In 2024, India became the world’s second-largest equity fundraising market after the US, driven by a surge in IPOs. Many new-age companies are listed at high valuations, attracting significant investments from both domestic and foreign investors. Experts predict that 2025 could be a record-breaking year, with IPOs expected to raise over $20 billion.

India's IPO market grew significantly in 2024, raising a record Rs 1.6 lakh crore. Many companies capitalized on investor enthusiasm and positive market sentiment, leading to inflated valuations.

Aggressive marketing by teams pre-IPO, and high brand recognition for some companies - despite being loss-making – garnered high participation even with steep valuations. These companies saw their valuations fell post-listing as the rules of the public market kicked in: regular financial and sales disclosures, closer business scrutiny, and questions from analysts.

These companies discover that the valuation rules of venture capital and public markets are very different. Steptrade Share Service founder Kresha Gupta states, “Many new-age unicorns are 'loss-making' because their valuations are largely driven by market share and consumer dominance. However, retail investors start evaluating the company on the basis of fundamentals like revenue, profit margins, and debt when they go public.”

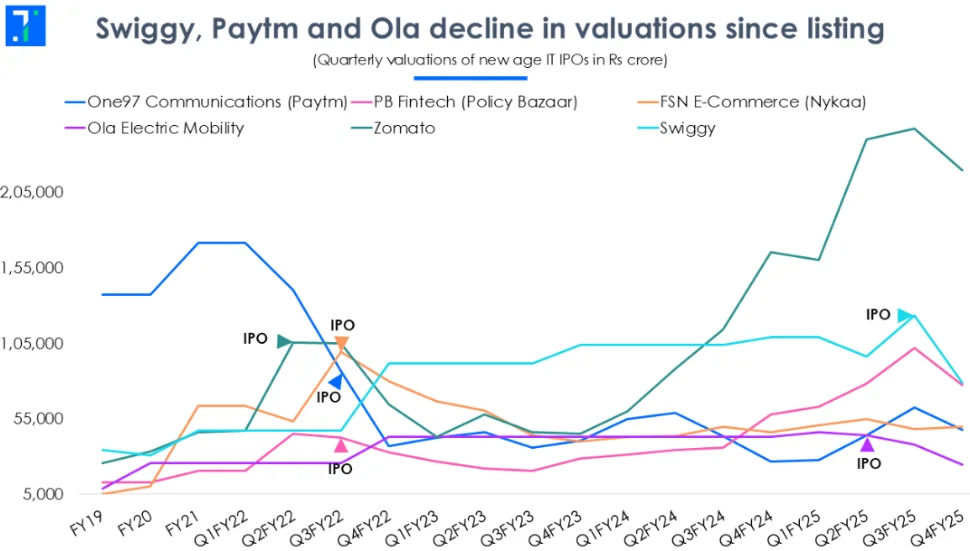

While some IPOs, like Zomato and PB Fintech, have successfully crossed the bridge into public markets, others such as Swiggy and Ola Electric, have seen significant declines in market value. In this edition of Chart of the Week, we analyze the valuations of top new-age IT companies before and after their IPOs and explore the factors influencing their current market performance.

Ola and Paytm face valuation decline amid regulatory hurdles

Ola Electric is facing mounting challenges with every news cycle. CEO Bhavish Aggarwal once stated, "Tesla is for the West, Ola for the rest." That quote has not aged well. Once valued at Rs 46,290 crore during its pre-IPO phase, Ola Electric has seen a significant valuation decline since its stock market debut. Since its IPO in August 2024, the company’s stock has fallen by 27.2%.

Ola Electric is grappling with operational inefficiencies, customer-related concerns and a PR debacle. Customer complaints on Ola scooters have ballooned and repair centers have been overwhelmed.

Sales have declined for three consecutive quarters, reducing its market share from 50% in May 2024 to 18% in January 2025. In February 2025, government data showed a market share of 11.4%, while Ola reported 28%, reflecting discrepancies due to sales delays and unregistered scooters, further impacting stock prices.

Falling revenue, delays in product launches and the exit of key executives contributed to the decline in performance, while legal and regulatory challenges have grown.

