By Melissa Koshy

Indian stock markets declined last week, with the Nifty 50 index falling by about 2.7%, with widespread selling after the US announced a steep hike in H-1B visa fee to $100,000 and a new 100% tariff on pharmaceutical imports.

This week, all eyes are on the Reserve Bank of India's (RBI) interest rate decision, scheduled for October 1. Most economists predict the central bank will hold the repo rate at 5.5%, especially after making significant cuts earlier this year to boost economic growth.

Vinod Nair, Head of Research at Geojit Investments, noted that investors will be watching upcoming US economic data, including the jobs report. "On the domestic front, the RBI’s policy decision and industrial production figures will be key," he said, adding that for the market to maintain its current levels, "a clear recovery in corporate earnings and a resolution to India-US trade issues are essential."

The IPO market remains active, with 21 new public offerings opening for subscription this week. Additionally, 23 companies will make their stock market debut, building on the 11 that listed last week.

Seven mainboard and four SME companies debuted last week

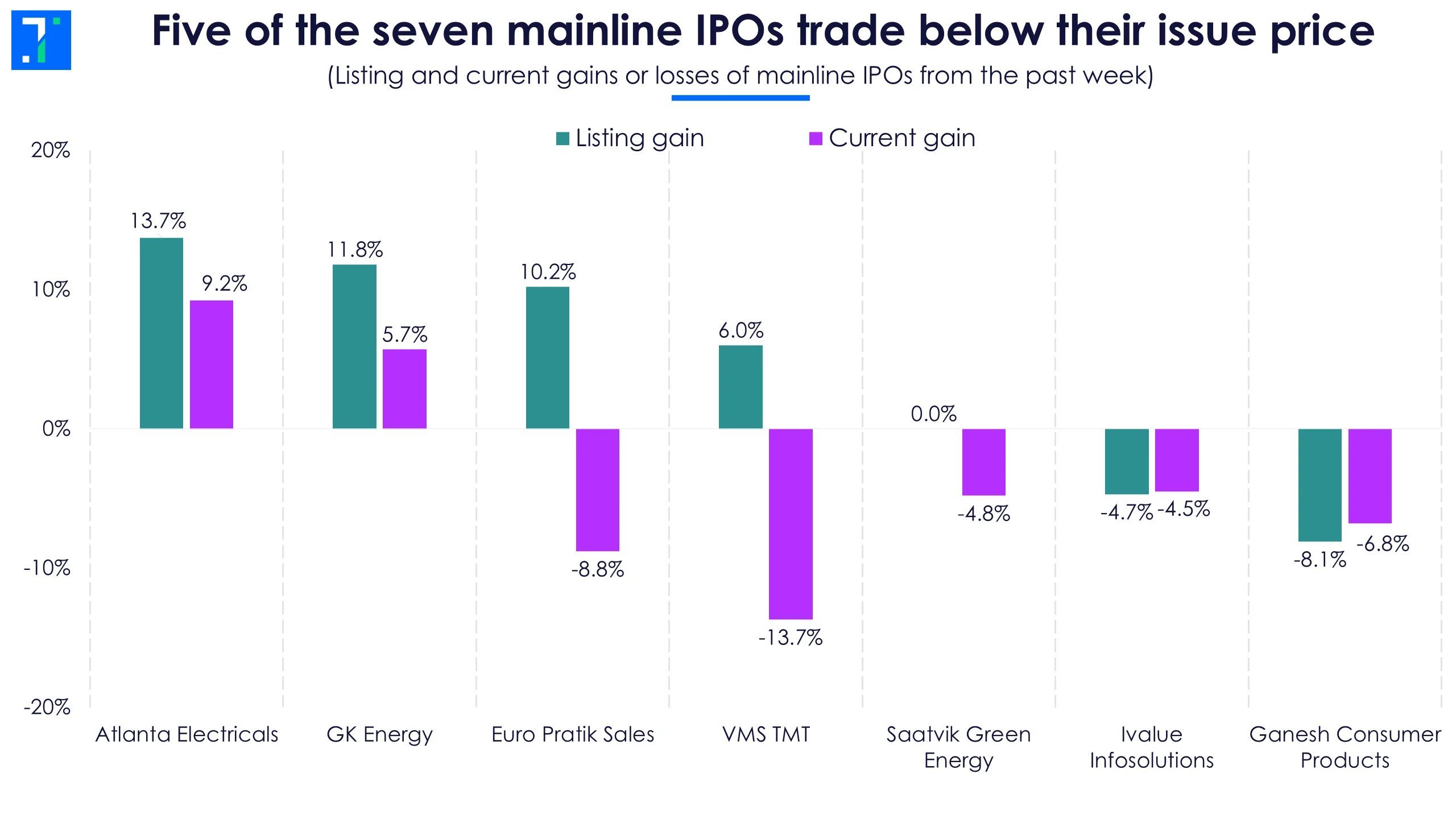

Last week saw a mixed performance for new listings, with most struggling to maintain gains.

Atlanta Electricals debuted at a 13.7% premium and is currently up 9.2% from its issue price.

GK Energy and Euro Pratik Sales listed at 11.8% and 10.2% premiums. GK Energy is now trading 5.7% above its issue price after its IPO was oversubscribed by 89.6X, while Euro Pratik is down 8.8%.

VMS TMT listed at a 6% premium but is now trading 13.7% below its initial price.

Saatvik Green Energy made a flat debut at Rs 465 and is currently trading 4.8% below its issue price. Meanwhile, iValue Infosolutions and Ganesh Consumer Products had a weak start, listing at 4.7% and 8.1% discounts, respectively.

Five of the seven mainline IPOs trade below their issue price

Among SME debuts, JD Cables was the only company with a positive debut. The company listed at a 5.3% premium after its IPO was subscribed by 119X. However, it is trading 3.2% below its issue price.

Sampat Aluminium had a flat debut after receiving bids for 153.8X the shares offered. It is currently trading 17.7% below its issue price.

Prime Cable Industries debuted at a 2.4% discount and is trading 7.3% below its issue price. Its subscription stood at 5.6X. Siddhi Cotspin listed at a 20% discount and is currently trading 27.8% below its issue price.

