By Shreesh Biradar

The recent volatility of stocks as the Lok Sabha election results came in has resurrected the debate of the alignment of Indian businesses with political parties. As the ruling party’s projected seat share fell, the highest volatility was seen in Adani Group stocks. Adani stocks had swung to 52-week highs with the release of exit polls projecting large majorities for the BJP and fell hard when the results fell short.

While the Adani Group has flourished under the BJP-led government in the past decade, it has had its share of problems. From opposition parties alleging favoritism, to the Hindenburg report alleging fraud in the conglomerate. Amid all this drama, Adani Group firms have strengthened their balance sheet and increased their profitability.

The allegations, remediation and clean chit

In January 2024, Hindenburg came out with reports alleging that Gautam Adani and his associates had done a series of frauds. The allegations included stock manipulation, flouting regulatory norms, siphoning money through a web of shell companies and inflating valuations. The report also mentioned shady deals undertaken by Vinod Adani (Gautam Adani’s brother) as a promoter. While the high debt levels were questioned in the report, high pledged shares were also flagged.

The immediate aftermath was a massive $150 billion wipeout for Adani stocks in the next two months. The management went into firefighting mode and brought in foreign investors like GQG Capital, Qatar Investment Authority and Bain Capital to boost investor sentiment. It also launched roadshows to ensure the offshore bondholders of the conglomerates were convinced of financial stability. Vinod Adani stepped down from the managerial post, while the promoter group raised capital to reduce its pledged shareholding.

SEBI gave a clean chit to Adani Group in the 22 allegations it investigated in May 2023. A petition was then filed in the Supreme Court, and the Court in its order stated, “Any third party cannot question SEBI’s credentials. The allegations can be used as inputs for investigation, but not as conclusive evidence”. This clarification helped investor sentiment. Adani Group has also been working behind the scenes to lower its pledged shares and debt levels and increase its profitability. The positive sentiment around the group companies have led the price to earning (PE) expansion for the Adani Group stocks.

