As the winter sets in, the stock market seems to have caught a cold. But the initial public offering market seems to be humming along. A new IPO that hits the markets at the beginning of this week is CMS Info Systems, a company that provides cash and ATM management services to banks.

The issue is entirely an offer for sale worth up to Rs 1,100 crore through which Baring PE Asia’s affiliate Sion Investment Holdings is selling its stake. The private equity firm is selling up to 34.41% stake in the company, giving it an implied post-market capitalization of a little over Rs 3,200 crore.

The issue is priced at Rs 205-216 and at the upper end of the price band, based on its diluted earnings per share, the company is valued at 19.5 times its FY21 diluted earnings per share.

When we use the company’s earnings for the five months ended August 31, 2021 (5MFY22), and annualise it, the company is valued at 16.4 times its diluted earnings per share. The company doesn’t have any listed peers, butSIS is also present in the same business as the company. Its TTM PE is currently at 19.4.

CMS Info Systems’ business is directly related to the expansion of the banking sector as more branches and newer banks will mean the company’s products and services will see higher demand. But at the same time, higher use of digital payments will eat into the market for its products and services. In this context, does it make sense for investors to consider the CMS Info Systems IPO?

Managed services to drive growth

As of March 31, 2021, CMS Info Systems is the largest cash management company in India based on the number of ATM and retail pick-up points. It is also the largest ATM cash management player based on the number of ATM points it serves. The company installs, maintains, and manages assets and provides technology solutions to banks on an end-to-end outsourced basis based on long-term contracts. The company also provides retail cash management services to retailers and corporates, and also debit and credit card personalization services to banks.