Paytm, once valued at Rs 1.4 lakh crore during its pre-IPO phase, has seen a sharp decline in valuation since its market debut in November 2021. Initially listed at Rs 1,950 per share, its stock dropped 27.7% on the first day, hitting the lower circuit. Since then, Paytm’s market capitalization has shrunk by nearly two-thirds, falling to Rs 47,000 crore.

The real plunge occurred after the lock-in period ended, with major investors like SoftBank, Alibaba, and Berkshire Hathaway exiting.

In January 2024, the RBI ordered Paytm Payments Bank to cease operations due to regulatory violations, severely impacting its digital payments business. Monthly active users fell from 168 million to 68 million by September 2024. Additionally, rising competition from UPI and private players reduced its market share from 40% in 2018 to 5.5% in 2024, raising concerns about its long-term sustainability.

Swiggy and Nykaa see declining valuations due to margin pressures

Swiggy debuted on the Indian stock market in November 2024 with a pre-IPO valuation of $11.3 billion (~ Rs 96,008 crore), lower than its initial target of $15 billion (~ Rs 1.3 lakh crore). Since then, its stock has declined by 43.2%, erasing nearly Rs 60,000 crore in market capitalization, bringing its current valuation to Rs 78,889 crore.

Swiggy faces rising cash burn, high competition in the quick commerce sector, and a slowdown in its core food delivery business. Operational expenses have surged due to dark store expansion and intense competition - both food delivery and quick commerce being cut-throat markets right now – contributing to increasing net losses.

Similarly, Nykaa, which was valued at Rs 53,204 crore during its pre-IPO stage, saw its market cap rise to Rs 99,481 crore on listing day. However, by March 2025, its valuation dropped to Rs 49,506.4 crore, with the stock falling 57%. Increased competition from Myntra, Ajio, and traditional retailers and higher marketing expenses have negatively impacted its performance.

Financially, Nykaa is struggling with slim margins and inconsistent profitability. To stay competitive, Nykaa is investing heavily in expanding its warehouse network. In the most recent quarter, the company allocated 13% of its capex to expanding its network in the first half of FY26. However, rising costs and intense competition have led to a significant drop in Nykaa's valuation and stock price.

Zomato and Policy Bazaar’s valuations grow, helped by expansion and strong financials

Zomato debuted in 2021 with a Rs 1.1 lakh crore valuation, more than double its pre-IPO valuation of Rs 47,147 crore. Since then, its market capitalization has surged to Rs 2.2 lakh crore. This growth was driven by business expansion, rising demand, and strong investor confidence. Its inclusion in the BSE Sensex and Nifty 50 attracted passive investments, which helped push the company’s valuation higher.

Between 2021 and 2025, Zomato’s market share in food delivery grew from 47% to 58%. The acquisition of Blinkit strengthened its presence in quick commerce, and by March 2024, Blinkit turned adjusted EBITDA positive. Expanding dark stores and rising order volumes improved profitability, leading to increased investor interest. Multiple brokerages remained bullish, raising margin and profitability estimates. These factors helped Zomato’s stock deliver a 183% return since its listing.

PB Fintech, the parent company of Policybazaar and Paisabazaar, was valued at Rs 45,187 crore before its IPO. At the time of its listing in November 2021, the company’s valuation was Rs 42,763 crore. Since then, its valuation has increased by nearly 25%, reaching Rs 77,357 crore. The company expanded into personal finance and lending services through Paisabazaar, diversifying its revenue streams.

In FY24, PB Fintech reported a 37% year-on-year increase in insurance premiums, along with a significant rise in new protection premiums, including health and term insurance. Additionally, PB Fintech improved its operating profit margin from -23% in FY23 to -5% in FY24 by implementing cost-reduction measures and focusing on operational efficiency.

The rise in annual renewal income, achieving an 85% margin, has further boosted profitability. To cut risks in unsecured lending, PB Fintech is prioritizing secured loan products like home loans. The company aims to achieve Rs 1,000 crore in net profit by FY27 and is considering a $100 million investment in new ventures