Q1FY23 is significant for the life insurance sector. This is the first quarter of the new financial year which will likely not be impacted due to Covid-19-related claims. In the past two financial years, mortality claims rose due to the pandemic which forced insurance companies to rework their calculations and even resulted in higher reinsurance costs.

Life insurers’ profits were hurt over the past couple of years due to the pandemic, and their profitability was highly affected. What began with unusually high mortality claims in FY21, escalated in FY22 with even higher death claims due to the second wave of the Covid-19 pandemic. This forced all life insurance companies to make additional claim provisions through FY22. Against this background, FY23 is expected to be much smoother and HDFC Life, one of the top three private life insurance companies in India, has announced Q1FY23 results that suggest that the industry is likely to see a new phase of growth from here.

Quick Takes

- APE (annualised premium equivalent) grew YoY by 22% to a total of Rs 1,900 crore in Q1FY23

- VNB (value of new business) grew YoY by 25% in Q1FY23 and VNB margins increased to 26.8%

- Persistency ratios improved across all time periods in Q1FY23

- Highest growth came from the protection segment with 31% growth in APE

- Net profit stood at Rs. 365 crore, up 21% YoY growth in Q1FY23

Healthy premium growth across product segments

HDFC Life’s profit surged 21% YoY to Rs 365 crore in Q1FY23. Although profit is an important metric for investors to look at, for a life insurance business certain industry-specific metrics are key. Two of these are APE and VNB. APE is the sum of the initial premium on new policies, plus 10% of the total premium received on new single-premium policies sold. VNB represents the additional profits expected to be generated through the new policies issued in a particular time period.

The total APEs of HDFC Life in Q1FY23 came in from different product categories. Majority of new policies issued this quarter belong to the “traditional” par and non-par products which essentially offer a savings benefit along with life insurance. These accounted for more than 50% in Q1FY23.

While the traditional plans generated higher sales, VNB, or higher profitability came from protection and annuity segments.

The protection segment is policies that are purely protection-oriented term plans. The annuity segment includes products that give an annual payout after a certain period of paying premiums.

The company’s Managing Director and CEO Vibha Padalkar said the product mix remains balanced, with non-par savings at 35%, participating products at 30%, ULIPs at 25%, individual protection at 5%, and annuity at 6%, based on individual APE.

After the past two years of the pandemic, there is growing customer interest in purchasing protection as well as annuity plans. This is also true in the case of HDFC Life, wherein the APE contribution from these two product categories is rising.

APE is rising YoY for almost all product categories. While the contribution to group savings remained constant, there was a higher percentage rise in protection (or term insurance) and annuity categories which saw their APE rise YoY by 28% and 44%, respectively. This increase is due to the higher awareness for protection, given the increase in perceived mortality risk during the second wave of the pandemic. Annuity APE also grew as people were looking for an income beyond the period of a life cover.

APE is rising YoY for almost all product categories. While the contribution to group savings remained constant, there was a higher percentage rise in protection (or term insurance) and annuity categories which saw their APE rise YoY by 28% and 44%, respectively. This increase is due to the higher awareness for protection, given the increase in perceived mortality risk during the second wave of the pandemic. Annuity APE also grew as people were looking for an income beyond the period of a life cover.

Padalkar said that the company continues to maintain a consistent growth trajectory, growing by 22% in terms of overall APE. This has enabled HDFC Life to maintain its top 3 status as a life insurer across individual and group businesses.

The distribution strategy of HDFC Life in the past relied heavily on using the reach of its group firm HDFC Bank. However, it also included many other banks over time including Bandhan Bank, IDFC First Bank, Yes Bank, AU Small Finance Bank, etc. which have only strengthened the bancassurance channel.

The distribution strategy of HDFC Life in the past relied heavily on using the reach of its group firm HDFC Bank. However, it also included many other banks over time including Bandhan Bank, IDFC First Bank, Yes Bank, AU Small Finance Bank, etc. which have only strengthened the bancassurance channel.

