For Indian pharma companies, pandemic treatments became a significant moneymaker in FY22. Post-Covid, drug markers are shifting their attention back to their core product portfolio.

This comes at a time when the US formulation business, which used to be a significant revenue contributor for Indian pharma, is facing intense competition in the generics space. Drug makers that quickly adapt to these changing dynamics are expected to come out ahead.

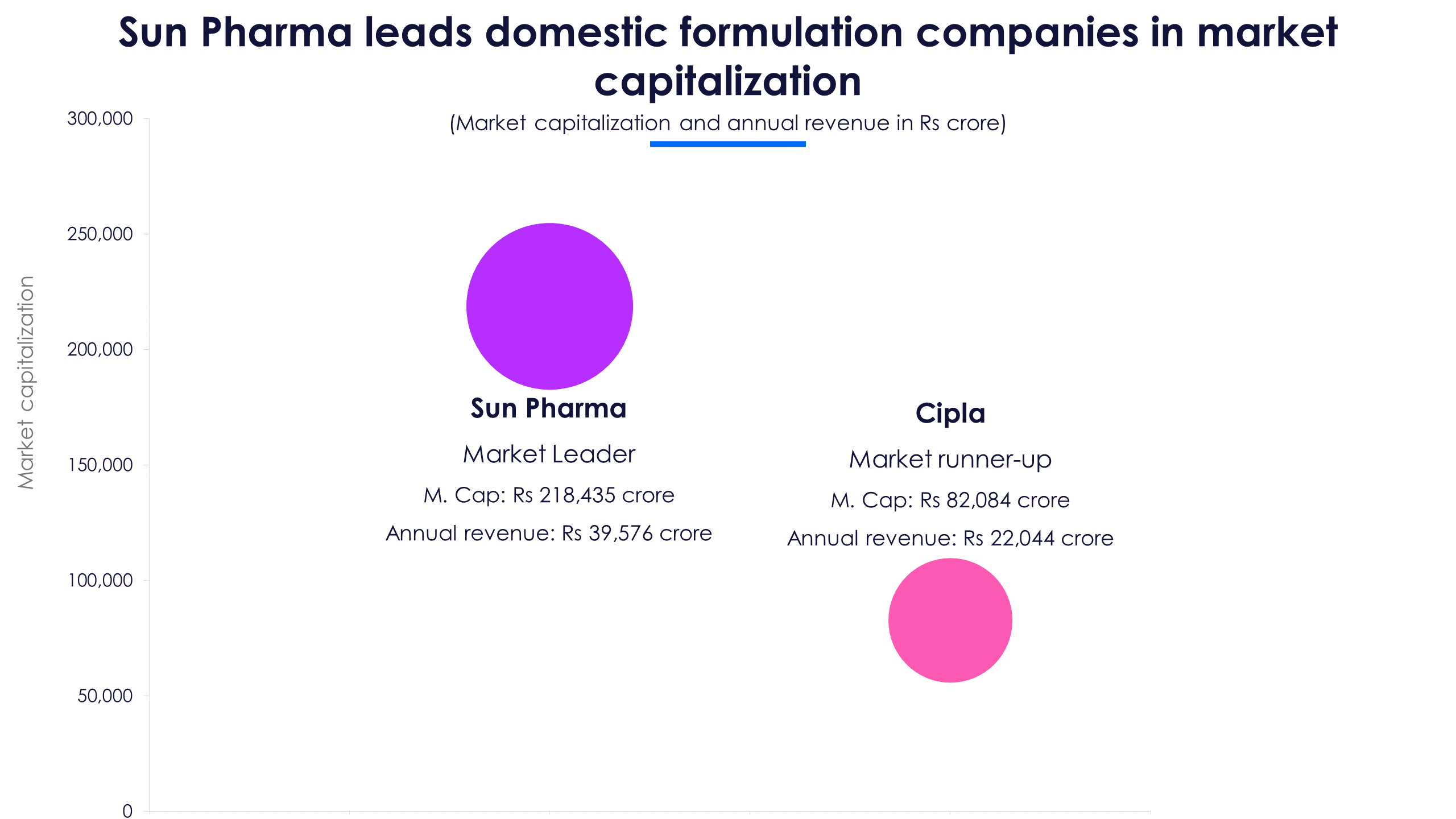

Sun Pharmaceutical Industries and Cipla, both posted a strong set of numbers in Q1FY23. But what surprised investors was the companies’ robust growth of over 15% YoY in the US market, at a time when much of the industry is struggling. In response, Sun Pharma’s share price rose 5.5% and Cipla’s stock rose 3% post their earnings release on July 29.

