With India entering another lockdown in Q1FY22, the automotive industry is in a fix. Many automobile original equipment manufacturers (OEMs) shut down plants or were forced to reduce production because of lockdowns.

One of them is Eicher Motors (Eicher), which makes owns the motorcycle maker Royal Enfield (RE). Through its material subsidiary Volvo Eicher Commercial Vehicles (VECV) (54.4% stake), Eicher is also present in the commercial vehicles (CVs) industry.

Eicher Motors earns over 90% of its revenues from Royal Enfield and the rest from VECV. While Royal Enfield sales are expected to be weak in Q1FY22 due to staggered production at its plants, VECV sales have been promising since the economy unlocked last year. In FY21, VECV’s wholesales were lower by 12% because of a 64% drop in bus wholesales. However, in the second half of FY21, commercial vehicle wholesales have improved. RE wholesales fell by 12% because of a 13% drop in domestic wholesale. Will the CV segment, which contributes 10% of Eicher’s profits, make up for the slump in RE? Let’s take a look.

Revenue inches higher, but net profits dip sequentially in Q4

In Q4FY21, Eicher’s revenues rose by 34% YoY to Rs 2,931 crore. This was due to a low base in the year ago period, as sales dipped in Q4FY20 because automobile OEMs were transitioning to the Bharat Stage VI (BS VI) emission norms. Eicher’s revenues rose sequentially by 4.3% due to higher RE exports. Net profits were higher by 73% YoY, as interest expenses fell by 29%.

