By Vivek AnanthFinance Minister Nirmala Sitharaman had promised a budget like never before— “once in 100-year budget”—, but considering her past couple of budgets, markets had tempered hopes last week. Looking at the budget numbers, mainly the fiscal deficit of 9.5% for 2020-21 and 6.8% for 2021-22, it appears Sitharaman has thrown the kitchen sink at solving India’s economic woes. But there is more than meets the eye.

This is how the trajectory of the union government’s fiscal deficit looks like compared to past years.

It shows that the government has finally bit the bullet and undertaken countercyclical economic measures to prop up the economy. The government expects the Indian economy to grow between 14.4% in nominal terms in 2021-22.

The government has opened its checkbook

The government has decided to breach its own targets for fiscal deficit and spend its way out of a recession. This can be seen in the higher allocation for infrastructure development, and the general focus on increasing capital expenditure in 2021-22. To this end, the budgeted revenue expenditure in 2021-22 has gone down by 2.7% compared to the revised estimate for 2020-21.

The government has also reset the glide path of the fiscal deficit and introduced an amendment to the Fiscal Responsibility and Budget Management Act. The government has stated that it will bring down the fiscal deficit to 4.5% by 2025-26.

This indicates that the fiscal deficit might remain high for a prolonged period of time to sustain economic growth.. The government has taken a calculated approach to take advantage of the extraordinary circumstances caused by the pandemic to revive the economy, despite the fear threat of rating action from credit rating agencies.

Here is the allocation to some of the major ministries compared to the past four years

Focus on health and infrastructure

Coming right after a global pandemic, it was a given that health care would be one of the main focus points for Sitharaman’s third budget. There is a Rs 35,000 crore allocation for COVID19 vaccination, which will be a direct transfer to states. There are various other allocations for “health and wellness”, but if we look purely at the Department of Health and Family Welfare, the allocation in Budget 2021-22 is Rs 71,269 crore. This is a 9.6% fall over the revised estimates for 2020-21.

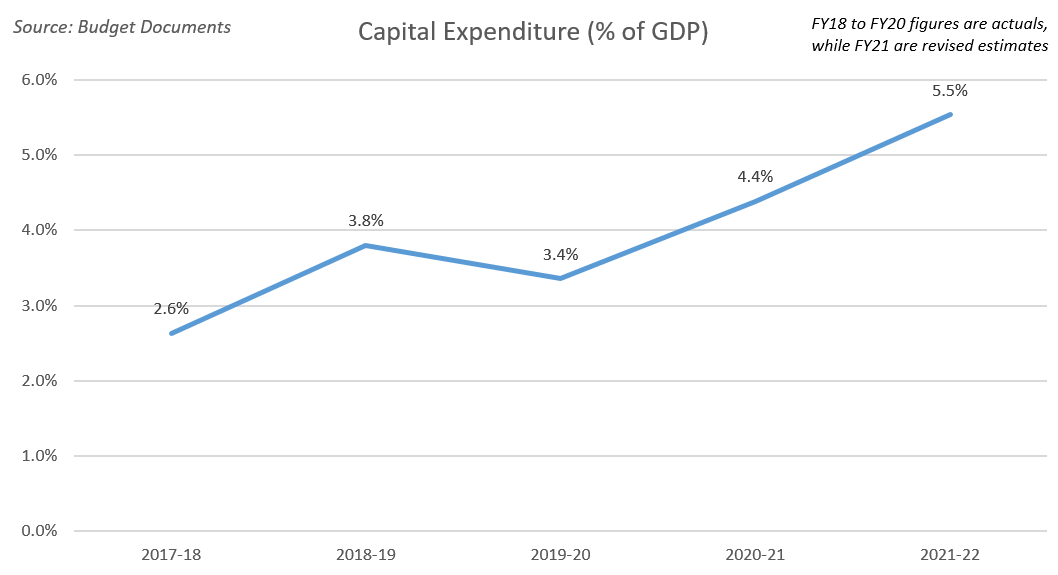

The other key focus area was physical infrastructure. The Centre has increased the total capital expenditure outlay by 26.2% for 2021-22 in the budget. The proportion of capital expenditure to the gross domestic product or GDP for 2021-22 is pegged at 5.54%.

In 2020-21, the government spent more than it had budgeted for capital expenditure (a 6.6% rise over the budgeted amount), and for revenue expenditure (14.5% over budgeted amount) which pushed up the total expenditure for the year by 13.4% over the 2020-21 budgeted amount to Rs 34.5 lakh crore.

The ministry that has been allocated the biggest chunk of capital expenditure is the Ministry of Defence at 25% of total budgeted capital expenditure for 2021-22. Then come Ministry of Road Transport and Highways and the Ministry of Railways.

Considering that the private sector investment cycle has been stuttering for the past few years, the government has decided to spend big on building infrastructure. The hope is that this will lead to demand for investment goods, and as a result, lead to a boost in demand. This is a tried and tested strategy that the government hopes will lead to a revival in growth.

