Like many of us, I sometimes fall into the pattern of ordering Swiggy one too many times, and get a bit chubby.

Soon enough, the comments start. Indian families don't hold back. From a favourite aunt who's handing me a plate of biryani: "Start your diet after eating this". From an uncle I haven't seen in a while: "Is that two of you or one?" and so on.

After the cutting comments, I do a whole year of avoiding my favourite sweets and snacks. Icecream is banished from the freezer, kit-kat is my enemy. But after losing the weight, my favourite foods return to the table. The supermodel Kate Moss once said that "Nothing tastes as good as skinny feels." I think she just never encountered a truly excellent jalebi.

Enter the GLP-1 drugs, a magical promise for the weak-willed among us.

The new generation GLP-1 weight loss medications have been called "miracle drugs" because they cause 15–25% weight loss on average, way more than any drug that came before. For a 60 kg person, that's a weight loss of at least nine kgs – the difference between rude comments and compliments.

We humans spend a lot of effort trying to resist the food that make us gain weight. The GLP drugs target brain pathways that manage our appetite, so that we just don't feel hungry. By outsourcing our willpower to these drugs, we can get a version of ourselves that wins the approval of uncles, aunties and dates everywhere.

GLP drugs are coming in just as India gets fatter

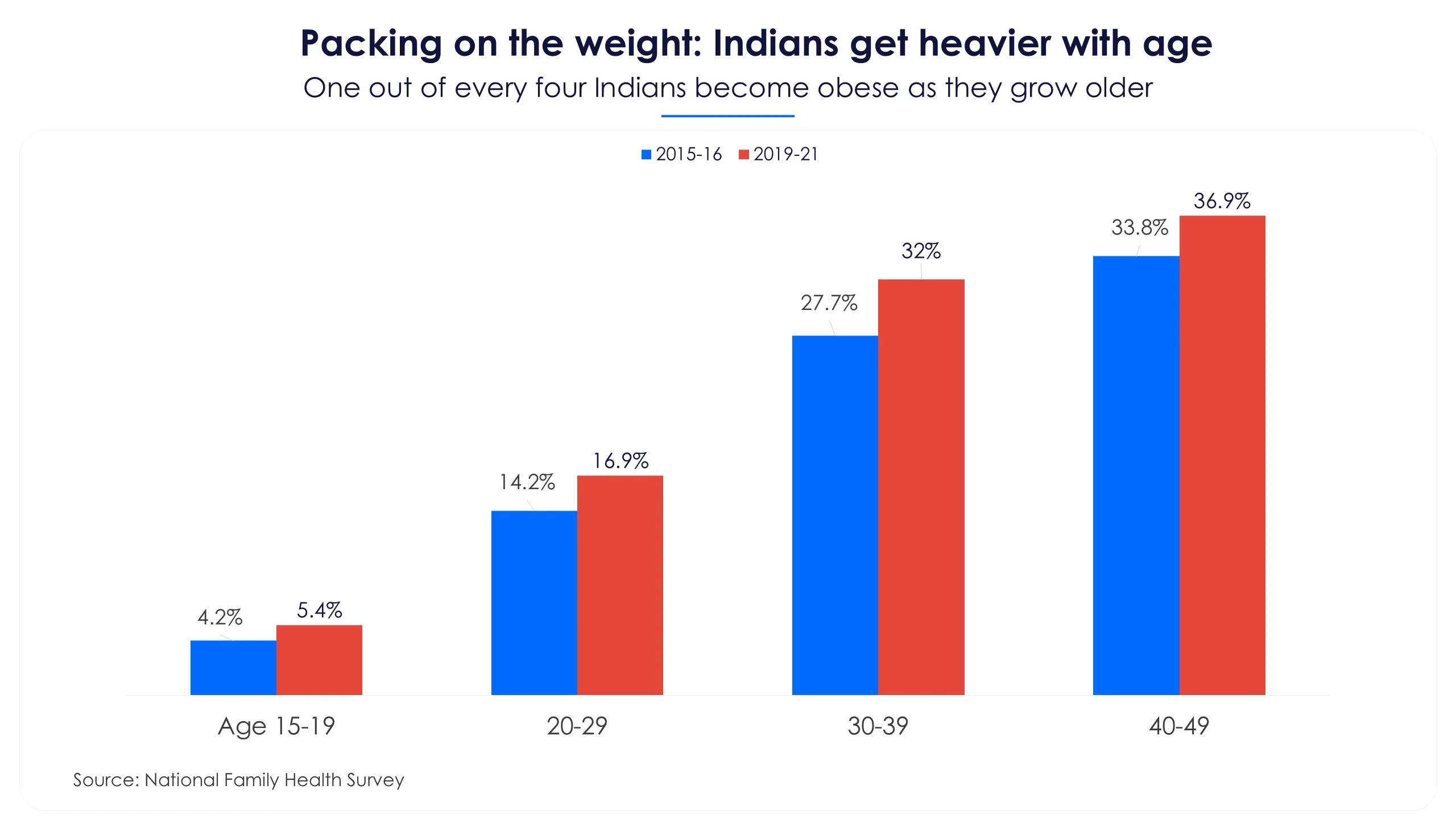

You are meeting your college friend after 20 years. When you see him you try to hide your shock

– more likely than not, he's much fatter than you remember.

Most college-age people are thin, but the percentage of thin people falls rapidly in each older age group. The total numbers are also higher than ever before. There are now about 254 million people classified as obese in India, and 40 million on diabetes medications.

