By Divyansh Pokharna

The Nifty 50 fell 2% last week as global risks unsettled investors. The main trigger was US President Donald Trump backing a proposed 500% tariff on countries buying Russian crude under the Russia Sanctioning Act.

Indian exports are currently exposed to 50% US tariffs, with no trade deal in sight. However, sentiment improved on Monday, as Indian indices closed in the green following upbeat comments from US Ambassador Sergio Gor on India–US ties and the next trade discussion scheduled for January 13.

This week, focus shifts to the start of Q3 earnings, led by TCS and HCL Tech. JM Financial said, “We expect Nifty to deliver YoY profit growth of 9.8% in Q3, driven by gains in IT services, autos, and metals.” Sandip Agarwal from Sowilo Investment Managers added, “Investors are likely to focus more on guidance and outlook from IT companies than on the reported numbers themselves.”

The IPO market remains active, with six new issues opening this week, including one mainboard IPO. Five companies are set to make their stock market debut, following one listing last week.

Modern Diagnostic makes market debut

Modern Diagnostic & Research Centre, a diagnostic services provider, listed on the stock exchanges on January 7. The Rs 36.9 crore IPO drew strong investor interest and was subscribed 350.5X.

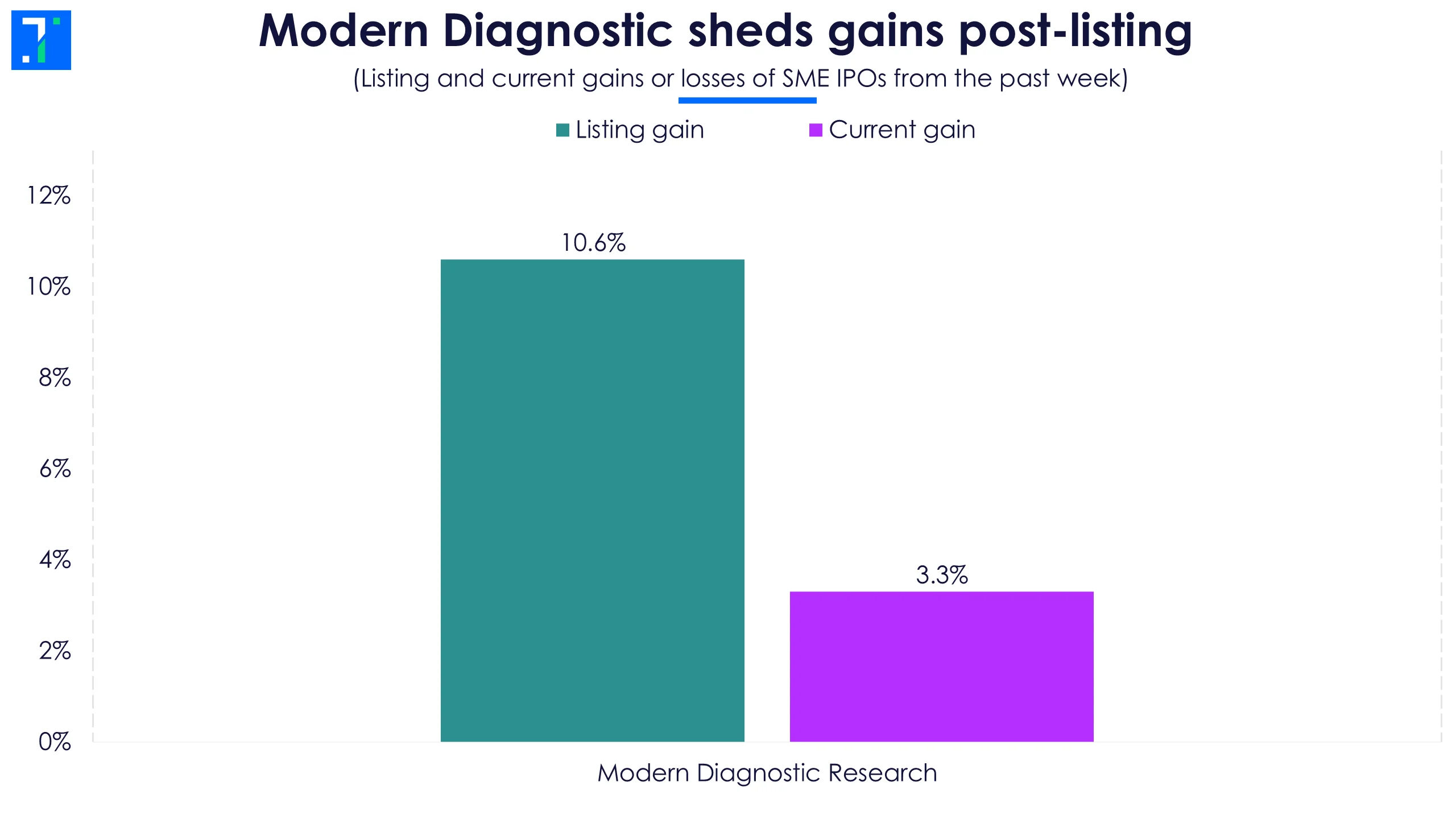

Modern Diagnostic sheds gains post-listing

The stock listed at Rs 99.5, a 10.6% premium over the issue price of Rs 90. Shares are currently trading around 3.3% above the issue price.

