To be an investor in Indian IT services companies these days is a guessing game, especially for investors who witnessed the rapid growth in the sector during the early 2000s. This is because companies are indicating that the current IT spends are less a flash in the pan, and more a multi-year cycle.

From the huge hikes in salaries that we are seeing across the board for software engineers, it appears there is a surge in demand for talent. TCS, Infosys, HCL Technologies and Wipro together are planning to hire nearly 1,20,000 freshers from colleges to plug this demand for talent.

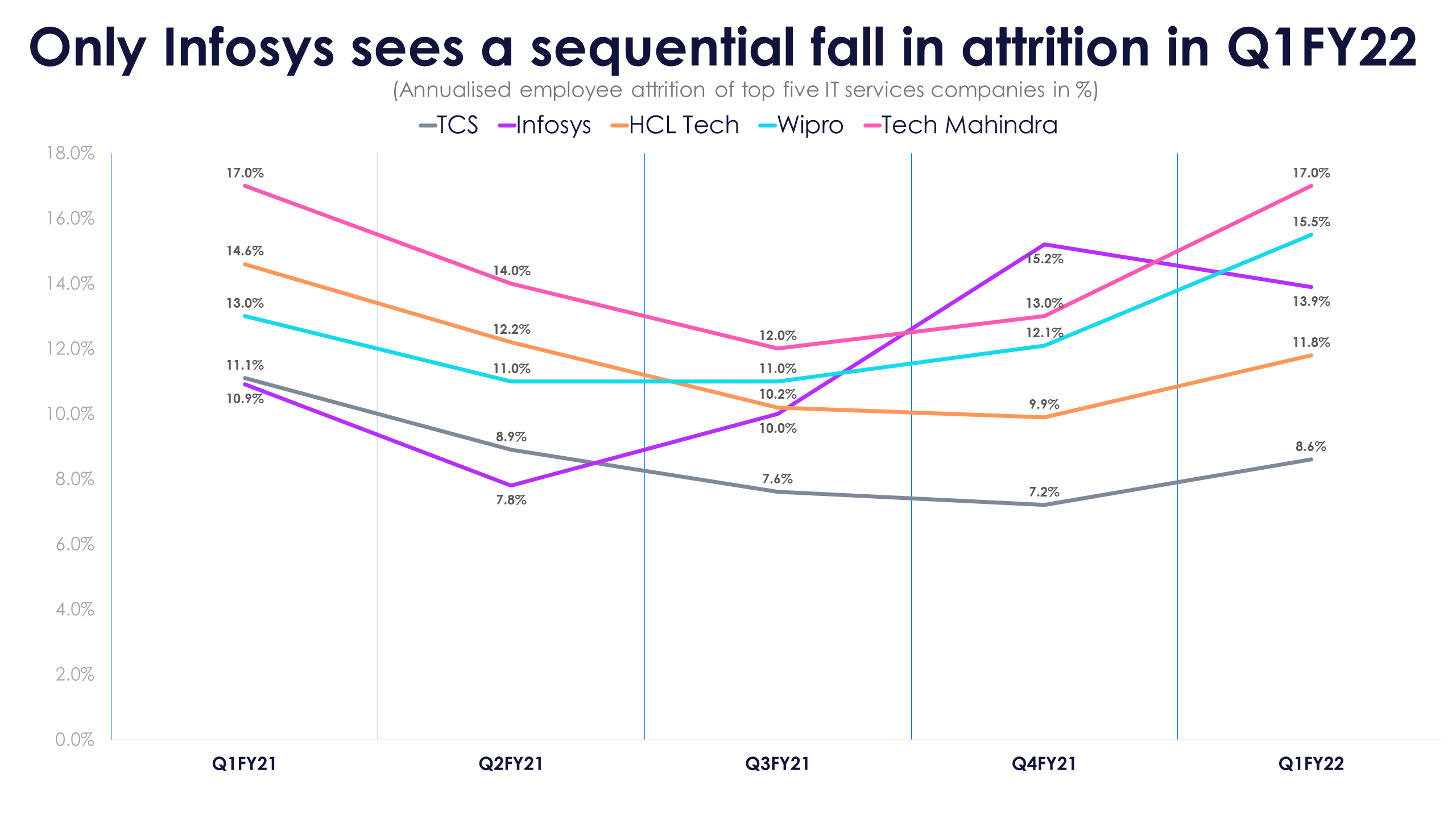

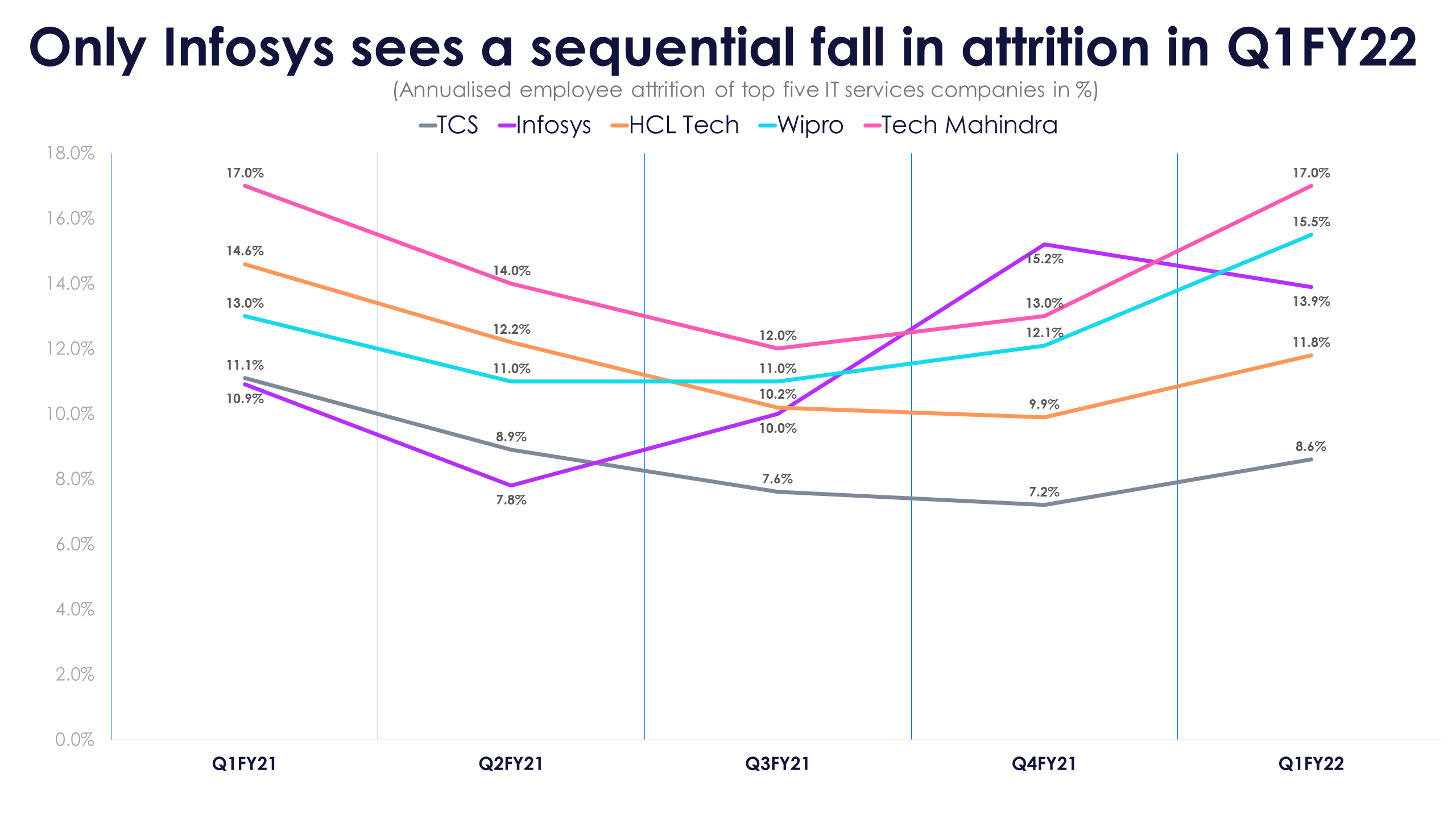

After starting FY21 under the cloud of the pandemic, with record low attrition, IT services companies are now hunting for talent and are ready to pay big bucks. How sustainable is this demand surge for IT services and will this lead sustainable growth over FY22 and beyond? Also, will high attrition rates cause trouble on the margin front?

Revenue growth slows for TCS and HCL Tech in Q1FY22

Wipro, helped by its acquisition of Capco, posted the best sequential growth rate in over 38 quarters. This company beat its large cap peers like TCS, Infosys, HCL Tech and Tech Mahindra in sequential growth rate.

TCS’ revenue growth stalled in Q1FY22 because its regional markets vertical’s revenues fell 4.8% sequentially to $1.09 billion. But this was because revenues in India were impacted by lockdowns in many states as many of the passport service centres were not functioning normally. Also, growth in the communication and media vertical slowed to 1.17% during the quarter, which also slowed revenues.

HCL Tech’s revenue growth slowed considerably as four of its seven verticals saw negative sequential revenue growth. Although the manufacturing and telecom, media, publishing & entertainment verticals saw revenues fall QoQ (2.0% and 1.6%), the lifesciences & healthcare vertical saw revenues grow 5.2% QoQ to nearly $400 million.

Most of Infosys’ verticals grew above the company average rate of 4.7% QoQ revenue growth (to $ 3.78 billion). The two outliers are engineering, utilities, resources and services vertical (which grew nearly 3% QoQ to $ 457.62 million) and the ‘others’ vertical (which saw a considerable fall of 10.72% to $ 109.68 million).

