullish rally. But that didn't happen.

Instead, inflation warnings, a mixed economic outlook, conflicting opinions among Fed officials about how much more to cut, President Trump complaining loudly about the Fed Chair -- all of this left the market struggling. The S&P 500 dropped by one percent immediately after the rate cut announcement, only to recover during the subsequent press conference. The dominant feeling is of economic uncertainty.

The Fed's words shake up the market

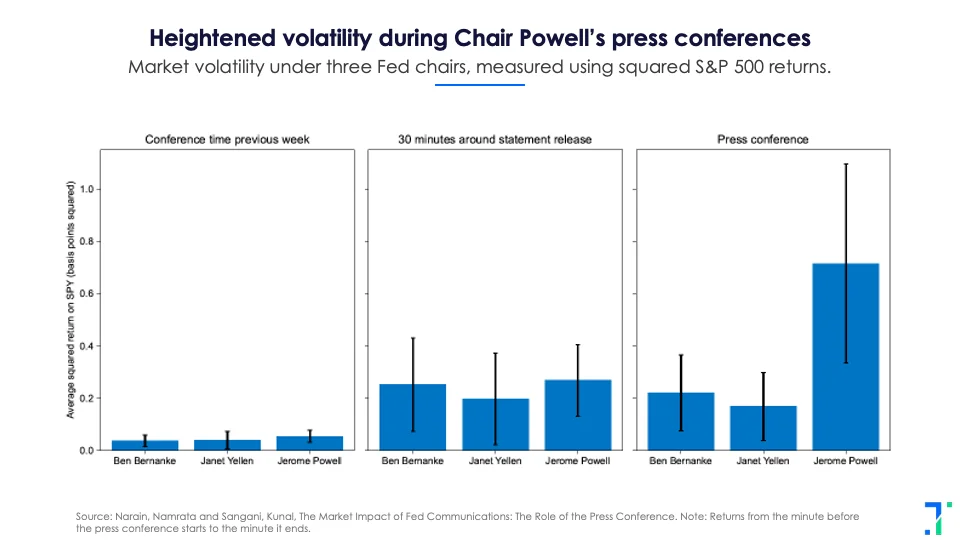

The Federal Reserve is now speaking to a market that listens to them more closely than ever before. Harvard University researchers have found that market swings during Fed Chair Jerome Powell's press conferences are more than three times higher compared to the Chairs before him. The regulator's words can now move markets as much as corporate earnings or economic data.

Ask your girlfriend if you are good looking. Then ask your brother. You will probably get very different answers. When it comes to markets, Trump is like the girlfriend, and Powell is like your brother: Trump thinks markets are always doing "great" under his Presidency, while Powell speaks without any frills. Even when delivering good news (a rate cut, market improvement) he mentions potential bad news that may lie ahead.

Powell's press conferences often send markets into a sharp reversal - this is a pattern rarely seen under previous Fed chairs.

India's RBI adds to the turmoil

The trend of markets reacting to every word of the regulator isn't just a US phenomenon. The Reserve Bank of India (RBI) faces a similar challenge. Just today, hints of a potential interest rate cut in December sent markets higher.

