By Trendlyne Analysis

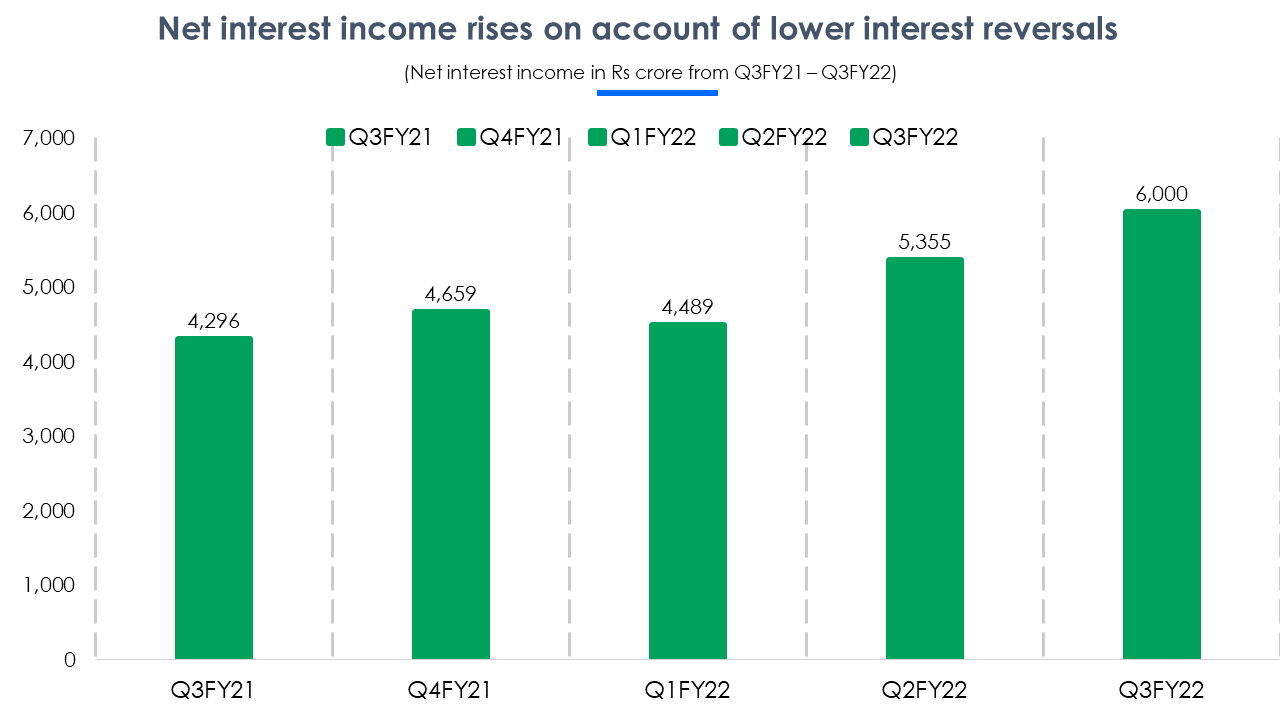

The market was anticipating a stellar Q3FY22 performance from Bajaj Finance. Analysts predicted robust numbers based on the company’s quarterly operational update. And boy did the company deliver. At a time, when NBFCs were still coping with growth challenges, Bajaj Finance’s net profits rose 85.5% YoY to Rs 2,125 crore with net interest income rising 40% YoY to Rs 6,000 crore.

This non-banking finance company (NBFC) began its journey of recovery in Q2FY22 and the current quarter saw its profits and business growth return to pre-Covid levels. Asset quality improved with a corresponding increase in assets under management.

AUM growth for the company is impressive as loan disbursements in Q3FY22 grew 23% YoY to 74.4 million. This led to a 23% YoY growth in its consolidated AUM to Rs 1.81 lakh crore.

The company’s management is wary of a severe third-wave, but predicts that if this wave of the pandemic wanes quickly, business will continue to keep momentum. This is because Bajaj Finance’s asset quality has shown remarkable improvement since the beginning of FY22. In Q3FY22, gross NPA ratio fell 72 bps QoQ to 1.73%, while net NPA by 32 bps to 0.78%.