Gearing up: 21 new IPOs are launching this week

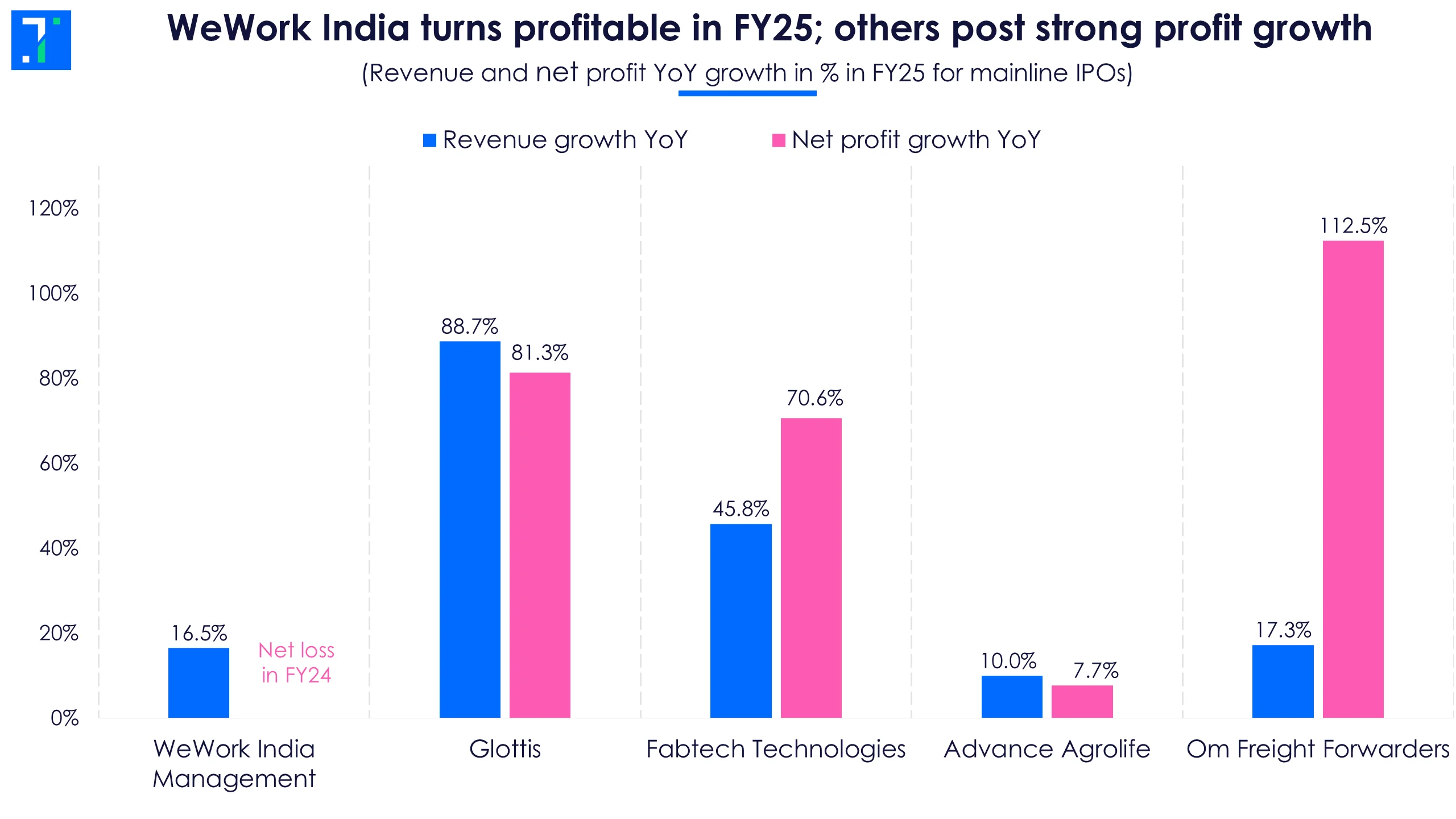

This week's largest public offering comes from WeWork India Management, a flexible workspace operator in India. It offers flexible workspace solutions, including custom buildings, enterprise suites, managed offices, private offices, and co-working spaces. The firm plans to raise Rs 3,000 crore with a price band of Rs 615-648. Its IPO will be open from October 3-7, and will list on October 10.

WeWork India turned profitable in FY25, reporting a net profit of Rs 128.2 crore, a major turnaround from last year's loss. But the gain was mainly driven by a Rs 285.7 crore deferred tax credit.

Glottis is a logistics solutions player that offers comprehensive transportation services through ocean, air, and road logistics. Its Rs 307 crore issue, opened on September 29, will close on October 1 and will list on October 7. The price band is set at Rs 120-129 per share.

Fabtech Technologies is a biopharma engineering company. The company designs and delivers turnkey projects, including cleanroom facilities and modular systems, catering to the life sciences, food and beverage, and aeronautics industries. Its IPO opened on September 29, will close on September 1, and is set for listing on October 7. The company aims to raise Rs 203.4 crore at a price band of Rs 181-191 per share.

Advance Agrolife manufactures a wide range of agrochemical products that support the entire lifecycle of crops. The company's products are used in the cultivation of major cereals, vegetables, and horticultural crops. Its IPO will be open from September 30 to October 3, and will list on October 8. The company plans to raise Rs 192.9 crore via a fresh issue. The price band is set at Rs 95- 100.

Om Freight Forwarders is a logistics player, offering services like international freight forwarding, customs clearance, vessel agency, transportation, warehousing, and distribution services. Its IPO opened on September 29 and will close on October 3, with the listing scheduled for October 8. It aims to raise Rs 122.3 crore at a price band of Rs 128-135.

WeWork India turns profitable in FY25; others post strong profit growth

Primary market action stays lively as 16 SME IPOs are also opening this week.

- Dhillon Freight Carrier and Suba Hotels opened their IPOs on September 29 will close on October 1, and list on October 7. Dhillon aims to raise Rs 10.1 crore, while Suba plans to raise Rs 75.5 crore.

- IPOs of Om Metallogic and VijayPD Ceutical opened on September 29 and will close on October 1, with listing scheduled for October 7. The issue sizes of these IPOs are Rs 22.4 crore and Rs 19.3 crore, respectively.

- Sodhani Capital and Chiraharit also opened for subscription on September 29 and will close on October 1, with their listing set for October 7.

- Sunsky Logistics, Munish Forge, and Infinity Infoway will open on September 30, close on October 3, and will list on October 8. Sunsky aims to raise Rs 16.8 crore, Munish Forge will raise Rs 73.9 crore, while Infinity plans to raise Rs 24.4 crore.

- Sheel Biotech, Zelio E-Mobility and B.A.G.Convergence will also be open between September 30 and October 3, with their listings scheduled on October 8.

- Valplast Technologies will be open for subscription from September 30 to October 3, and Greenleaf Envirotech will be open for subscription from September 30 to October 6.

- Shipwaves Online and Shlokka Dyes’ IPOs will open on September 30, close on October 6, and will list on October 9.

23 companies are set to list this week

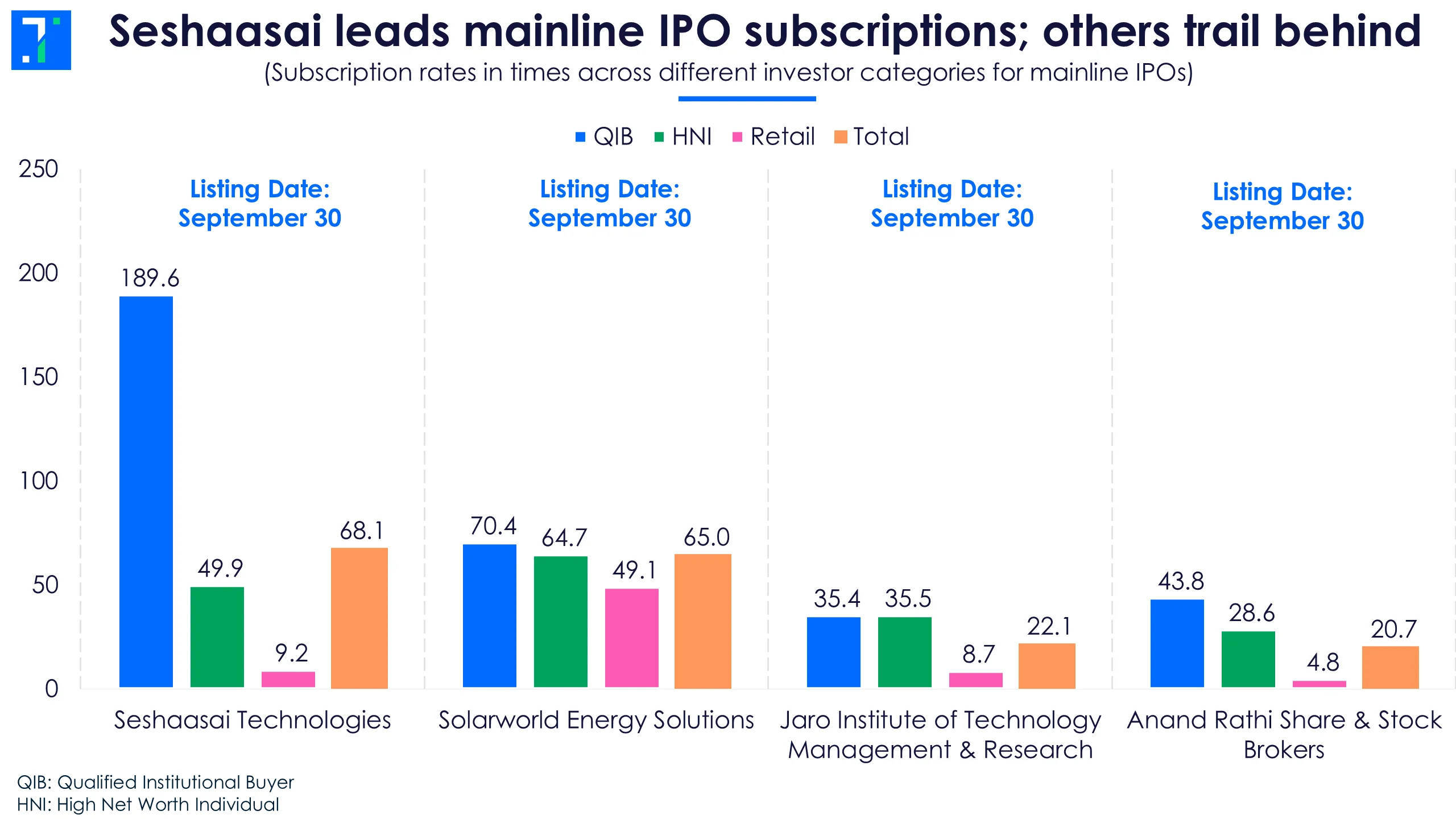

Among mainline IPOs, Seshaasai Technologies stood out with bids for 68.1X the shares on offer, with QIBs showing strong interest at 189.6X. The company is set to list on September 30. Seshaasai Technologies is a technology solutions provider offering payment and communication solutions to the banking, financial services, and insurance (BFSI) industry.

Solar energy solutions provider Solarworld Energy Solutions received bids for 65X the shares on offer. Brokerage firm Anand Rathi received bids for 20.7X the shares on offer. Online higher education platform Jaro Institute was oversubscribed at 22.1X. All three companies are set for listing on September 30.