As the competition in the US generics space intensified over the past year, India business became a silver lining. In Q1FY23, Sun Pharma’s revenue from India rose 13% YoY and Cipla’s revenue grew 8%, excluding Covid drug revenues. Overall, revenue from the India business was flat to marginally lower YoY on a high base.

To drive its top line, Cipla is banking on its ‘One-India’ (prescription, trade generics, and consumer health) strategy, and on a complex respiratory and peptide product portfolio in the US market.

Sun Pharma plans to focus on its fast-growing specialty products in the US and sustain new product launches (22 products launched in Q1) in the Indian market to drive revenue growth.

However, increased competition in the US business and any delays in the product launch timeline due to late US FDA approvals may play spoilsport.

Quick takes

- Sun Pharma’s and Cipla’s revenue (excluding covid drug sales) rise YoY in Q1FY23

- High input and freight costs impact the operating profit margin of both companies

- A combination of price hikes and increase in volumes lead to an YoY and QoQ rise in India business (excluding covid drug sales)

- Sun Pharma’s specialty products contribute to a 15.8% YoY growth in US business

- Cipla’s North America business rises 15% on the back of strong demand for its respiratory and peptide products

Sun Pharma’s and Cipla’s net profit beats forecaster estimates by over 18%

Sun Pharma’s Q1 revenue beat Forecaster estimates by 4.5%, on the back of strong demand for its specialty products in the US market. Revenue rose 11% YoY to 10,761.8 crore.

However, excluding the covid products, Sun Pharma’s revenue rose 14% in Q1FY23. Cipla’s revenue, which was in line with the Forecaster estimates, fell 2% YoY in Q1FY23.

However, excluding the covid products, Sun Pharma’s revenue rose 14% in Q1FY23. Cipla’s revenue, which was in line with the Forecaster estimates, fell 2% YoY in Q1FY23.

However, excluding the Covid product sales in Q1FY22, Cipla’s revenue rose 6% YoY. Interestingly, both drug makers’ revenue rose QoQ in Q1 mainly because of strong growth in India business.

Both companies’ net profit beat Forecaster estimates by over 18%. Sun Pharma’s net profit rose 47% YoY to Rs 2,060.9 crore. But adjusting for an exceptional item loss in Q1FY22, profit rose about 4%. In Q4FY22, Sun Pharma had reported a net loss of Rs 2277.2 crore due to the settlement of a class action lawsuit in the US and restructuring expenses.

Though Cipla’s net profit beat estimates, it fell 1.2% YoY to Rs 706.1 in Q1FY23. High raw material and freight costs, as well as price erosion in the US ate into the operating profit margin of both companies, which fell YoY in the range of 2.2 to 3.2 percentage points.

However, Sun Pharma’s management expects margins to gradually improve by FY24 with its increased focus on India business and due to high medical representative (MR) productivity. Both drug makers’ margins improved QoQ due to lower R&D cost, which is expected to normalize in the coming quarters.

However, Sun Pharma’s management expects margins to gradually improve by FY24 with its increased focus on India business and due to high medical representative (MR) productivity. Both drug makers’ margins improved QoQ due to lower R&D cost, which is expected to normalize in the coming quarters.

Revenue from India business muted on a high base but rises excluding Covid drugs revenue

Pharma companies focusing on the Indian market to offset the price erosion in the US market helped them to post robust YoY growth in Indian business (excluding Covid products). All three drug formulation companies (Sun Pharma, Cipla, and Dr Reddy’s Laboratories) in the Nifty 50 grew YoY in Q1FY23.

Cipla’s domestic revenue growth was led by the branded prescription business on the back of sustained momentum across core therapies led by pricing and new product launches. Growth in the domestic market is important for Cipla as it contributes to about 46% of its total revenues.