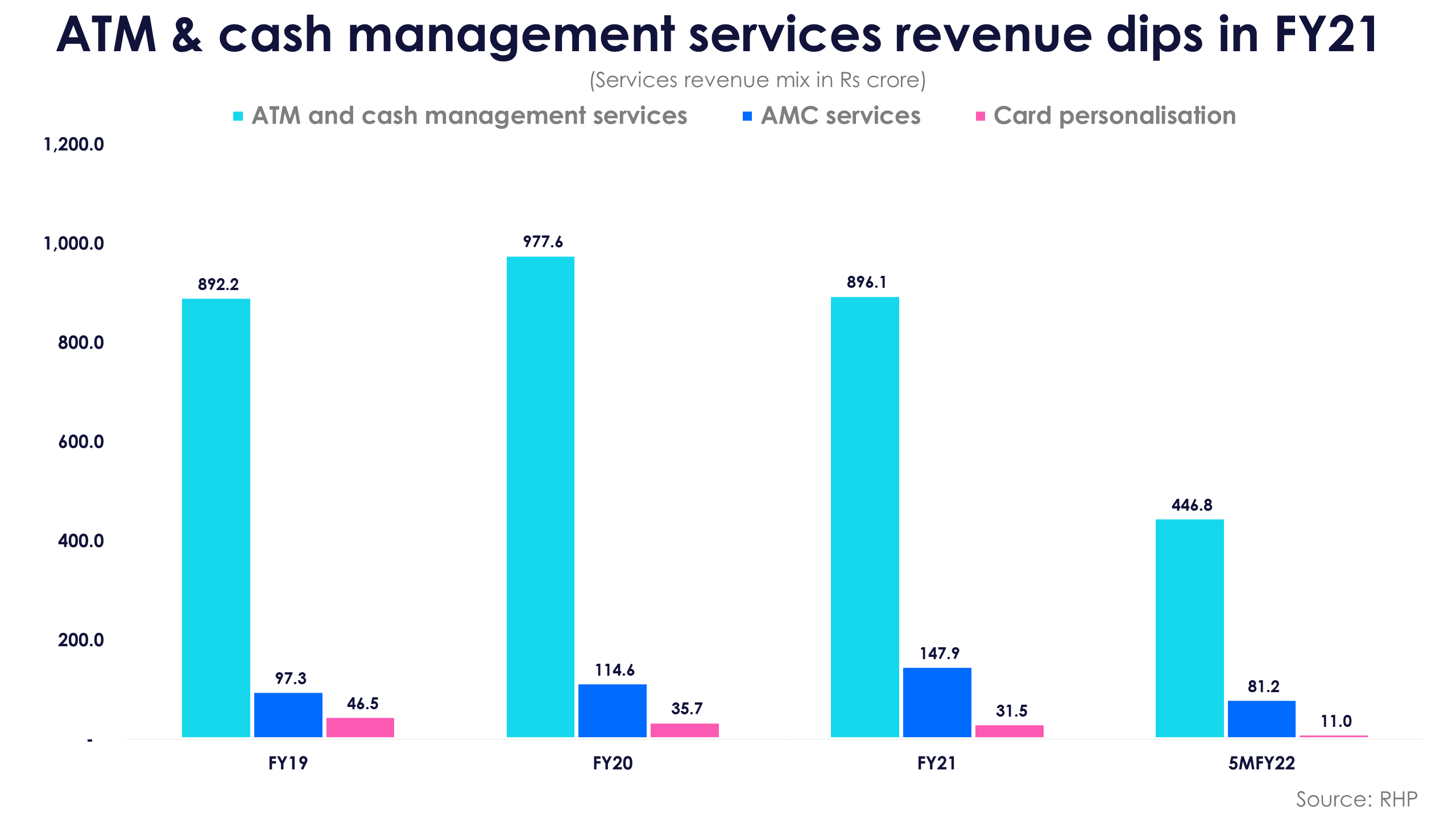

Over the past three completed financial years, 83%-90% of CMS Info Systems’ revenues came from the sale of services. At the end of 5MFY22, 86.1% of the company’s Rs 626.3 crore revenues came from the sale of services, while the rest came from the sale of products and the sale of ATM and ATM sites.

The sale of services consists of revenues from ATM and cash management services, baking automation product sales and services (AMC services), and card personalisation services to banks.

The sale of products includes the sale of ATM spares and related products, the sale of cards, and other products.

The company’s cash management business is mostly route-based. This means the route in which the cash vans operate and the density of customers on the routes that these vans serve determines how much revenues this business earns. The higher the density of customers in a particular route, the higher the profitability due to higher operating leverage. Essentially, a fall in the density of customers that it serves in a particular route for its cash vans for any reason results in lower profits.

A growing market for managed ATMs

The company also operates brown label ATMs, where it deploys, maintains, and manages ATMs on an end-to-end basis for banks. It also provides other services like multi-vendor software solutions and remote monitoring services to help its customers better manage their ATMs.

Many banks are expanding their ATM networks and at the same time increasingly outsourcing ATM management to companies like CMS Info Systems. This market is expected to grow to Rs 17,090 crore by 2027 at a CAGR of 16.5% from Rs 6,810 crore at the end of FY21, according to market research company Frost & Sullivan. At the end of FY21, the company had a 41% market share in the ATM cash management market.

There is a risk of revenue concentration with its top 10 customers contributing nearly 75% of its revenues as of August 2021. This includes 18.8% of total revenues from a single public sector bank customer. Some of its customers includeAxis Bank,HDFC Bank,ICICI Bank, among others.

The company operates out of all states and union territories in India, except for Lakshadweep. The company also made multiple acquisitions like Securitrans India in 2011 for around Rs 120 crore and other smaller cash management companies in 2017, 2018, and 2020 for a cumulative Rs 49 crore.

It also acquired a smaller brown label ATM operator in 2017 for Rs 6.56 crore to increase its capacity to serve mid-sized banks and other customers. It provides brown label ATM services for 3,669 ATMs as of August 31, 2021.