Wipro’s revenue performance was not due to one particular vertical doing well, with communications, BFSI, consumer business unit and energy, natural resources & utilities verticals posting double-digit sequential revenue growth. In a sign that manufacturing companies are still not ramping up their IT spends, the vertical saw 0.60% fall in revenues. The company’s quarterly revenues came in at $ 2.42 billion, near the quarterly run rate to post $ 10 billion annual revenues.

Tech Mahindra saw all-round growth in revenues which helped it post 4.1% QoQ growth to $ 1.38 billion. Its mainstay communications, media & entertainment vertical posted a 3.2% QoQ growth in revenues, as companies started spending on 5G upgradation. The company said that many telecom related deal wins include 5G related work, which bodes well for the future as there are many use cases for 5G which will lead to larger deals in the future.

Rising demand for talent can hurt margins

After seeing a couple of quarters of low attrition, Infosys, TCS and Wipro saw attrition rise in Q4FY21. To tackle this, companies across the industry raised salaries and gave generous bonuses to employees.

This led to pay hikes in all five companies. A rise in pay for employees led to a sequential fall in EBIT margins in Q1FY22. Infosys and HCL Tech’s margins were within their guided range, but TCS’ margins were below its aspirational range.

Higher employee costs with rising revenues does bode well for the quintet. However, TCS saw employee costs as a proportion of its revenues stay constant QoQ in Q1FY22. The stupendous growth in revenues in Q1FY22 meant that only Wipro’s employee costs were less than 50% of its revenues.

Although the rise in attrition caused employee costs and subcontracting costs to go up, as a proportion of revenues, subcontracting costs fell for the top five IT services firms. This means that operating leverage will drive margins higher over the next few quarters.

Deal wins and pipeline bode well for rest of FY22

The top five IT services companies saw robust momentum in deal wins during Q1FY22, which bodes well for the rest of the financial year. Except for Wipro, the rest break out their deal wins in as total deals won (TCS), large deals (Infosys) and net new deals (HCL Tech and Tech Mahindra)

TCS bagged deals with a total contract value (TCV) of above $ 8 billion in three of the past five completed quarters (and $ 6.8-6.9 billion in the other two). Although the TCV of deals were lower by 12% QoQ, the $ 8.1 billion TCV of deals that TCS bagged in Q1FY22 was the highest ever in Q1 for the company. Another thing to note is a higher tenure of deals that the company has bagged. This is succour for investors who were worried about TCS underperforming its peers in an otherwise seasonally strong quarter in Q1FY22.

Infosys’ large deals (above $ 50 million) in Q1FY22 were $ 2.57 billion (up 21.7% QoQ), which is a second consecutive quarter above the $ 2 billion level. The company also has a strong deal pipeline, which will contribute to its revenues once they ramp up, which includes the ramp-up of its largest deal ever ($ 3.2 billion) with Daimler AG that it bagged in Q3FY21. This confidence in revenue growth is what led the company to up its revenue growth guidance band by 2 percentage points to 14-16% after it declared its Q1FY22 results.

Infosys management said that pricing for deals is relatively stable, and the company didn’t have to resort to discounts to bag these deals. The deal pipeline is strong in banking, financial services and insurance, retail, manufacturing, life sciences and utilities verticals. However, some deal ramp-ups with banking clients in Europe are seeing delays. But the company doesn’t see anything fundamentally different with business in Europe and the US.

For HCL Tech, net new deals fell by 46.5% to $ 1.66 billion. This is concerning for investors, but the company said that it has enough deals in the pipeline to help it post double-digit organic revenue growth in constant currency terms. The company had also bagged some large deals in Q4FY21, which meant the fall in net new deals in Q1FY22 was more pronounced. The slow sequential revenue growth in Q1FY22 is expected to be made up in Q2FY22, and the company expects H2FY22 to be normalized in terms of YoY growth in revenues.

Although Tech Mahindra’s net new deal wins fell nearly 22% to $ 815 million in Q1FY22, it is fairly higher than the $300-450 million odd range. The company said it expects quarterly deal wins to be in the $ 800 million to $ 1 billion range. According to management, its deal pipeline is at an all-time high, which bodes well for growth in FY22. With these tailwinds in place, it makes Tech Mahindra confident to be able to post double-digit organic revenue growth during FY22.

Wipro bagged $ 750 million worth of large deals in Q1FY22, which led the management to guide for a 5-7% sequential revenue growth in Q2FY22. The company expects double digit revenue growth in FY22 and says that it will cross $ 10 billion revenues in a financial year soon. It expects to cross the quarterly revenue run rate in Q2FY22 itself.

For investors, execution and ramp-up of deals over the next few quarters is key for the top five IT services companies. But with attrition and high demand for talent pervading the industry, protecting margins will be more dependent on revenue growth than cost control, unlike FY21.