Hero Motocorp has been the worst affected company among the top three listed two-wheeler manufacturers due to the rural slowdown and raw material price inflation. Its stock touched its 52-week low on December 2, 2021 after its November wholesale volumes declined 41% YoY to 3,49,393 units. This is the steepest fall in wholesale volume compared to close peers like Bajaj Auto (BAL) and TVS Motor. The slump in demand has exposed HMCL’s lower export contribution to its total wholesale mix. With a third coronavirus wave potentially looming due to a new variant, investors are left wondering how the world’s largest two-wheeler manufacturer (by volume) will deal with these headwinds. As nearly 50% of its revenues come from rural areas, a revival in demand in the region, which accounts for 50% of its revenue mix, is key to improving Hero MotoCorp’s future prospects.

Quick Takes

- Hero MotoCorp expects its premium motorcycle segment to achieve a 10% market share by March 2022

- After a price increase of Rs 2,200 in Q2FY22, Hero MotoCorp is going for another price hike of Rs 2,000 in January 2022 to offset the impact of commodity price inflation

- With the upward revision in prices, operating margins are expected to improve in Q3FY22

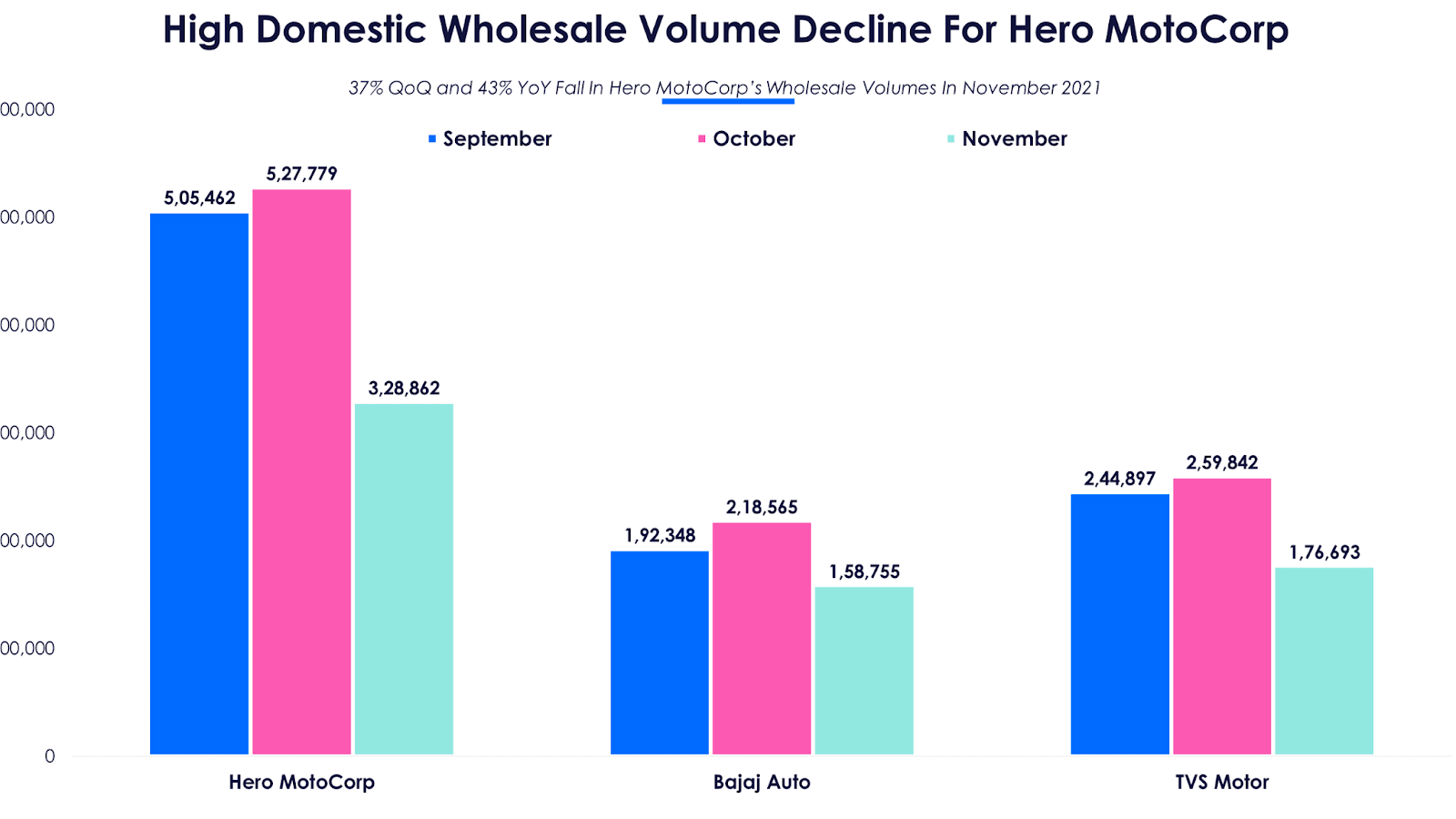

- Aggregate October-November 2021 domestic wholesale volumes fell 37% YoY, Q3FY22 is expected to report a high volume decline

