By Melissa Koshy

Last week, Indian stock markets closed higher, with the Nifty 50 gaining 1.5%. This rise was driven by optimism for stronger second-half earnings, following GST rate adjustments and the US Federal Reserve's upcoming rate cuts. Improving prospects for India–US trade talks also bolstered market sentiment.

Commerce Minister Piyush Goyal expressed confidence that an initial trade deal could be finalised by November, noting progress in ongoing discussions.

Siddhartha Khemka, Head of Research, Wealth Management at Motilal Oswal, said, "The Indian stock market saw strong buying after US President Donald Trump and Indian Prime Minister Narendra Modi's social media interaction. Further progress in India–US trade negotiations could boost investor confidence.”

The IPO market continues its active streak this week, with five new issues opening. Additionally, eleven companies will debut on the stock market, building on last week's eight listings.

Last week's listings: SMEs lead

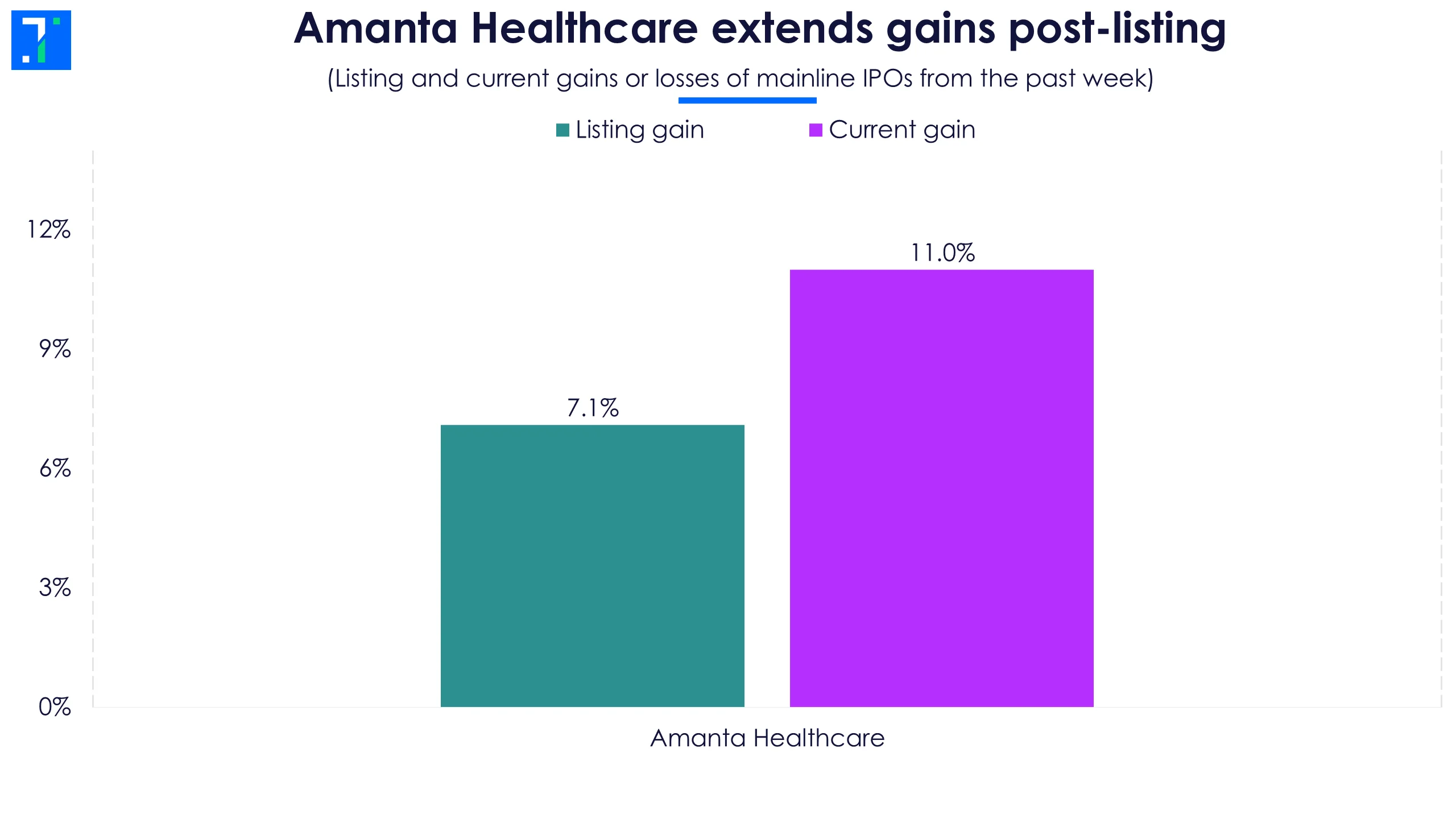

Only one mainline IPO debuted last week: Amanta Healthcare. It opened at a 7.1% premium, and is now trading 8.1% above its issue price. Its IPO was subscribed 82.6X.

Amanta Healthcare extends gains post-listing

Among SME debuts, Austere Systems and Optivalue Tek Consulting stood out, listing at 37.4% and 23.3% premiums, respectively. Austere Systems' IPO saw strong demand, subscribed 1001.8 times, while Optivalue Tek saw 60 times oversubscription. Both are trading above their issue prices.

Goel Construction Company debuted at a 15% premium after bids for 115.8 times the shares offered. It currently trades 22.1% above its issue price. Sharvaya Metals listed at an 11.7% premium, and is now trading marginally above its issue price.

Vashishtha Luxury Fashion debuted at a 6.3% premium and is trading above its issue price. It received a modest 2.1X subscription. Vigor Plast listed at a 4.9% premium after its IPO was subscribed 3.7X. It currently trades 2.5% above its issue price.

Rachit Prints was the sole IPO to list at a discount after a 1.9X subscription. It currently trades 41.1% below its issue price.