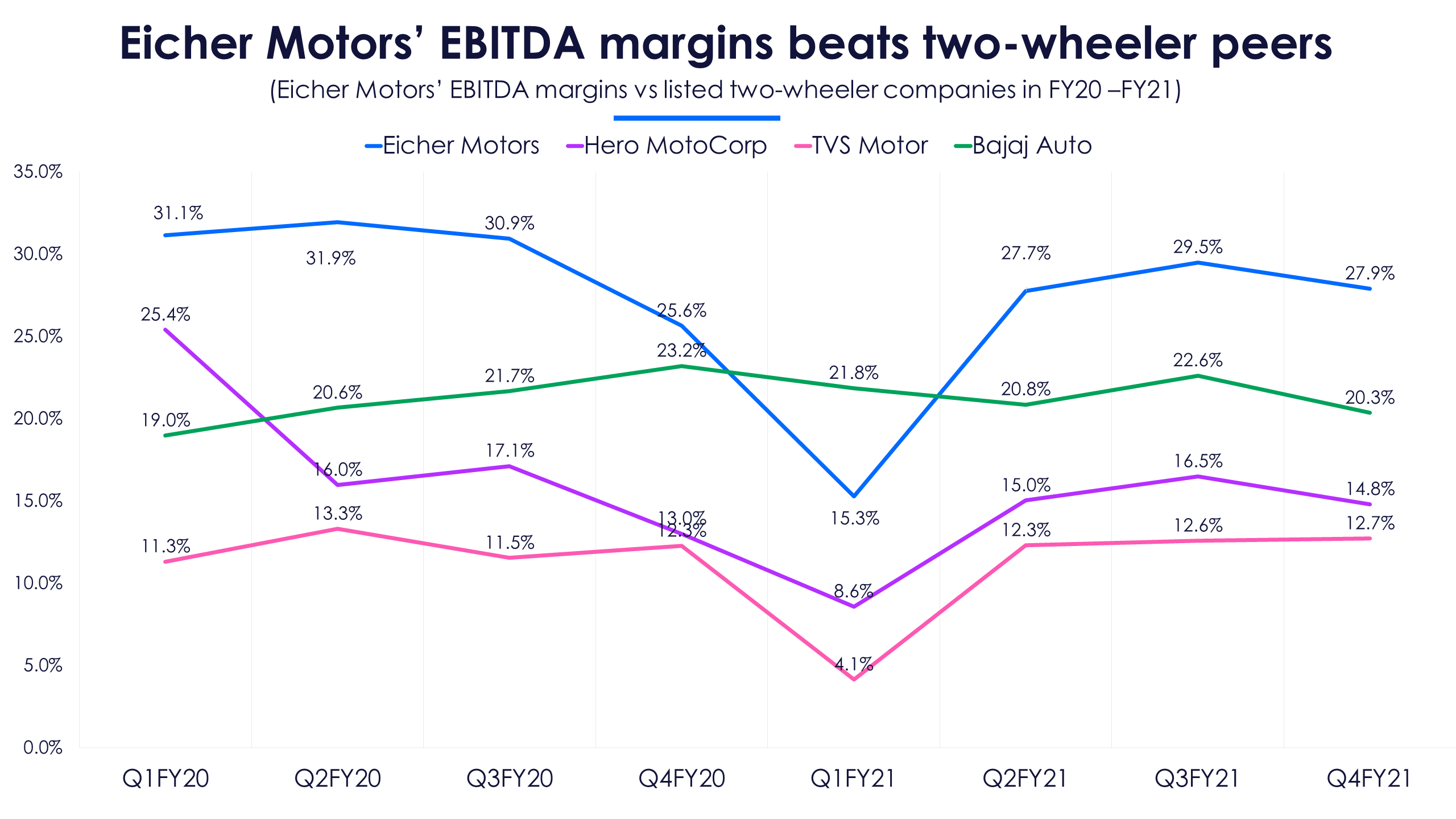

Eicher’s EBITDA margins were 27.9% in Q4, a 230 basis points growth YoY. Margins were lower by 160 basis points sequentially due to rising input costs. RE motorcycles have a higher engine capacity (350-650cc) which requires 35% more commodities (like steel, copper, rhodium, etc.) than two-wheelers with a lower engine capacity (less than 150cc).

To account for rising input costs, Royal Enfield decreased reliance on certain commodities. For instance, in Q4FY21, RE motorcycles reduced consumption of rhodium by two-thirds. This is expected to boost its margins in the short term. However since the company has already stocked up on rhodium, the decrease in rhodium consumption will help its margins only in Q3FY22.

In FY21, Eicher hiked Royal Enfield prices by 9%. In January 2021, it hiked prices again by 3-8% for entry-level and premium bikes. With commodity costs not easing in FY22, RE hiked prices in April 2021. Other two-wheeler makers’ hiked prices in Q4FY21 due to rising input costs as well. Rising input costs lowered two-wheeler OEMs’ margins since Q3FY21. However, Eicher’s margins remain higher than its peers.

Rising export demand and international focus in FY22

After commercial activity recovered in late September 2020, Royal Enfield’s domestic wholesales rose by 2.6x in Q2FY21 against the previous quarter. In Q3FY21, backed by pent-up demand and the festive season, domestic wholesales were 1.8 lakh units, a 3.4% growth YoY and a 28% growth sequentially. In Q4FY21, the sequential growth in domestic wholesales slowed down to 5% QoQ.

In April 2021, fewer than 49,000 RE motorcycles were sold in India, a drop of 19% against March 2021. Two-wheeler OEMs had zero domestic sales in April 2020 due to the nationwide lockdown. This continued in May as just over 20,000 motorcycles were sold, a 60% drop MoM.

Royal Enfield’s exports will be the key to boost sales in FY22. Its exports were 27,180 units in the second half of FY21, a 67% growth YoY and a 2.4x growth against the first half of FY21. In April and May 2021, as several states went into lockdown Eicher’s Royal Enfield motorcycle production at its Chennai plant decreased due to lockdowns. This resulted in domestic wholesales dropping by 19% and 59% in April and May MoM.

In May, exports were 7,221 units, a massive 10x growth YoY and 60% growth MoM. This is despite lockdowns curtailing production domestically. Exports formed 26% of total wholesales in May 2021, an 18 percentage point growth MoM.

The management remains positive on demand momentum in FY22, backed by exports. In the Q4 earnings call, the management said that Royal Enfield has an order backlog for 2-3 months post the reopening of the domestic economy.

The management remains positive on demand momentum in FY22, backed by exports. In the Q4 earnings call, the management said that Royal Enfield has an order backlog for 2-3 months post the reopening of the domestic economy.

Premium bikes to boost domestic volume growth

Domestic demand will be driven by its premium 650cc bikes (Continental GT and Interceptor). The sales for these bikes in early Q1FY22 were low as discretionary spending fell during the lockdown. Among mid-sized cruisers, the Meteor 350 (launched in Q2FY21) is expected to perform well after the lockdown.

Brokerages expect the cruiser to increase sales of its add-on products (customized accessories, motorcycle apparel, etc.) because 90% of Meteor 350 sales are through Royal Enfield’s mobile application. However, the management said it’s facing supply and production challenges due to lockdowns (in Tamil Nadu) causing labour shortage and sourcing alternate inputs. With production in June 2021 likely to be affected by the lockdown, RE’s domestic volumes are expected to drop sequentially and volume growth to pick up in Q1FY22.

Eicher Motors began setting up international Royal Enfield exclusive stores in 2016. This was to promote its premium bikes and increase sales in export markets. Over the years, Royal Enfield has prioritized two regions - South America and Southeast Asia, by setting up over 50 exclusive stores. The management expects low footfall in domestic exclusive stores in Q1FY22 due to the lockdown, similar to the first half of FY21.