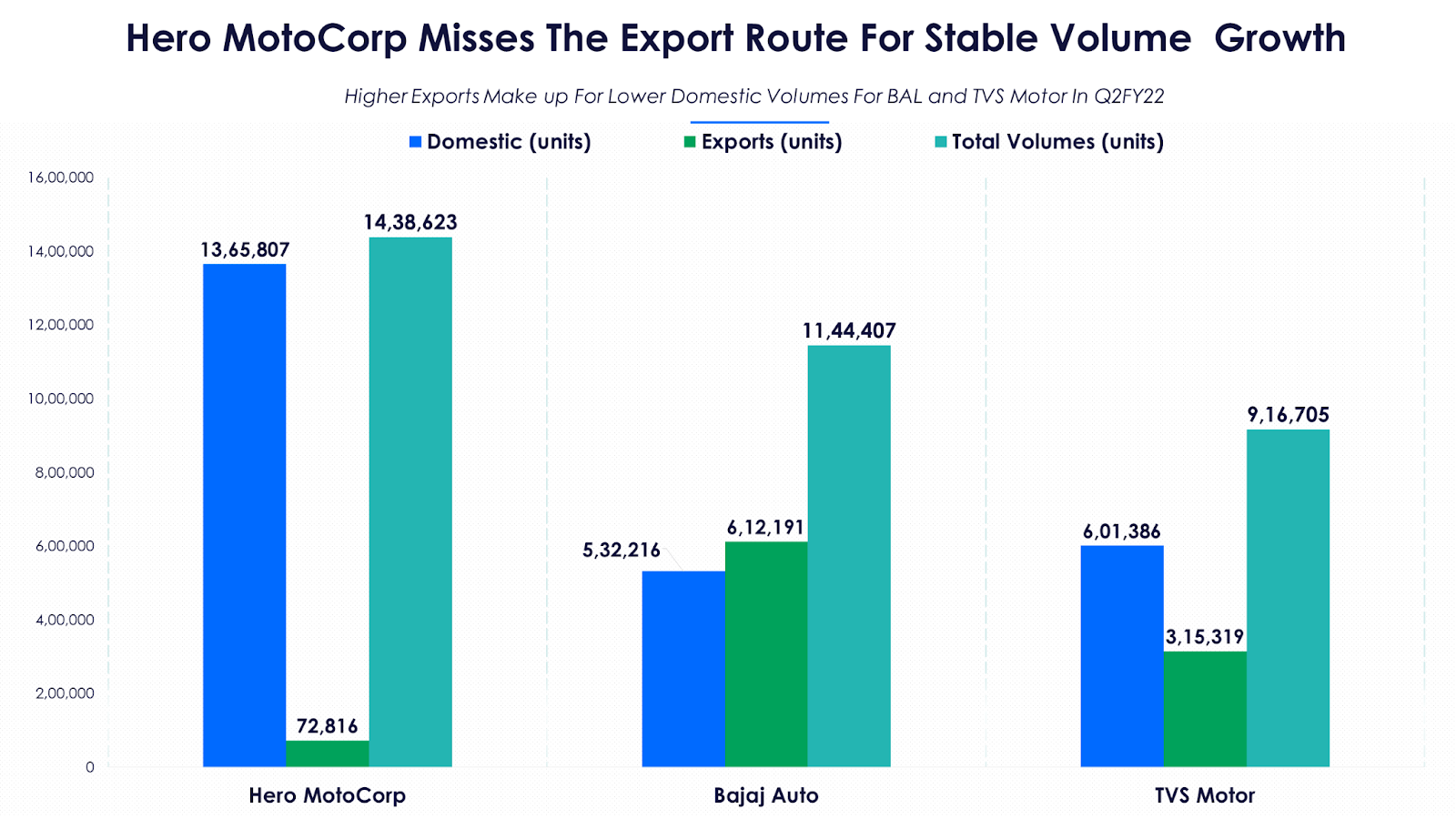

- Hero MotoCorp’s export revenue contribution stands at 5% compared to BAL’s and TVS Motor’s 53% and 34% respectively in Q2FY22

Lower realisations and negligible exports drag growth

Hero MotoCorp reported volumes of 14.4 lakh units in the September 2021 quarter, the highest in the Indian two-wheeler space. However, it reported a subdued set of financials, with revenues and net profit growth taking a hit. Close peers BAL and TVS Motor were better off in Q2FY22 despite lower volumes, because of higher realisations per unit compared to HMCL. HMCL’s topline was dented due to a 20% volume decline in the September 2021 quarter.

HMCL derives 95% of its revenues from the domestic market with exports contributing to the rest. The company’s domestic volumes are 2.5 times higher than both BAL and TVS Motor individually. But it’s the export volumes that helped both BAL and TVS Motors make up for their lower domestic wholesales. BAL’s export contribution to total revenues stands at nearly 53% while TVS Motor garnered 34% from exports in Q2FY22.

In addition to a resilient export revenue source, a diversified revenue mix also helps limit the impact of headwinds in the domestic market. While Bajaj Auto has three-wheelers and small commercial vehicles (quadricycles) in its product mix, TVS Motor has three-wheelers and mopeds.

In addition to a resilient export revenue source, a diversified revenue mix also helps limit the impact of headwinds in the domestic market. While Bajaj Auto has three-wheelers and small commercial vehicles (quadricycles) in its product mix, TVS Motor has three-wheelers and mopeds.

Both Bajaj Auto and TVS Motor have a strong presence in the premium motorcycle market. BAL is the market leader in the premium motorcycle segment (more than 50% market share) and TVS Motor’s market-share is around 20%, while Hero MotoCorp is around 4%. Higher share of premiumisation of product mix leads to higher realisation per unit and higher topline as premium motorcycles are priced nearly double or even higher than that of commuter (entry level) bikes.