Five new offerings are set to hit the market this week

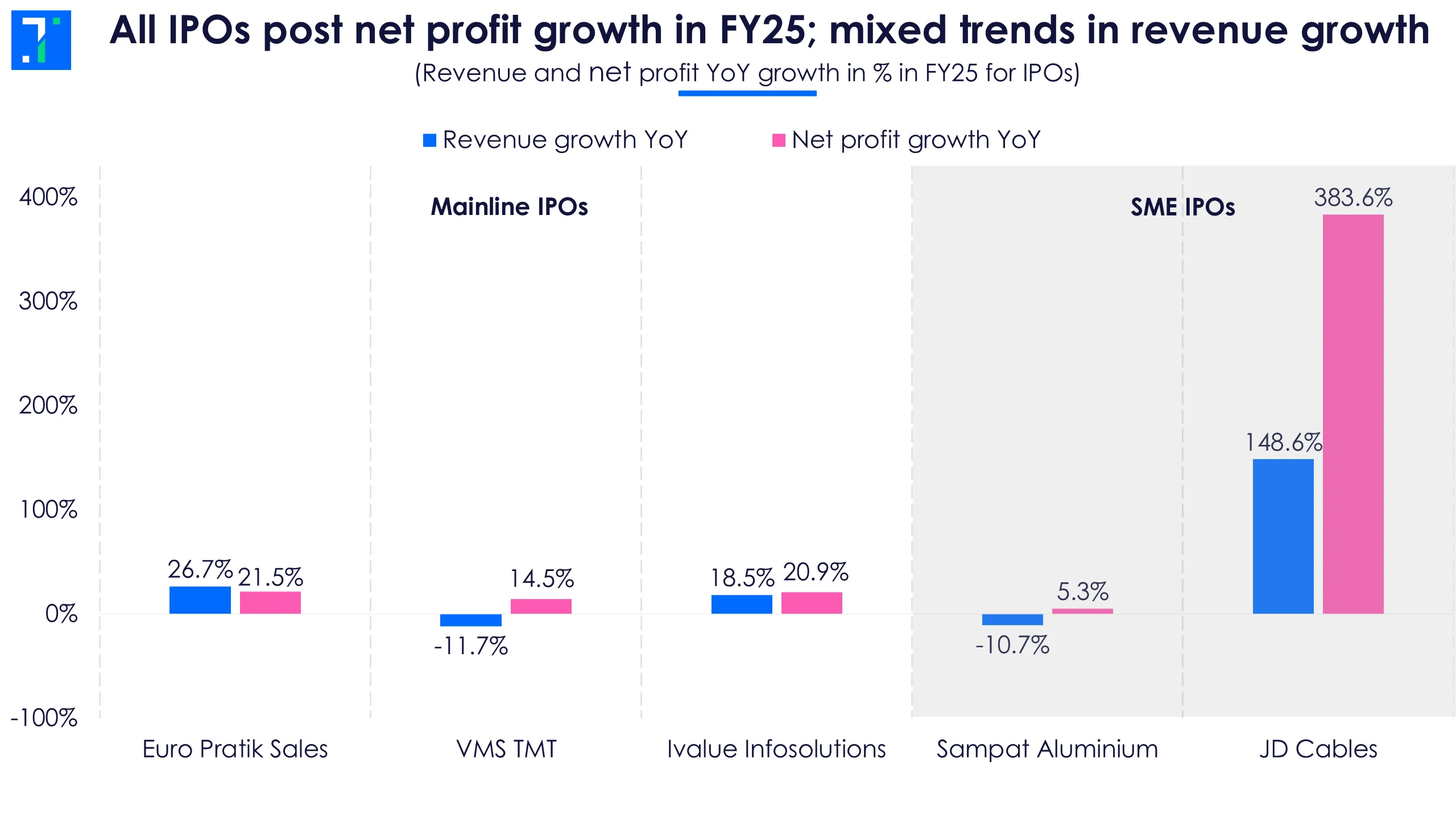

This week's largest IPO, Ivalue Infosolutions, is a technology services and solutions provider. It helps businesses manage and secure digital data and applications, and offers technical expertise to System Integrators, large businesses, and OEMs.

Ivalue Infosolutions' IPO will open on September 18, close on September 22, and is set for listing on September 25. The company aims to raise 560.3 crore at a price band of Rs 284-299 per share. The issue is entirely an offer-for-sale.

Euro Pratik Sales designs and sells wall panels and laminates. The company offers eco-friendly, durable alternatives to traditional wall coverings. Its IPO runs from September 16-18, listing on September 23. Euro Pratik aims to raise Rs 451.3 crore via an offer-for-sale.

VMS TMT manufactures and sells thermo-mechanically treated (TMT) bars. It also deals in scrap and binding wires, distributing products in Gujarat and other states. VMS TMT's IPO will be open from September 17-19, and will list on September 24. The company plans to raise Rs 148.5 crore via a fresh issue, with a price band of Rs 94-99 per share. Proceeds will repay borrowings and serve general corporate purposes.

All IPOs post net profit growth in FY25; mixed trends in revenue growth

Two SME IPOs are also opening for subscription this week.

Sampat Aluminium's IPO will be open from September 17-19, and will list on September 24. It manufactures aluminum long products (wires, rods) essential for electricity distribution, transformers, and industrial use. It aims to raise Rs 30.5 crore via a fresh issue, with a price band of Rs 114-120.

JD Cables' IPO will open on September 18, close on September 22, and will list on September 25. It manufactures high-quality cables and conductors for the power transmission and distribution sector. JD Cables plans to raise around Rs 96 crore with a price band of Rs 144-152.