Building roads and railways

Out of the capital expenditure outlay to build infrastructure, nearly 20% has been allocated to build roads under the Ministry of Road Transport and Highways. The ministry has got a total allocation of Rs 1.18 lakh crore, out of which nearly 92% has been allocated for capital expenditure. There are new projects that have been announced in states that are going to have elections soon like Tamil Nadu, Kerala, Assam and West Bengal. The rest have been earmarked for the existing Bharatmala project, and various expressways and new national highways. This bodes well for companies like L&T, Dilip Buildcon, Ashoka Buildcon, KNR Constructions, among others.

Similarly, around 20% of the total capital expenditure has been allocated for railways. The Ministry of Railways has got a total allocation of Rs 1.10 lakh crore, out of which a little more than 97% is earmarked for capital expenditure.

Measures to boost the economy in real estate, banking

To give a fillip to the real estate industry, the government has extended by one year the deduction that buyers of affordable housing got for their interest payments (Rs 1.5 lakh). This means that those buyers of affordable houses who take a loan till March 31, 2022 will be eligible for the extra income deduction up to Rs 1.5 lakh for the interest they have paid on home loans.

There is also a corresponding extension of the income deductions by a year to March 31, 2022 for developers of affordable houses. This was going to lapse by March 31, 2021. This is expected to give a huge boost to construction of affordable housing across the country. This will give a boost to real estate developers and housing finance companies. The Finance Minister also announced a scheme to provide income deductions for developers of affordable rental housing projects, which will be notified separately.

Then there was the big bang announcement that everyone was waiting for—the bad bank. The government finally bit the bullet on an idea that has been in the public realm for many years now. The surge in non-performing assets or NPAs that PSU banks will face because of the moratorium on loans in 2020 could have crippled their ability to lend, and in turn boost economic growth.

The government announced that it will set up an asset reconstruction company (ARC) and an asset management company (AMC). The ARC and the AMC will take over NPAs from PSUs and then sell it to private parties to recover the loans. The government has also made an allocation of Rs 20,000 crore to capitalise PSU banks.

The much-discussed development finance institution to fund future infrastructure projects is finally here. The government will contribute Rs 20,000 crore to its share capital. The Finance Minister said that this institution will leverage this capital to lend up to Rs 5 lakh crore in the next three years towards infrastructure projects.

Another measure that will help to build infrastructure is a new bailout plan for state power distribution companies (discoms). This scheme worth 3 lakh crore, which will be unveiled soon, will have reform-linked targets for discoms. The hope is this will help remove the bottleneck that discoms have become in the development of the power sector.

Meagre growth in expenditure

Despite the claim of spending its way out of the economic morass, there is some evidence that the government has not spent as much as it claims. When we look at the total budgeted expenditure for 2021-22 (Rs 34.83 lakh crore) vis-à-vis the revised estimate for 2020-21 (Rs 34.5 lakh crore), the increase is a meagre 1%.

Also, the government’s expenditure in 2020-21 has increased considerably because it has now accounted for a large chunk of its subsidy bill on its own books. Earlier, the National Small Savings Fund was used to lend money to the Food Corporation of India to fund the food subsidy the government incurred on the public distribution system. The budgeted amount for this in 2020-21 was around Rs 1.15 lakh crore, but the revised estimates pegs it at Rs 4.22 lakh crore. This clean-up of government accounting has inflated the fiscal deficit to 9.5% in 2020-21, according to revised estimates. It has also inflated the budgeted fiscal deficit number of 2021-22.

Asset sale, privatisation and disinvestment to fund infra splurge

Using idle government assets is probably the only way the government has to fund capital and revenue expenditure, considering how tepid the revenue mobilisation has been in the past couple of years.

The government plans to raise Rs 1.75 lakh crore through disinvestment of Bharat Petroleum Corporation, Container Corporation of India, Shipping Corporation of India, and Life Insurance Corporation of India. The budgeted amount for disinvestment proceeds is Rs 1.75 lakh crore. There are also plans to privatise two PSU banks, one general insurer and IDBI Bank in 2021-22.

The government will also use the InvIT route to hive off assets like roads built by NHAI, gas pipelines built by GAIL India and transmission lines built by Power Grid. There is also a proposal to hive off surplus land assets of PSUs into an SPV and monetise them to raise money to fund infrastructure projects.

The Finance Minister also said that the government will go full steam on strategic disinvestment of various PSUs. It will hold on to only those PSUs that operate in the strategic sector, and that too only one entity. The rest will be privatised. The PSUs in non-strategic sectors will also be privatised.

Although the budget speech makes a statement of intent, the follow through on some of these promises is what investors will be looking at. The markets however have given their verdict with the Nifty 50 recouping almost all its losses of the past week. But this is more because there were no additional taxes to rock the boat.