Thus, the largest two-wheeler manufacturer in the world reported lower operating revenues at Rs 8,453 crore, 4% lower than Bajaj Auto at Rs 8,762 crore in Q2FY22. Hero MotoCorp’s underperformance is the result of lower exports, low single-digit market share in the premium motorcycle segment, scooters constituting just 7% of total volumes and most significantly, high dependence on rural India.

Rural slowdown impacts Hero’s growth trajectory

The total cost of ownership of a two-wheeler increased roughly 40% over the past three years. This was due to implementation of BSVI, mandatory anti-lock braking system (ABS), hike in insurance rates, increase in fuel prices and GST which impacted two-wheeler demand in India. Middle class and weak socio-economic sections largely dependent on two-wheelers (entry segment) for their daily mobility needs were badly hit by the Covid-19 second wave. Job losses and the closure of small businesses deeply impacted rural and semi-urban India. After the second wave, the unemployment rate in rural India rose to 14% in May 2021. Though the unemployment rate was almost halved by November 2021, consumer sentiment took a deep hit with a lack of credit availability and rickety health infrastructure in rural areas.

The first wave of Covid-19 infections brought with it certain tailwinds like preference for personal mobility and pent-up demand visible in the July-November period in 2020. But higher input costs passed on by original equipment manufacturers (OEMs) and inflationary headwinds contracting household earnings doused any kind of festive demand resurgence in 2021. Vinkesh Gulati, President, Federation of Automobile Dealers Associations (FADA), said that rural India exhibited distress in lower two-wheeler volumes in festive season, due to frequent price hikes, fuel price hikes and customers conserving funds for healthcare emergencies. He added that the two-wheeler segment continues to face the brunt of low sales with the entry level category being the biggest spoilsport.