Dr Reddy’s brand divestments contributed mainly to its India market revenue growth. However, its management said that growth is in the double digits even after adjusting for brand sales. Sun Pharma also grew in double digits (13%) due to traction across therapies in the chronic and the sub-chronic segment. Its management added that Sun Pharma’s domestic market share improved by about 50 bps over the past year to 8.5%.

Dr Reddy’s brand divestments contributed mainly to its India market revenue growth. However, its management said that growth is in the double digits even after adjusting for brand sales. Sun Pharma also grew in double digits (13%) due to traction across therapies in the chronic and the sub-chronic segment. Its management added that Sun Pharma’s domestic market share improved by about 50 bps over the past year to 8.5%.

Sun Pharma and Cipla to focus on lower competition complex drugs segments

The US generic market used to be a lucrative segment for drug makers. However, in the past year, pricing pressure in this segment pushed pharma companies to pivot to less competitive segments like specialty products, complex generics, peptides, etc. In Q1FY23, Cipla earned 22% of its total revenues from its North America business and Sun Pharma got 31% of its total revenues from the US market.

While Sun Pharma has set its focus on its rapidly growing specialty product segment (segment revenue up 29% YoY), Cipla has zeroed in on complex respiratory products and peptides. This strategy of growing in segments with lower competition paid off for both companies as their revenue from the North America business (Only US business for Sun Pharma) rose about 15% YoY in Q1FY23.

Going forward, both Cipla and Sun Pharma are heavily focusing on launching new products in segments with lower competition, where they already have a foothold. To reduce its dependency on the generics business, Sun Pharma is investing in its specialty business, mainly in dermatology, ophthalmology, and oncology therapies. A few drugs in this segment include Ilumya, Levulan, BromSite, and Cequa. In Q1FY23, Specialty R&D cost contributed to 21% of total R&D cost and is expected to go up with increased clinical trials for more specialty drugs.

Going forward, both Cipla and Sun Pharma are heavily focusing on launching new products in segments with lower competition, where they already have a foothold. To reduce its dependency on the generics business, Sun Pharma is investing in its specialty business, mainly in dermatology, ophthalmology, and oncology therapies. A few drugs in this segment include Ilumya, Levulan, BromSite, and Cequa. In Q1FY23, Specialty R&D cost contributed to 21% of total R&D cost and is expected to go up with increased clinical trials for more specialty drugs.

Cipla’s respiratory product portfolio (up 22% in Q1FY23), led by Albuterol (16.5% market share) and Arfermoterol (~33.4% market share) contributed to the growth in its North America business. Cipla’s management said that its existing peptide asset is on track to achieve a mid-teen market share by FY23.

Cipla also has five peptide products in its pipeline, out of which one is expected to be launched in FY23 and two in H2FY24. Other high-profile launches over FY22-FY24 for Cipla include Advair, Revlimid, and Abraxane. The total market size of these three products is around $ 15 billion dollars.

Sun Pharma to grow at 10% in FY23 despite a higher base in FY22

Trendlyne’s consensus estimates show a 10.2% CAGR growth for Sun Pharma over FY22-FY24. This is higher than the FY20-22 CAGR of 8.7%, which was boosted by Covid drug revenues.

Sun Pharma’s shift from the competitive generic space in the US to higher margin specialty products and improved traction in the domestic market is expected to contribute to the top line over the long term. Cipla is also expected to grow at high single digits over FY22-FY24. While its fast-growing prescription business and consumer health business is expected to contribute to domestic sales, higher contribution from its respiratory and peptide segment in the US market is expected to drive its top line.

Sun Pharma’s shift from the competitive generic space in the US to higher margin specialty products and improved traction in the domestic market is expected to contribute to the top line over the long term. Cipla is also expected to grow at high single digits over FY22-FY24. While its fast-growing prescription business and consumer health business is expected to contribute to domestic sales, higher contribution from its respiratory and peptide segment in the US market is expected to drive its top line.

However, success will depend on the execution as new product launches will be key. Any delay in the product launch timeline, be it in clinical trials or in US FDA approvals may impact the companies’ financials significantly.