Seshaasai leads mainline IPO subscriptions; others trail behind

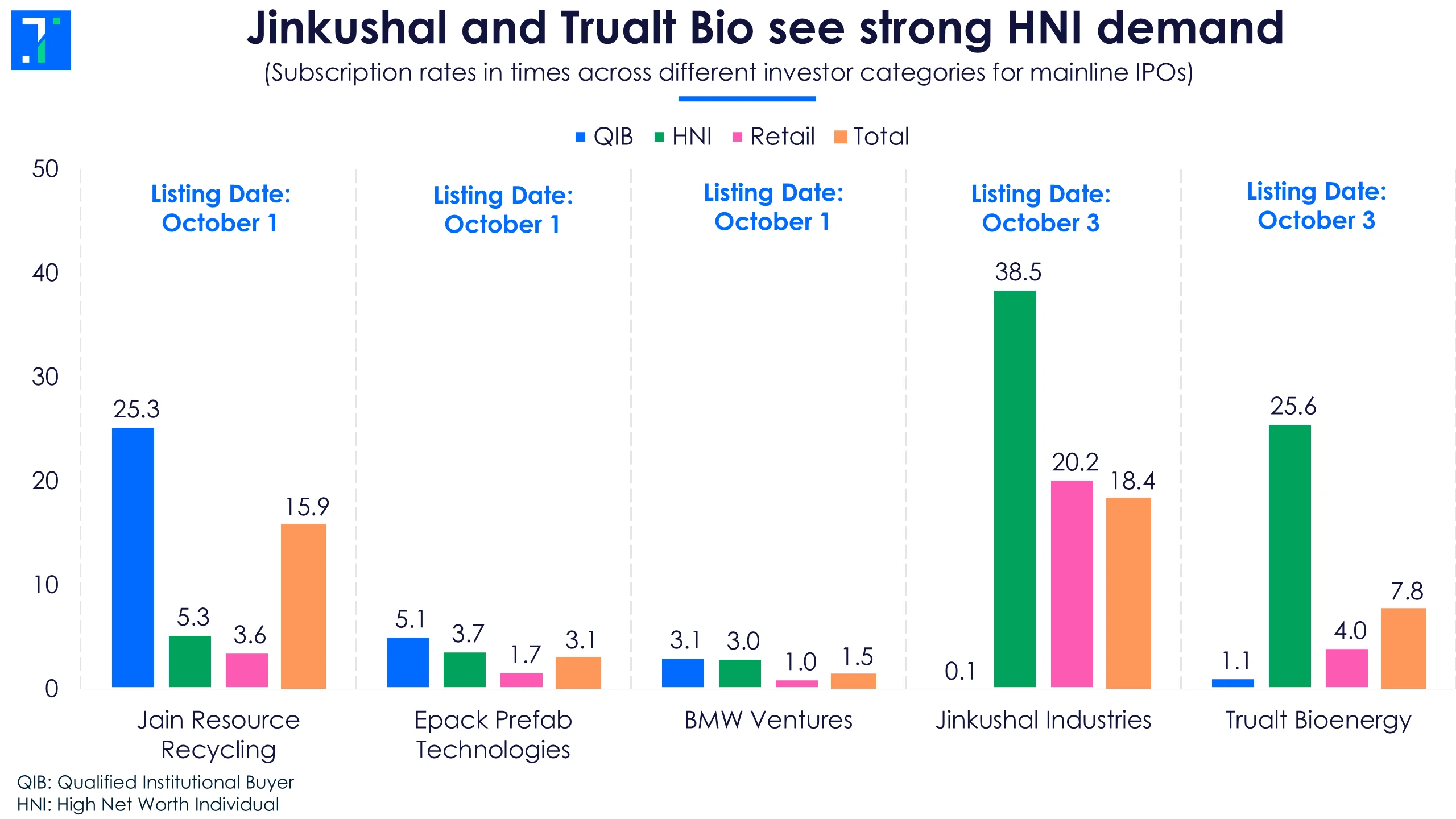

BMW Ventures, Jain Resource Recycling, and Epack Prefab Technologies are scheduled to list on October 1. The IPOs of these companies received bids for 1.5X, 15.9X, and 3.1X, respectively.

Trualt Bioenergy and Jinkushal Industries are set for listing on October 3. Trualt received bids for 0.8X the shares on offer, while Jinkushal received bids for 5.1X as of day 2.

Jinkushal and Trualt Bio see strong HNI demand

14 SMEs are also lined up for listing this week:

- True Colors, Aptus Pharma and NSB BPO Solutions are set for listing on September 30. True Colors’ IPO received bids for 42.4X the shares on offer, while Aptus Pharma was oversubscribed at 20.8X. NSB BPO Solutions remains undersubscribed.

- Matrix Geo Solutions, Ecoline Exim, and BharatRohan Airborne are also set for listing on September 30. Their IPOs were subscribed 7.2X, 5.7X, and 9.5X, respectively.

- Gurunanak Agriculture, Justo Realfintech, and Praruh Technologies will list on October 1. Praruh was undersubscribed at 0.9X, while the other two companies received modest subscriptions.

- Systematic Industries and Solvex Edibles will also list on October 1. The companies received bids for 4.2X and 1X the shares offered.

- Chatterbox Technologies, Telge Projects, and Gujarat Peanut & Agri Products are scheduled for listing on October 3. As on day 2, IPOs of Chatterbox and Gujarat Peanut were subscribed 2.3X and 1.3X respectively, while Telge Projects was undersubscribed by 0.3X.