Over the past few years, HDFC Life diversified its sales channel across agency, direct, and brokers. Agency includes individual agents, and over the past few quarters, agents belonging to Exide Life were added to this as well. The total strength is around 1.2 lakh agents, with 9,500 added in Q1FY23.

Higher awareness of insurance drives growth across channels and products

Due to the pandemic, the digital channel received an impetus across the insurance industry, and HDFC Life put in efforts for the seamless issue of policies via its website. Besides the regular channels, a lot of new-age fintech start-ups offer life insurance, and contribute to the growth of brokers & online channels, like Phone Pe, Fisdom, Cover Fox etc.

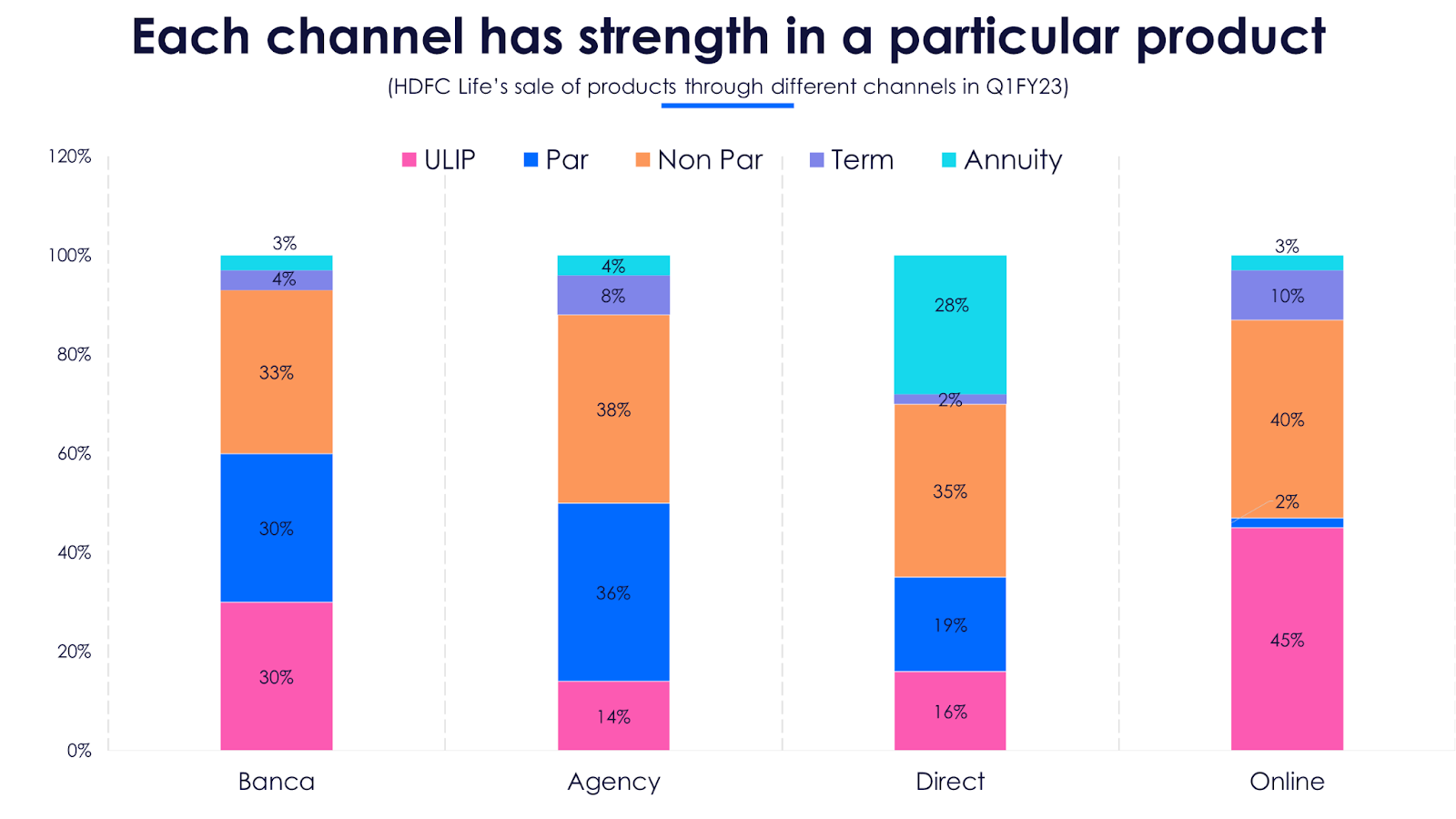

The addition of online distribution channels not only helped grow its product sales but also created strength in each of the channels for a particular product segment. The bancassurance and agency channels witnessed higher sales of traditional products like the par and non-par policies, which are oriented towards a saving component along with insurance.

The addition of online distribution channels not only helped grow its product sales but also created strength in each of the channels for a particular product segment. The bancassurance and agency channels witnessed higher sales of traditional products like the par and non-par policies, which are oriented towards a saving component along with insurance.

Online channels like Paytm contribute a major part to unit-linked policies, in which customers also expect to grow their investments via market-linked instruments in addition to a life cover. The direct channel, which is essentially the company’s website, saw higher sales of Annuity plans after it launched the Jeevan Sanchay Annuity plans in Q3FY22.

One interesting trend that emerged in Q1FY23 was that the average tenure of policies in each product category is up. This in turn translates to higher premium-paying years for policies.

ULIP, par(participating), and health policies saw the average tenure rise by a year or two to 13 years in ULIP, and 26 in health. The biggest change was in the protection category with the average tenure rising by six years to 39 years.

ULIP, par(participating), and health policies saw the average tenure rise by a year or two to 13 years in ULIP, and 26 in health. The biggest change was in the protection category with the average tenure rising by six years to 39 years.