The maximum contribution to the rise in AUM was by the mortgage lending segment. In Q3FY22, AUM for mortgage lending stands at Rs 58,304 crore Q3FY22 compared to Rs 46,758 crore in Q3FY21. Slippages or stage 1 NPA numbers are basically an indication of a loan becoming an NPA. This number reduced drastically for the company in FY22. In Q3FY22, slippage numbers are at Rs 3,972 crore whereas, the number was as high as Rs 29,273 crore in Q1FY22. This is an important metric as it helps understand how the company’s asset quality is maintained.

Mortgage lending contributes the maximum to AUM mix

Mortgage lending continues to thrive with a 25% YoY increase to Rs 58,304 crore. It constitutes 32% of the total AUM for Q3FY22. In terms of percentage growth, AUM for loan against securities grew the most at 80% YoY to Rs 9,127 crore, increasing its contribution to 5% of the total AUM from 4% in Q2FY22. This is followed by the rural B2B segment with 64% YoY growth to Rs 3,993 crore.

The share of the consumer business remains steady but auto finance AUM fell 16.4% YoY to Rs 10,620 crore. Consumer B2C loans continue to grow due to rising online shopping as the segment records a 25% YoY increase in AUM to Rs 36,344 crore.

Consumer B2B loans also fared extremely well in Q3FY22 growing at 46% YoY to Rs 14,920 crore. Bajaj Finance’s consumer and rural B2C segments comprise consumer durable loans, EMI cards, personal loan, gold loans, and salaried personal loan among others.

Rural business (both B2B and B2C), small and medium enterprise lending, and commercial lending also showed decent growth during the quarter. Bajaj Finance’s rural B2B and B2C, and SME lending segments combined, consist of 23% of the total business mix, indicating that there is room for growth in rural markets.

Auto industry sales were tepid over Q3FY22 and that led to Bajaj Finance’s auto finance business taking a hit. With the ongoing third wave of the pandemic and government restrictions in force in some states, the revival of the auto industry is going to be slow. This will probably mean that a meaningful revival in auto sales will be pushed forward to FY23. The management plans to tackle this problem by launching a new digital app to disburse two-wheeler loans, hoping to reach a wider customer base and improve auto finance sales.

Net interest income for Q3FY22 shows a decent growth of 40% YoY to Rs 6,000 crore as there was a reduction in interest reversal to Rs 241 crore from Rs 322 crore in Q2FY22. The management expects this number to further reduce to pre-Covid levels in Q4FY22 to Rs 180-200 crore.

Conservative provisioning, but a decent growth in profits

The management is a little conservative on the provisioning bit as the third wave of the pandemic is raging. The company’s provisions were significantly reduced by 22% YoY to Rs 1,051 crore. With no adverse impacts of the third wave, the management plans to reduce provisions further in FY23.

Net interest income rose 40% YoY to Rs 6,000 crore and NPAs are down, while cost of funds is down 5 bps to 6.72% in Q3FY22.

NPAs continue to fall even after Bajaj Finance implements RBI’s new norms on NPA classification

Although the new NPA norms kick in from March 31, 2022, Bajaj Finance decided to tweak their accounting books according to the new rules drafted by RBI. While reports did suggest that the new NPA norms might lead to an increase in bad loans, Bajaj Finance proved them wrong.

Bajaj Finance’s asset quality improved quite a bit on a QoQ basis as its net NPA ratio fell 32 bps. According to analysts and the company’s management, these numbers are back to pre-Covid levels. So some semblance of normalcy has returned to the business.

FY22 was a rough start for Bajaj Finance but the company’s NPA has been falling since. Even RBI’s new norms of NPA classification led to no negative impact on the numbers and gross NPAs significantly reduced.

Digitalization initiatives and the roadmap ahead

The digital initiatives do not excite some brokerages, such as HDFC Securities. It recently downgraded its rating for Bajaj Finance to 'Sell'. The reason the analysts offered is that they want to see some evidence of progress in the management’s digital initiatives, which is in its second phase of expansion. Bajaj Finance management says that phase-1 of digital transformation rolled out smoothly and the app is currently used by 1.65 crore customers. The company expects to add 80-90 lakh more customers once phase-2 goes live this week.

New loan origination numbers are still below pre-Covid levels and the company is strategizing to deal with the problem head-on. The management is positive regarding further growth of business in Q4FY22 – January 2022 numbers to date look promising, and currently, there is no impact of the third wave of the pandemic on business momentum. There will however be better clarity on this once the January default rates, and collection efficiencies numbers emerge. For now, the company expects volumes to increase and bounce rates to stabilize in FY22.