A busy week ahead as eleven firms are set for listing

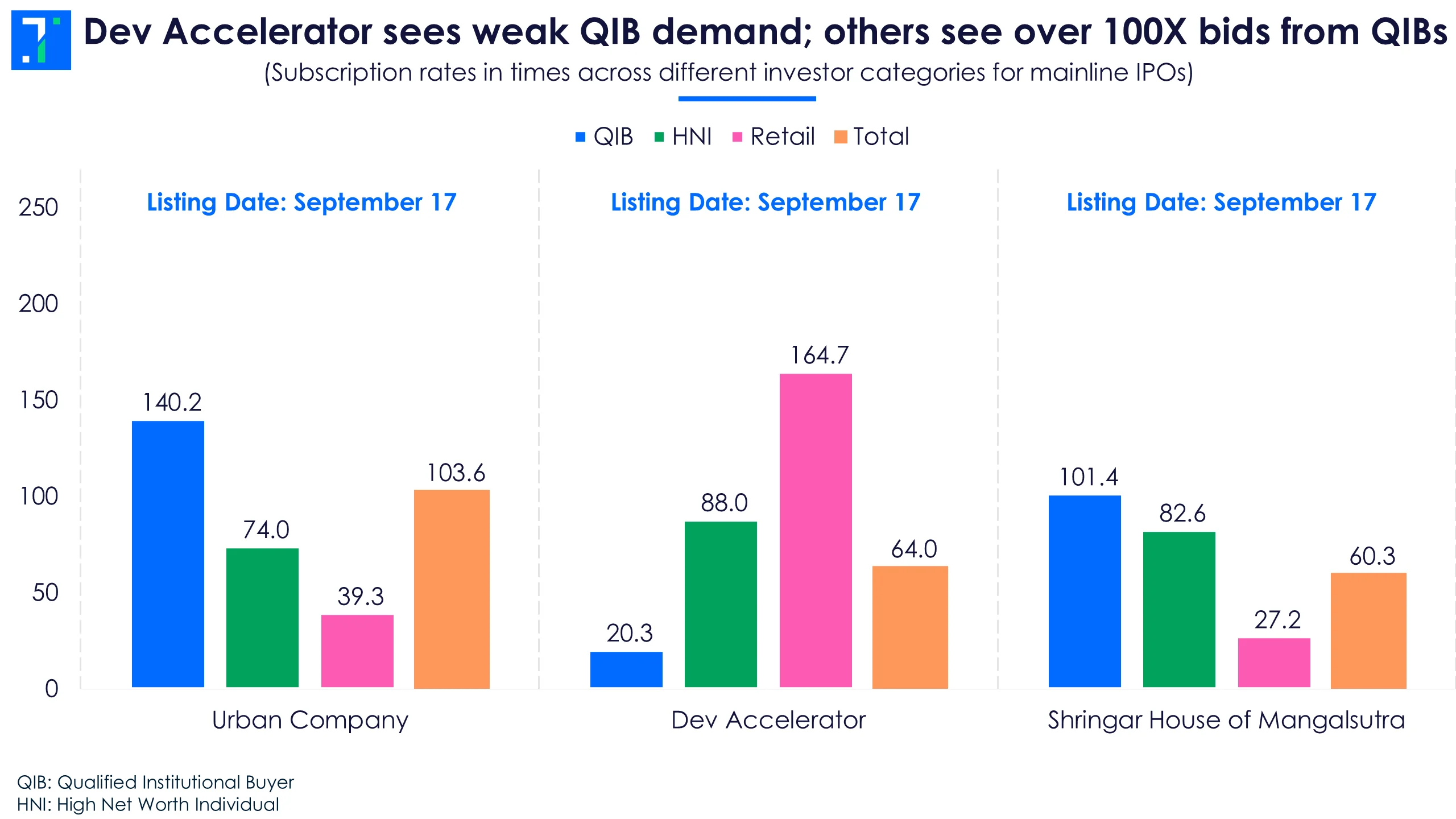

Among mainline IPOs, Urban Company received bids for 103.6X the shares on offer, with QIBs showing the strongest demand at 140.2X. The company is set to list on September 17. Urban Company offers a tech-enabled platform for home and beauty services—from cleaning and repairs to grooming and home massages.

Dev Accelerator and Shringar House of Mangalsutra will also list on September 17. Dev Accelerator, a consumer services company, provides flexible office spaces, including coworking. Its IPO was subscribed 64X, with retail demand at 164.7X. Shringar House designs and manufactures a variety of Mangalsutras with stones like American diamonds and pearls. It received bids for 60.3X the shares.

Dev Accelerator sees weak QIB demand; others see over 100X bids from QIBs

Eight SMEs are lined up for listing this week: