By Ketan Sonalkar

The pandemic woke many people up to the importance of life cover in FY21 and has changed the dynamics of the life insurance industry. Not only did most life insurance companies issue the highest number of new policies during the last financial year, but they also settled a huge number of claims due to Covid-19. The pandemic also led life …

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

Subscriber exclusive for you. Click here to read.

This is a premium article. Click here to read.

The pandemic woke many people up to the importance of life cover in FY21 and has changed the dynamics of the life insurance industry. Not only did most life insurance companies issue the highest number of new policies during the last financial year, but they also settled a huge number of claims due to Covid-19. The pandemic also led life insurers to adopt digital strategies to offer online solutions to customers even during lockdowns.

The oft-repeated truism about the Indian life insurance space is that it’s an underpenetrated market with vast potential for future growth. There are four listed players and HDFC Life Insurance is the leader in terms of market capitalisation. This is soon going to change with the IPO of LIC (Life Insurance Corporation), India’s oldest government-owned life insurance company, with a market share of 50%. LIC’s IPO is going to be one of the biggest this year.

HDFC Life’s acquisition of Exide Life shows that consolidation is taking place in this highly competitive sector. This is only the opening salvo and there will be many more deals that might happen in the future in an extremely competitive industry.

Quick Takes

-

HDFC Life’s board approved the acquisition of 100% share capital of Exide Life Insurance for a total consideration of Rs 6,687 crore on September 3, 2021

-

Out of this, Rs 726 crore will be payable in cash and the balance by issuing 8.7 crore equity shares of HDFC Life to Exide Industries at a price of Rs 685 per share

-

After completion of the deal, Exide Industries will hold 4.1% stake in HDFC Life, and these shares will be locked in for a year

-

This is one of the largest acquisitions in India’s life insurance space, which has a total of 23 private insurers

-

With this acquisition, HDFC Life’s market share will rise by 1.4% in a highly competitive industry

HDFC Life gets second time lucky and Exide Life changes ownership third time

This is the second time HDFC Life has tried to acquire a competitor. HDFC Life earlier intended to acquire Max Life Insurance, but the deal did not go through because of regulatory hurdles.

Exide Life has changed hands before. It started off in 2000 as ING Vysya Life Insurance Company Limited. In 2014, Exide Industries, a battery manufacturer bought a 26% stake in the company from ING Group. Since then, Exide Industries has neither been able to significantly increase its market share nor justify the diversification from automotive batteries.

Given this background, investors need to understand the long-term and short-term consequences of HDFC Life’s acquisition of Exide Life.

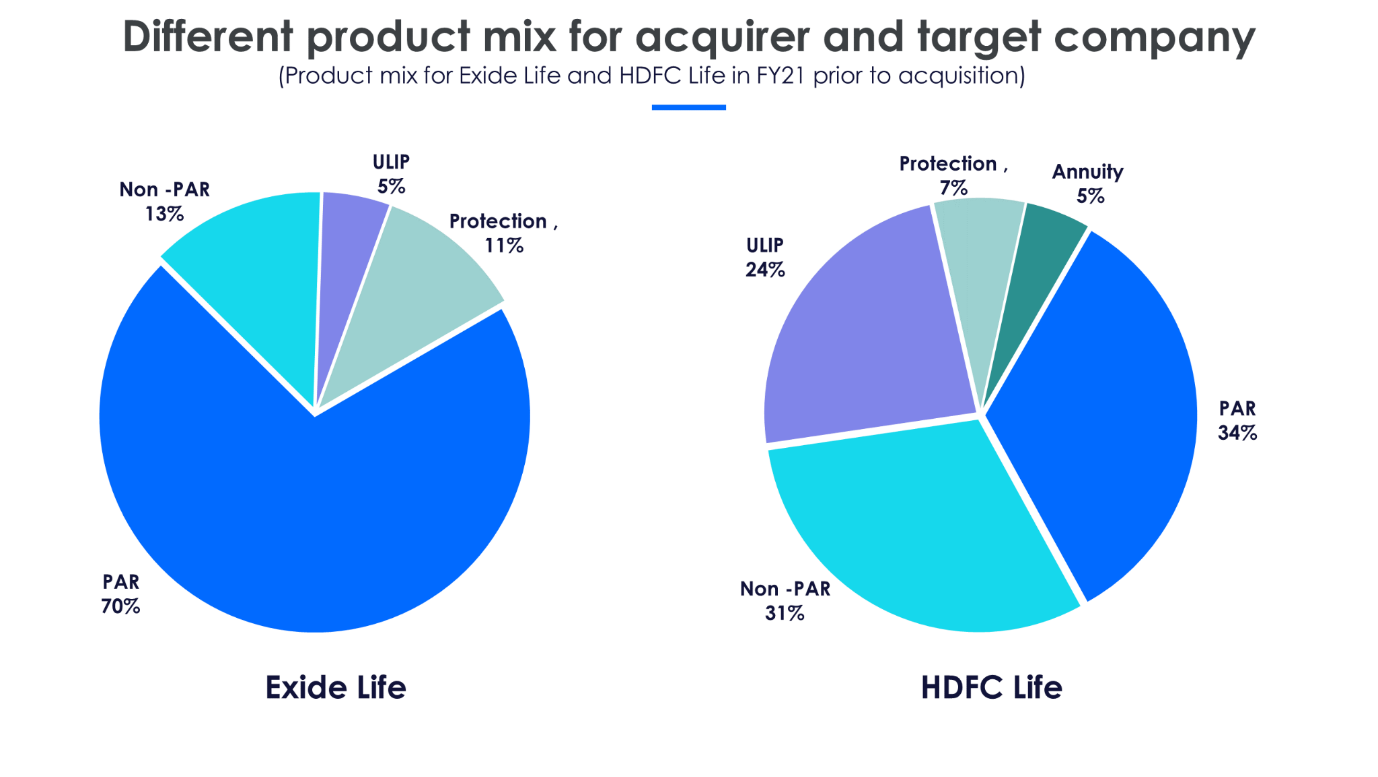

There is a big difference in the product mix of both the insurers. Exide Life is heavily dependent on participating (par) policies followed by protection. HDFC Life has a near equal mix of par as well as non-participating (non-par), with a quarter of the revenues coming from ULIPs (Unit Linked Insurance Policies).

A participating (par) insurance policy provides both guaranteed and non-guaranteed benefits. Par policies allow policyholders to share in the profit of the par fund and this comes in the form of bonuses or cash dividends. A non-participating (non-par) policy typically provides guaranteed benefits.

According to the management of HDFC Life, there are three key reasons which make Exide Life a suitable target for acquisition. First, HDFC Life is aggressively adding numbers to its agency channel. It added 20% new agencies to its existing base in FY21. However, they felt a saturation point was reached as far as organic growth of the agency channel was concerned. Addition of Exide Life’s agencies gives HDFC Life another 40% more agencies and is seen as a favourable inorganic growth opportunity.

Second, validation of Exide Life’s business by internal and external auditors confirmed the business as suitable for acquisition. The third reason is that HDFC Life perceives the work culture and ethos of Exide Life as similar to its own, and expects the transition to be cohesive post-integration.

Most market analysts believe that the deal is overvalued as it values Exide Life Insurance at about 2.5 times the price to embedded value. HDFC Life’s rationale for the deal is that Exide Life’s value is at a discount of 30% of the embedded value of other listed life insurance players.

While digital selling of insurance is gaining momentum, the life insurance industry requires an agency channel in smaller geographies to service customers. HDFC Life is focused on expanding its reach by building agency channels and has over 1,00,000 advisors. The Exide Life acquisition gives it access to 40,000 more. The agency channel is the highest contributor to Exide Life’s revenues. This bodes well for HDFC Life.

With the acquisition, HDFC Life gets the additional infrastructure of branches, networks, and products to scale up the overall premium under the combined network. Bancassurance is a strong channel for HDFC Life. It has spoken about growing its agency channel and now with this transaction, the agency channel will get a boost giving it two strong modes of distribution as far as its products are concerned.

Exide Life’s industry-specific ratios an immediate concern

Persistency ratio is the proportion of policyholders who continue to pay their renewal premium and is an important metric in the insurance business. HDFC Life has a higher persistency ratio compared to Exide Life. One of the challenges post-acquisition would be to get the persistency ratio of existing policyholders of Exide Life in line with HDFC Life’s ratio.

With technology playing a major role in the industry, data analytics, artificial intelligence, etc. can be used to gain meaningful insights into the customer base of Exide Life. Analytics run on products of Exide Life can help define a wider suite of products in the merged entity.

One thing that might concern investors of HDFC Life is Exide Life's cost structure. It is quite high compared to HDFC Life or any other well-established players. There are two key parameters, ratio of expenses of management and commission ratio that determine the cost efficiency of any life insurance player.

While the management cost would be rationalised post the merger, it is expected that HDFC Life would reduce the high commission structure of Exide Life over a period of time.

Exide Industries wanted to exit the life insurance business for a long time and was looking for a suitable buyer. It got a better-than-expected exit deal. There is speculation that Exide Industries will use the proceeds received in cash towards funding the expansion of a plant that will make batteries for electric vehicles. This will be an expansion of its core business.

HDFC Life, on the other hand, acquired Exide Life for its strengths in the agency channel as well as to help it enter underpenetrated markets of South India, particularly deepening its reach into tier-2 and tier-3 cities of south India. It also increases its market share by 1.4% in a highly competitive market. While the complete amalgamation will take a couple of quarters, the merged HDFC Life entity will be stronger in maintaining its leadership position in the private life insurers space in the long term.