Bharat Coking Coal and four SME firms to list this week

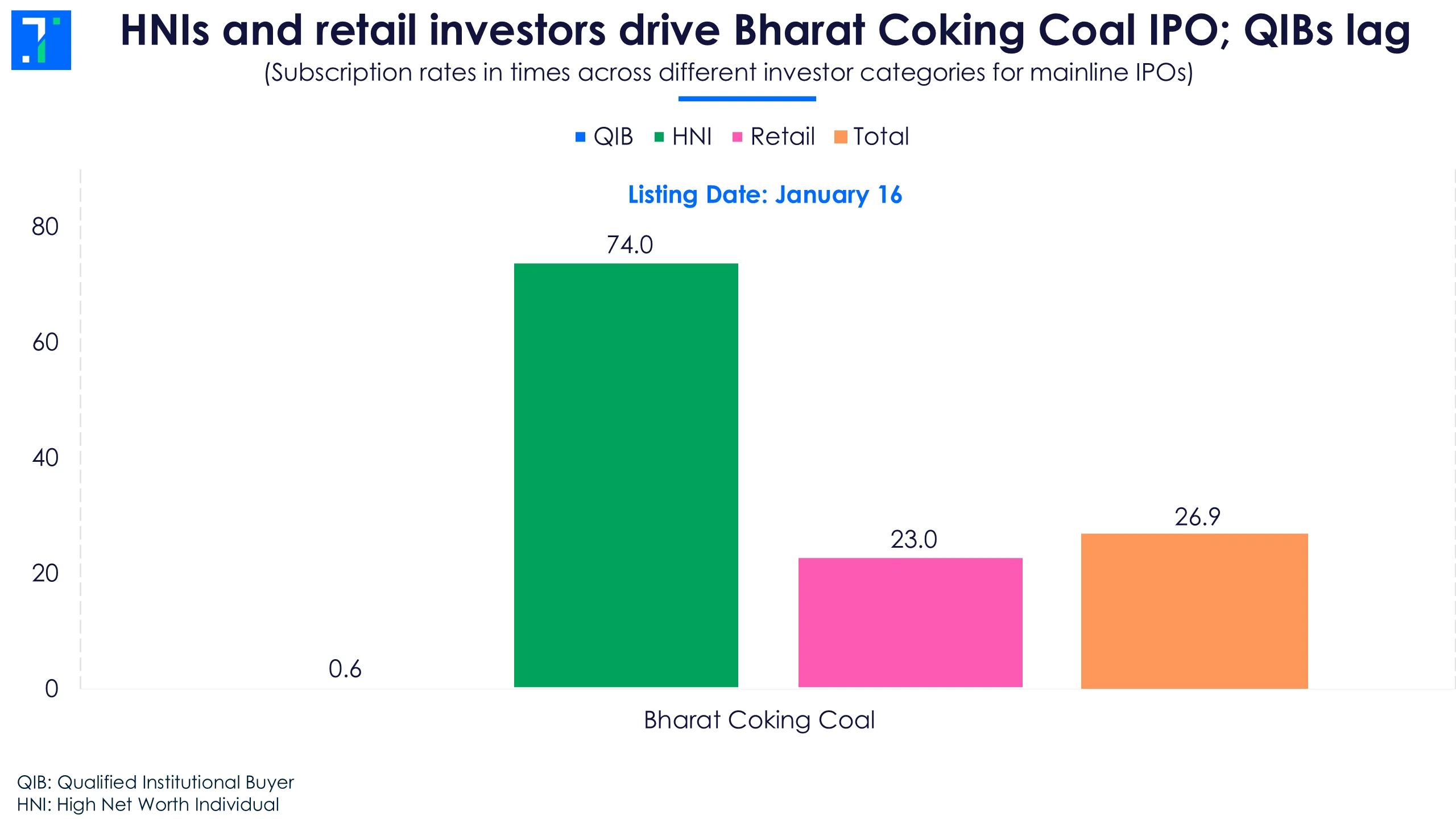

Bharat Coking Coal, India’s largest producer of coking coal and a Coal India subsidiary, opened its Rs 1,071.1 crore IPO on January 9. The issue, which is fully an offer for sale, was fully subscribed within 30 minutes and ended day one with an 8.1X subscription.

On day two so far, the IPO received bids worth 26.9X the shares on offer. The issue will close on January 13, with listing scheduled for January 16.

HNIs and retail investors drive Bharat Coking Coal IPO; QIBs lag

Gabion Technologies India, an infrastructure company, closed its Rs 29.2 crore IPO on January 8. The issue saw very strong demand and was subscribed 768.1X. The stock will list on January 13.

Yajur Fibres, a textile manufacturer, closed its Rs 120.4 crore IPO on January 9. The issue saw steady demand and ended with a 1.3X subscription. Listing is scheduled for January 14.

Victory Electric Vehicles International, an electric vehicle maker, closed its Rs 34.6 crore fixed-price IPO on January 9. The issue was subscribed 1X, mainly driven by retail investors. The company will list on January 14.

Defrail Technologies, a rubber components manufacturer, opened its Rs 13.8 crore IPO on January 9. The issue was subscribed 6.2X so far on day 2. The IPO closes on January 13, with listing planned for January 16.

Subscription opens for Amagi Media and five SMEs

Amagi Media Labs, a media technology company, will open its Rs 1,789 crore IPO on January 13. The issue closes on January 16 and will list on January 21. The price band is set at Rs 343–361.

