By Suhani Adilabadkar

Nestle India reported healthy numbers for Q1 CY21, carrying forward the growth momentum of the past two quarters. Nestle has four main revenue segments- milk products and nutrition, prepared dishes and cooking aids, confectionery, and beverages.

After growing consistently over the past four years, Covid-19 caused it to skid in the quarter ended June 2020. The company has since then got its act together, resolving its supply chain constraints and focusing on rural India.

Quick Takes:

-

Capex of Rs 2,600 core laid out for the next 3-4 years for Maggi, coffee and confectionary segments

-

Rural footprint will be increased more than 30% by 2024, with the total rural reach of about 120,000

-

Margins might be impacted by higher crude and rising raw material prices in the near future

-

The company has 40 new products in the pipeline and new product sales contribute 4.3% of revenues rising from a low 1.5% in 2016

Revenues grow at a fair clip in Q1CY21

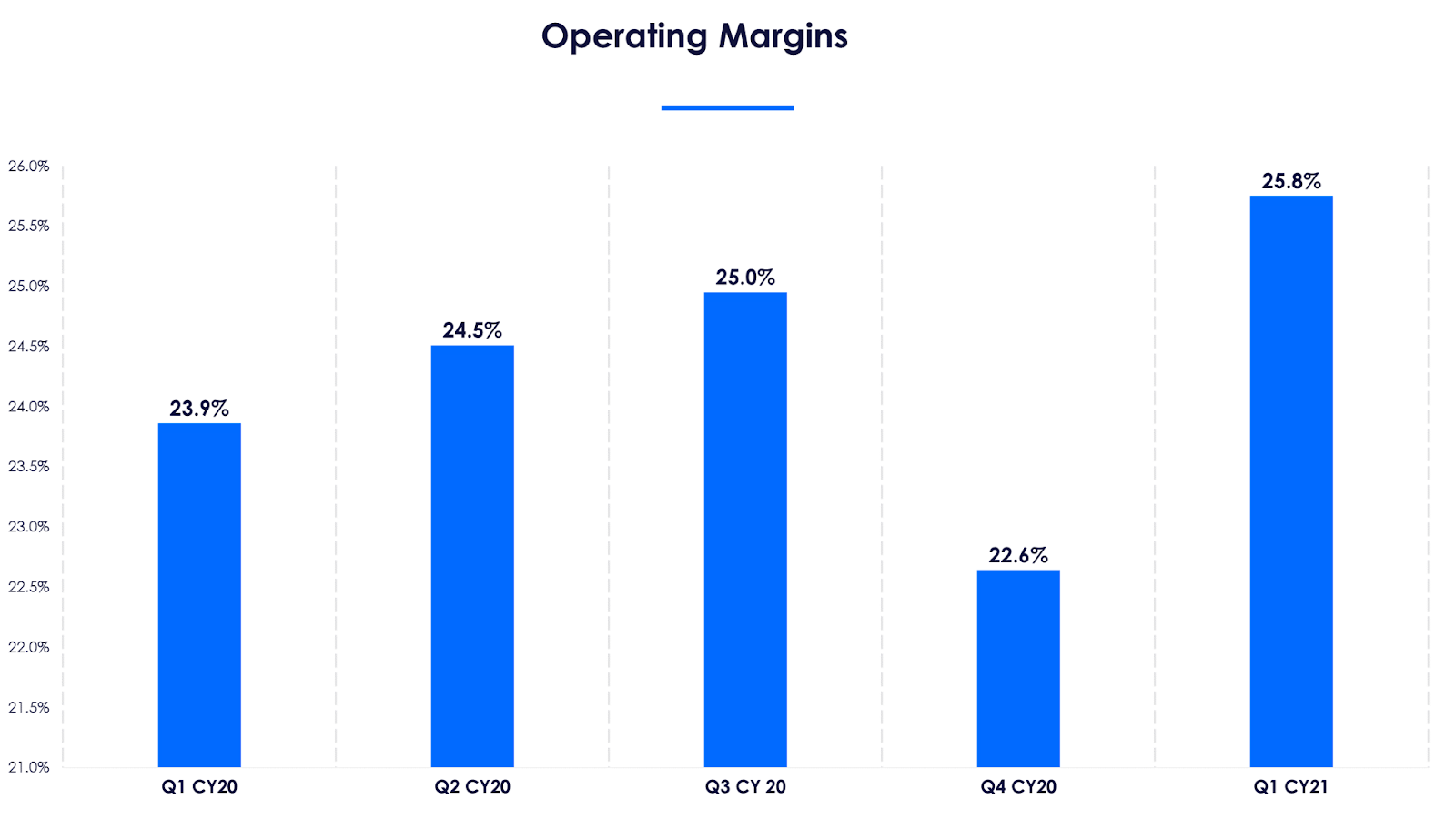

Nestle India reported a third consecutive quarter of double-digit domestic sales growth (10.2% YoY) in Q1 CY21 (calendar year 2021). Revenue from operations came in at Rs 3,611 crore compared to Rs 3,325 crore a year ago, rising 8.6% YoY. Growth for the quarter ended March 2021 was broad-based across all product categories, and largely driven by a rise in volumes and better product mix. Despite facing headwinds in commodity and packaging material costs, operating margin for Q1 was 25.8%, expanding 190 bps (basis points) YoY during the quarter. Net Profit or PAT was reported at Rs 602 crore, compared to Rs 525 crore a year ago.

The management said products like Maggi Noodles, Kitkat, Nescafé Classic, Maggi sauces, Milkmaid and Maggi Masala-ae-Magic delivered robust performance, achieving double-digit growth during the quarter. E-commerce revenues continued to deliver strong performance in Q1 CY21 increasing 66% YoY maintaining its contribution to domestic sales.

Nestle Vs Britannia Quarterly Volume Growth

Beating the slowdown effect, Nestle India was reporting strong numbers, better than its closest peers Britannia and Hindustan Unilever (HUL). Then the Covid-19 pandemic struck. The company has distinguished itself by exhibiting resilience and with its product stable.

Competitors such as Britannia captured Covid driven tailwinds of the packaged foods industry at a faster pace, reporting 21.5% jump in volumes in the quarter ended June 2020. Nestle on the other hand was unable to catch up owing to its lower dependence on co-packers and manufacturers.