Profits rise in FY21 despite fall in revenues

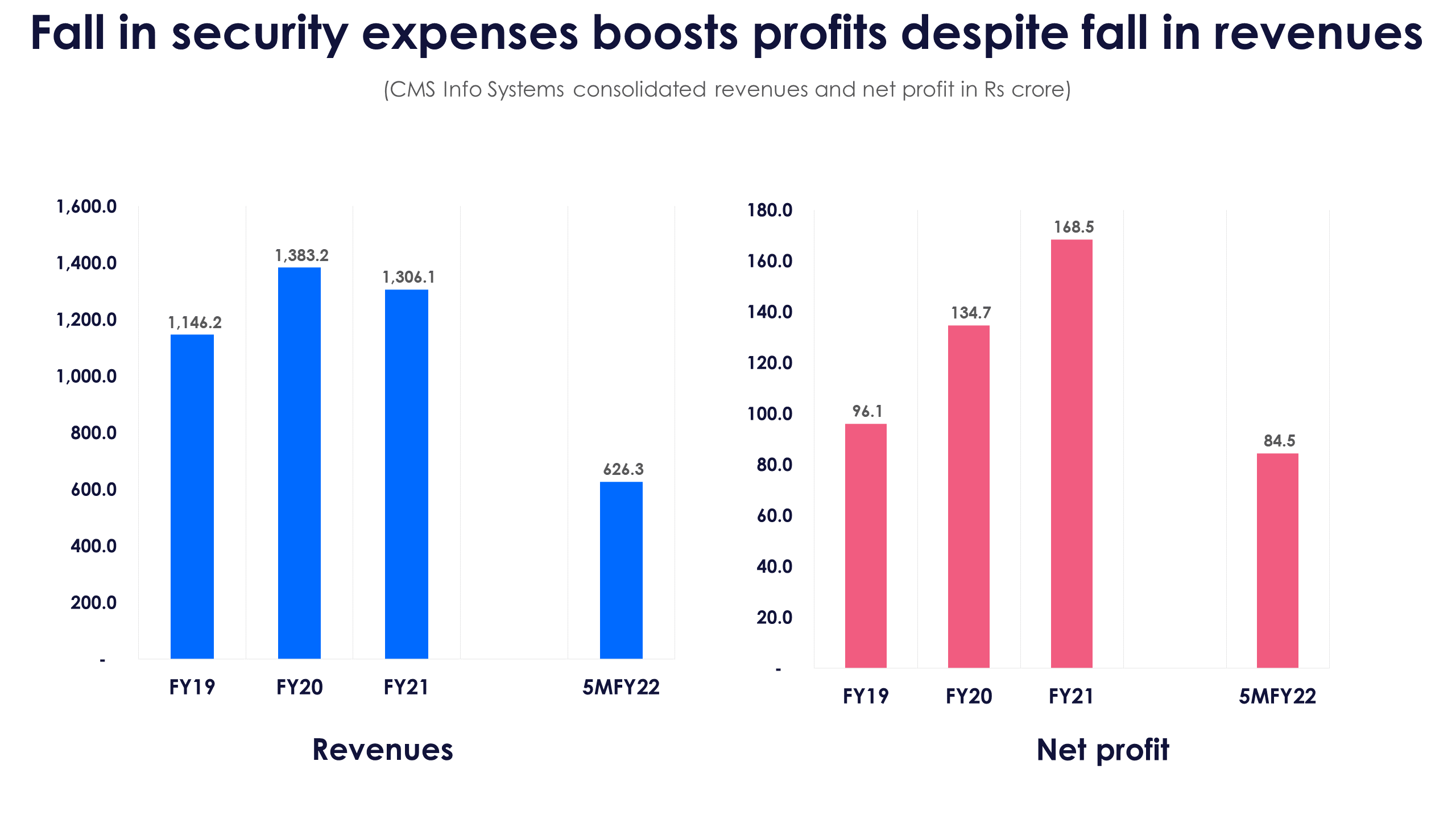

In FY21, CMS Info Systems’ revenues fell 5.6% YoY to Rs 1,306.1 crore as revenues from ATM and cash management services fell 8.3% YoY to Rs 896.1 crore. The revenue contribution from this business to total revenues fell to 68.6% in FY21 from 70.7% in FY20.

But the fall in revenues did not lead to a fall in net profit as a fall in security expenses helped profits rise 25.1% to Rs 168.5 crore. For 5MFY22, the company’s revenues were at Rs 626.3 crore, and if its average monthly revenue run rate persists, it will easily cross Rs 1,500 crore.

Although this high revenue run rate translated into a similar high-profit run rate for the 5MFY22, the company’s cash flows didn’t measure up to the same pace. Due to higher working capital needs, the company’s operating cash flows were meagre. This could also be due to the lockdowns impacting the movement of people during the first 3-4 months of FY22.

Once the cash flow stabilises, the company should be able to generate decent cash flows when its business grows at a fair clip.

For investors, the call they will have to make is whether they want to use CMS Info Systems as a play on the growth in the banking sector. India’s cash in circulation to GDP ratio as of the third week of December 2021 is 13% of its gross domestic product. This is lower than 14.41% in FY21. This shows that cash continues to remain important for the Indian economy, despite the exponential rise in digital payments. For instance, five years after demonetisation, after an initial fall in cash-to-GDP ratio, India’s cash-to-GDP ratio is higher than what it was before India demonetised 86% of its currency in circulation.

Essentially, investors will have to take a call on whether this ratio of cash-to-GDP will rise or fall before they decide to invest in this company’s IPO