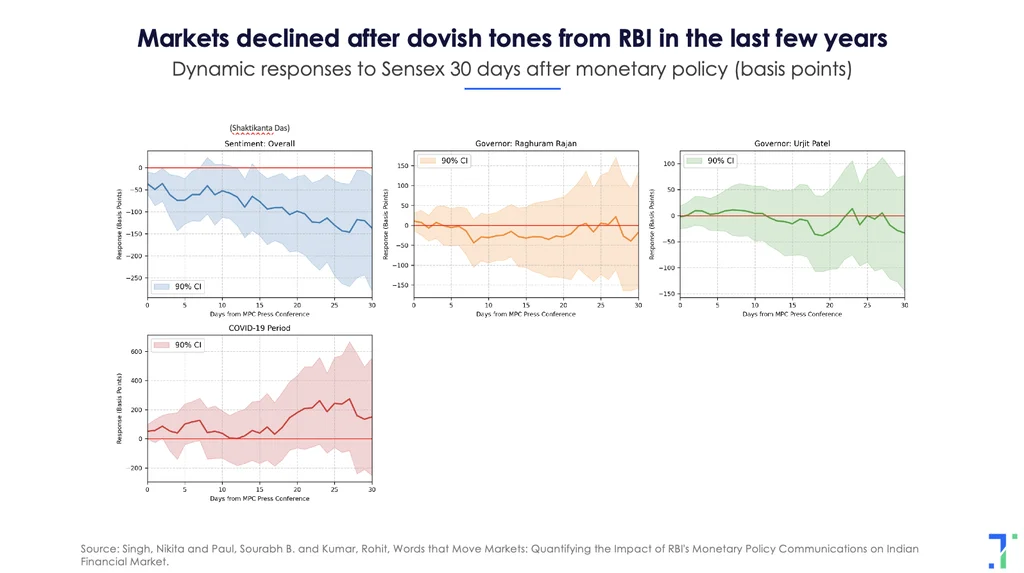

RBI meetings and commentary are now dissected in heavy detail by analysts, so governors have to watch every word. Personalities are also analyzed closely. Under Raghuram Rajan, dovish comments barely moved markets. In contrast, under Shaktikanta Das, dovish messages consistently led to stock market declines.

The change in RBI's direction has also been very visible after the governor's role went from Das to Sanjay Malhotra in December 2024. The RBI’s approach in currency markets changed dramatically, and under the new governor, it has allowed the rupee more flexibility, letting it move within a wider band. This has led to increased day-to-day volatility in the rupee, with daily trading ranges nearly tripling compared to before.

Market participants, especially corporates, have reacted by ramping up currency hedging to manage this higher volatility. This differs from Shaktikanta Das’ interventionist approach, where the rupee barely budged. The first rate cut in several quarters also came only when Malhotra took charge.

So are regulators the new market movers?

India's securities market regulator, SEBI, also wields significant power over markets, and is more heavy handed compared to the US equivalent, the SEC.

When SEBI banned Jane Street Capital in July 2025, it triggered a sharp drop in trading volumes and erased over Rs. 12,000 crore in market value for several financial firms.

SEBI's reforms in the derivatives market also cooled retail participation. Its moves in derivatives have impacted the business models of major brokerages like Zerodha, which is considering shifting away from the discount brokerage approach and charging fees to make up for the loss in F&O revenues.

One argument here is that markets and retail participation are changing fast. The regulators have to respond accordingly. As the current SEBI chief, Tuhin Kanta Pandey, says, “volatility is the new normal”.

Algorithms add fuel to the fire

Technology is accelerating these market reactions. With automated systems now responsible for over half of all trading, regulatory news triggers instant positive/negative tagging and algorithmic trades, replacing slow human decision making.

This speed can be dangerous. A simple typo in Lyft’s 2024 earnings report, which mistakenly projected a 500-basis-point profit surge instead of 50, caused trading algorithms to flood the market. The stock shot up 60% in after-hours trading before the error was caught.

The Financial Stability Board warns that as finance gets faster, regulators must keep pace. A crisis like the Silicon Valley Bank failure, can now spark global financial turmoil as algorithms react before regulators do.

The transparency paradox

Communication in an environment like this is a double-edged sword. Being transparent about the risks for example, helps reduce differences between the analysts the regulator is speaking to, but doesn’t necessarily make their predictions more accurate.

More transparency and detailed briefings can also cause regulatory errors or miscommunication, causing immediate market disruption. “As the speed of risk and information increases, so does the speed at which trust can be won or lost”, says analyst Martin Moloney.

Regulatory statements are no longer just commentary—they are driving asset prices and market volatility.