Most Adani Group companies have seen PE expansion since March 2023

Most Adani Group companies have seen PE expansion since March 2023

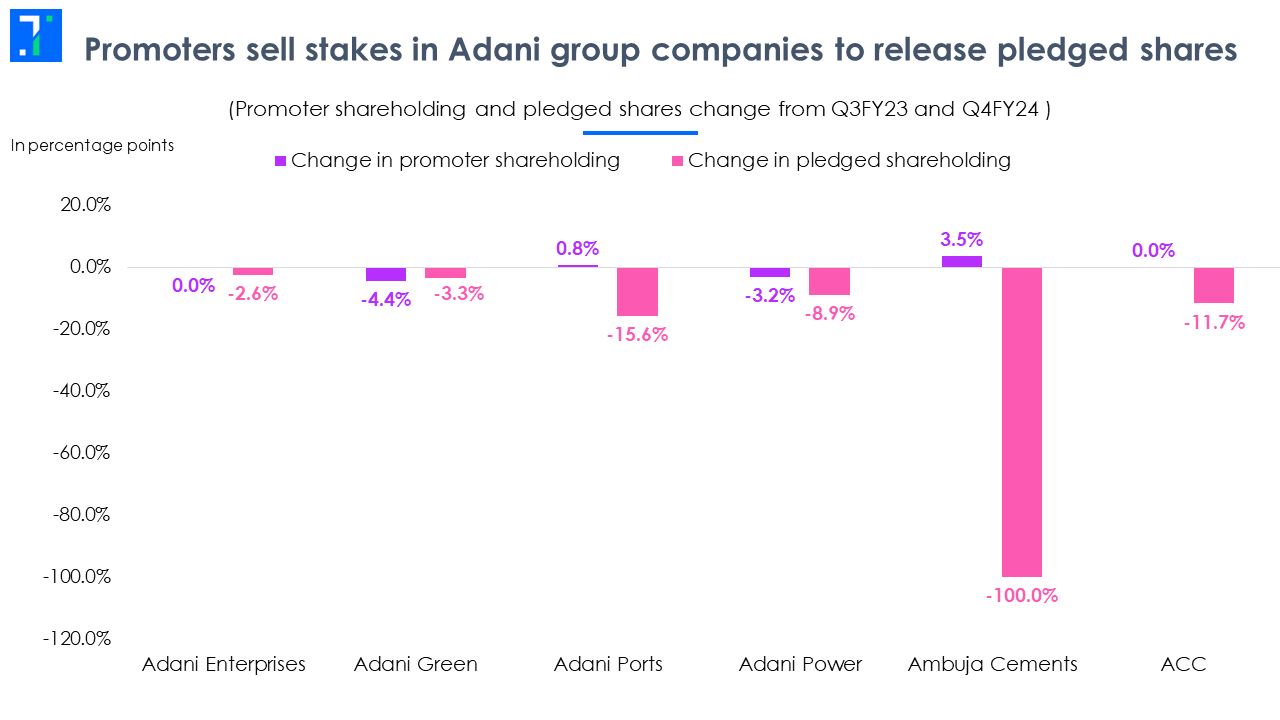

Adani Group reduces pledged shares post-Hindenburg event

According to the Hindenburg report, “a portion of promoter equity in Adani Group listed entities is pledged for loans, effectively leveraging the group to the hilt”. While promoter pledging is common, higher pledging is a risk factor. Problems with the promoter can lead to banks forfeiting the pledged shares and dumping them in the open market. Initially, in the first three months of the Hindenburg saga, Adani Group promoters sold stakes in Adani Green (4.5%), Adani Enterprises (4.9%), Adani Ports (2.2%), and Adani Power (3.2%). Over the next 12 months, the promoters infused capital and increased their stake in Adani Ports (3%), Adani Enterprises (4.9%), Ambuja Cements (3.7%) etc. Adani promoters raised around $2.15 billion via stake sale to pare promoter pledging.

Promoters sell stakes in Adani group companies to release pledged shares

The reorganization of promoter holdings helped generate surplus cash to release pledges across Adani’s listed firms. Most of the stakes sold by the promoter entity have been bought by Rajiv Jain-led GQG partners. Apparently, GQG partners have invested roughly Rs 21,660 crore in Adani Group firms.

Consolidated net debt of Adani Group firms drops by 10% in the past year

Investors had many questions about the debt levels of the Adani Group after the Hindenburg report. Most of the debt on its books has been due to the massive capex it undertook in the past ten years. Adani Group had a net debt of Rs 1,72,000 crore at the end of FY23 and has reduced it by around 10% in FY24 to Rs 1,55,000 crore. The group has repaid the debt held by Indian banks and domestic bondholders. It simultaneously raised capital from the offshore bond market, which is comparatively cheaper.

The overall net debt of Adani Group declines in FY24

The conglomerate halted its expansion spree in FY24 due to difficulty in raising debt. Now the group plans to slowly increase its capex spending, with plans to spend around $90 billion in capex over the next ten years. At the end of FY23, Adani Group’s Net Debt to EBITDA ratio was at 3.2; it has come down to 1.9 at the end of FY24.

EBITDA and net profit of Adani firms increase by over 50% in the past year

The conglomerate reported an EBITDA increase of 55% YoY in FY24. While Adani Power, ACC, and Ambuja Cements EBITDA grew on the back of the lower cost of fuel, Adani Port’s margin growth was driven by volumes. Adani Enterprises on the contrary reported lower inventory helping boost the overall margins. Adani Ports has been vital in shipments of coal to its group companies. The vertical integration of group firms has helped in building significant synergies. For instance, the Adani Group plans to use its ports for the transportation of cement from Gujarat to South India.

EBITDA increases for Adani Group firms in FY24

The profit growth has been led by lower finance costs. The group has shifted significant debt from rupee to dollar denominations. The resulting lower cost of funds has driven the overall profitability. The group’s firms reported a profit growth of 68.1% in FY24.