Thus Hero MotoCorp, with its 50% revenues from rural India, and 70% from the highly price-conscious entry motorcycle segment (100-110cc), is in trouble. It reported the highest fall in wholesale volumes in November 2021 among the top three listed two-wheeler manufacturers on December 1, 2021. BAL dethroned HMCL as the largest two-wheeler manufacturer in November 2021. Subsequently, Hero MotoCorp's stock price touched its 52-week low on December 2.

In addition to weak rural demand, volumes fell on a YoY basis due to a high base during September-November 2020. HMCL had reported its highest-ever monthly wholesale volumes in September-November 2020 (7-8 lakh units per month) driven by pent demand and festive fervor. OEMs dispatching a high number of vehicles to dealers in anticipation of similar festive zeal in 2021 also contributed to double-digit wholesale volume fall of the two-wheeler sector.

Economy on the mend, investors hope for Hero’s recovery

The Indian economy is definitely on the upswing with key high-frequency indicators (HFIs) like e-way bills, rail freight traffic, merchandise exports, power consumption, coal production, toll collection, tractor sales, etc above pre-pandemic levels.

But the auto sector’s volumes are yet to reach pre-pandemic levels seen in 2018 or 2019. According to Naveen Chauhan, Head Sales, Hero MotoCorp, the two-wheeler industry will take another year to go back to the pre-pandemic levels of FY19. Though two-wheeler wholesale numbers (September-November 2021) were subdued, retail sales in November 2021 indicate a semblance of a recovery.

In urban India, the scooter is a unisex vehicle catering to the mobility needs of the entire family. Thus, scooters are replacing entry/executive level motorcycles in urban & semi-urban regions. The company needs a ‘Splendor’ in the scooter category to combat Honda’s Activa and Dio, and TVS’ Jupiter and Ntorq 125. HMCL’s current market share in the scooter segment stands at 10% which needs to be increased aggressively to diversify Hero MotoCorp’s revenue stream.

Exports (Rs 72,816 crore) stand at 5% of the revenue mix and are growing strongly on a small base. Exports were up 74% YoY in Q2FY22. Though HMCL is present in more than 40 countries, the company is mainly focussing on 9-10 countries to increase its export growth momentum in the near term.

Hero MotoCorp aims to attain a 10% market share in the premium segment by March 2022. In the premium segment, HMCL launched Xtreme 160R Stealth and XPulse 200 in Q2FY22. The company is also working on a Hero-Harley Davidson product, but no timeline is outlined for the joint product launch.

Lastly, to augment its entry-level volumes and tap into lower-income group customers, HMCL increased its finance penetration through its associate company, Hero FinCorp (NBFC). Retail finance penetration increased from 50% in Q2FY21 to 55% in the September 2021 quarter. As NBFCs and banks reduce their exposures to the two-wheeler sector due to rising NPAs, captive finance units like Hero FinCorp help OEMs to maintain sales during a down-cycle. Hero MotoCorp is increasing finance penetration for its entry-level segment among customers with low banking habits through the ‘Suvidha scheme’ (no bank cheque) and customized Kisan EMI and balloon EMI schemes for farmers and seasonal workers.

Covid-19 disruption continues with Omicron

Though estimated to be less deadly than Delta (lower probability of hospitalization), the Omicron variant is expected to spread by January-February 2022. Night curfews and restrictions are already announced in some states. This can be ominous for the auto sector, which is already reeling under commodity price inflation and semiconductor chip shortages. Speaking on the Omicron impact, FADA president Gulati said that the two-wheeler industry, already facing headwinds, will further go into a slump if the third wave becomes a reality.

After being severely hit by the second wave, rural India could further reduce its propensity to spend if Omicron hits the economy. As visible from a muted festive season, there is already no pent-up demand, inflation and income erosion is taking their toll and cash conservation for health emergencies is a prime priority for households now. Hero MotoCorp is the most vulnerable among listed two-wheeler manufacturers. The company announced a price increase of Rs 2,000 from January 2022. The December 2021 quarter will be another low volume quarter and decent demand is expected again only by Q1FY23. OEMs will have to find ways to ride the pandemic out or wait till Covid-19 becomes history.