This is again a reflection of growing customer interest in pure protection plans (plain term insurance policies) after the pandemic.

Various metrics including persistency show Q1FY23 was a good quarter

Persistency ratio is the percentage of customers who renew their policies in a particular time frame. Higher persistency ratio indicates that a higher number of policyholders are paying their annual/quarterly premiums.

In Q1FY23, the persistency ratios for HDFC Life were higher across all the time periods, with 13th, 25th and 37th the more important ones. This was also largely driven by the digital initiatives taken by the company which automated the messages to customers regarding renewals.

Other key metrics where HDFC Life fared well was its solvency ratio, which stood at 178% and embedded value or EV which stood at around Rs 30,000 crore, and the EVOP (embedded value operating profit) which stood at 16.5%.

Other key metrics where HDFC Life fared well was its solvency ratio, which stood at 178% and embedded value or EV which stood at around Rs 30,000 crore, and the EVOP (embedded value operating profit) which stood at 16.5%.

Competition intensifies in the life insurance sector

A major event for the insurance industry in Q1FY23 was the listing of India’s largest life insurance company, the state-owned Life Insurance Corporation of India. This was also one of the biggest ever IPOs in the Indian stock market. Though LIC's major contribution (90%) comes from the agency channel, diversification of distribution channels including a digital strategy by LIC could end up lowering the market share of private insurers like HDFC Life and ICICI Prudential Life Insurance.

HDFC Life, as a strategy for growth, announced the acquisition of Exide Life insurance in September 2022. Since then it has received approvals from most of the regulatory authorities Including the NCLT. Right now Exide Life is a subsidiary of HDFC Life and the final regulatory approval from the IRDAI is awaited. According to the management, this approval should be through H2FY23.

ICICI Prudential Life, which released its Q1FY23 results a few days before HDFC Life, delivered a better performance with a 24.7% growth in APEs and VNB margins of 31.6%. While HDFC LIfe’s Q1FY23 numbers look decent, it remains to be seen how it compares with other players, including the market leader LIC.

Though a post-pandemic world is promising for life insurance companies, investors need to take a careful call on which of the companies from this sector is likely to outperform in the long term