Despite the price tag, weight loss drugs are growing fast

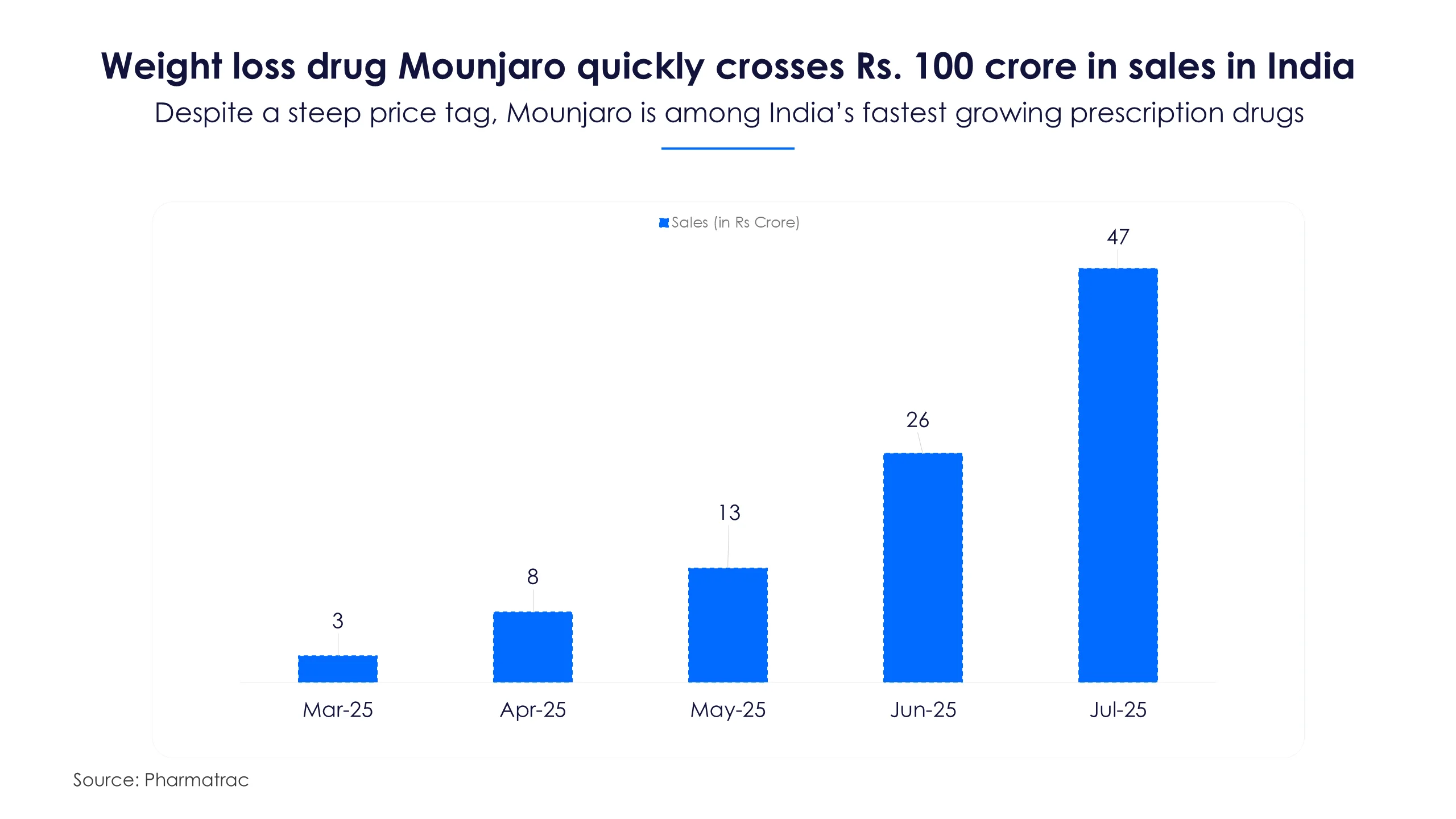

Eli Lilly launched its anti-obesity drug, Mounjaro (tirzepatide), in India in March 2025. Mounjaro is a weekly dose, and a month's supply costs Rs 14,000-17,500.

Despite the price, the drug has crossed Rs 100 crore in sales in just four months, making it one of the country’s fastest-growing prescription brands ever by value. The drug had sales of Rs 47 crore in July, double its June figure.

Weight loss will be the "largest category of drugs" in India within five years, as generics boom

Right now the GLP-1 market globally is a duopoly of Novo Nordisk and Eli Lilly. These companies built on decades-long diabetes research to come up with these revolutionary drugs for weight loss.

But the patents for semaglutide, the active ingredient in Ozempic and Wegovy, are set to expire in India in March 2026. This will pave the way for a "generic tsunami," with major Indian pharma companies like Sun Pharma, Dr. Reddy's and Lupin getting ready to launch affordable generics. The CEO of India Business at Sun Pharma, Kirti Ganorkar, says that Sun will be among the first to launch GLP generics in India on patent expiry. They are also planning to launch in non-US markets like Canada and Brazil.