Adani Group companies see rising profitability in FY24

Political uncertainty is the biggest threat to the group

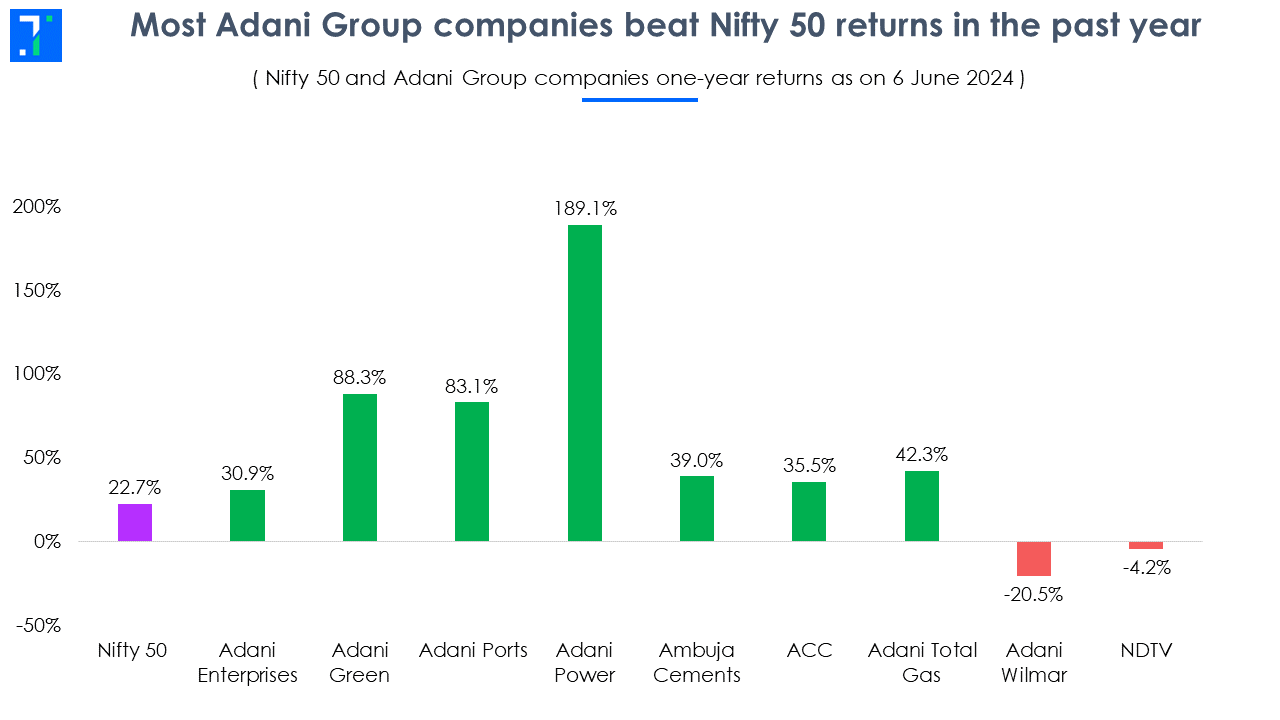

The surge in Adani group firms has been backed by rising investor confidence. Foreign institutional investors' holdings have gone up post the Hindenburg event. For instance, Adani Power’s FII holding has increased by 300 bps to 15.9% from December 2022 to March 2024. Most of the Adani Group stocks have beaten the broader Nifty 50 in the past years.

Most Adani Group companies beat Nifty 50 returns in the past year

Adani Group’s joint venture partner Total Energies has agreed to invest in a port development in Sri Lanka. The project is partly financed by the US government-backed Development Finance Corporation (DFC). While the US government's backing move was primarily driven by politics, it indicates that the Hindenburg report is in the rear-view mirror for most governments and investors.

With the BJP-led NDA gaining a thin majority in the general elections, the government will be in a less comfortable position in the next five years. The Congress-led INDIA alliance has been vocal about Adani’s relationship with Modi and the ruling party. If Congress-led INDIA topples the incumbent government, then a political witch-hunt might hamper Adani’s growth story. This was quite evident in investor sentiments before and after the election counting process. The group will have to navigate the changing political landscape in India over the next few years.