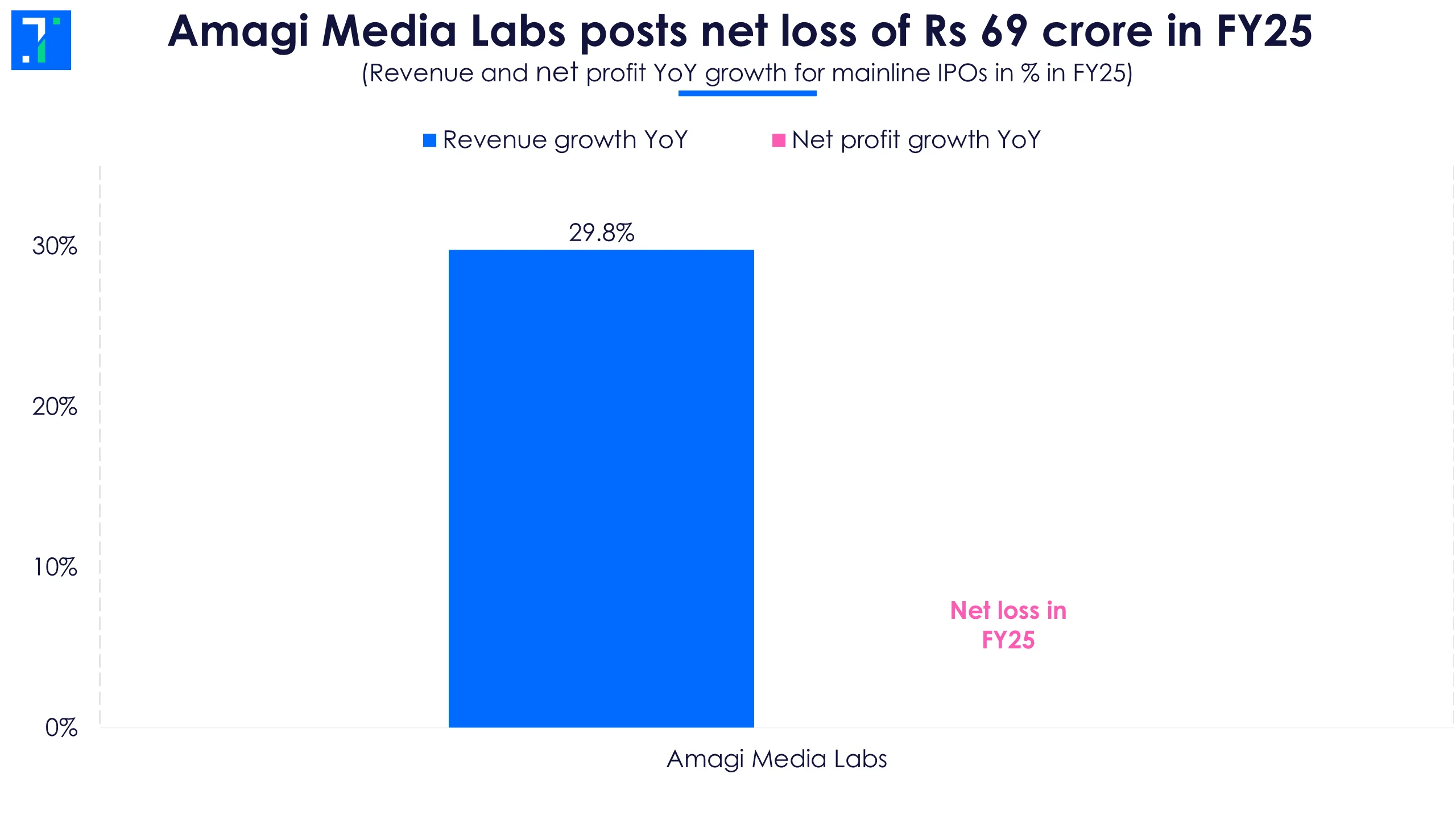

The IPO includes a fresh issue of Rs 816 crore and the rest as an offer for sale. The company will use the proceeds to invest in technology and cloud infrastructure, and fund acquisitions. In FY25, Amagi cut its net loss by 72% to Rs 68.7 crore, while revenue grew 29.8% to Rs 1,223.3 crore.

Amagi Media Labs posts net loss of Rs 69 crore in FY25

Five SME IPOs will also open for subscription.

Avana Electrosystems, which makes power electronics and switchgear, opened its Rs 35 crore IPO on January 12. The issue will close on January 14, with a price band of Rs 56–59 and listing scheduled for January 20.

Narmadesh Brass Industries, a brass components maker, will raise Rs 45 crore at a fixed price of Rs 515 per share. The IPO opened on January 12, closes on January 16, and is set to list on January 21.

Indo Smc, a manufacturer of electrical components, plans to raise Rs 92 crore at a price band of Rs 141–149. The IPO runs from January 13 to January 16, with listing on January 21. The funds will be used for capex and working capital.

GRE Renew Enertech, which provides solar energy solutions, will open its IPO from January 13 to January 16. The company aims to raise Rs 40 crore at a price band of Rs 100–105, with listing scheduled on January 21.

Armour Security, a security and facility management services provider, will raise Rs 27 crore at a price band of Rs 55-57. The IPO opens on January 14, closes on January 19, and will list on January 22.