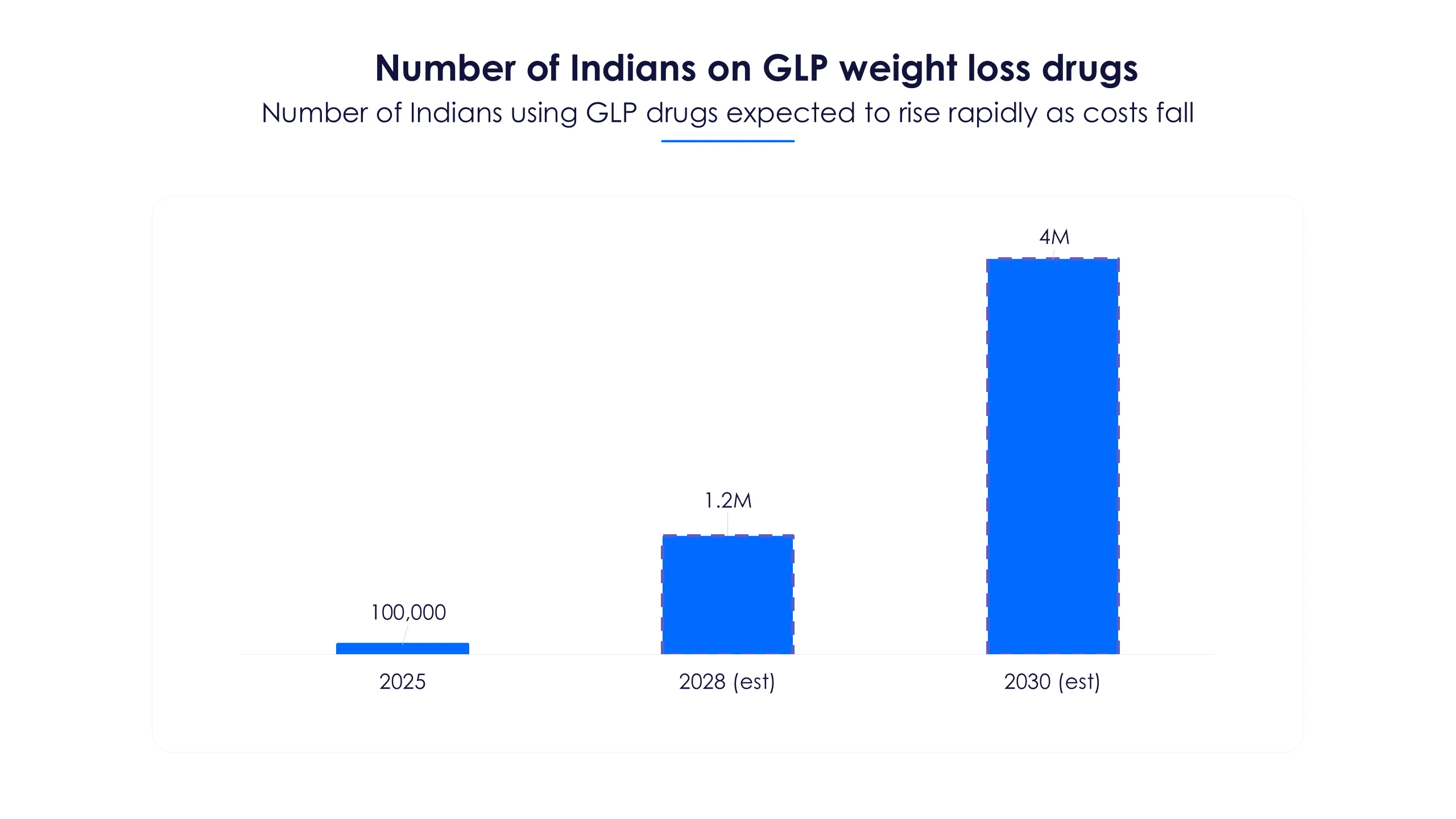

With the entry of generics next year, drug prices are set to crash by as much as 80% from the current price tag of Rs. 14000+ a month. “Weight-loss molecules like semaglutide and tirzepatide will be the largest category of drugs in the country in the next 4-5 years,” Vishal Manchanda, pharma analyst at Systematix Group says. He estimates that India's weight-loss drug market will rise from Rs. 700 crore today to Rs 8,000-10,000 crore by 2030.

The GLP effect on other industries

Early evidence suggests that the impact of these drugs will not be limited to India's pharma sector. Their role in killing appetite has according to JP Morgan, slowed growth in the FMCG and food sectors in the US, and caused this segment to underperform the S&P 500 by nearly 40% year to date.

“We have seen a number of...disruptions come and go in consumer staples over the years, but never one quite like GLP-1,” Ken Goldman, an equity analyst at JP Morgan says. Current GLP-1 users in the US purchase around 8% less of items like snacks, packaged foods and soft drinks compared with the average consumer. If this pattern holds in India, it could mean slowing growth across FMCG and QSR.

Companies like PepsiCo and Nestle are already set to launch smaller portion sizes and healthier options in the US. Companies here may have to plan similarly, as Indian consumers get on GLP-1s.