Eicher Motors began setting up international Royal Enfield exclusive stores in 2016. This was to promote its premium bikes and increase sales in export markets. Over the years, Royal Enfield has prioritized two regions - South America and Southeast Asia, by setting up over 50 exclusive stores. The management expects low footfall in domestic exclusive stores in Q1FY22 due to the lockdown, similar to the first half of FY21.

In FY22, Royal Enfield’s export focus will be on Thailand, Brazil, and Argentina. These countries have 36 exclusive stores (40% of all exclusive international stores). The management expects to increase its store count in these countries by 55% (to 56 stores) in FY22.

The sales in these regions will be boosted by localised production. In FY21, Eicher set up an assembly plant in Argentina and it will set up assembly plants in Thailand, Brazil, and Columbia respectively in FY22. This is part of Royal Enfield’s plan to generate 20% of revenue from exports by FY25.

The sales in these regions will be boosted by localised production. In FY21, Eicher set up an assembly plant in Argentina and it will set up assembly plants in Thailand, Brazil, and Columbia respectively in FY22. This is part of Royal Enfield’s plan to generate 20% of revenue from exports by FY25.

VECV in contrast, expects a smooth ride in H1FY22

VECV in contrast, expects a smooth ride in H1FY22

Eicher’s subsidiary VECV has been progressing smoothly since last year’s lockdown. With economic activity resuming in Q2FY21, CV sales gradually improved.

Unlike Royal Enfield’s wholesales which bounced back in Q3 and then slumped again in Q4, CV sales were higher by 54% YoY in Q4FY21. This was because of lower sales in the year ago period as the CV industry was transitioning to BS VI. VECV’s CV sales grew 43% sequentially as demand for cement and infrastructure companies rose in Q4. This helped VECV clock revenues of Rs 3,602 crore in Q4FY21, a 71% jump YoY.

Revenues were higher by 34% sequentially thanks to demand from cement and infrastructure companies staying firm in Q4. This helped VECV clock revenues of Rs 3,602 crore in Q4FY21, a 71% jump YoY.

VECV’s revenues declined by 15% YoY in FY21, compared to the CV industry’s 30% drop in revenues, according to a note from Motilal Oswal.

Eicher’s market share in the light commercial vehicle (LCV) market grew to 30.6% in FY21, from 29.8% in FY20. VECV’s market share in heavy commercial vehicles (HCVs) was 7.9% in FY21, from 5.9% a year earlier. The VECV revenue growth in Q4FY21 was because of 56% YoY growth in volumes and a 5% growth in realizations.

Another expected positive for the company is replacement demand. The HCV and trucks market relies on replacement sales. In the Q2FY21 earnings call, the management said trucks and HCVs are replaced every 4-6 years, and over the past two years (FY19-21) replacements were low. As economic activity recovered in Q3FY21, the company expected replacement demand to revive in Q4FY21. However, as Covid-19 cases began to rise from March 2021, the replacement demand did not materialize. Once the second wave subsides, the management expects replacement demand to return.

Another expected positive for the company is replacement demand. The HCV and trucks market relies on replacement sales. In the Q2FY21 earnings call, the management said trucks and HCVs are replaced every 4-6 years, and over the past two years (FY19-21) replacements were low. As economic activity recovered in Q3FY21, the company expected replacement demand to revive in Q4FY21. However, as Covid-19 cases began to rise from March 2021, the replacement demand did not materialize. Once the second wave subsides, the management expects replacement demand to return.

With construction activity allowed in the current lockdown, HCV and tippers, tractor trailers, and haulage truck wholesales are expected to be robust in Q1FY22. Since construction operations are uninterrupted and e-commerce sales are increasing, the demand for VECV’s HCVs, trucks, and LCVs will be strong in Q1FY22, expect analysts.

Poor Royal Enfield outlook despite VECV positives

The demand for Eicher Motors’ Royal Enfield bikes is robust because of its premium offering. This has helped it in the past when discretionary spending dropped. But this time, the scenario is different.

With the second wave of Covid-19, analysts are expecting domestic demand for Royal Enfield’s motorcycles to be weak in the first half of FY22. Domestic wholesales slumped in April and May 2021. Since lockdowns have continued in May, the management expects low wholesales in June as well. Margins, already under pressure due to rising input costs, will continue to remain under pressure in FY22. However, the management has guided for EBITDA margins of 23-27% in FY22. For RE, exports will likely be the saving grace. Since Eicher intends to double motorcycle exports in the next four years, this will be the focus going forward, and its sales in April and May 2021 have given it a healthy start.

VECV has recovered strongly since a poor H1FY21. In H1FY22, its market share gains (in LCV, and HCV) and demand from cement, construction and e-commerce companies will bode well for Eicher Motors. But given VECV’s small contribution to the engine that is Eicher Motors, this will likely not be enough to ensure a joyful ride for its investors in FY22.