Consequently, volumes in June quarter 2020 grew in single digits (2.6% YoY). But as the economy opened and supply chain disruptions were resolved, Nestle was back to its usual double-digit growth trajectory. The company reported domestic sales growth of 10% for the past three quarters. Britannia, on the other hand reported 5.6% YoY sales growth and revenues fell sequentially in the December 2020 quarter.

Resurgence post Maggi Noodles fiasco

Resurgence post Maggi Noodles fiasco

The Maggi fiasco unravelled Nestle’s high dependence on its flagship product. Due to five months ban on Maggi, annual revenue declined 17% and PAT 52% YoY in CY 2015. The company has launched 80 new products in the past five years. New product sales contributed 4.3% of revenues, rising from a low 1.5% in 2016. Nestle also started working on its urban centric customer base with just rural reach of 1000 villages.

By 2020, rural reach has been increased to 89,288 villages, penetrating into resilient rural Bharat. But the cornerstone of its resilient performance is mainly due to the strong leadership position of its product stable. Nestle is the market leader in seven out of its total eight product categories. Except in ketchups & sauces, the company is market leader in infant cereals, infant formula, tea creamer, instant coffee, instant noodles, white & wafers and instant pasta. In fact, in baby food products where advertisements are banned by International Medical Health Organization (IMHO) and World Health Organization (WHO), the company has an envious market share position of 96% in the infant cereal category (Cerelac). And lastly, higher contribution from traditional trade, namely kirana stores roughly 85%, also aided its faster recovery.

Optimistic 2021 outlook

Optimistic 2021 outlook

As India reels under pandemic, the packaged food industry has its tailwinds intact. Nestle’s management is optimistic about future growth prospects and has laid down a Rs 2,600 crore capex plan spread over the next 3-4 years. The company will undertake capacity expansion for Maggi in Sanand (Gujarat), new product manufacturing plant for coffee segment in Nanjangud (Karnataka) and expansion for confectionery segment in Ponda (Goa) and Tahiwal (Haryana).

Nestle is also moving ahead on its innovation plans. The company has 40 new products in the pipeline. It is also expanding its rural footprint with an aim to increase its rural reach to 120,000 villages by 2024. Currently, Nestle earns 25% of its revenues from rural areas, while most of its top tier peers earn 30-40% of their revenues from rural India.

While the company seems set for future growth, margins might be impacted by rising crude prices (packaging material uses crude derivatives) and higher raw material costs. The management will have to work out how to deal with these headwinds, and new strategies to tackle the impact of the ongoing second wave.